The path to becoming a physician is a tough one at every stage.

First a student has to be accepted to medical school, take the classes, go through the U.S. Medical Licensing Exam steps or Comprehensive Osteopathic Medical Licensing Exam (COMLEX) levels, graduate medical school and match for a residency program. Each step is a challenge that must be overcome.

Though most aspiring physicians make it through, there are many who don’t. This tough situation can leave them depressed, anxious and staring at a mound of student debt without the great six-figure income they were anticipating.

Before we go any further, if you are having feelings of despair or suicidal thoughts over student debt, stop reading this and call the National Suicide Prevention Hotline at 1-800-273-TALK (1-800-273-8255).

All is not lost. In fact, you have more options than you ever realized. And many of these options are still quite good for your long term future.

The student loans don’t have to be a burden, and there are other career choices that can provide the satisfaction of being a physician.

The student loan repayment options available to students are extremely flexible, which makes paying back the debt manageable even if someone failed out of medical school.

I’ll walk you through a few different paths that someone can take if they failed or dropped out of medical school and what student loan repayment might look like.

Get Started With Our New IDR Calculator

Career options after failing out of medical school

It can be a huge psychological blow to fail out of medical school, and it could take some time to get over it. But think about what’s next. Just about everyone who gets into medical school has shown themselves to be intelligent and have a good work ethic. So, as much as failing is a tough thing to handle, it doesn’t mean that there isn’t a high-paying, satisfying career ahead.

A great place to start is asking yourself questions like these:

- Do I want to stay in the healthcare field?

- Should I pursue something in science or research?

- Is there another career path outside of healthcare and science that I’m excited about?

After answering those questions, one of three choices will emerge:

- Go to grad school and pursue something in healthcare or science.

- Go to grad school to pursue a totally different career path.

- Jump right into the workforce either in healthcare, science or something completely different.

You might be thinking, why would anyone go back to grad school and possibly take out more student loans when they already have a mound of debt from medical school?

The answer is that student loan repayment won’t be much more expensive than it would have been otherwise and could be worth it to pursue a fulfilling career and potentially earn more money.

Student loans operate much differently than any other kind of debt out there. Income-driven repayment (IDR) options tailor the debt payments to income regardless of the amount of debt, so whether you’re taking on more than $200,000 in medical school loans or a high amount of student loan debt to pursue a different educational path, you could be eligible for an IDR plan.

Student loan repayment case study: An aspiring doctor becomes a professor

Let’s use a hypothetical case study to illustrate how someone can manage their medical school debt even if they don’t finish med school.

After a challenging road, John fails out of medical school. It was a big blow, but after a lot of reflection, he figures out that teaching would be a very rewarding profession to pursue. In order to become a professor, he’d have to go back to school and get either a master’s degree or a doctoral degree.

Right now, John has $250,000 of med school debt, so he’s hesitant to take out even more student debt. This path could add another $150,000 to his student debt with the extra student loans to go back to school and the med school debt accruing interest along the way too. It’s possible he could end up $400,000 in debt.

The average professor earns around $80,000, so let’s say he’d earn $65,000 at first and his salary would grow at 5% per year for 10 years. Along the way, he’s working full time for a PSLF-qualifying employer.

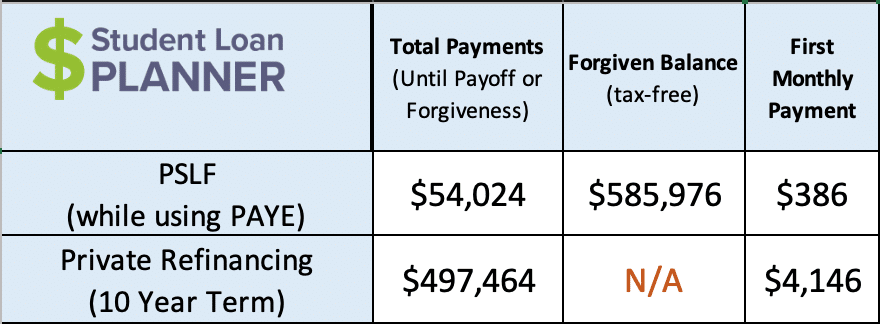

What would be the difference in the projected cost of loan repayment? Let’s compare his projected path on PSLF versus if he were to pay it off in full by refinancing at 4.5%. Both options mean he’d be debt free in 10 years:

This comparison is incredible. Pursuing PSLF using the PAYE plan is projected to cost him only $54,024 to pay back the potential $400,000 of loans. His payment for the first year would be $386 per month. That is less than 10% of the payment he’d make by refinancing.

