Many student loan borrowers aren’t sure how to get Stafford loans forgiven, or if it’s even possible. Fortunately, there are several routes to federal loan forgiveness for borrowers who have Stafford loans.

In practice, though, unsubsidized Stafford loans are forgiven more often compared to subsidized Stafford loans because subsidized loans are generally issued at a low dollar amount. Here’s what you need to know about Stafford loan forgiveness programs and how to decide if it’s the right strategy for you.

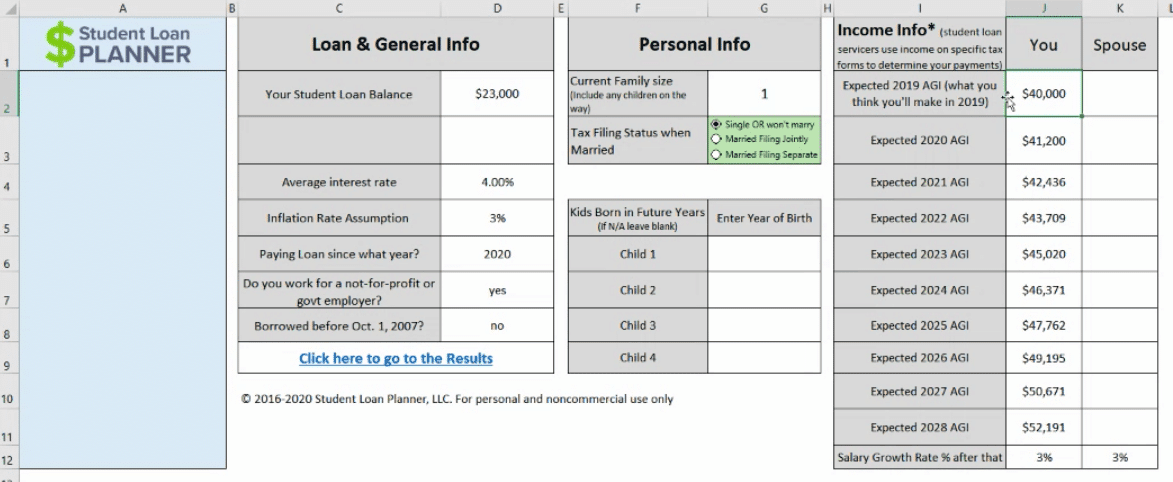

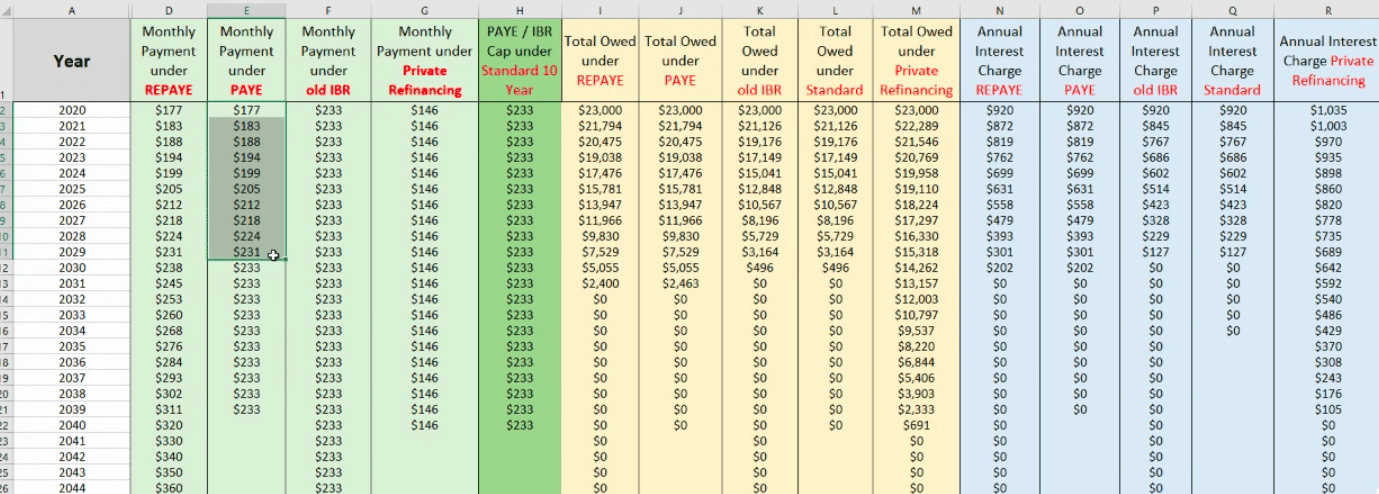

Get Started With Our New IDR Calculator

What are Stafford loans?

Stafford loans technically belonged to the discontinued Federal Family Education Loan Program (FFEL) program that ended in 2010. Although FFEL loans are no longer awarded, their successor— federal Direct Loans — are sometimes still referred to as a Stafford loan. However, they are two different products.

These loans are awarded to undergraduate and graduate students and those pursuing professional degrees. They’re not based on financial need. Instead, the amount you receive is determined by your school based on its cost of attendance. There are two types of Stafford loans:

- Subsidized Stafford loans: With a subsidized Stafford loan the government pays the interest on your loan while you’re enrolled in school and during the first six months after your graduation, known as the grace period.

- Unsubsidized Stafford loans: Interest on unsubsidized federal Stafford loans is charged as soon as the loan is funded. You can choose to defer payments while you’re in school, during the grace period, or during any deferment or forbearance. However, the interest still accumulates during this time and capitalizes, which means it’s added to your principal loan amount.

