The average endodontist in the United States makes a six-figure salary. But the many years of experience and education, including dental school and extra training to specialize in endodontics, also means racking up multiple six-figures of student debt.

What are the best ways endodontists can pay back their student debt? Is it even worth it to take out that much debt to become an endodontist? Let’s explore answers to those questions to help you decide if this is the career path for you.

Requirements to become an endodontist

Most people don’t know the difference between a dentist and an endodontist, but the American Association of Endodontists clears that up by explaining that endodontists specialize in “saving teeth.” Endodontists focus on the inside of the tooth — think root canal procedures (or don’t if it makes you uncomfortable). Their focus is on the tooth pulp, as well as the soft tissue and nerves. Unlike dentists, they don’t do the outside work like filings or your biannual cleanings.

The inside of the tooth is tiny and sensitive. Therefore, endodontists often need extra training to use special technology, dental instruments and numbing techniques. This extra endodontist training also includes learning how to find the cause of tooth pain that could be difficult to diagnose.

Because of the specialization beyond general dentistry, endodontists require a great deal of education. First, they need to complete a four-year dental school program after earning a bachelor's degree. This may be either a Doctor of Dental Surgery (DDS) or Doctor of Dental Medicine (DMD) degree. It is then followed by a two- to three-year accredited endodontic residency program.

It’s a long and expensive road to achieve the experience level needed to become a great endodontist. But it can be rewarding to see the patient transformations, as well as the high wages.

Average endodontist salary

The American Dental Association, in conjunction with the Health Policy Institute, surveyed dentists about their incomes from 2022.

The compensation data showed that dental specialists earn substantially more than general dentists. Of those dental specialists, the endodontists ranked at the top of the salary survey data for highest salary.

Specifically, endodontists in private practice. According to ZipRecruiter, the national average for endodontist salary was $263,789.

For dentists as a whole, average net income declined by 7% in 2022. The long-term trend has shown a slight decline, ever since 2020. The ADA cites that the reason for this is that practice expenses are outpacing practice revenues. Therefore, this is driving the downward trend in dentist net incomes.

Population density and geographical location can have a big effect on the endodontist salary range just like it can on general dentistry. The bigger the city, the lower the income. Endodontists who live in more rural areas tend to make more money. The income spread could be substantial too.

The endodontists we’ve worked with on debt repayment plans here at Student Loan Planner® who live in major cities tend to make in the mid-$200,000s. However, those working in more rural areas can make upwards of $400,000.

Practice ownership plays a role in income also. Endodontists who set up shop in an area without much competition can pull in more than $500,000.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Typical endodontist student loan debt

Dental school is expensive on its own. But when you add in two to three years of endodontic residency, student loan debt can increase even more. Endodontic training isn’t nearly as expensive as becoming an orthodontist, but it’s not cheap either.

The average dentist we have worked with at Student Loan Planner® has $438,000 of student debt. Meanwhile, the average endodontist has $544,000 in debt. That’s $106,000 in extra student debt compared to general dentists. This is attributed to the extra cost of endodontic residency and the extra interest that accrues during that time.

Endodontist student debt ranks among the highest average debt load by profession that we’ve seen.

The best student loan repayment strategy for endodontists

Becoming an endodontist is expensive. But there's a student loan debt plan that can work for an endodontist’s career goals.

Let’s take an example of an average endodontist scenario: Jennifer owes $533,000 in student loans and earns $345,000 per year. Is it better to take the aggressive approach to pay back student loans in 10 years or less with refinancing? Or should she pay as little as possible to maximize the taxable loan forgiveness?

