Sophisticated investors often leverage a technique known as tax-loss harvesting to optimize their investment returns while minimizing tax liabilities. This can be a powerful tool in an investor's arsenal. But is it worth the effort?

Learn how tax-loss harvesting works, and discover how this tax management strategy can be used to lower your federal student loan payments.

Understanding tax-loss harvesting

This approach involves strategically selling poorly performing investments to offset taxable gains within a portfolio. The resulting losses can be utilized to counterbalance gains and potentially reduce the overall tax burden on tax return filers.

It allows individuals to deduct up to $3,000 in excess losses against ordinary income. Any additional losses can be carried forward to future years to lower your tax bill even more.

At its core, tax-loss harvesting involves selling an underperforming investment to create a loss, which can be credited against realized gains. The asset sold can then be replaced with a similar investment, ensuring the portfolio's desired asset allocation and risk-return profile. However, careful consideration is necessary when replacing the investment to ensure compliance with the ‘wash-sale rule'.

Related: How to Unlock Tax-Loss Harvesting Strategies for Couples Filing Separately

IRS wash-sale rule

Understanding the ‘wash-sale rule' is critical to the success of tax-loss harvesting. The IRS states that buying substantially identical securities within 30 days, before or after selling an investment at a loss, could disallow the deduction of that investment loss for tax purposes. This rule applies universally across different accounts, including joint accounts shared with a spouse.

The IRS shares the following example:

“You buy 100 shares of X stock for $1,000. You sell these shares for $750, and within 30 days from the sale, you buy 100 shares of the same stock for $800. Because you bought substantially identical stock, you cannot deduct your loss of $250 on the sale…”

How tax-loss harvesting affects student loans

An overlooked yet consequential aspect of tax-loss harvesting lies in its unintended impact on student loan payments. If you have federal student loans, you have access to income-driven repayment (IDR) plans, which calculate monthly payments based on your income.

As previously stated, this strategic tax approach can yield a deduction of up to $3,000 from ordinary income. This directly impacts an individual’s Adjusted Gross Income (AGI). Since the Department of Education uses AGI to calculate your monthly payment, a lower AGI from the $3,000 deduction can potentially reduce your monthly payment calculation.

Example: Tax-loss harvesting impact on student loans

Let’s look at an example to understand the impact of this tax strategy on student loan payments.

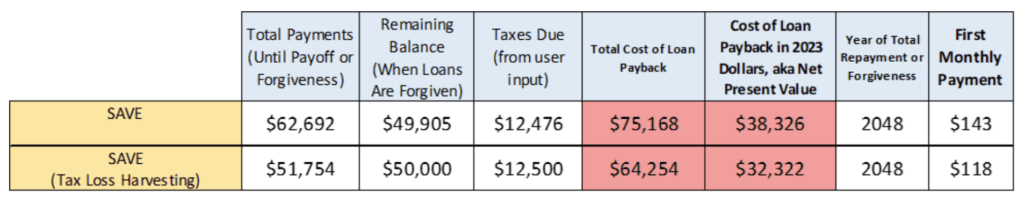

Imagine a borrower with $50,000 in graduate loans at an interest rate of 6.80%. This individual is single, has no children and has a gross income of $50,000. If this student loan borrower enrolled in the IDR plan, called SAVE, their required monthly payment would be $143.

However, with the ability to deduct $3,000 from ordinary income through tax-loss harvesting, this same individual would reduce their payment amount to $118.

Now, consider the broader financial implications captured in the chart below. Although the immediate monthly savings might appear modest, the long-term effect reveals a substantial unintended benefit. Through the tax-loss harvesting strategy, the borrower stands to save $10,914 over the life of their loans, as seen in the ‘Total Cost of Loan Payback' area. This surplus amount can be channeled toward other financial objectives, such as saving in retirement accounts or building up a brokerage account.

However, this example represents just one among many potential scenarios. Factors like family size, poverty guidelines, current and anticipated future income, and even opportunities for loan forgiveness are all interconnected and can impact student loan payments.

This highlights the importance of seeking professional guidance to navigate the complexities of tax strategies and their impact on student loan repayment calculations.

Can tax-loss harvesting be worth it for you?

A study called “An Empirical Evaluation of Tax-Loss Harvesting Alpha” by Shomesh E. Chaudhuri, Terence C. Burnham, and Andrew W. Lo analyzed historical data from the Center for Research in Securities Prices database.

This study analyzed the period from 1926 to 2018, focusing on the 500 securities with the largest market capitalization. The findings, considering long- and short-term capital gains tax rates at 15% and 35%, respectively, revealed that a tax-loss harvesting strategy generated a tax alpha of 1.10% annually.

However, when restricted by regulations such as the wash-sale rule, the tax alpha declined from 1.10% annually to 0.85% annually. Other studies put the annual tax alpha at around 1%. Regardless, the strategy's effectiveness varies based on an investor's individual circumstances, including their tax bracket and investment horizon.

The evolution of financial technology has also significantly enhanced the viability of tax-loss harvesting strategies for everyday investors. Technological advancements have revolutionized tax-loss harvesting, introducing sophisticated algorithms and platforms capable of automatically identifying opportunities to strategically sell investments for tax benefits. These innovations offer real-time tracking of portfolio positions and have significantly reduced costs, making tax-efficient strategies accessible to a broader range of investors.

The bottom line

Tax-loss harvesting presents opportunities for tax savings. It also potentially provides benefits to lower federal student loan payments and optimize future loan forgiveness opportunities. Lowering your taxable income through strategic deductions, like those from tax-loss harvesting, could impact IDR amounts for federal student loans.

Nonetheless, the true impact on IDR plans requires an assessment considering the unique terms of the repayment plan, family size, and poverty guidelines beyond AGI alone. Also, the actual effectiveness of tax-loss harvesting varies based on a taxpayer’s individual circumstances, including income tax brackets for the applicable tax year and investment horizon.

Still unsure whether tax-loss harvesting is right for you? Seek advice from financial advisors or tax professionals to get a tailored approach to your personal finances, financial goals and student debt repayment.