There are three main strategies to pay back pharmacy school loans. The one you use depends entirely on where you work.

The first strategy is for borrower with federal loans who work at a a not-for-profit hospital or community health center. It involves using the Public Service Loan Forgiveness (PSLF) program with the Pay As You Earn (PAYE) or Revised Pay As You Earn (REPAYE) repayment plans.

The second strategy is to apply for a pharmacy loan repayment program. Examples include the NIH Loan Repayment Programs, the IHS Loan Repayment Program, and the Health Professional Loan Repayment Program (HPLRP).

And the final strategy is refinancing your loans with a private lender if you work at a private sector employer such as CVS or Walgreens. If you're not using one of these three strategies to pay back pharmacy school loans, you're probably paying too much.

Note that the COVID-19 pandemic and federal relief measures have impacted many student loan borrowers. To learn more about your options and whether you should consider refinancing now, check out our guide.

The pharmacy loan forgiveness path

This path allow you to qualify for tax free loan forgiveness in as little as 10 years. One of my friends from college went to pharmacy school and had worked at a community health center for the past three years. He mentioned that he used the Standard 10-Year repayment plan because he wanted to pay back everything in a reasonable amount of time.

Right away I knew he had better options. If you're paying the standard monthly payment on $100,000+ in pharmacy school loans, you should at least consider private refinancing. However, in his case he worked at a not-for-profit employer.

Luckily, the 10-year Standard Plan counts towards the Public Service Loan Repayment program (PSLF), along with all the Income-Driven Repayment (IDR) options like REPAYE, PAYE and IBR.

He worked full time at this not-for-profit facility and, therefore, qualified for the PSLF program. Thankfully, he used the Standard 10-Year Plan instead of something like Extended or Graduated. That way he could count the three years of payments towards the 10 needed for loan forgiveness. The first thing we did was have him apply with the PSLF employment certification form.

Then, we needed to reduce his payments so he'd get some major loan forgiveness. Otherwise, he would just pay everything off in 10 years. Using REPAYE, we dropped his monthly payment down to about $600 a month instead of the $1,500 a month he had been paying. He'll put that extra $900 into a retirement plan instead and build his savings.

In total, he'll save over $100,000 simply by signing up for a loan forgiveness program he had no idea he was eligible for.

If you work at a not-for-profit employer and have federal student loans, PSLF is almost certainly your best pharmacy loan repayment strategy.

Example: Shawn the not-for-profit hospital pharmacist

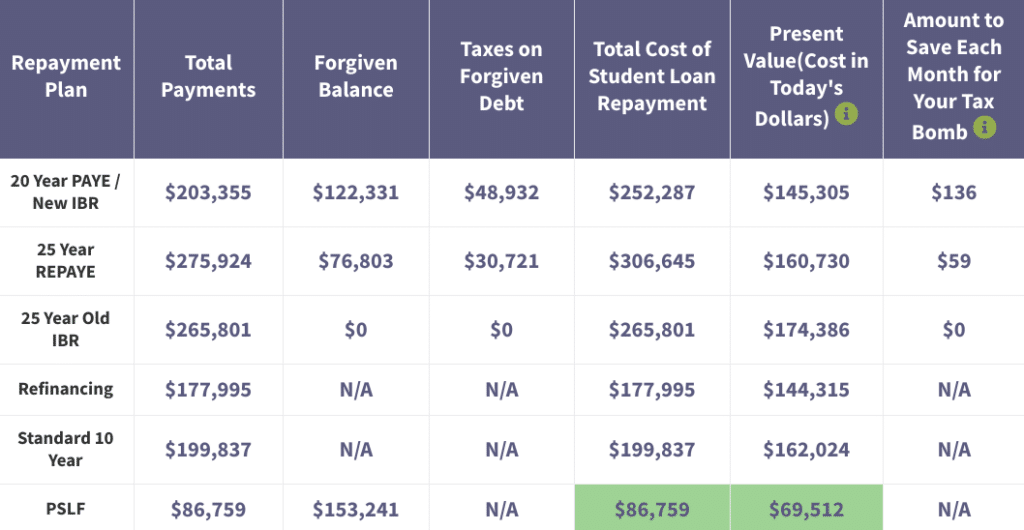

To show why PSLF is such a powerful option, we'll look at an example. Shawn works at a not for profit hospital making $95,000 a year. He expects that will grow with inflation. He has $150,000 of pharmacy school loans at a 6% interest rate and started repaying it in 2021. Here's the cost of various payback strategies.

