If you look at dental practices in America, you’ll see many 70 and even 80 something-year-old dentists still working close to full-time schedules.

If that’s their calling and they’re financially independent, then awesome. We need more of those kinds of people in the world, especially when it comes to figuring out how to pay off dental school loans and become financially independent. However, for many, I would suspect that their work schedule is not entirely voluntary.

If you look at the older dentists in the profession today, they had to contend with five and low six figures of student debt, often with lower interest rates and fees.

What will happen when today’s millennial and Gen X dentists approach retirement age? Will the dental school graduate with over $400,000 of loan debt still be able to retire before dying while holding a handpiece?

Whether or not you’ll hit the point of no longer having to practice dentistry one day depends entirely on your savings rate.

Dentists have to play catchup financially compared with their friends from undergrad

A typical college grad might start off earning between $40,000 to $60,000 per year. They might also have $30,000 to $40,000 of federal or private student loans. To top it off, let's say they get a 401k match and save for retirement right away.

Dentists earn $0 for four years of dental school while they’re borrowing hundreds of thousands to fund their tuition and overall cost of attendance. While compound interest is aiding their undergrad degree-holding peers, dentists are fighting against the forces of interest working against them.

After working with hundreds of dentists through student loan consults, I’ve seen a huge range of dental school debt consisting of both federal student loans or loans through private lenders. On the low end, you could have received a three-year HPSP scholarship with the military or tons of family assistance and only owe $60,000 to $80,000. On the high end, a few repayment mistakes (e.g. unnecessarily putting your loans into deferment or forbearance) after graduating from a high-cost private school could leave you with over $600,000, which will continue to grow of the life of the loan.

To earn a significantly higher income than what you could’ve earned with a bachelor’s degree, you probably will need to own a practice. That means taking on even more debt.

In fact, even the most responsible and frugal young dentists can be facing down $1,000,000 in debt or more before they start to see make some real progress financially.

If you do need a practice loan, check out our form below.

Practice Loan Quote Form

Many dentists must confront the student loan tax bomb

After 20 years of making monthly payments of 10% of your income on the PAYE repayment plan, your student debt can be forgiven. Of course, then you'll owe taxes on the forgiven balance of your federal loans.

That could result in a $200,000 to $400,000 tax liability as a result of dental school debt forgiveness. Meanwhile, your friend from college is getting an employer-sponsored student loan repayment assistance benefit to tackle student loan debt that is in the mid-five-figure range.

The math often strongly supports this approach, but it’s still a hit to your net worth that sucks up additional assets in your 40s or 50s after decades of income-driven payments.

Dentists’ financial challenges make retirement very difficult

Dentists face intense pressure to meet all their financial obligations, put some money away for their future, and provide for their families. In most cases, dentists will be the primary breadwinners.

Here are only a few financial issues dentists have to deal with:

- Student loan balances higher than the cost of some McMansions

- Years of training before six-figure incomes start

- Saturation in large city metro areas in the market for dentists

- PPO plans negotiating incredibly low prices of dental procedures

Dentists are forced to delay gratification. When the rewards finally start coming, every bank and salesperson in the world wants to sell you something, because your high, stable income and good credit history is a great credit risk for them.

Dentists respond by buying big-ticket items like houses and cars at the limit of what they can get approved for.

What I do know is unless you’re saving a significant percent of your income as a dentist, your default plan is to work into your 70s.

Kevin the dentist who saves a lot and still might not have enough for retirement

Let’s take a look at Kevin the 26-year-old recent dental grad as an illustration.

He makes $130,000 a year as an associate at Heartland, but he hopes to take over his own practice in the Chicago area.

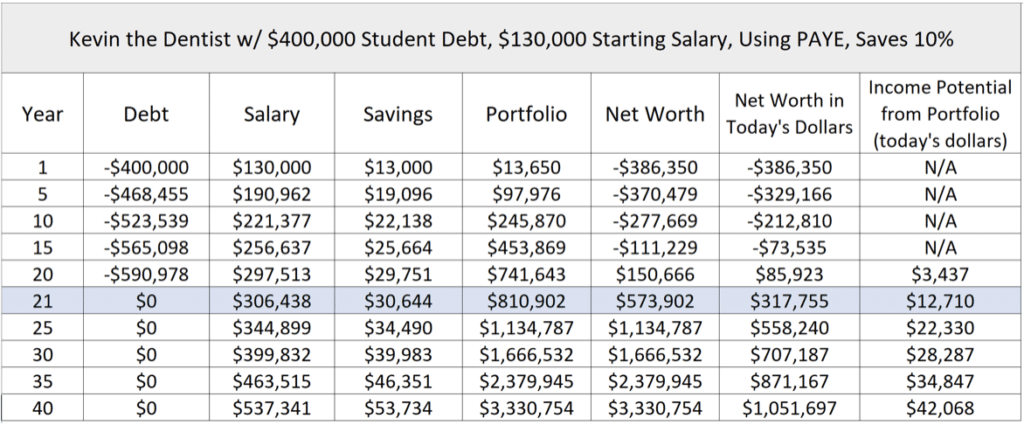

Let’s assume that Kevin chooses the PAYE plan from the available federal repayment programs since he owes $400,000 of student debt.

