The data on student debt for dental specialists like endodontists leaves a lot to be desired. We're probably the only group in the United States that creates student loan plans for endodontists on a regular basis. What's the average amount for endodontist salary versus student debt?

Our average endodontist client has a debt burden of $466,571. But we've seen anywhere from $166,000 to more than $700,000. Meanwhile, the average endodontist salary from our data is approximately $250,000.

Root canal surgeries have an infamous reputation among the public because of pain. That same dread seems to apply to discussions of endodontist student loans, as well as among new general dentists. Although previous generations might've graduated dental school with a manageable amount of debt, new grads come out of endodontics residency, in some cases, owing more than twice their already considerable salaries.

Endodontist salary depends on geographical location

The dentists we’ve worked with have made anywhere from $200,000 to $500,000 per year. However, far more have an endodontist average salary in the low- to mid-$200,000s. Your total compensation (including opportunities for incentives or bonuses) as a new endodontist will heavily depend upon where you decide to practice. For example, an endodontist without much competition in an exurban area of Texas could expect to make loads of money.

Meanwhile, the same person in parts of southern California might feel lower-middle class, as their endodontist salary might be in the $200,000 to $250,000 range. Meanwhile, their housing expenses might eat up 30% to 40% of thier pay.

Supply and demand are powerful forces for endodontist salaries. You’re much better off being one of only a few endodontists in town as a trusted source of help for general dentists in rural areas. It increases your chances of being the go-to choice for specialty dental issues, like addressing damage to the nerves, tooth pulp or other dental tissues.

However, in highly populated, primarily east and west coast areas where young dentists like to live, we’ve noticed significantly lower rates of compensation based on a variety of salary information.

There are also other factors when considering the salary of an endodontist, such as experience level and additional skills and occupation certifications.

Related: Disability Insurance for Endodontists: How to Buy It + Costs

Is financial planning with SLP Wealth right for you?

Looking for student loan aware financial planning custom tailored for professionals like you? Check out the discounts below for becoming a client of SLP Wealth (our SEC Registered Investment Advisory firm).

SLP Wealth, LLC (“SLP Wealth”) is a registered investment adviser registered with the United States Securities and Exchange Commission with headquarters in Durham, NC.

What is the average endodontist student debt?

To become an endodontist, you must complete an approved residency program after earning your Doctor of Dental Surgery (DDS), Doctor of Dental Medicine (DDM) or Doctor of Medical Dentistry (DMD). Most dental care professionals seem to choose two-year programs with stipends in the $40,000 to $60,000 range, although three-year programs are still out there. Some programs require additional fees, usually in the $10,000 to $20,000 range from our experience.

The biggest factor in how much debt you have when you start practice is your choice of dental school. If you want to pay off your debt as an endodontist, you better make sure you chose your in-state, public dental school and eschewed the offers from the high-cost private dental schools in big cities.

Remember that during endodontics residency, your loans continue accruing interest. Often these additional couple years of residency will result in an additional $40,000 to $60,000 of interest piled on top of your balance.

Here’s a hack to realize. The Revised Pay As You Earn (REPAYE) repayment plan allows you to receive an interest subsidy from the government. This subsidy is equal to 50% of the interest your required payment doesn’t cover. With a stipend of $55,000 for example, many dentists choose the easiest option, which is deferment.

If you waived your right to in-school deferment and requested REPAYE start immediately, you might only pay $300 a month. But you’d receive between $10,000 to $30,000 of interest subsidies during training.

How endodontists earn a living

Although some doctors choose to have their own private practice, we’ve seen some travel around to various dental practices. They’ll split whatever revenue they produce with the general dentist who owns the practice.

Although the nomadic option seems riskier, we’ve seen a lot of our highest-earning clients take this independent contractor route. After all, if you’re getting 50% of revenue but don’t have much overhead, you’re capable of bringing in a lot more money, too.

Of course, deciding the right career path is a case-by-case issue.

Endodontist vs. general dentist: Which is the better path?

Many young dentists get restless and ask if they think it’d be a smart idea to go back for a residency program. My advice is if you’re business-minded and enjoy the nuts of bolts aspect of building a dental practice, then you’ll probably do better in general dentistry.

However, if you’re going to be a corporate associate and have an endodontist salary of $130,000 a year working for a group practice like Heartland Dental, then I strongly suggest continuing your education and pursuing an endodontist career.

We have plenty of general dentist clients earning as much as our highest-earning endodontist. Earning a lot in dentistry is more of a function of how good you are as a business person rather than what's your specialty and job description.

That’s only the financial aspect of the decision, though. If you feel a lot more passionate about being a diagnostician to find the true source of pain than doing bread and butter dentistry, you could have a fulfilling career as an endodontist.

Endodontists vs. other dental specialists

I can confirm that oral surgeons and orthodontists have more debt than endodontists on average. They generally have a higher average annual salary, too. However, I would go with endodontics over these other fields if you’re worried about student debt because the time necessary to earn higher dentist wages is shorter.

You’ll probably have a higher income than pediatric dentists, too, with a similar amount of training and work experience.

