Investing during a recession can be downright scary. It’s a real challenge to put money away in the face of a bear market, which is when prices are falling 20% or more. But historically, it has provided fantastic investment opportunities and has been one of the most rewarding times to invest.

The problem is that our psychology not only gets in the way of thinking clearly, it actually sabotages the average investor. They have done much worse than the stock market over time, and most of that underperformance comes during down markets.

How do you avoid doing worse than the market and maybe even do better than it? And how can you make sure you’re not putting your current situation at risk while setting yourself up for financial independence? Let’s dig into answers to these questions to help you invest during the current economic downturn related to the COVID-19 pandemic.

What is a recession?

A recession is when the economy shrinks for two consecutive quarters. It’s far more common than you think. There have been eight recessions since the 1960s, about one or two per decade. And though we’re not technically in a recession yet, the current market conditions caused by coronavirus-related circumstances appear to be headed toward a recession.

Why the average investor does far worse than the stock market

When there’s a recession, businesses may struggle, consumers aren’t spending as much and unemployment ticks up. Business profits and prospects are lower than anticipated, which makes the companies less valuable too, leading to a drop in prices.

Anyone invested in the stock market is a part-owner of all of the companies they hold as investments. As an investor, they participate in the company’s financial ups and downs.

Normally a recession is temporary and the stock market recovers; however, investors don’t always recover as quickly as the economy.

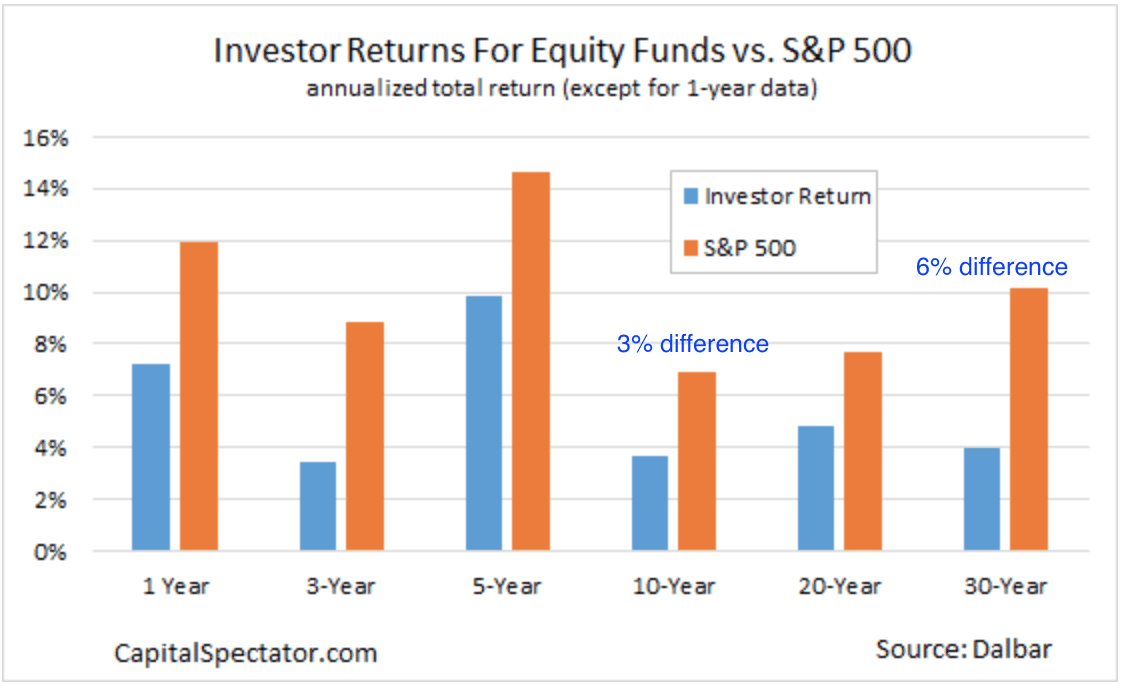

Psychology plays a major role in an individual’s investment returns. In fact, the individual investor has done far worse than the markets over time. Market research firm Dalbar did a major study in 2017 on how investors fared in the market compared to the S&P 500 index. It’s not pretty.

