Editor's note: President Biden has completed an extensive overhaul of the PSLF and IDR rules that will benefit most resident physicians. Residents and fellows will want to choose between the new SAVE plan (formerly REPAYE), which heavily subsidizes interest, and PAYE / NEW IBR, which allows for capped payments. The other mistakes borrowers make with student loans in residency are listed below still apply.

Doctors are perhaps the most prone of all occupations to making student loan blunders, because they have the most student loan complexity of any profession. One of the biggest reasons is that many don't fully understand how to take advantage of the special benefits available for student loans in residency or fellowship.

Residency can count towards PSLF, but doctors must meet certain conditions for student loan payments to qualify. This includes working for a PSLF-eligible residency program and choosing the right student loan repayment program.

If you have federal student loans and you're planning to work for a not-for-profit hospital after training, you must understand student loans rules surrounding PSLF. Medical students and recent grads could lose out on tens or hundreds of thousands of dollars by making the wrong decisions with their student loans in residency.

Common Resident Physician Student Loan Mistakes

With Biden's new income-driven repayment plan (IDR), even doctors planning a future in private practice could make huge and costly mistakes from not understanding common student loan pitfalls in residency.

If you're a medical resident with federal loans, here are the biggest student loan mistakes you'll want to avoid now that payments have resumed following the COVID-19 forbearance period.

1. Failing to consolidate med school loans

The average student loan debt for a medical student is just north of $200,000, according to the most recent data from the Association of American Medical Colleges (AAMC). Many of those students wonder, “Do you pay students loans during residency?” The answer is yes.

That might seem like a bummer at first. After all, your resident income will likely be much lower than your attending salary. However, that lower resident income could also qualify you for lower payments since IDR plans use your discretionary income to determine your payment amount. And it could potentially help you maximize student loan forgiveness.

If maximizing forgiveness is your goal, consolidate all your federal student loans at the beginning of residency into one federal Direct Loan. You should aim to do this during your grace period before repayment begins. All Direct Loan borrowers can do this, regardless of credit score or income.

By consolidating, all your student loan debt will be eligible for the Public Service Loan Forgiveness program. Moving forward, each year of medical residency or fellowship will count towards the 10 years of qualifying payments needed to reach tax-free loan forgiveness.

Note that private student loans aren't eligible for a Direct Consolidation loan and may not offer a grace period after you finish medical school. If you have private medical school loans, you may want to consider student loan refinancing. A few student loan refinancing lenders offer reduced payments for medical residents. Some even provide a grace period after residency ends, before you're required to make payments.

2. Failing to work for PSLF-eligible employers

If your only choice is a residency at a for-profit hospital or none at all, then it's not really a choice. But if you have any say, try to make sure you end up at a program at a nonprofit hospital.

It's important to note that not all residencies will qualify as PSLF residency programs and that working for a hospital doesn't automatically qualify you for student loan forgiveness. To qualify for PSLF, you must take a full-time “qualifying public service position.” PSLF residency programs are typically 501(c)(3) nonprofit organizations or state hospitals. According to the Association of American Medical Colleges (AAMC), example qualifying fields may include:

- Emergency management

- Government

- Military service (active duty)

- Public safety

- Public health

Medical professionals could discover that their residency doesn't count toward loan forgiveness if they don't work for a qualifying employer. If you plan to pursue PSLF after residency, it's imperative that you narrow your search to PSLF residency programs, or you won't cover any ground toward PSLF during your residency. To verify an employer's eligibility, contact MOHELA or use the PSLF Help Tool.

As an attending, you also want to investigate employer eligibility. Usually that will be easy to see as your employer needs to be a public sector employer or a 501c3 not-for-profit organization. Note that some previously ineligible employers like Kaiser Permanente now qualify as well.

3. Failing to submit the PSLF Employment Certification Form annually

If you're in medical residency or fellowship, this PSLF form from the federal financial aid office should be your best friend. Very few residents ever submit the form though. A common misconception among residents is that the PSLF program automatically results in loan forgiveness once you're eligible.

This idea is probably the most common of the PSLF mistakes. Nothing could be further from the truth. You have to apply after working for a public service (not-for-profit) institution for 10 years.

Unfortunately, a lot of doctors will make payments for 10 years and be in for a rude awakening when they submit this form. Some folks will have loans they failed to consolidate, as I warned with Mistake #1. In that case, all your loans without “Direct” in the name aren't even eligible for forgiveness. Others will have to deal with the horrible record-keeping of federal loan servicers.

Our Personal Example Should Drive Home How Important Submitting the PSLF Form Really Is

Let me give you a personal example. My wife submitted the PSLF certification form to the U.S. Department of Education. The financial aid office transferred her from Nelnet to FedLoan Servicing, which previously handled all PSLF cases (now MOHELA has that responsibility). They returned her form with the shocking answer that she had only made two of the 120 loan payments required for PSLF.

This answer is totally wrong and is an example of extreme incompetence. She consolidated everything into a Direct Consolidation Loan at the end of medical residency. And she had made at least three years' worth of loan payments during fellowship. But she only submitted the PSLF certification form at the end of her fellowship, instead of during her first or second year of residency. So their record-keeping was completely off.

The PSLF paper trail is a beautiful thing

So what do you get with submitting the PSLF certification form annually? You get a paper trail and proof that you're progressing in the program. If you submit the form each year, you will have proof that you made each payment.

This has proven especially important when borrowers have had to deal with the previous loan servicer, FedLoan Servicing. So, begin as soon as you get your first couple paychecks in residency and begin to make payments on your loans. Submit the form to know exactly where you stand in regard to the PSLF program.

