While Direct Unsubsidized Loans come with annual borrowing limits, MBA students can borrow up to their total cost of attendance with Grad PLUS Loans. And this unlimited fountain of federal student aid often leads MBA schools to charge high tuition rates and students to end up with large amounts of MBA debt.

Around 200,000 people graduated with an MBA in 2018. According to a Bloomberg Businessweek survey, 18% borrowed more than $100,000 in student loans, with the bulk of those people attending top 25 business schools. Seventeen percent borrowed between $50,000 to $100,000. When adding in undergrad loans, many MBA program graduates end up with six figures of student debt.

Unlike graduating as a doctor, veterinarian or dentist, MBA grads have a bunch of different career options to choose from. The Bureau of Labor Statistics cites 21 different business and financial occupations with their median salaries. But even a list of that size isn’t comprehensive. For example, it doesn’t list entrepreneurship, business executive and many other career options.

The MBA is the most versatile graduate degree, which means the optimal loan repayment strategy could be all over the map, depending on the career path the MBA grad decides to take. Before we dive into solid repayment strategies, it’s important to note the differences between student debt and other types of debt.

What makes MBA debt different than standard debt?

Student debt has two nuances that make loan repayment different from other unsecured debt. First, student loan interest is simple interest. If monthly payments don’t cover the loan interest, it simply accrues in another bucket. It doesn’t compound.

This means when comparing an investment with a projected return of 6% compounded with paying off 6% of student loan debt, the investment with compound interest would be the better option from a financial optimization standpoint (without accounting for risk, of course).

Just a small note: There are a few things that could trigger the interest to capitalize, like putting MBA loans in forbearance, missing a payment or switching repayment plans.

Second, student loans have plans based on income, not the amount owed, with either taxable or tax-free loan forgiveness at the end of the repayment term. Let’s say two individuals are working as financial analysts making the exact same income. But one owes $150,000 for their MBA and undergrad and the other owes $300,000.

Their payments would be different if they were on plans where the payments were based on the amount of debt, such as the standard, extended or graduated plan. The one who owes $300,000 would have payments virtually twice as large the one who owes $150,000.

That’s not the case if they’re both on an income-driven plan like Revised Pay As You Earn (REPAYE). The amount of debt is irrelevant when calculating the payments. The monthly payment is based on their income. In the example of the two borrowers with different amounts of debt, they would have the same exact monthly payment if they were on REPAYE.

Editor's note: The REPAYE plan was replaced by the Saving on a Valuable Education (SAVE) plan. Learn how the SAVE plan can save you money on your MBA.

Get Started With Our New IDR Calculator

MBA student loan repayment options

It seems pretty simple. You have debt. Find the lender that offers the lowest interest rate and either carry the leverage to optimize your return on equity or pay it off quickly to maximize cash flow in the long run. And, for private loans, that simple strategy is probably best.

But MBA student loan debt repayment on federal student loans is a little bit trickier due to the repayment options available to pay off MBA debt. Here at Student Loan Planner®, we’ve done over 5,000 consults and advised on over $1,3 billion of student debt. Our experience shows there are two optimal ways to pay off student loans:

Aggressive Payback. For people who owe 1.5 times their income or less (e.g., the MBA grad who makes $100,000 with loans at $150,000 or less), their best bet is usually to throw every dollar they can into paying back their loans as fast as possible for no more than 10 years. Income-driven repayment doesn’t typically come into the picture.

Pay the least amount possible. For people who owe more than twice their income (e.g., an MBA grad who makes $60,000 and owes $120,000 or more), the goal is to get on an income-driven repayment plan that will keep their payments low and maximize taxable loan forgiveness. This can be optimal due to simple interest, as well as the difference in paying off the debt in full compared to having 20 to 25 years to save and invest for the tax portion.

MBA student loan repayment scenarios

Let’s take a look at a couple of different scenarios — one where the person owes more than twice their income and another where they owe less than 1.5 times their income.

Note that in all the scenarios below we'll assume that 100% of the student debt is in federal loans. If you have a private student loan, you should ignore the advances strategies below and start looking into your refinancing options with private lenders.

Scenario 1

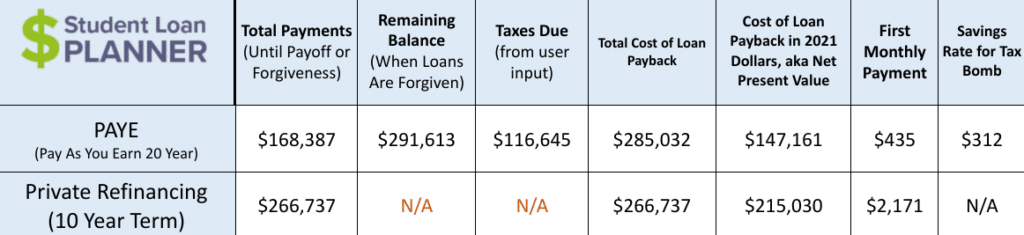

Let’s say Jon has $200,000 of undergrad and MBA debt at 6.5% interest. He’s making $70,000 a year with 5% projected income growth for the next 10 years.