No matter what time frame you look at, the market beats the average investor by a lot. Over a 30-year period, the average investor earned 4% versus the S&P 500 earning 10%, which means the average investor ended up with only $0.30 for every $1.00 the market earned.

Why has this happened? It’s mainly due to people getting scared and pulling their money out of the market when they’ve had enough of the roller coaster. They sell after taking major losses and can’t find the confidence to get back in even as the market recovers, missing on the recovery and gains.

Some of this loss may also be due to an attempt at “timing the market,” which is when someone tries to figure out when the top and bottom will be. This investing strategy can be very costly, and very rarely can people do it at all, let alone consistently. Even the most successful investors of all time — Warren Buffett, Peter Lynch, John Templeton, Jack Bogle and others — are focused on the long-term returns, the opposite of trying to time the market.

How to overcome fear in favor of the proven long-term investing approach

The way to not only match the market but also take advantage of bear markets is to take a long-term approach and stick to the plan.

That’s easier said than done though, so let’s start by taking a look at what has happened after big drops in the stock market in the past to help you gain more knowledge and confidence.

Take a look at the pattern of bear markets and recoveries

It’s hard enough to deal with the anxiety around COVID-19 from a health standpoint, but the stock market has been very scary these days too. The market has experienced some of the sharpest declines in history, but markets have tended to recover quickly after sharp declines in the past.

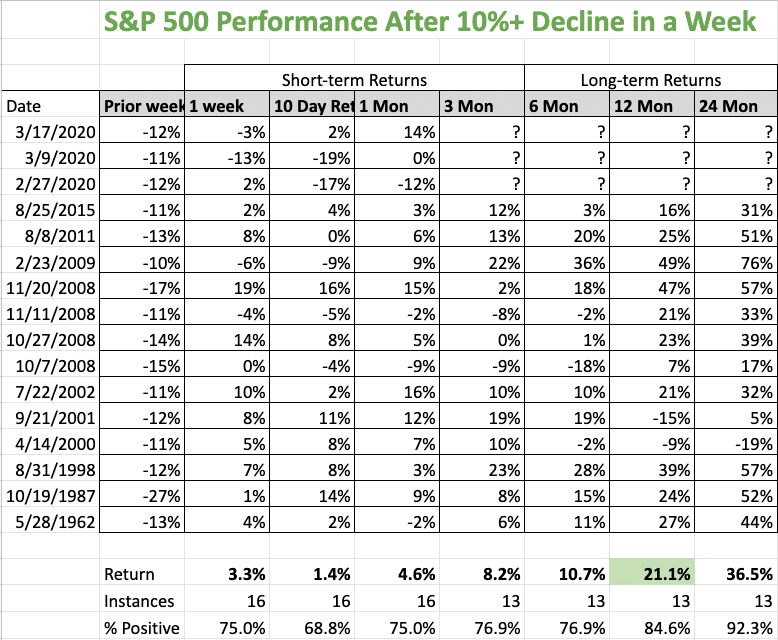

Check out this chart that Tom Eidelman, Chartered Financial Analyst® of Eidelman Virant Capital, published. It charts all the weeks that have had a double-digit decline in the S&P 500 and how the market has fared afterward. Some declines have happened multiple times during the same recessions, similar to what we’re seeing with the COVID-19 effect on the current market.

According to this chart, the S&P 500 has averaged 36.5% positive total return over the two-year period following the drop. There has only been one instance of a negative return out of 13 drops, resulting in a 92.3% success rate. We just, obviously, don’t have the data following the latest drops yet.

Nonetheless, those who continued to invest during market declines fared well over the long run. It’s best to invest money that you don’t need for a while so you don’t have to sell at the wrong time.