Clearly, PSLF wins by a long shot. The next cheapest option is refinancing, and that's over $90,000 more expensive. Shawn would and IDR program to minimize his payments while filing the PSLF employment certification form. In 10 years, the remaining balance would go away tax-free courtesy of the federal government.

If he used the Standard 10-Year Plan instead, all he would do is cost himself money by paying back the pharmacy school loans in full before qualifying for any forgiveness.

Related: See our complete list of student loan forgiveness programs.

The pharmacy loan repayment assistance path

If you have private pharmacy student loans, you won't qualify for PSLF. But you may still be eligible to join a federal pharmacy loan repayment assistance program.

Here a few popular programs that pharmacists may qualify for:

- National Institutes of Health Loan Repayment Programs: There are eight different NIH Loan Repayment Programs. Each program can provide qualifying medical researchers (such as primary care physicians, dentists, and clinical pharmacists) up to $50,000 of student loan repayment per year.

- Indian Health Service Loan Repayment Program: The IHS Loan Repayment Program provides up to $40,000 of loan assistance for IHS clinicians. The program requires a service commitment of at least two years at an approved site that serves American Indian or Alaska Native communities.

- Health Professional Loan Repayment Program (HPLRP): The HRLRP program can provide up to $40,000 of loan repayment per year ($120,000 maximum award) for Army, Navy, or Air Force medical personnel.

- National Health Service Corps (NHSC) Substance Use Disorder Workforce Loan Repayment Program: This program will repay $37,500 to $75,000 of a health care professional's student loans if he or she will commit to at least three years of service in a health professional shortage area (HPSA).

Also, keep in mind that you may qualify for a NHSC State Loan Repayment Program (SLRP). States with generous programs include California, Colorado, New Mexico, North Dakota, Oregon and more. Learn more about the current SLRP programs and eligibility requirements.

Looking for more pharmacy loan repayment programs to consider? Check out our 10 favorite grants to pay off your student loans faster.

The pharmacy loan refinancing path

Say you go to work for one of the national pharmacy chains like CVS or Walgreens. You won't qualify for tax-free loan forgiveness. In fact, most pharmacists will not even qualify for IDR loan forgiveness.

The reason is because pharmacists, in general, have reasonable debt-to-income ratios. Also, IDR programs require 20-25 years of student loan payments before forgiveness. However, the average pharmacist salary is high enough that everything is usually repaid before the end of the repayment plan.

Hence, many pharmacists pay the Standard Repayment Plan amount until their loans are gone. If that's you, you might save a lot of money by refinancing to a lower interest rate.

Example: Catherine the private sector pharmacist

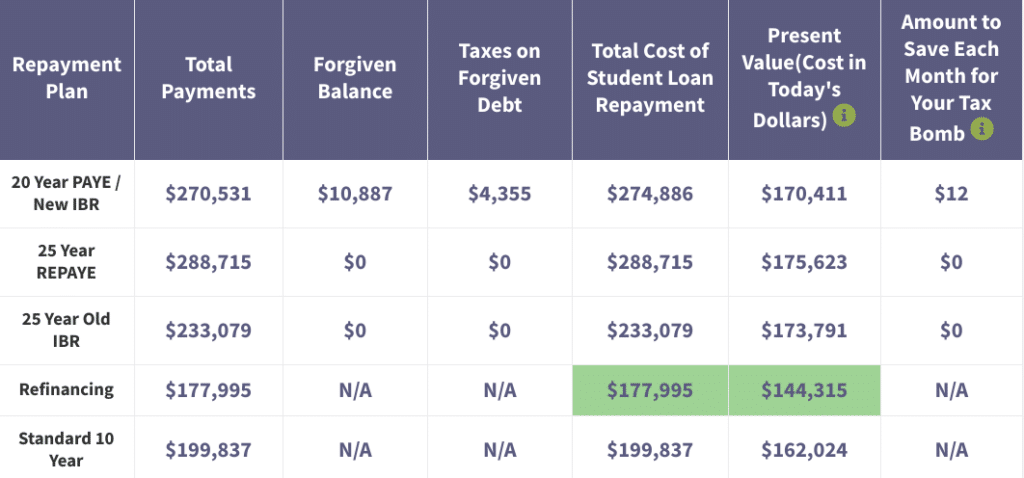

Consider this example to see what I'm talking about. Assume Catherine just graduated and starts to pay back pharmacy school loans in 2021. She makes $120,000 a year working lots of hours at a major national pharmacy chain.