PAYE is the clear winner here from a wealth-optimization standpoint. After adding up the projected payments of $168,387 over the next 20 years and the tax bomb of $116,645 due in 20 years, it would only cost Jon $20,000 more out-of-pocket than refinancing. But he’d be able to spread out the cost over 20 years on PAYE versus only 10 with refinancing.

This is more apparent when looking at the cost of loan payback, or net present value (NPV), for PAYE. It’s about 31% less than refinancing using the assumptions of 5% investment growth and 3% inflation.

Rather than making monthly payments of $2,171 for 10 years, Jon would actually end up in a better spot from a net-worth standpoint by going on PAYE and investing on the side for the tax bomb of $116,645. He could make his payments, save $312 per month for the tax bomb (at 5% annualized growth) and still have the money to invest another $1,400 per month.

Scenario 2

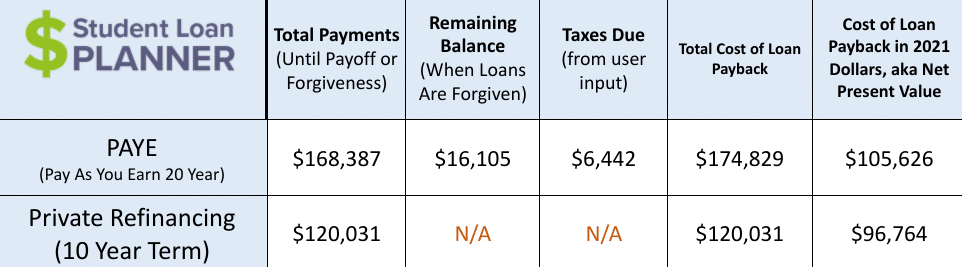

Let’s say Janet has $90,000 of undergrad and MBA debt at 6.5%. She’s making $70,000 a year with 5% projected income growth for the next 10 years — same as Jon.

Janet’s scenario clearly favors refinancing and aggressively paying off the loan. She can save $54,000 out of pocket paying back the loans and be debt-free in 10 years instead of 20. The payment of $977 per month on a $70,000 salary is much more manageable than Jon’s $2,171.

One other thing to point out is their payments on PAYE would be identical — $435 per month for the first year — because their income is the exact same. Even though Jon has more than twice the student loans of Janet.

These two scenarios are fairly clear-cut. But what happens if someone starts out with a debt-to-income of 2-to-1, yet has a high income-growth trajectory? How do they handle their MBA debt when they can’t afford the large payment but will be able to in the next two to three years?

The REPAYE interest subsidy & waiving the grace period

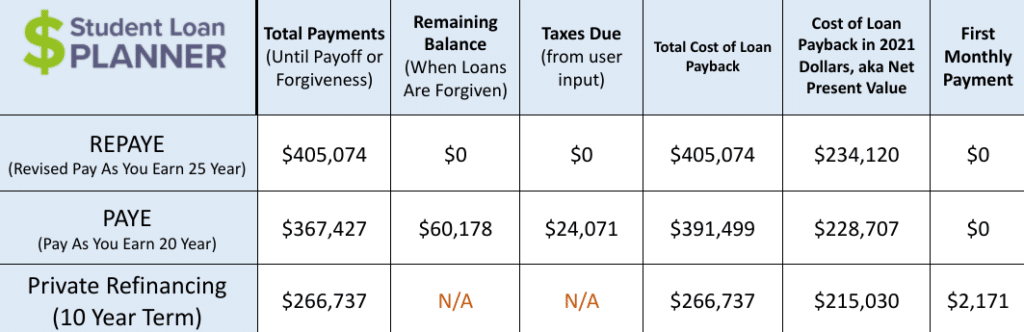

Let’s say Samantha just graduated and owes $200,000 in student loans at 6.8%. Right now, she’s not working but will start at her job in two months making $70,000. She expects her income to grow rapidly and anticipates making $150,000 in five years and $250,000 in 10 years.

Refinancing is the best long-term option, but she can’t make that $2,171 payment right now.