The total cost of PSLF is $443,440 cheaper than paying back the loans the old-fashioned way if he could even afford that $4,146 payment on a $65,000 salary. Plus, the PSLF path is even less expensive than paying back his current $250,000 in debt if he decided not to go back to school.

So, taking out more debt to pursue a career working for a PSLF-qualifying employer could actually be less expensive than paying back the med school debt on its own.

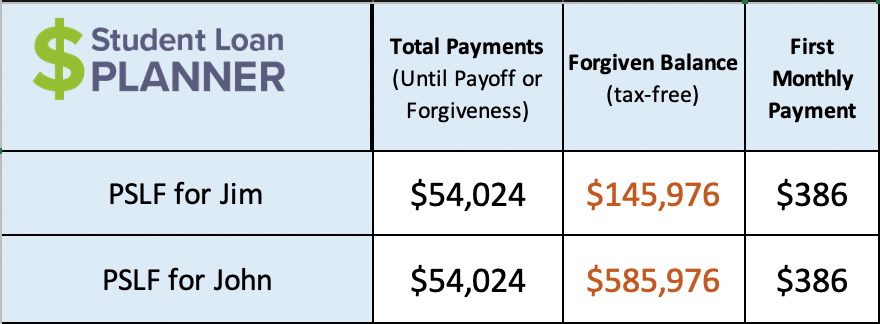

Now, how does John’s PSLF track compare to Jim? Jim is also a professor with the same income trajectory as John. The difference is that Jim “only” has $125,000 of student debt instead of $400,000. What does Jim’s PSLF cost look like compared to John’s?

This comparison makes it very clear that the cost of loan repayment using PSLF is significantly based upon income and not the debt amount. Assuming they make the same income, the cost of loan repayment is identical even though John starts with 3.2 times the amount of debt as Jim.

Jim gets his grad school loans forgiven. John gets both the med school and grad school loans forgiven. The extra med school debt didn’t impact John’s loan repayment one bit.

With this in mind, John could go back to school and take out more debt. If he selects any PSLF-qualifying job, the extra debt has no impact on the cost of loan repayment.

If he wants to stay in the medical field he could go back to school to become an registered nurse, nurse practitioner or physician assistant and work for a PSLF-qualifying employer, get a research position at a university or pursue many other options. If he wanted to stay in healthcare with the potential to make more than a primary care physician, he could pursue becoming a CRNA.

There are also PSLF-qualifying jobs that don’t involve going back to school. For example, John could take a job as a chemist at the FDA or work in hospital administration. Here’s a list of PSLF-qualifying employment characteristics from StudentAid.gov

PSLF negates the extra debt accumulated from medical school and makes loan repayment very affordable.

Income-driven repayment for failed medical students

Let’s look at the path for John if he decides to jump into a new career path that wouldn’t qualify for PSLF and without going back to school.

John decides to take a sales position and really excels. The first year he makes $50,000. The second year he makes $100,000, and his salary grows to $150,000 within five years, then levels out. That’s not bad at all.

