No matter how difficult a career path might seem, most of us can still lean on the tired, old adage, “Well at least it’s not brain surgery.” But not so for medical school grads who are pursuing a specialty in neurosurgery.

Neurosurgeons are some of the few skilled physicians who perform brain surgery — and that’s not all they do. A neurosurgeon’s span of care encompasses the entire central and peripheral nervous system, including the spine, skull base, vertebral column and more.

As would be expected, choosing a career in neurosurgery requires a serious commitment of time toward education and training. And, like all doctors, many neurosurgeons finish medical school with six figures of student debt.

But how much do neurosurgeons make? And is the typical brain surgeon salary worth the financial cost? In short, yes.

Neurosurgeons are some of the most highly compensated of all physicians. With the right student loan plan, a neurology career can make even more financial sense. Here’s what you need to know.

Neurologist education and training requirements

The path to becoming a neurologist begins with earning an undergraduate degree and getting accepted to a medical school. An applicant usually requires a strong GPA and MCAT score to get accepted to a medical school program, and programs take four years to complete.

After finishing medical school, physicians pursuing a speciality in neurosurgery must apply for open residency positions. Getting a residency can be a difficult step for aspiring neurosurgeons as the American Medical Association said that neurosurgery residency positions are among the seven most competitive of all medical specialties.

Medical school grads who land a neurosurgery residency are then barely halfway along their path to board certification. At seven years, the neurosurgery specialty has one of the longest residency requirements of all specialties.

After completing seven years of residency, neurosurgery doctors must pass a written exam. And, lastly, candidates for neurology board certification are eligible to sit for their final oral examination after logging 125 cases.

Average neurosurgeon salary

In the American Medical Group Association 2019 Compensation and Productivity Survey, the median neurosurgeon salary was an impressive $833,133. Here’s what other surveys reported the average neurosurgeon salary to be:

- Doximity 2023 U.S. Physician Employment Report: $788,313 (neurosurgery was the highest-paid specialty in its report)

- MGMA 2018 Provider Compensation and Production Report: $883,020

- NERVES Socio-Economic Survey 2018 Report: $737,000

As the most recent Harlequin Recruiting Neurosurgery Market Watch Compensation Update highlighted, the survey conducted by NERVES offered a few deeper insights. For example, it was able to rank the neurosurgeon specialties by pay. Here are the median salaries for each neurosurgery specialty:

- Spine: $820,000

- Vascular: $793,000

- Cranial: $655,000

- Functional:$626,000

And here’s how the NERVES survey broke down median neurosurgeon pay by employment type:

- Private practice: $889,000

- Hospital:$786,000

- Academic: $647,000

Wondering if going into private practice is the right move for your neurosurgery career? Take our practice ownership quiz to find out.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Neurosurgeon student loan debt

In its most recent student debt fact card, the Association of Medical Colleges reported that median indebtedness for 2019 medical school graduates was $200,000. Because medical school costs are similar for all physicians, this number can be used as a good baseline for estimating the debt load that a neurosurgeon will face after graduation.

However, due to long residency requirements, it will take seven years or more before brain surgeons can start earning those hefty practicing salaries. And for those who choose to join an income-driven repayment (IDR) plan, that could mean a long time making student loan payments that don’t even cover the interest charges.

Many neurosurgeons might actually see their student loan balances grow during residency. This delay in being able to pay down student debt could be one of the reasons that a six-year JAMA Network study published in 2017 found neurosurgery to be among the five most indebted medical specialties.

Best student loan repayment strategies for neurosurgeons

No matter which practice you ultimately choose, an IDR plan will be your best student loan repayment option while you’re in residency.

According to Medscape’s 2020 Residents Salary & Debt Report, the average resident salary is $63,400. At that compensation level, making standard payments on $200,000 or more of student debt could feel suffocating.

But on IDR plans, your payments are capped at 10% to 20% of your discretionary income. IDR can keep your payments manageable until you get that big raise after residency.

Once you’ve achieved board certification, your best student loan repayment strategy depends largely on the type of practice that you choose. You’ll want to think through how your career path will impact your journey to becoming debt free.

Related: Student loan mistakes doctors make in residency

Best strategy for neurosurgeons working for a nonprofit employer

More young physicians are choosing to work as employees than ever before. Other medical school grads dream of someday being able to perform research and teach in academic circles.

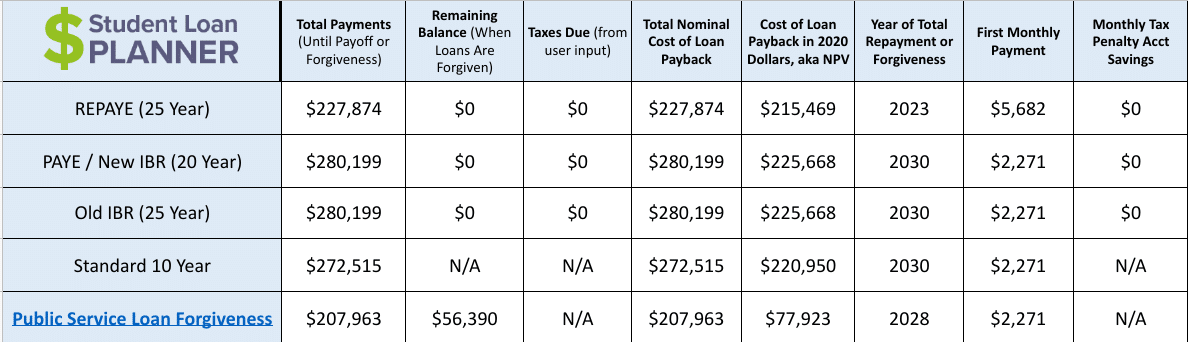

If you have plans to follow either of these career paths, focus your job search on nonprofit hospitals and universities. By working for a qualifying nonprofit employer, you might qualify for the Public Service Loan Forgiveness (PSLF) program.

