On October 6, 2021, the government announced the Limited Public Service Loan Forgiveness (PSLF) program waiver opportunity. Federal Student Aid added additional benefits for the PSLF waiver in mid-May 2022, such as allowing certain types of forbearances and deferments to count towards the PSLF program.

Here is a guide on the limited PSLF waiver and how it worked. Note that the IDR Waiver lasts until June 30, 2024 and has almost all of the benefits listed below. The only difference between the PSLF Waiver and the IDR Waiver is that the PSLF Waiver did not require you to be employed at a qualifying employer when you received forgiveness. That waived requirement is back in place. But all the other PSLF Waiver rules listed below are accessible under the IDR Waiver currently in place.

Limited PSLF Waiver program rules

Remember, the PSLF Waiver expired on October 31, 2022, but many of these benefits are available through the IDR Waiver.

Here are a few highlights of the PSLF Waiver:

- Borrowers with previously ineligible types of loans, most notably Federal Family Education Loan Program (FFELP) loans, qualified as long as payments were made while employed at a 501(c)(3) or government employer. To qualify, you must have consolidated these loans into the Direct Loan Program with a Direct Consolidation Loan and applied for PSLF.

- All repayment plans qualified for PSLF if certified before this PSLF Waiver expired.

- All past loan payments made before a loan was consolidated could have been counted as well.

- Deferment and forbearance due to active-duty deployment could have been counted toward PSLF for current and former active-duty military service members.

- Before March 13, 2020, if you spent 12 months or more in consecutive forbearance, or 36 months or more in aggregate forbearance, those periods of non-payment may have counted towards PSLF.

- For any type of deferment before 2013 besides in-school deferment, that period may have counted. Only economic hardship deferments were counted as of January 2013 and after.

Note that only months on or after October 2007 could have qualified for credit towards forgiveness.

What is the Public Service Loan Forgiveness limited waiver opportunity?

The Biden administration used authority under the HEROES Act of 2003 to enact the now-expired PSLF waiver. This Act allows the President to modify many of the normal rules about student loans during periods of national emergency (e.g., the COVID-19 pandemic). Under the PSLF waiver, all federal loans, repayment plans and some kinds of forbearance and deferment could have qualified for loan forgiveness if you were a public servant at the time.

You could have even received a refund if you end up with more than 120 months of qualifying credit.

Borrowers who already received loan forgiveness, paid off their loans or have refinanced with a private company will not receive this benefit.

May 2022 Limited PSLF Waiver update and FAQ

The guidance on the PSLF Waiver is constantly changing. Here are the latest answers to questions you may have.

Even though the PSLF Waiver is expired, the IDR Adjustment offers many of the same benefits. The IDR Waiver, or IDR Adjustment, is a one-time account adjustment to give credit for qualifying payments to borrowers on income-driven repayment plans and under PSLF.

The government will give you at least the amount of credit on the loan with the longest payment history. This is an extraordinarily generous decision by Department of Ed, and it allows many borrowers to consolidate strategically to get additional credit on more recent loans. In one case, a surgeon used an old loan from undergrad to get years of extra PSLF credit on his med school loans by consolidating.

No. Prior guidance from the Department of Education stated that the loans needed to have overlapping payment histories, but they changed their mind.

No. But if you consolidate Parent PLUS loans with at least 1 loan from your own education, then the new Direct Consolidation Loan could benefit.

No. Some borrowers who still have years to go before they reach 10 years of public service credit might hurt themselves by consolidating. This is mainly true for borrowers with incomes higher than their debts, who might lose the ability to cap their payments at the standard 10 year plan level.

Borrowers with FFEL loans should consolidate in order to benefit from the PSLF waiver. You can call your servicer to find out if you have this type of loan, which only existed prior to 2010.

If you need to consolidate first, do that and then apply with all of your employment history with the PSLF help tool at studentaid.gov/pslf. If you do not need to consolidate, you still need to apply. Many borrowers have never submitted their full employment history through the Federal Student Aid website, and these borrowers risk missing out completely on the PSLF waiver benefits.

How to get loan forgiveness from the PSLF Waiver

Borrowers needed to take different steps depending on what kind of loans they have and how much employment history they've certified with the U.S. Department of Education.

Borrowers with older loans needed to take two steps. Whereas borrowers with newer Direct Loans only needed to take one step.

Editor's note: Even though the PSLF Waiver is expired, the IDR Adjustment offers many of the same benefits. The IDR Waiver, or IDR Adjustment, is a one-time account adjustment to give credit for qualifying payments to borrowers on income-driven repayment plans and under PSLF.

