If you’re a student loan borrower, there may come a time when you need to put a hold on your student loan payments. One way to do that is through deferment. Read on to learn what deferment is and how to defer your student loans.

What is deferment?

Deferment means to postpone things to a later date. Student loan deferment is the process of putting a pause on your student loan payments for a period of time.

Federal student loan borrowers may qualify for deferment in certain cases. Private student loan borrowers may be eligible for a deferment if their lender offers it as an option and they meet specific eligibility criteria. These criteria vary by lender.

The unique thing about deferment, compared to forbearance, is that you may not have to pay interest on your loans during deferment. If you have subsidized loans, the government is offsetting your loans with a subsidy, and in this case, you don’t have to pay interest. You won’t have to pay interest in deferment for:

- Direct Subsidized Loans

- Subsidized Federal Stafford Loans

- Federal Perkins Loans

- The subsidized portion of Direct Consolidation Loans

- The subsidized portion of FFEL Consolidation Loans

If you have unsubsidized loans, however, interest will accrue during your deferment. Depending on the size of your loans, the interest could add a lot of extra money to your balance. You will have to pay interest in deferment for:

- Direct Unsubsidized Loans

- Unsubsidized Federal Stafford Loans

- Direct PLUS Loans

- Federal Family Education Loan (FFEL) PLUS Loans

- The unsubsidized portion of Direct Consolidation Loans

- The unsubsidized portion of FFEL Consolidation Loans

When can you defer student loans?

Whether you can defer your student loans depends on timing and your situation. For example, you can defer your student loans when:

- You’re enrolled in school more than half-time (this is probably the most common deferment, as borrowers defer payment while in school).

- You’re dealing with cancer treatment — you can defer during your treatment and for six months afterward.

- You’re unemployed — you can defer up to three years.

- You’re experiencing economic hardship or you are a volunteer in the Peace Corps — you can defer up to three years.

- You’re serving in the military.

- You’re in a rehabilitation program if you’re disabled.

- You’re in an eligible graduate fellowship program.

As you can see, there are specific types of deferment that are dependent on your situation. So the length of your deferment will depend on the type you qualify for and your personal circumstances.

How to defer student loans

If you find yourself in a situation where paying back your student loans is difficult or impossible, then you can request to defer your student loans. Let’s review how to defer student loans.