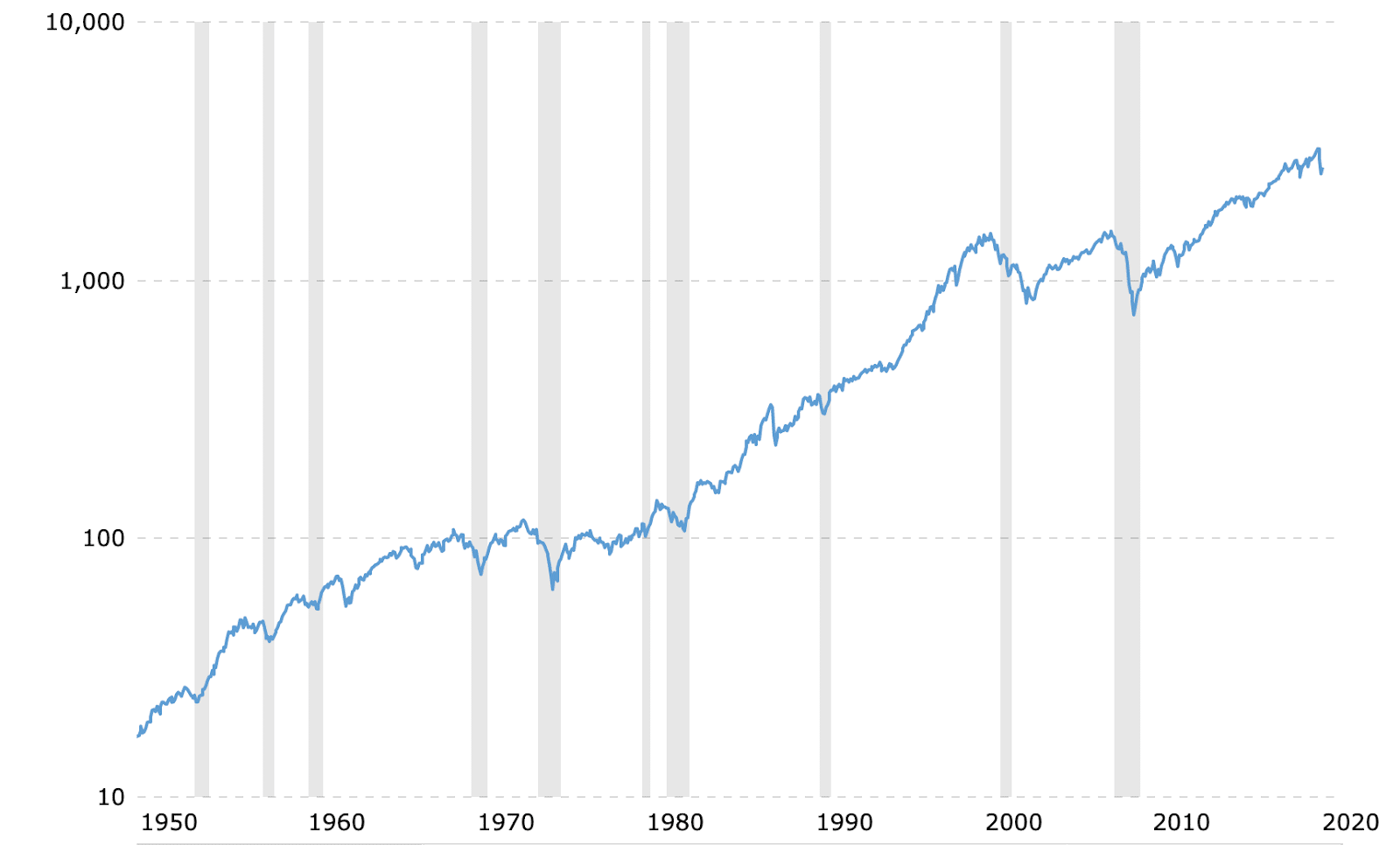

Take a look at this historical chart of the S&P 500 from MacroTrends that shows the long-term ups and downs of the stock market.

