Editor’s Note: The final version of President Biden’s New IDR rules announced on June 30, 2023 would phase out the double consolidation loophole by July 1, 2025. Anyone who completes the process of consolidating twice before that date would be able to access the new REPAYE / SAVE plan, but if you miss that date, you would be stuck paying 20% of your income on ICR with a very low deduction (100% of the poverty line).

Why is that a big deal? Take a borrower earning $50,000 a year with $100,000 of Parent PLUS loans. The ICR monthly payment would be $590, while the new SAVE plan would be only $143 monthly, and that plan offers huge interest subsidies too. The stakes have never been higher for Parent PLUS borrowers seeking a more affordable repayment plan. If you can’t follow how to complete this process yourself with the article below, our team of student loan experts can help. We’ve got more than 2,300 five star reviews and have been helping borrowers navigate these complex repayment options since 2016.

Picture this scenario: 18 years ago — if you were lucky to have considered it — you started a college savings account for your child who is now graduating from high school.

The past two years have been a whirlwind of campus visits and applications. All of this work resulted in a thick envelope delivered to the threshold of your home. Inside the envelope, your child finds out they’ve been accepted, and you quickly learn just how close (or not close) the school’s cost-of-attendance net price calculator is to your situation.

As the excitement settles and you begin planning for the next chapter, the reality of higher education costs can be overwhelming. Let’s explore strategic options like Parent PLUS Loans and PSLF, along with 529 savings to help ease the burden.

College costs hit record highs over the decades

College education costs today have skyrocketed since the 1990s. According to College Board’s annual Trends in College Pricing report, from 1992-93 to 2022-23 academic years, average published tuition & fees for:

- Four-year public universities increased from $4,870 to $10,940.

- Four-year private nonprofit college increased from $21,860 to $39,400.

The above figures don’t include room and board, allowances for books and supplies, transportation and other personal expenses. The geographic location of an educational institution might drive a large piece of these costs, but the annual extra costs to consider could easily be another $15,000 to $20,000 per year.

Just imagine what it costs to maintain a one-bedroom apartment in a city and cover expenses for food over the course of a year.

The average inflation-adjusted cost of education has gotten twice as expensive since your generation went to college. Add in four years of college for one child to the above numbers, and you could be looking at an average bar tab (kidding) that ranges from $100,000 to $240,000.

Let’s also not forget that averages are averages. The actual cost of education ends up on your door’s threshold just months before your child starts their first semester of college.

Is a 529 college savings plan your best option?

So how do you prepare for this unknown, likely very high, expense?

Traditionally, you’d fill the costs in the following order:

- Scholarships received and/or grants awarded.

- Federal aid in your child’s name.

- A combination of the 529 College Savings Plan and your cash.

But let’s set aside the first two above, and instead, consider legitimate replacements for the third solution.

| Option A | Option B | Option C |

|---|---|---|

| You (the parent) work for the college your child attends. | You work for a college affiliated with the school your child attends. | You work for any nonprofit 501(c)(3) organization, federal employer, or state employer and pursue PSLF after graduation, utilizing double consolidation. |

| Result: Free Tuition & Fees, and possibly Room & Board | Result: Same as Option A, at best. | Result: Low payments during repayment term, and your remaining loans are forgiven. |

Option A and Option B take advanced planning. Usually, parents who are professors utilize these two options and primarily work for the university for other reasons (i.e., research opportunities, tenure, etc.). Additionally, there’s a risk that their child really wants to attend college elsewhere.

Option C is not necessarily a tried and tested path, but it is something to consider for parents who haven’t had the opportunity to save for something they couldn’t have anticipated would double in price or simply didn’t have the means to save along the way.

Maximizing your budget with Parent PLUS Loans

When it comes to filling in the remaining cost after scholarships, grants and federal aid offered in your child’s name, you might be staring at a six-figure or multiple six-figure financial commitment. If you tackle how to pay for it with loans, the Department of Education offers Parent PLUS Loans to fill that gap.

Parent PLUS loans are, on the surface, expensive loans. Like other Direct PLUS Loans from the Department of Education, they come with a nearly 4% origination fee and are always 1.0% higher than federal loans in your child’s name.

But the amount you borrow for your child’s education (think $20,000 to $60,000 annually) is usually much higher than the amount that is offered to your child (somewhere between $5,500 to $7,500 annually).

When your child receives a financial aid package from their undergraduate institution, it could very easily look something like this:

Total cost of annual attendance: $65,000

- Merit-based scholarship: $8,000

- Grants: $0

- Direct Stafford Subsidized Loans: $2,000

- Direct Stafford Unsubsidized Loans: $3,500

So that means that the first semester total is $32,500:

- Merit-based scholarship: $4,000

- Grants: $0

- Direct Stafford Subsidized Loans: $1,000

- Direct Stafford Unsubsidized Loans: $1,750

Amount due September 15th, this year: $25,750

So fast forward to the end of eight semesters. If you took out Parent PLUS Loans under one parent’s name for the above amount, then you’d have $206,000 of loan debt, plus accrued interest — perhaps a total of $250,000.

Seeing a number like that can be alarming — especially if that amount multiplied by eight semesters — isn’t sitting in your child’s College Savings 529 Plan. The amount due can usually be paid in installments, but four months later, another installment plan would start for the next semester.

Compound this with two children who overlap in college years, and the situation just got doubly difficult to keep up with!

Instead, consider this four-step strategy:

- Borrow Parent PLUS Loans. A parent who works for, or is planning to work for, a PSLF-qualifying employer and/or has a lower income, can accept Parent PLUS Loans to pay the balance due each semester. NOTE: For forgiveness purposes, “sharing” the Parent PLUS Loan burden between two spouses isn’t a great idea. Pick one parent and put all of the loans in their name alone.