Applying for deferment

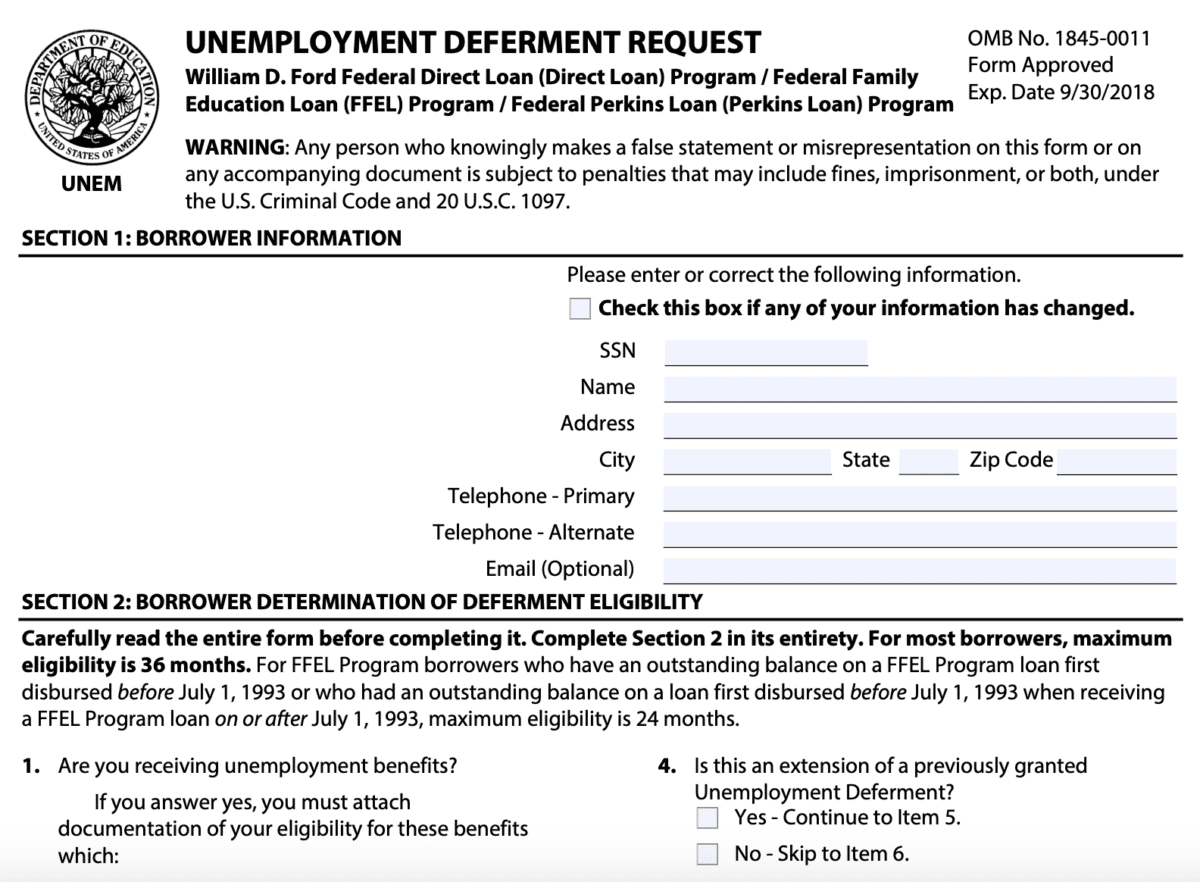

Deferring your student loans is something you have to actively apply for. You’ll need to fill out the specific form for the type of deferment you are requesting. For example, you might fill out the Economic Hardship Deferment Request form or the Unemployment Deferment Request form.

Preview of the Unemployment Deferment Request form.

Talk to your loan servicer about your situation to see which type of deferment you’ll qualify for. After reviewing which type of deferment would best suit your needs, you can fill out the appropriate request form. All types of deferment request forms can be found here.

How to defer student loans when going back to school

If you’re in school, typically you don’t have to do anything as your loans will automatically go into in-school deferment. If you’re unsure about this or you haven’t heard a notice regarding the status of your loans, follow up with your loan servicer.

There may be associated documentation that you must submit to your loan servicer to meet the eligibility requirements for deferment.

Important tips for deferment

For any deferment, you want to have everything in writing and know exactly when the deferment period ends. For example, you could qualify for three months of deferment and then be required to make payments. Or, you might qualify for an option to renew or extend your deferment.

Knowing when you need to start making payments again can help you avoid any consequences associated with missed payments. If you’re eligible for more deferment time, stay in touch with your loan servicer.

When deferment isn’t a good idea

Deferment can seem like an easy way out of making payments, but in some cases, deferment isn’t a good idea. Here’s when you should find a solution other than deferment for your loan payoff challenges:

1. You can actually afford your payments

You might not feel like paying your student loans and think deferment would be a good option, but if making payments won’t set you back financially, we hate to break it to you, but you should continue with your payments.

2. If you are in the Revised Pay as You Earn plan

Revised Pay as You Earn (REPAYE) has a unique perk that other repayment plans don’t. Under REPAYE, you’re eligible for generous interest subsidies that may make more financial sense in some cases than opting for deferment.

If your income is low, then your payments under REPAYE could be as little as $0. In this type of situation, not having to make a payment and getting the interest subsidy is more advantageous than deferring your loans.

According to the Federal Student Aid Office of the U.S. Department of Education, “Under the REPAYE Plan, if your calculated monthly payment doesn’t cover all of the interest that accrues, the government will pay.”

You could get the interest on your subsidized loans paid for up to three years in a row, including half of the interest on these same loans after the three years is up. Additionally, the government will pay for half of the interest on your unsubsidized loans during all periods of repayment.

Alternatives to deferment

You want to weigh the pros and cons of deferment before choosing it as an option. There are some alternatives to deferment you can consider as well:

1. Income-driven repayment plans

If you’re struggling to make payments on your federal student loans because of your income or unemployment, you can choose to go on an income-driven repayment plan in which your payment could be $0.

Yes, that’s correct! You could qualify for a $0 payment where you’d be in good standing with your loans and also working toward student loan forgiveness.

2. Student loan refinancing

If your student loan interest rate feels like it’s slowly killing you, then you should consider student loan refinancing. Student loan refinancing is when you apply for a refinancing loan with a private lender at a lower rate than what you currently have.

Ultimately, this option could save you thousands of dollars in interest. That money could go to the principal and accelerate your journey to becoming debt-free.

It’s important to be aware of what you’ll give up, though. Because you’re applying with a private lender and your old loans will be paid off, you’ll give up federal benefits such as student loan forgiveness and income-driven repayment.

Decide whether to apply for student loan deferment

Given all these options, you can review the pros and cons of deferring versus applying for income-driven repayment or refinancing options.

The key is to make sure you stay in touch with your loan servicer if you’re having trouble making payments. Doing so can keep your credit in good standing so your student debt doesn’t cause you to fall into financial trouble such as loan delinquency or default.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).