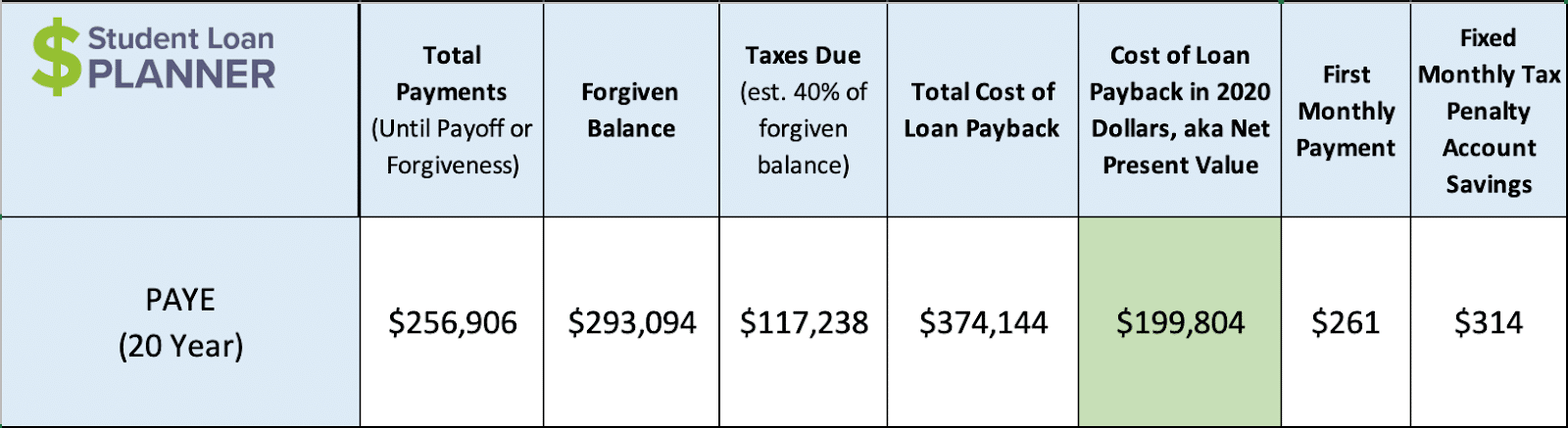

What is the projected cost of paying back his student loans with that income trajectory?

PAYE projects to be a very reasonable way to pay back John’s student loans. His payments on PAYE would be $261 per month for the first year using his $50,000 income to certify his payments. PAYE is based upon 10% of discretionary income, so as his income grows, so will his payments.

One way to look at income-driven repayment (IDR) is like an extra income tax. For example, when John’s income jumps from $50,000 to $100,000, he’ll have to pay a 10% “tax” on that extra earnings in the form of his PAYE payment. In other words, his payment will jump from $261 per month to $673 per month based upon the $50,000 income bump.

An increase in payments on an IDR plan is manageable and much more affordable than paying back a large debt in full.

We’ve talked about the PAYE payment so far but not the potential “tax bomb.” After 20 years of payments on PAYE, the remaining balance is wiped away, but the government issues a 1099 tax form, meaning that the forgiven balance is added to your income on your tax return. Because of that, the borrower has to pay a lump sum of taxes the year of loan forgiveness. The tax bomb is the projected taxes owed by the borrower once their loans are forgiven.

John is projected to owe about $117,238 in taxes on the forgiven loan balance assuming he’s taxed at 40% on the forgiven balance of $293,094. This amount seems like a lot, but remember that he has 20 years to save up for it. All it would take is investing about $314 per month, and the payment never increases (assuming a 5% annual investment return). After 20 years, that manageable $314 per month would grow to enough money to cover the tax bomb.

Even when dealing with big amounts of debt and tax bombs, debt repayment can be affordable when you look at it as an extra income tax and break it down to the monthly payments to get you there.

There is a way out even after failing out of medical school.

After leaving medical school, John was in a real funk and facing $250,000 in debt and feeling like he had nothing to show for it.

But after examining his options and what student loan repayment could look like, it turns out that the student loans won’t get in the way of him pursuing another fulfilling career. In fact, he can feel free to go back to school if he had to and everything would be OK.

What was once a depressing time has now become an exciting time to dream again.

Get a customized student loan repayment plan for your med school debt

Even after failing or dropping out of medical school, you can create a clear path to paying back student loans, one that could save you a bunch of money in the long run.

Student Loan Planner® has done over 10,000 individual consultations advising on more than $2,000,000,000 worth of student debt. No matter what career path is ahead of you, we can help you figure out the optimal student loan repayment plan in one hour. Plus, we include email support after our call to continue to answer your questions and help you implement the plan.

Anyone on our team can help you, so check out how the consult process works and book a convenient time for you.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.