She also has pharmacy school student loan balance of $150,000 at a 6% interest rate. I'm assuming her income increases with inflation and that she could refinance at a 3.5% fixed interest rate with a 10-year term. Here's the cost of various options based on my simulation tool that I built.

Student loan refinancing isn't just cheaper, it's a lot cheaper! Compare it to the Standard 10-Year plan that many responsible pharmacists in her situation would choose by default. She could save about $21,000 of after-tax income just by refinancing. If she wanted to pay back her loans faster, she could choose a shorter loan term and save even more in interest.

Note that by refinancing Catherine would be forfeiting her ability to take advantage of federal benefits (such as the federal grace period, forbearance, and deferment) or loan forgiveness options. But she wouldn't be forfeiting her chance to join a pharmacy loan repayment program.

So, for example, if Catherine chose to work in an American Indian community, she could still qualify for up to $40,000 of loan assistance from the IHS Loan Repayment program. And she'd save a ton of interest on the remaining $110,000 of student loan debt!

We can help you make a plan for your pharmacy school loans

Our business model here at Student Loan Planner® is helping graduate professionals with high debt conquer their student loans with flat fee consultations.

During the consult, we perform a holistic loan analysis with our proprietary simulation tool to see what your best available repayment options are (government, private refinancing, etc).

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Thanks for detailed breakdown! Is it possible to use a hybrid approach of refinancing the student debt right after graduating (say 7% debt refinanced to 4.7%), then apply for the non-for-profit loan forgiveness program?

Ideally, this would lower the monthly interest accrued year to year while waiting for the loan forgiveness program to kick in. Is this possible?

Not for the government programs. You must keep those in federal loan form. There are some smaller programs that will allow this but it’s a bit dangerous to do without reading the fine print.

A friend of mine had discount because she was married. They divorced and she lost her discount. Now single and paying 1600.00 per month. Just around 180,000 to go. Will a credit union work with her , or would she need to a private lender?

If she has private loans then her only option would be to refinance again, unless the ex is a cosigner on the loan.

Hi Travis,

I just discovered your blog and I’m very impressed with the content. I have a question about my loans.

I graduated from pharmacy school last year and have $40k in federal student loans consolidated at 5.6% interest. (Also $30k“interest-free” loan from my parents but we won’t worry about that right now!) I am completing a residency and will be working completely in the private sector due to the nature of my specialty. My plan is to pay off my loan aggressively in the first 1-2 years after residency. Your post recommends refinancing for private sector jobs. However, I’ve always been told to not refinance so I don’t lose the flexibility from federal loans in case I lose my job. What would you suggest? Thanks!

Well probably getting it on REPAYE and making extra payments just in case you get some subsidy from that plan. But honestly I don’t think the protections are a big deal with 50k of debt given that you’ll make double that at some point. It’s not going to make or break you either way so if it was me I would refi just to pay less in interest.

Hi Travis,

I’m currently in pharmacy school and i will be a 2nd year in august. I have $171,340 in loans right now, $40,000 is under graduate loans. All of this is federal loans and I have an IBR and in-school deferment so I’m paying nothing until 2033 since i have no income right now. I wanted to know what should be my plan to repay this when i graduate in 2022? I was thinking of working with the government or a Walmart or Costco pharmacy but definitely not retail or hospital since I’m not doing residency.

Very likely an income driven forgiveness option. We’d be happy to help when you graduate. Right now I’d try and get the degree. That said, you just want to focus on getting a job you’ll like at an employer you respect. We can easily figure out the loan math as long as the first two things are figured out.

Hey Travis – For someone like Shawn the Not-for-profit pharmacist who is pursuing PSLF and getting married to a spouse with no student loan debt and similar income – I’m assuming that they would want to switch from REPAYE/PAYE to IBR?