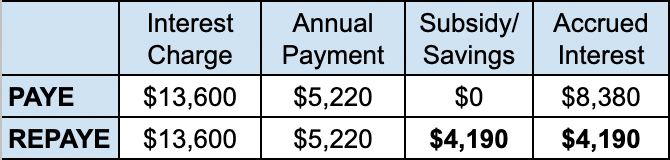

If she chooses to wait her entire grace period and then chooses PAYE, her loan would have accrued six months of interest — $6,800. Her monthly payment would then be $435 or $5,220 for 12 months, based on a $70,000 income. After 12 months on PAYE, she would have accrued another $8,380 on the loan ($13,600 in interest – $5,220 of payments).

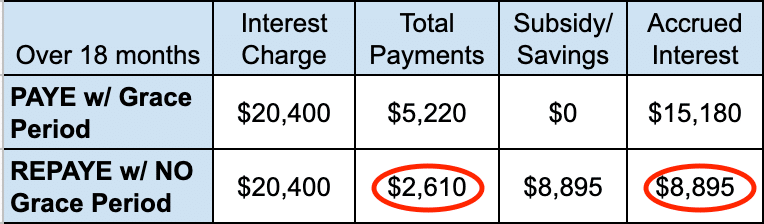

So by the end of 18 months (the six-month grace period plus 12 months on PAYE), she would have accrued $15,180 of interest and made $5,220 in payments.

Here’s an advanced technique she can use to save money paying back her loans while keeping her payments low for two to three years and slowing down the growth of the loan: Consolidate in order to waive the grace period, go on Revised Pay As You Earn (REPAYE) and then refinance when she can make the $2,000-plus payment.

Here’s how it works.

The REPAYE interest subsidy

Let’s start with talking about the REPAYE interest subsidy: The simple explanation is that any interest that would accrue on the loan gets cut in half, which cuts the loan growth in half.

In other words, that $8,380 that would accrue on the loan under PAYE would be half of that under REPAYE — $4,190. The government subsidizes, or wipes away, the other $4,190 that would have accrued on the loan.

Since Samantha is going to pay the loan back in full anyway, the interest subsidy would save her $4,190 just by selecting REPAYE.

But what if she waives the grace period, goes on REPAYE six months earlier and starts making payments right away?

The interest subsidy cuts accrued interest

Another awesome benefit in this case is that she isn’t working at the moment. With her income at $0, her REPAYE payments should be $0 for 12 months. Plus, waiving the grace period to go on REPAYE means the six months of interest charges that would have accrued on her loans while in the grace period gets cut, too. She won’t have to certify her $70,000 income until it’s time to recertify in 12 months.

Here’s how much Samantha could save by implementing this strategy over 18 months. Under PAYE, she’s taking the full six-month grace period, then making 12 months of payments. With REPAYE, she’s waiving the grace period, then making 12 months of payments at $0 and six months at $435:

Implementing this strategy is projecting to cut her payments in half over that time and save her $8,895 in accrued interest, compared to a more traditional approach and going to PAYE.

Guess where all that money ends up instead of being used to pay back her loans? Her bank account.

This strategy isn’t for everyone, and consolidation should really be thought out if there’s any credit toward loan forgiveness, whether taxable or Public Service Loan Forgiveness. But it works well for someone in Samantha’s situation.

It’s a no-brainer that will save her almost $10,000 over 18 months. Once she can easily afford the 10-year payment and as long as she isn’t working for a nonprofit or government employer, she should look into refinancing if she can get a lower interest rate.

How to refinance MBA student loans

There are many online lenders today that make it easy to apply for a rate quote on student loan refinancing without a credit check. You can also use lender marketplaces like Credible to check your rates with multiple private lenders in minutes.

When choosing a refinancing lender, know that all of the reputable companies don't charge origination fees or include a prepayment penalty. Lenders typically have a range of rates they may charge with excellent credit being required to access the lowest rates.

You'll generally have the option to apply for a fixed or variable rate loans. However, with interest rate currently hovering nearly all-time lows, fixed rates are extremely attractive. Choosing a variable interest rate right now may be a riskier move than usual. Note that you may be able to reduce your interest rate even further if you sign up for autopay. A 0.25% autopay discount is most common in the industry.

In addition to rates, you'll want to consider whether the lender allows periods of forbearance of academic deferment. And, depending on your credit standing, you may also want to consider each lender's cosigner and cosigner release options. Compare your student loan refinancing options here.

MBA grads need a plan for student loan repayment

MBA graduates can find a clear path to payoff for their student loans. This path that could not only save them significant money — it could also help them fully understand the action steps required to get it done.

Student Loan Planner® has done over 5,000 student loan consults for clients with over $1.3 billion of student loans. We can help you figure out the optimal path in just one hour.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).