I don’t see a clear difference between endodontists and prosthodontists or periodontists in terms of debt and income. If you’re undecided between these three fields, don’t choose based on money.

How a Texas endodontist can get ready to refinance

Pretend that your friend, Jill, just finished her endo residency after completing four years of dental school in Texas. She comes out owing $400,000, but she expects to earn $35,000 per month shortly. This will likely increase. Is dental school debt worth it?

She could refinance right away, but then she would have to pay huge cash flow per month. This could hurt her in qualifying for a private practice loan if she wanted to buy or start her own. Endodontist student debt makes it harder for dentists to build wealth.

In this situation, I’d suggest that Jill gets certified immediately after residency on her resident income. Her REPAYE payment would be $307 per month.

Normally, her interest would accrue at $28,000 per year (assuming a 7% interest rate on her debt). With the REPAYE subsidy, she would have an interest accrual of only $15,840. That’s a difference of over $12,000 in year 1. That’s an effective interest rate of 3.96%, which is lower than everything but a five- or seven-year student loan refinance.

Jill could stay on this REPAYE plan and make extra payments to try and get below $350,000 in her first year. At that point, the loan servicer would find out about her higher income from her tax return. Therefore, she could refinance to a private lender.

How endodontists can focus on wealth instead of debt

Let’s assume Carmen lives in southern California where her family is located, even though she knows she will earn less money long-term. Carmen owes $400,000 on her loans from becoming an endodontist.

She has been paying on the PAYE program for two years, but she hasn’t thought about her loans much. However, she's decided to start a family with her partner, who’s a high school teacher earning $60,000.

This is a classic case showing the complexity of student loan repayment rules because California is a community property state. If Carmen got married, she could file taxes separately and equalize their incomes on the federal tax return.

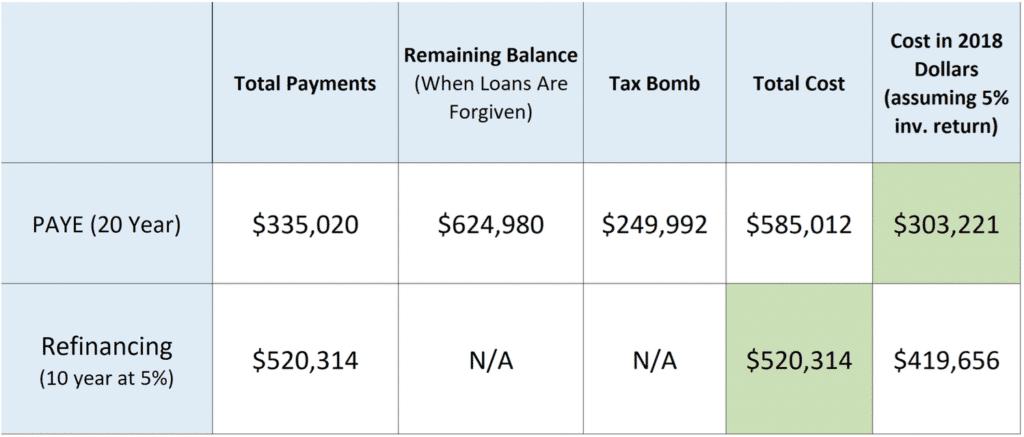

In other words, instead of paying off dental school debt based on a $225,000 endodontist salary with PAYE (10% of discretionary income), Carmen could pay based on ($225,000+$60,000)/2 = $142,500. This results in payments of $1,036 a month instead of $1,723 a month. Here’s an illustration of the cost below (keep in mind to focus on the present value at the far right).

Carmen could pay over $4,000 per month and try to get out of debt in 10 years. Alternatively, she could get married and take legal advantage of the student loans rules. We didn’t even discuss how she could open up special retirement accounts, take deductions on her adjusted gross income, and the other countless tips you could apply to increase the value of endodontist student loan forgiveness.

Buy into Endodontist Practice Ownership

One of the best ways to rapidly grow wealth is to build equity in your own private practice. Endodontists who do this can retire with a seven figure asset when they retire instead of relying solely on the value of their labor.

If you wanted to start the preapproval process for that, fill out the short form below.

Practice Loan Quote Form

Get a plan to get out of your endodontist student debt

It will take a lot longer to deal with student debt than it takes for you to do a root canal. But the pain needn’t be that high.

The worst situations are when a dentist has put zero thought into their strategy and is on autopilot. This can be detrimental to your finances considering you likely have outstanding debt from your bachelor's degree and beyond.

Luckily, with a little attention, you can drastically slash the long-term cost of your student debt regardless of your endodontist salary.

The right plan depends on a combination of factors, such as how much money you plan to earn, what you want for your career, your state of residence, and your attitude towards debt.

You can figure out what path to use with our tools and resources. You can also hire us for a custom student loan repayment plan.

Either way, don’t be like the patient who ignores their problem until it’s so serious that it takes huge amounts of effort to fix. Get a plan sooner rather than later. That way you can rule your future, rather than letting your endodontist debt rule you.

What state will you practice in? Has this changes at all after reading this article?

Comments are closed.