With PSLF, you could earn tax-free forgiveness on your remaining student loan balance after 10 years of nonprofit work and loan payments. And according to the Student Loan Planner® calculator, that could save you $29,000 to $72,000 over every other repayment plan.

PSLF is even more valuable for neurosurgeons who worked at a nonprofit clinic or hospital during residency. If you fall into that category, you’ll need to only work three additional years at an eligible employer to earn PSLF forgiveness.

Related: How PSLF distorts physician salaries

Best strategy for neurosurgeons working in private practice

With PSLF off the table, an aggressive payment strategy is the best move for a private practice neurosurgeon. Let’s take a look at a case study to illustrate what that approach can look like.

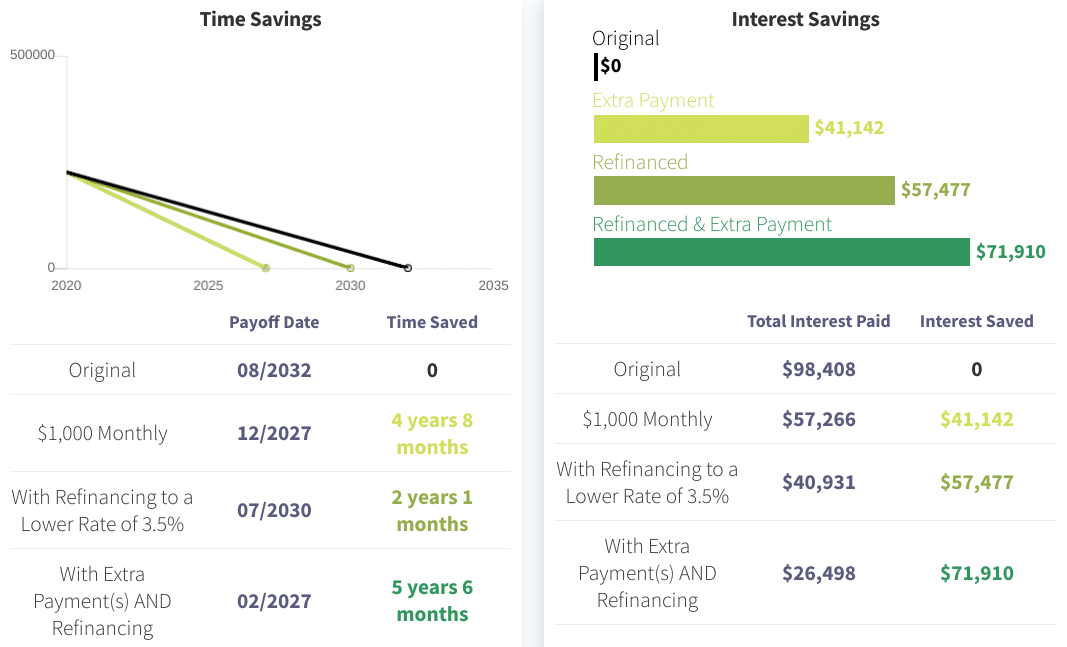

Jared’s student loan balance has ballooned to $225,000 by the time he finished residency. The average interest on his loans is 6.5%. By paying an extra $1,000 per month, Jared could pay the loans off 4.5 years sooner.

Next imagine that he refinanced down to a new 3.5% rate and continued to make the additional $1,000 payments. In that case, he’d pay off his loans even faster and would save $71,000 in interest along the way.

Another factor to consider is if you can purchase a share of ownership in a private practice, you can accelerate your income and pay down your student loans much sooner. If you wanted to get preapproved for practice financing, check out the form below.

Should neurosurgeons delay a private practice for PSLF?

If you decide that private practice neurosurgery work is right for you, losing access to PSLF is a relatively minor loss. According to NERVES compensation data, the typical neurosurgeon in private practice earns $103,000 to $242,000 more per year than those working at hospitals or academic institutions.

When compared to the $72,000 max benefit of PSLF (for neurosurgeons who would need to work the full 10 years after residency to earn forgiveness), it makes financial sense to pursue private practice ownership. Even if you worked for a nonprofit resident program and could earn PSLF forgiveness in just three years, working for a private practice could still be a smart move.

For example, $200,000 of loan forgiveness would work out to an annual benefit of around $66,000. That’s good, but still less than the extra income you may have earned by choosing private practice work from the start.

Get a comprehensive plan for your neurosurgeon student loans

Not sure which repayment strategy would save you the most money? Student Loan Planner® can help. Whether you own a private practice or work for a nonprofit employer, we can help you figure out your best path to save thousands of dollars.

Our advisors would love to help you create the plan that best fits your specific student loan and employment situation.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*