Here are the key differences between a subsidized Stafford loan versus an unsubsidized Stafford loan:

Unsubsidized Stafford Loan | Subsidized Stafford Loan | |

Government pays | No | Yes |

Eligible for | Yes | Yes |

Time limit | No | Yes (Maximum eligibility period is 150% of the published length of your program) |

Available to | Yes | No |

Must demonstrate | No | Yes |

Ways to get Stafford loan forgiveness

There isn’t a blanket approach to Stafford loan forgiveness because there’s more than one type of Stafford loan and loan forgiveness option. Here are two loan forgiveness plans to consider:

Public Service Loan Forgiveness program (PSLF)

If you consolidate Stafford loans into a Direct Consolidation loan, you might be able to pursue PSLF; however, you’ll lose any qualifying payments toward loan forgiveness previously made up to this point. Plus, you must meet a host of PSLF eligibility requirements, such as working for an eligible employer — such as a non-profit organization, law enforcement, teaching service at an educational service agency, or in public health — full-time while making 120 qualifying payments.

To stay on track, submit your employer certification form each year to FedLoan Servicing. You don't have to pay taxes on your forgiveness amount. You won't qualify to discharge loans if you work as part of labor unions or as part of a partisan political organization.

Income-Driven Repayment (IDR)

Another option to get an unsubsidized Stafford Loan forgiven is through an IDR plan. If you consolidate your loans into a Direct Consolidation loan, you can qualify for student loan forgiveness programs under IDR. There's no employment certification needed and this program can offer financial assistance with low percentage caps on payments. Here are the four IDR repayment plans:

- Saving on a Valuable Education (SAVE), formerly REPAYE, which sets payments generally at 5% to 10% of your discretionary income

- Pay As You Earn (PAYE), also generally 10% of your discretionary income

- Income-Contingent Repayment (ICR), which is generally 20% of your discretionary income or what you would pay on a fixed payment plan over 12 years, taking your income into account

If you choose not to consolidate your loan, you’d only qualify for Income-Based Repayment (IBR). If you come disabled, you may apply for permanent disability discharge.

If you work at an elementary or secondary school, you may qualify for the Teacher Loan Forgiveness Program. Elementary school teachers and secondary school teachers who teach subject areas like mathematics and science may be eligible for up to $17,500.

Who benefits the most from Stafford Loan forgiveness?

The aggregate borrowing limits of a subsidized Stafford Loan are quite low, set at just $23,000 for undergraduates. This borrowing limit makes it unlikely for some people to qualify for loan forgiveness with a subsidized federal Stafford loan. Unsubsidized Stafford Loan holders are the most likely to reap the benefits of federal loan forgiveness and cancellation.

For example, let’s say you’re a teacher earning $40,000 with the maximum allowable amount of subsidized Stafford loans.

With that income, your debt-to-income ratio is quite close, and the average payment would be around $230.

Because of that, it works out that you’d only have around $5,000 remaining debt that’s forgivable. In this case, pursuing forgiveness wouldn’t be as beneficial for a subsidized Stafford loan borrower as it would be for an unsubsidized Stafford loan borrower.

The reality is that federal student loan forgiveness requires getting on an IDR plan. These plans can take anywhere from 20 to 25 years to complete before you become eligible for forgiveness.

If you have all — or mostly — subsidized Stafford loans, you might end up paying off your student loan balance before you’re eligible for forgiveness. Check out the Student Loan Planner® repayment calculator to see whether you can benefit from loan forgiveness.

Alternative repayment options for Stafford loans

Even though federal loan forgiveness is certainly an attractive option to many borrowers, it’s not the only way to get rid of your Stafford loans. Here are some options for repaying your Stafford loans if a 10-Year Standard repayment plan doesn’t work for you:

- Extend your loan. If you’re having difficulty making your monthly payments, you can apply for an Extended Repayment Plan, which can stretch the life of your loan out to 25 years and lowers your monthly payments so you can make funds more available for other monthly expenses. Keep in mind that extending your loans also means you’ll pay more in interest overall.

- Graduated Repayment Plan. If you aren’t quite earning enough at the start of your career to comfortably make your student loan payments, you can choose a Graduated Repayment Plan. Your payments are initially lower and gradually increase every two years at a rate that repays your loans in 10 years. Remember, because you’ll pay less upfront — and hold onto a higher balance longer — you’ll pay more in interest with this plan.

How to refinance your subsidized Stafford loans

Because Stafford loans have strict lending limits imposed by the federal government, many borrowers find they can actually repay their loans faster through other means, rather than by pursuing loan forgiveness.

When you refinance your loans, you get a new loan for the total amount of your existing loan (or loans) — this new loan ideally comes with a lower interest rate. You use those funds to repay your original loans and then focus on repaying the new loan.

With a lower interest rate, you’ll save money over time, which you can use to make extra payments and repay your loan faster. You’ll need good credit to do this, but the savings can make it an attractive option. Keep in mind, when you refinance your federal loans you’ll lose any options for federal loan forgiveness down the road.

If you’re considering refinancing, take our refinancing quiz to help you decide if it’s the right option for you.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Jolene and Travis, great information provided. It is often difficult to understand the terms and conditions of these loans and one often finds themselves in an unsurmountable amount of debt due to student loans. I have quite a large amount owed due to my doctorate which is creating a problem for me buying a home. I am still working on my dissertation but I need to show that I am paying on my student loan debt to be able to qualify for a mortgage. I applied for consolidation and IDR and I am not sure if I made the right decision. I am the only breadwinner in a household of 4. Did a make the right decision?

Sounds like you’re on the right track. To know for sure, you’d have to book a consult with a student loan planner. With the CARES Act suspension, some lenders are defaulting to using 1% of your loan balance which makes qualifying for a mortgage incredibly difficult. But not all lenders are doing that, so you may have to shop around a bit.