- Work for a qualifying employer. Plan to work for – if you don’t already – a qualifying employer for the PSLF program by the time your child graduates college.

- Take advantage of double consolidation. (See Editor's note above.) Consolidating your Parent PLUS Loans gives you access to only the Income-Contingent Repayment plan. The double-consolidation loophole lets you access a greater variety of income-driven repayment plans that can reduce your payments to only 10% of your discretionary income.

- Work toward Public Service Loan Forgiveness (PSLF). Pursue a 120-month PSLF track on an income-driven repayment plan, and get your remaining balance forgiven tax-free.

If your income as a parent household (let’s use a family size of 2) were $150,000 per year, then your monthly payment on an income-driven repayment plan, such as the new Income-Based Repayment (new IBR) plan, would be about $1,000 per month.

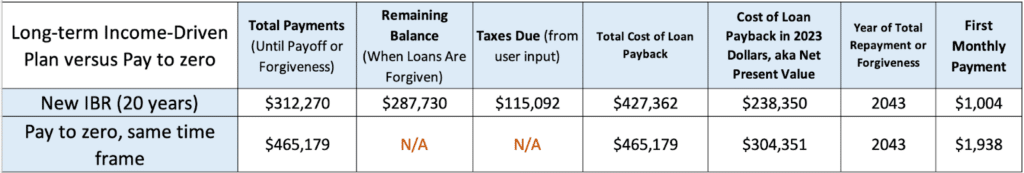

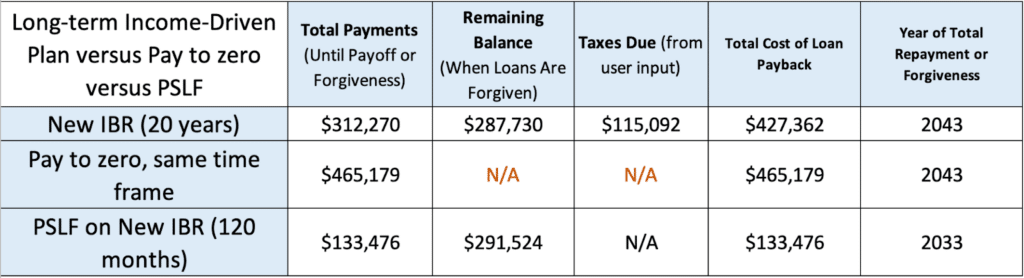

If your household income increases by 3% per year, then your recalculated monthly payments would increase every 12 months as well. Below is a breakdown of what you’d end up paying if you continued making these payments throughout the 20-year new IBR term:

Compare the income-driven repayment plan to the “pay to zero” path (same interest rate, same timeline) and it comes out ahead, on paper.

If you worked a W-2 job, full-time, for a qualifying employer that qualifies under PSLF, then you could shortcut your timeline for forgiveness. After 120 months of payments made on any income-driven repayment plan — continuing to use the new IBR plan as an example — it could look something like this:

So through month 120, you’d end up paying about $133,000 in total monthly payments, with a projected $291,500 balance forgiven that is NOT taxable at the federal level.

Note: You might pay state income tax, so it’s a good idea to earmark savings for this.

All in all, there is a pretty good case for the cost of education with a PSLF outcome. The key factors include one parent borrowing Parent Plus loans, the same parent's employer being a qualified employer for PSLF purposes, and household income.

Most of the income-driven plans let the parent borrower exclude their spouse’s income if they file as “married, filing separately.” Also, with the proposed Biden IDR plan, the numbers above look rosier for the PSLF outcome. It proposes a lower drop for the family poverty guideline which determines discretionary income percentages for undergraduate, versus PLUS Loans.

Common FAQ from single parents

For single parents, the math for a forgiveness outcome on an IDR plan is relatively straightforward since household income is one and the same. But let’s say that you are a single parent who has loans from your past education and are thinking of adding on Parent PLUS Loans.

For a lot of parent borrowers who have loans from 15+ years ago, it’s common to have taken out undergraduate Stafford Subsidized Loans, and undergraduate or graduate Stafford Unsubsidized loans which have since been consolidated.

Consolidated loans, or even loans kept as they were, have a payment history. Some might have been on an IDR plan and some might have been on a fixed or graduated repayment plan.

When you have a repayment history on a loan and you consolidate that loan with a Parent PLUS Loan or group of Parent PLUS Loans, the repayment history of your loans could add to the resulting consolidated loan repayment history. But even if there is repayment history on the Parent PLUS loan(s), that history is erased.

Historically, and (as of the writing of this), consolidation erases any and all repayment history on any loans. But that isn’t the case with the IDR waiver; also, going forward beyond mid-2023, that might not be the case with consolidation.

With the IDR Waiver, the repayment history of your education loans would be counted toward repayment status on an IDR plan for a newly consolidated loan that includes Parent PLUS Loans. When the IDR waiver period is over, the proposed treatment for consolidations is that new consolidations would take a weighted repayment history average of the underlying loans (those being consolidated).

Let us help

The timeline of months that count toward PSLF starts when your Parent PLUS Loans are in repayment. If you have multiple children in college, then an IDR plan payment is due for as long as the youngest of the loans is projected to end in total repayment or forgiveness. Although we think it’s worth a pre-debt consult to figure this out with just one child, it goes without saying that a pre-debt consult is worth a paid conversation with a certified student loan professional when there are multiple children set to attend college.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.