PSLF Waiver action steps for borrowers with loans from BEFORE 2010

Borrowers with federal student loans from 2010 or before may have two kinds of loans: Direct and FFEL.

Most of these loans will be from the FFEL program (FFELP), which previously didn't qualify for PSLF at all.

For all FFELP and Federal Perkins Loans, you must first consolidate your loans into a Direct Consolidation Loan. If you have Parent PLUS loans, you can do a double consolidation to get around the rules excluding Parent PLUS from forgiveness!

Editor's note: If you have an FFEL loan, both public and private sector employees can benefit from the IDR Adjustment. Borrowers with commercially held FFEL debt will need to consolidate to take advantage of these benefits by June 30, 2024. Borrowers with federally-owned FFEL loans do not have to consolidate to get these benefits. If you need help navigating these options, we provide professional help.

Second, submit the PSLF Employment Certification Form on StudentAid.gov, also called the ECF. Use the Federal Student Aid's (FSA) PSLF Help Tool to do this.

If you have Direct Loans from this period, certify ALL your years working at a nonprofit or government employer. You could pick up years of additional credit toward forgiveness. This applies even if you were on the wrong student loan repayment plan.

Note that you can consolidate multiple loans with different payment counts and get credit for the new consolidation loan for the one with the most months of credit!

Many FFEL borrowers could qualify for immediate forgiveness by consolidating and certifying at least 10 years of eligible employment. Most FFEL borrowers have been in repayment for at least 10 years. That means, if you have 10 years' worth of public sector employment between 2007 and 2022, you could qualify for a tax-free discharge of your loans.

PSLF Waiver action steps for borrowers with loans FROM 2010 and AFTER

If you have federal student loans after 2010, you most likely only have Direct Loans. This is because the FFEL program ended in 2010. Therefore, there's no need to consolidate.

Although, given new guidance on the consolidation of Direct Loans during the waiver, you might want to consider it.

Consider this scenario. You worked as a teacher after undergrad for four years, went back to grad school, and borrowed another $100,000.

If you consolidate the grad school loans with the undergrad loans, your new loan will get credit for those four years you paid as a teacher!

The guidance on the PSLF waiver seems to change WEEKLY. It's frustrating when we're trying to help clients and readers maximize their benefits. But just know that there are A LOT of planning opportunities around this.

Next, use the PSLF Help Tool and formally apply for PSLF

After determining if you need to consolidate or not, you only need to submit the PSLF ECF. Any previously ineligible years of payments will now count as long as you made payments of any kind on your student loans.

If you've already certified your PSLF credit, you can benefit automatically in the coming months as the government reviews loan accounts.

That said, I recommend you resubmit your ECF even if you've already done so. Include ALL employment from a 501(c)(3) or government employer between 2007 and 2021.

I expect many borrowers (even those who are PSLF-certified) to neglect to include qualifying employment for years in which they didn't make an income-based payment on their student loans.

This new PSLF order allows ANY past payment to qualify. So, one of the most common reasons borrowers will fail to benefit will probably be neglecting to include all qualifying public service employment on their ECF.

How long until you see the PSLF Waiver help you?

The Education Department is in the middle of transferring 16 million borrower accounts to a new student loan servicer. FedLoan Servicing, the company that manages PSLF, is one of the servicers quitting.

If you took the actions above by October 31, 2022, I expect you'll have nothing to worry about.

As of May 2022, we have already seen over 100,000 borrowers get forgiveness on over $6 billion. You need to be patient and make sure you have taken all the necessary steps. Then it's just a waiting game.

We see most consolidations happen within one or two months. Many borrowers report seeing their payment counts updated anywhere between two and six months.

Limited PSLF Waiver benefit: Technical payment problems eliminated

Here's another big benefit of the PSLF Waiver. Those with late payments and payments slightly less than the total amount due will now qualify.

The PSLF program had a lot of trouble with accidental payment mistakes. For example, paying one penny less than the required amount would cause a payment not to count.

Many borrowers have been fighting for years to get payment issues fixed, often of no fault of their own.

This provided relief to many thousands of borrowers.

How many student loan borrowers will benefit?

Early reporting suggested the Biden Public Service Loan Forgiveness Waiver would benefit as many as 550,000 borrowers. However, this number only includes borrowers who have already applied for PSLF.

We've already seen over 100,000 borrowers get PSLF due to this waiver. But we expect that's just the tip of the iceberg.

If you include the millions of borrowers with previously ineligible loans, millions of people could receive benefits under this PSLF Waiver.