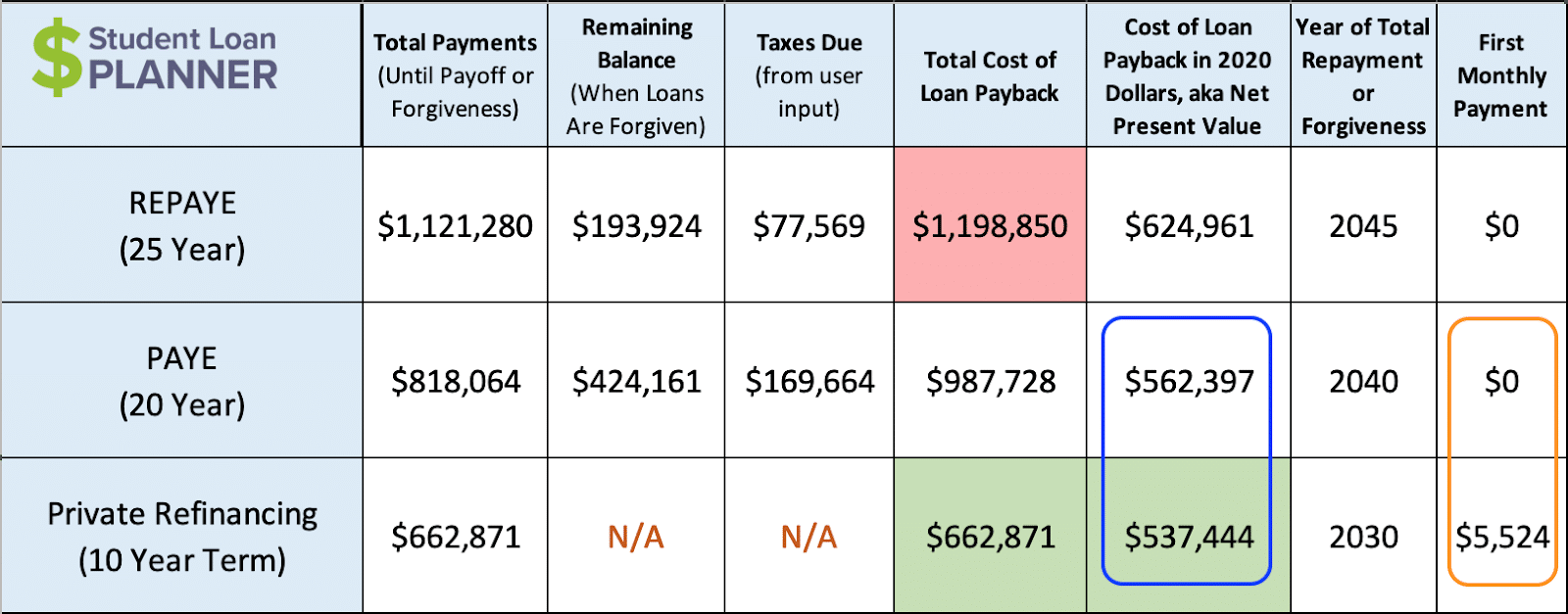

Compare the three repayment plan options of PAYE, REPAYE and student loan refinancing:

Although it looks on the surface like refinancing is the way to go, it’s not that cut and dry. First, let’s take REPAYE out of the running because it's the most expensive way to pay back the loans of the three options.

Breaking down realistic options

Jennifer could refinance to a 10-year rate at 4.5%, pay $5,524 per month and be debt free in 10 years. That option is projected to cost her $662,871 in total payments to pay off the debt with interest.

Let’s now focus on the blue circled area above. These numbers are the net present value, or the cost in today’s dollars. We’re using 3% for inflation and a 5% discount rate.

That means when we take into account inflation at 3% and a potential 5% investment return on the payment difference, Jennifer would end up in pretty much the same spot financially no matter which of these two options she chooses.

This point is where we’d have a conversation about her future plans and her views on the student debt. Is being debt free a priority? Or does she want to have lower payments so that she can save up for an endodontic practice and maximize her net worth?

Both paths work. But we’d definitely spend some time discussing those options in detail as well as other factors, like how much she has saved up right now, what kind of lifestyle does she want (e.g. flexible work schedules), and whether other life goals like buying a house or starting a family are in the near future. All of these things will impact which direction she could choose as an early career endodontist.

We’re just looking at this individual scenario. But any endodontist’s student loan repayment strategy will vary depending on factors such as but not limited to:

- Income

- Amount of student debt

- Practice ownership goals

- Spouse’s income and student debt situation

In today’s world with all that COVID-19 has brought, as well as uncertainty in the political arena, I’d lean toward going on PAYE and saving aggressively on the side, especially if practice ownership is in her future.

Is the average endodontist salary worth the student debt?

It’s a tough call to determine whether pursuing a career as an endodontist is worth the cost, so let’s talk through it.

The amount of student debt needed to become an endodontist is only part of the picture. What really matters is how much it will cost to pay back the debt and how much extra salary can be earned compared to taking on the debt. Let’s look at a comparison to a general dentist.