A couple points to note here:

- This is a logarithmic chart, so the movements are in percentage terms rather than raw numbers.

- The dark gray lines are recessions so you can see how many there have been and how the market performed during and after it was over.

Notice how the market recovered and then some even after some pretty severe times. When the tech bubble burst from 2000 to 2002, the S&P 500 dropped 43%. During the Great Recession in 2008, it dropped 56%. The drops and recoveries look like small blips when taking this long-term view.

Even if someone invested all of their money at the top in 2007 just before the Great Recession and stayed the course as their portfolio was cut in worse than half, they would have more than doubled their money by the end of 2019 if they had stayed invested. An S&P 500 index fund bought at the low in 2009 would have been up a whopping 300% by 2019.

Big dips in the stock market have been fantastic investment opportunities historically. Even the sharpest of declines have resulted in higher prices over time.

But what happens if someone not only stays the course but continues to make regular investments along the way? This strategy is called dollar-cost averaging.

Dollar-cost averaging may enhance investment returns during a recession

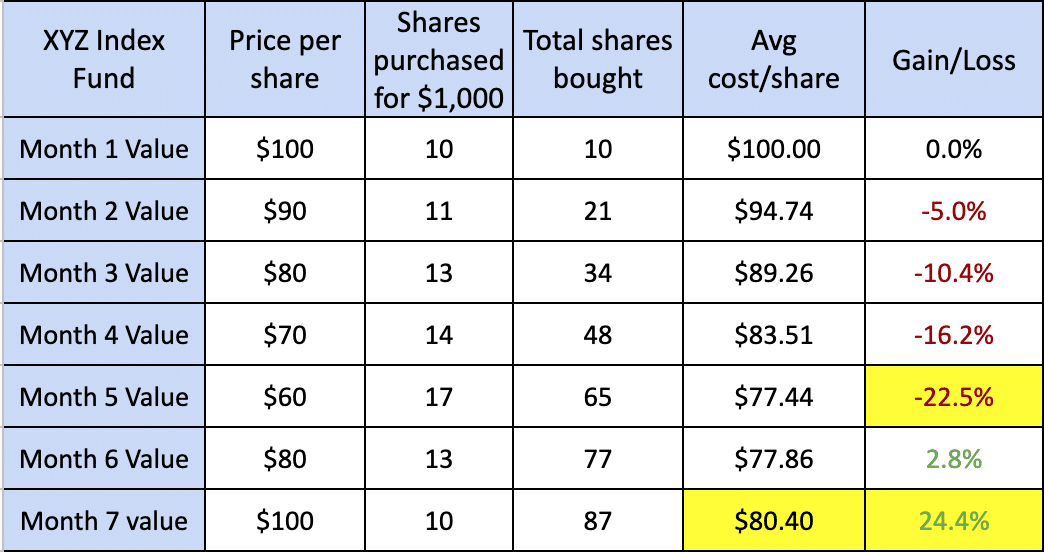

Dollar-cost averaging is when someone makes consistent investments each month. It’s a powerful way to take advantage of market dips. Think of it like making regular contributions to your retirement plan. Whether the market is up or down, you invest the same dollar amount each pay period. Here’s an example:

Let’s say an investor has a regular $1,000 monthly investment going into a low-fee reputable index fund. Right now it’s valued at $100 per share. But then, a recession and bear market hit. The investor keeps investing $1,000 per month even as the price drops. It drops to $60 per share then recovers to $100 within seven months. All the while, this investor kept chugging along and investing $1,000 per month.

Now this is wild: When this index hits it’s low of $60, that is a 40% drop from the high, but dollar-cost averaging on the way down created a lighter loss of 22.5% on the total investment. Dollar-cost averaging decreased the investment loss.