He gets 3% raises. I’m assuming an inflation rate of 2% and an investment return of 5%. Kevin saves 10% of his pay for retirement. That is a combination of his contribution and his employer match.

At year 20, Kevin’s loans are forgiven. He must pay over $230,000 in taxes since his loans have grown to almost $600,000.

Assuming a 40-year career, Kevin would have about $3.3 million at age 66.

Unfortunately, you need to adjust that down for inflation.

In today’s dollars assuming 3% inflation, Kevin would have about $1.05 million to spend in retirement. That amounts to roughly $42,000 in income that he could spend yearly on from his portfolio.

Can a dentist retire on $42,000 a year? Almost certainly not. In this 10% saving scenario, Kevin would be working well into his 70s. See the numbers below.

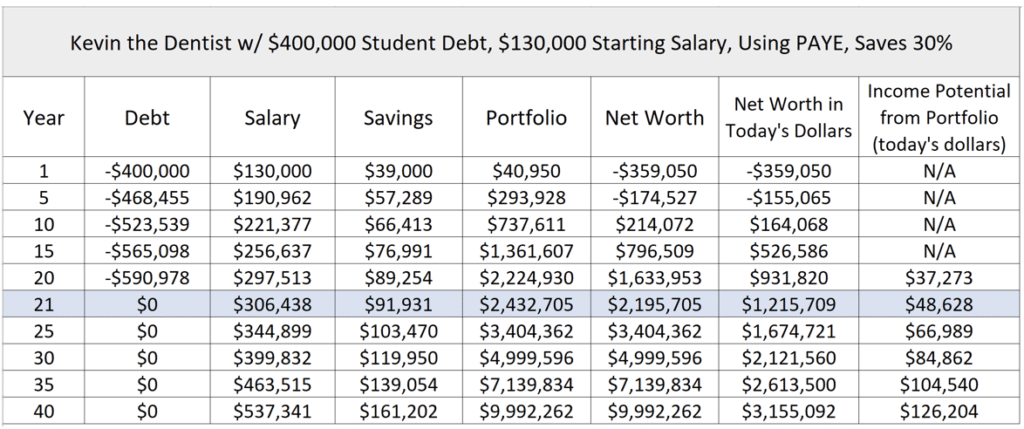

What if Kevin saved 30% of his dental income?

Let’s adjust Kevin’s savings rate to 30%. We see that he now has options for when work is optional.

Kevin hits close to $84,000 in retirement income potential (the final column on the right) after 30 years of working. I’m assuming that Kevin bought a practice and is essentially making a low $200,000 type income adjusted upwards for inflation.

He could probably also sell his practice and add a low five-figure amount to his income total coming from investments.

If he had stayed an associate, Kevin would have no such asset.

If I had a dollar for every dentist I heard was trying to use his or her practice as their primary income source in retirement, I’d be rich.

Clearly, saving 10% of your pay is a recipe for relative poverty in your older years. This is in large part due to the big tax bomb that hits you when you owe a massive chunk of student debt.

The synergy with student loans and retirement savings that dentists need to know about

Dentists who’ve hired me for a student loan consult know they should put $19,500 into a 401k and get a break on their student loan payments.

If you own your own practice or your spouse is employed in an outside job with benefits, you want their 401k maxed out too for another $19,500 going in a year.

It’s clear that if your debt from dental school is big, you need to focus on making equally big contributions monthly to grow your assets.

That means paying down a loan on a valuable dental practice you’ll own outright one day, paying down your mortgage, investing in a brokerage account, and maxing your 401k.

Dentists need a higher savings rate thanks to student loans

Dentists with big student debt need to target at least a quarter of their pre-tax salary for 401k and taxable brokerage account savings.

If you’re putting money away for the tax bomb in a brokerage account separate from retirement savings, put away more in that brokerage account if you can afford to after fully funding retirement. Then you’ll just be setting yourself up to be financially free at an even younger age.

Most dentists are not saving nearly enough for their futures. You can’t use the same playbook that the older generation of dentists used and expect to come out ahead. After all, their dentist student loan debt balances they came out with were in some cases less than one-tenth of what many students owe today thanks to the ever-rising cost of dental school tuition.

A higher savings rate and more frugality will be required to figure out how to pay off dental school debt and be successful financially.

And like Howard Farran of Dentaltown likes to joke, the six-figure student loans are nothing if you end up getting a divorce after you’ve built up your practice.

So invest in the important things in your life: your relationships, funds for the future including retirement savings, career development, and a good plan for your student debt. Don’t let the siren song of luxury cars and giant castle-like houses prevent you from reaching financial security.

You can still get there decades earlier than the vast majority of America thanks to your degree. Seize the opportunity.

If you have questions or concerns about your dental student loan debt, please don't hesitate to reach out and schedule a consult with us so we can come up with a custom plan.

Comments are closed.