4. Failing to choose the right med school loan repayment program

Here's the honest truth: your financial aid officer is going to give you a one-size-fits-all answer regarding your student debt repayment options. Few financial aid counselors consider your career, marriage, or life plans. And even fewer input them into a spreadsheet to simulate the cost of each option.

But choosing a repayment program is complicated. The right choice for you will depend on your life plans, goals, future income, and more. We consider all of these factors during our student loan consultations. But, for now, here's some general guidance.

Saving on a Valuable Education (SAVE), Pay As You Earn (PAYE) or Income-Based Repayment (IBR) are good options if you expect a surge in income, your training period lasts four to six years, or your spouse has a high income. If that's the case, then you should consider filing taxes separately. That way, the monthly payment is based on only your income instead of your spouse's income too.

Also note that PAYE and IBR place a cap on total monthly payments based on the 10-Year Standard Repayment amount. However, SAVE (formerly known as Revised Pay As You Earn, or REPAYE) has no such cap.

5. Not Taking Out and Keeping the Max in Federal Student Loans that You're Eligible For

With the new IDR plan from Biden allowing you to receive huge interest subsidies, taking out the max in federal student loans will be like an extremely low interest loan.

Furthermore, with new PSLF rules expanding the pool of eligible employers for physicians, there's a very high chance your loans will be forgiven tax-free anyway.

So a huge mistake might simply be trying to pay down your loans during residency. As a med student, the mistake would be not maxing out all the loans you can get for all eligible costs, such as living expenses.

An Example of Student Loan Errors During Residency

I'd like you to meet Tim, a soon-to-be-attending physician finishing up his five-year medical residency program. He's really excited about the new contract he signed with a major academic medical system that is a qualifying public service employer for PSLF.

Tim has $200,000 worth of education loans with an interest rate of 6.8%. His contract stipulates a starting salary and bonus of approximately $250,000 in the first year. He expects his salary will grow to about $300,000 over the next five years.

Unfortunately, Tim made nearly all the wrong moves with his federal student loans in residency. While he did work for one of the PSLF residency programs, he never submitted the PSLF form. He never consolidated his loans. And he never checked to see if there was a better repayment plan than IBR.

PSLF might be off the table for this physician

Tim discovers that because he did not consolidate his old loans, the five years of IBR monthly payments he made during residency do not count towards PSLF. His loan balance is higher than it would have been otherwise too, because he never looked into other income-driven repayment options.

If Tim paid attention to this blog, then he would have known to submit for the IDR waiver, which would have eliminated this mistake. There's always tricks and temporary programs to save more money in the student loan business.

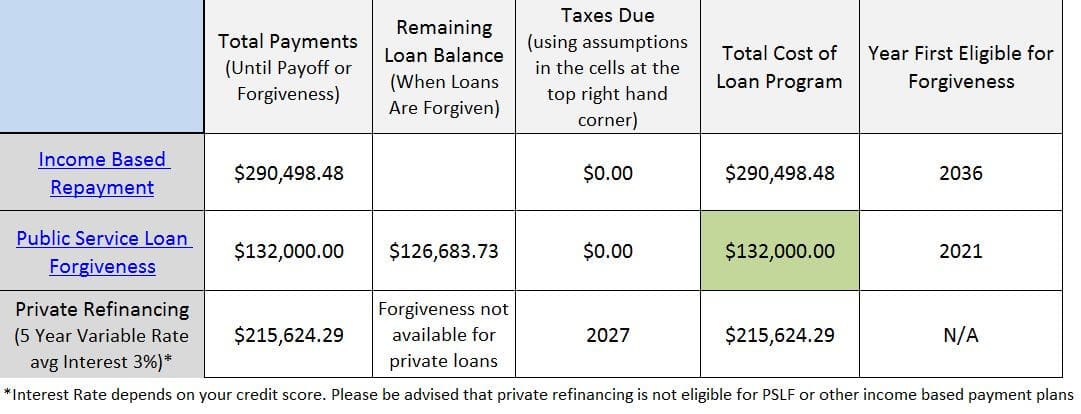

For this example, I will compare the cost of IBR and private refinancing with the PSLF program, if Tim had not made the student loan mistakes doctors make in residency. I'll model his loans using the Student Loan Planner® Calculator.

To reiterate, Tim's only real options now are refinancing to a lower interest rate with a private lender or joining the IBR program. I'm only showing the cost of PSLF to expose how much money was left on the table.

Tim's only real cost-saving option now is student loan refinancing. Comparing PSLF with the cost of refinancing to a lower interest rate, we see that Tim cost himself over $80,000 by not knowing student loan rules. If he had not made these mistakes, he would have been eligible for tax-free loan forgiveness in just five short years.

How to save money on student loans in residency

If you're still in medical school or are just starting your residency or fellowship, you can avoid these student loan mistakes. All you have to do is consolidate your loans within a year of starting residency. Then, file the PSLF employment certification form annually.

Additionally, make sure you choose an intelligent repayment plan that can provide low monthly payments today and (hopefully) forgiveness down the road.

Avoid the three common student loan mistakes I mentioned, and you'll be ahead of 90% of other doctors. If you plan to go into private practice and have a good credit score, you may also want to consider refinancing your med school loans and planning for an aggressive pay off. Whether you're a medical resident who wants to lock in today's low interest rates, or you're already working in private practice, it could make a lot of sense to refinance.

Student Loan Planner® can help you save money on your medical school student loans. Our advisors perform holistic loan analysis to see what your best available repayment options are. We've helped more than 13,000 clients take on over $3 billion of student debt, and we'd love to help you too.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.