Beyond that, when the stock recovers to the original $100, it’s much better than breaking even for the investor. The $7,000 invested over seven months has turned into $8,700. This investor actually made 24.4% on their money by staying in the market and continuing to buy at lower prices even though the index fund just went right back up to where it was before the dip. They already had a 2.8% gain when the stock rebounded to $80.

If another investor had poor timing and put all $7,000 into the fund at one time at $100, they would have lost 40% when the fund hit $60 then ended up with a 0% return when it recovered back to $100.

Dollar-cost averaging helped the first investor lose less money on the way down and make more money on the recovery compared to the one who put all the money in at once when the index was $100.

Sticking with the plan and continuing with regular monthly contributions during downturns has proven to be a great opportunity and strategy. That said, it isn’t prudent for everyone to be investing. Whether or not you should invest depends on your personal financial situation.

How do you know if you’re ready to invest?

It’s no fun to see your portfolio and wealth drop precipitously, but staying in the game is critical to long-term wealth building. To get and stay in the investing game, you need to make sure that you’re not taking risks that are not right for your current personal financial circumstances.

Here are some important considerations to review in your financial situation before beginning to invest:

Make sure you have a big enough emergency fund

Chances are that if the market is down, other things are happening in the economy that can affect your day-to-day finances. During the COVID-19 pandemic, massive layoffs and furloughs have swept the nation. The skyrocketing unemployment was so sudden that it seemingly came out of nowhere. Few were financially prepared.

Before you take on any kind of investing, you need to have a cash cushion so you can survive the lean times. Traditional advice had always been three to six months’ worth of expenses in cash on hand. After seeing what has happened since the coronavirus outbreak, I’m thinking everyone should have six months’ worth of expenses in cash at a minimum. If you’re a business owner, it should be more like 12 months’ of expenses.

Only invest money that you don’t need for the next 5-10 years

I get this question a lot: “Rob, we’re thinking about buying a house in the next year or two. Should we invest this money?” No way!

Markets are volatile. Anything can happen in the short run. Don’t invest any money that you plan to use in the next five years, minimum. Otherwise, you risk needing the money when your portfolio has dropped by 30%. Keep your savings for short-term goals in cash.

Volatility is part of investing, so invest in what you understand and at your comfort level

Don’t let anyone talk you into investing in something you don’t fully understand or when you don’t understand the risks associated with it. Doing so is one of the easiest ways to lose money. Use an investment strategy laid out by an expert that resonates with you.

Why you should consider investing during this recession

Investing can have a massive impact on wealth creation and reaching financial independence. Stock market returns have consistently outperformed cash by a wide margin over time, but navigating the stock market requires gaining knowledge and understanding around the risks and rewards.

Anyone investing should have a rock-solid emergency fund in cash and should only invest money that they don’t need to use for at least five years, or better yet, 10 years. Only invest in things you understand, whether you’re doing it on your own or working with a professional.

Having a game plan, sticking with it, and continuing to invest during market downturns has been very financially rewarding over time.

There’s a lot more to investing than what I outlined here, so if you want to learn more about how you can invest, including more advanced strategies like tax-loss harvesting, check out Student Loan Planner® Podcast Episode 58 and Episode 59. Student Loan Planner® founder Travis Hornsby shares some gold nuggets of information in those episodes that you will want to know.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

I enjoyed reading your post. The point is especially drive home now that the market has nearly reached pre COVID levels. I am a strong proponent of approximating market average with broadly diversified low cost index funds at a set asset allocation that is rebalanced yearly. I personally don’t use DCA but add new contributions to rebalance according to my written plan. While you make your most money in a bear market by staying put and adding new contributions, I don’t have a crystal ball and don’t try to time things. I just follow the plan. This is all relatively new to me though and I enjoy learning from posts like yours. I share my journey from financial know-nothing to working towards financial well-being in my blog: http://www.prudentplasticsurgeon.com .

Thanks again!