The Public Service Loan Forgiveness (PSLF) program is available for some federal student loan borrowers. Keeping track of PSLF qualifying payments has been a frustrating process. However, there's a tool that makes tallying up your qualifying payments easier.

This guide shows you how to qualify for the PSLF program and how to use the StudentAid.gov PSLF Help Tool.

Editor's note: Changes to prior PSLF payment eligibility have positively impacted millions of borrowers thanks to the Biden administration’s PSLF order. While it expired in October 2022, many of the same benefits are available through the IDR Waiver. The IDR Waiver, or IDR Adjustment, is a one-time account adjustment to give credit for qualifying payments to borrowers on income-driven repayment plans and under PSLF.

5 Requirements to be eligible for PSLF

To qualify for the Public Service Loan Forgiveness Program, there are five requirements to successfully receive loan cancellation.

1. Work full-time for a public service entity

A public service entity can include a government organization, a nonprofit that is tax-exempt under Section 501(c)(3) of the Internal Revenue Code, a private not-for-profit organization that provides certain public services or serving in an AmeriCorps or Peace Corps position. This might include military service, law enforcement, emergency management, religious instruction, public education and many other public interest employers.

You must also work full-time. Full-time employment means working for one or more qualifying employers for the greater of an annual average of at least 30 hours per week or the number of hours the employer considers full-time.

2. Have Direct loans

Only student debt under the Direct loan program will receive forgiveness via PSLF. If you have Federal Family Education Loans (FFEL), Perkins loans, HEAL, HPSL, LDS or any other loan type eligible for a Direct Consolidation Loan, you can convert them into qualifying loans after reviewing these considerations.

3. Repay your loans on an income-driven repayment (IDR) plan

Qualifying repayment plans include Pay As You Earn (PAYE), Income-Based Repayment (IBR), Income Contingent Repayment (ICR) and Saving on a Valuable Education (SAVE), which was formerly called REPAYE. These student loan repayment plans are based on 5% to 20% of your discretionary income.

4. Make 120 qualifying payments

A qualifying payment is a monthly payment made on time, in full, while all four of the above-listed requirements are also met. Neither the 120 qualifying payments nor the employment status has to be consecutive.

5. Submit an Employment Certification Form (ECF)

The first two requirements are certified via the Employment Certification Form (ECF). This form is retroactive. So, it only certifies past PSLF qualifying payments up to the date on the form. Submitting the form annually isn't a requirement to qualify for PSLF, but it's recommended. An annual submission can help make sure you're on the right track and give you an updated qualifying payment count.

Related: How to Get an Electronic Signature for Public Service Loan Forgiveness

PSLF Help Tool

In 2019, the U.S. Department of Education introduced the PSLF Help Tool to assist those interested in pursuing this program. A series of questions help applicants determine if their employer may qualify. It also assists with finding out if they have the correct loan type.

Additionally, the tool generates a prefilled ECF for signatures to return to MOHELA for approval. Note that FedLoan Servicing was the previous PSLF servicer. As of December 2022, all PSLF accounts have been transferred to MOHELA.

What to expect after submitting your ECF

If your ECF is accepted, MOHELA has verified that your loans and employment qualify.

They'll then review your student loan payment history (including any payments you made to another federal loan servicer before your loans were transferred). This helps them determine how many payments made during the period of eligible employment certified on the ECF are qualifying monthly payments for PSLF.

You will then be notified of the total number of qualifying payments you’ve made and how many payments you must still make before you can qualify for PSLF. This is usually a letter sent via mail or email.

It’s best practice to submit the ECF annually. But you’d have to wait until your next submission to view your updated payment progress.

PSLF payment tracking

If your account is still with MOHELA, you can quickly track your PSLF payments online as it made some upgrades to its online user portal to include PSLF Payment Tracking. This is probably under a “payments & billing” tab.

*Note: a prior version of this article showed where to do this on the FedLoan website

This Tracker will list out each of your loans and reflect your PSLF qualifying payments. It separates payments that have already qualified via an ECF and those that need employment certification. Additionally, this tool helps you see your progress toward getting PSLF more transparently. This includes payments you made since your last ECF submission, something you would have had to track on your own prior to this feature launching.

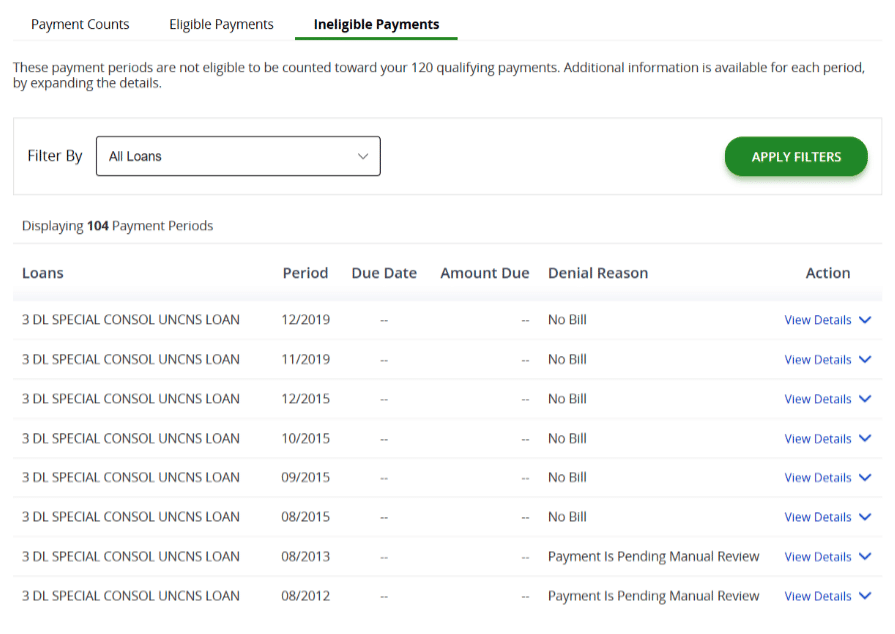

If you have any “ineligible payments,” the tracker will help identify those and list a reason for why. It might look something like this:

While steps are being made to increase accuracy, loan servicers as a whole are notorious for making processing mistakes. So, you need to stay on top of your own paperwork and pay attention to your payment count.

“MOHELA constantly applies my payments incorrectly every month. They lost my PSLF waiver application on multiple occasions forcing me to start over. Then they finally processed my PSLF but miscalculated the payments count.”

January 2024 Student Loan Planner Reader Survey

If you believe there is an error in your payment count reflected after a new ECF is submitted and after reviewing the denial reason provided, here are five steps to fix your PSLF payment count.

Be confident about your PSLF payment timeline

This online feature from MOHELA is a big improvement that could help borrowers feel more confident about their timeline toward earning PSLF. Moreover, it will hopefully help borrowers catch discrepancies sooner rather than later.

The Department of Education’s goal is to improve customer service and hold student loan servicers accountable for their performance in managing federal student loans while moving more of the servicing experience over to the federal Studentaid website. So, expect more improvements.

If you need additional guidance with your specific student loan situation, schedule a consultation with us. Our team has helped hundreds of people handle their student loan debt.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).