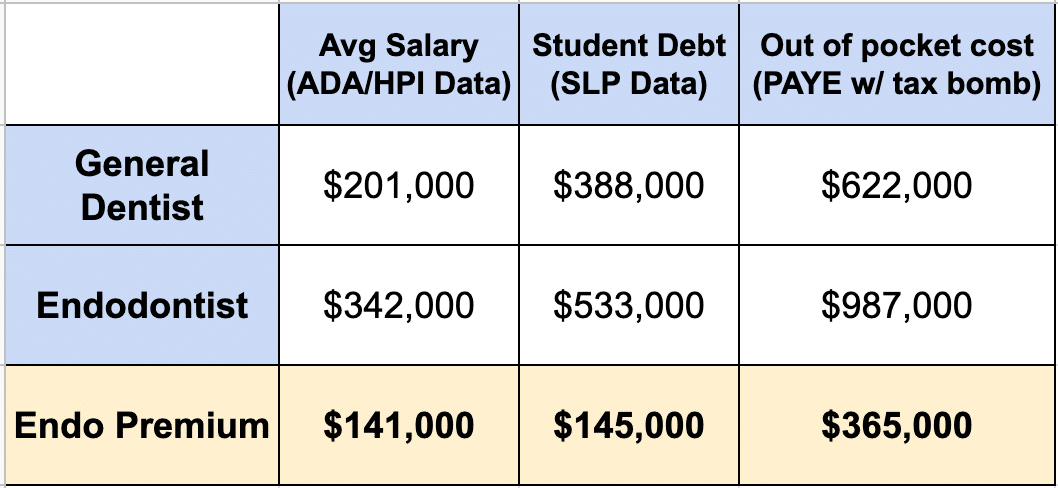

The numbers below show that a general dentist practice owner’s salary is about $201,000. The Student Loan Planner® data shows that general dentists’ average student debt is $438,000. An endodontic practice owner makes about $342,000, and the Student Loan Planner® average debt for endodontists is $544,000.

The projected cost to pay back student debt for a general dentist is about $622,000 out of pocket using PAYE. The projected cost for an endodontist is $987,000 on PAYE.

A practice-owning endodontist can make $145,000 more than a general dentist practice owner. Let’s say that the endodontist is in a 40% marginal tax bracket (federal and state), so they take home an extra $87,000 per year. The extra cost of loan repayment is projected to be roughly $365,000.

At that rate, it would take about 4.2 years for an endodontist to earn enough after-tax money to make back the extra cost of paying back the higher debt load. In other words, an endodontist can recoup the extra cost of endodontics residency within five years of practicing.

How to compare dentist vs. endodontist salaries

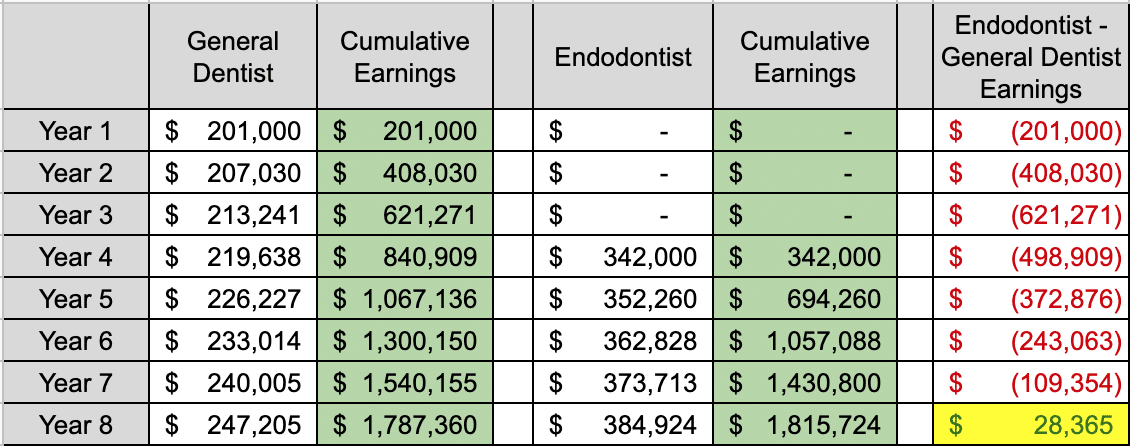

Another thing to think about is that the endodontist is also missing out on three years of earning $200,000 or more per year to take on the extra certification compared to a dentist. We need to factor that missed income in as well.

It would take a little more than five years after completing the three-year residency to break even with a general dentist. See the breakdown of the earnings comparison in the table below:

When we look at the fact that it will take about eight years total to break even with a general dentist earnings and add the 4.2 years to pay for the extra endodontist student debt, it would take a little more than 12 years for an endodontist to fully “catch up” to a general dentist.

Is it worth it to complete that extra training to become an endodontist? The answer is yes from a pure numbers standpoint, but the payoff might not come until 12 years after graduating from dental school.

The breakeven timeline pushes out even further if an endodontist has no plans to open up a practice or lives in a highly populated city on one of the coasts. Both of these factors could result in earning less money than in this hypothetical scenario.

That being said, the tables turn to being worth it for a practice-owning endodontist who plans to live in a place outside of the top 10 most populated areas. To make things even more financially rewarding, they’d also want to avoid private dental school and expensive endodontics residency programs to keep the relative debt to a minimum.

Endodontists can get on a smart student loan repayment plan

Endodontists can find a clear path to pay back their student loans — one that could not only save them significantly more money but also could give them a step-by-step action plan to get it done. The salary of an endodontist can be quite substantial, but so can the student debt. Part of figuring out whether going into this field is worth the debt load depends on your loan repayment strategy and your career choices.

Student Loan Planner® has done over 5,875 student loan consultations for clients totaling over $1.44 billion of student loan debt. Whether you’re a practice owner, striving to be one, or are happy to be an employee, we can help you figure out the optimal repayment plan in just one hour. Plus, we include email support after the consultation to continue to answer your questions and help you implement the plan.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*