PSLF for FFEL loans could result in complete forgiveness for millions of borrowers

Take a look at the current state of FFEL loans below, none of which are eligible for PSLF under normal rules. Keep in mind all FFEL loans have been around for at least 10 years and could have qualified for PSLF under this executive action.

| Dollars of FFELP loans (Q2 2021) | # of borrowers with FFELP loans |

|---|---|

| $238.8 billion | 10.6 million |

There are presently more than 10 million borrowers with FFELP loans.

Non-profit workers represent about 10% of the workforce, according to the Bureau of Labor Statistics. And a Brookings report found that government workers represent approximately 15% of the workforce.

That means approximately 25% of the workforce would work for a qualifying employer under PSLF.

Public-sector workers are more highly educated than private-sector workers as a group. That means this 25% number is likely a floor. Likely, more than 25% of the 10 million borrowers above could work for a qualifying employer.

A rough guess of the FFEL loans that could be forgiven immediately

That said, you need to be employed full-time for 10 years cumulatively to benefit. You also must have made payments while employed for those 10 years to get PSLF. Of the current public sector workers, it's reasonable to guess at least half have met those eligibility requirements. More than 90% of FFEL loans are in active repayment and have existed for at least 10 years since the program ended in 2010.

PSLF borrowers also tend to have higher average student loan debt balances. So, an absolute floor for eligible FFEL loans might be 25% (share of the workforce in public service) * 50% (share that's been employed in public service full time for 10 years) * $238.8 billion = $29.9 billion.

That number could easily double in size if the share of FFEL borrowers is disproportionately working in public service.

This cost estimate was not included in the Department of Education announcement.

How many Direct Loans will be forgiven from this PSLF order?

The typical public servant borrower with Direct Loans who benefits from this PSLF order will probably just get a couple of years of extra credit toward their 120 months of qualifying payments.

Many borrowers started out on the wrong repayment plan or made a loan consolidation mistake. But they figured out what to do shortly after that.

Borrowers who didn't certify credit toward forgiveness while they were on plans besides an IDR plan will have the most to gain.

Also, FAR more borrowers qualify for PSLF with Direct Loans than have currently submitted an approved employer certification PSLF form. The final benefit amount of the PSLF Waiver may ultimately depend on reaching a huge number of individuals in the next year.

PSLF Waiver results so far

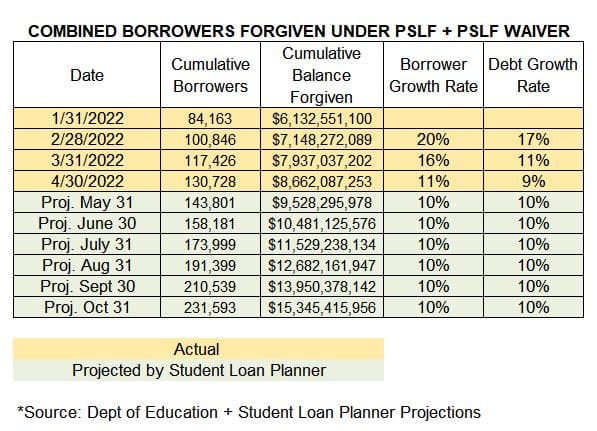

Department of Education has released forgiveness totals for each month under the PSLF waiver. Here's what the results look like. A yellow color indicates official numbers. A green color indicates our projections if the growth rate in approved borrowers and debt forgiven remains at 10%.

Notice that the rate of growth in approvals is slowing.

The big danger with the PSLF Waiver

The massive danger with the Limited PSLF Waiver is that borrowers will not hear about this life-changing opportunity in time. You only had until October 31, 2022. Our consult business has tripled partly due to this waiver's massive saving opportunities.

Please tell your friends and colleagues. My wife is a physician, and many of her highly educated physician colleagues have just discovered that they can get their entire balance forgiven by consolidating thanks to this waiver.

How many borrowers will fail to receive forgiveness simply because of how complex the government made this waiver? Far too many. Please 1) take advantage of this limited-time opportunity for you, and 2) tell others about it.

Getting help navigating PSLF

Following the action steps in this article carefully could knock years off your repayment or even get complete forgiveness.

Borrowers who already had a plan in place from the beginning will likely not benefit. This order targets borrowers who experienced difficulty with PSLF during the late 2000s and early 2010s when information about PSLF was less widely available (and what was available was often incorrect!).

While the PSLF Waiver expired on October 31, 2022, the IDR Waiver offers many of the same benefits. Our team of CFA and CFP® professionals can help make sure you get the max benefits under the waiver rules. We also have the highest reviews of any company operating in the student loan industry. So, you can trust that we take our responsibility to save you money incredibly seriously.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.