Growth in the average pharmacy school debt has accelerated greatly in recent years. Now, you're unusual if you graduate without taking on six-figure pharmacist school debt to finance your education. Based on the most recent 2020 national survey from the American Association of Colleges of Pharmacy, almost 85% of graduating students borrowed to pay for their Doctor of Pharmacy (Pharm.D.) degree.

Luckily, pharmacists also have some of the best tools at their disposal of any profession to pay back their student loans. We've saved our average pharmacist client a projected $55,769 on their average student loan debt balance of $217,542. Here is my prescription to cure pharmacy school debt.

Get Started With Our New IDR Calculator

Figure out your debt-to-income ratio

A debt-to-income ratio is a statistic I use in my student loan consulting business to figure out what options a client might have to pay back their pharmacy school debt. To calculate it, you simply take the total amount of student debt and divide it by the client's income. For example, let's say Sue had $150,000 of pharmacy school debt and an income of $115,000 as a retail pharmacist at CVS. Her debt-to-income ratio would be $150,000/$115,000 = 1.3.

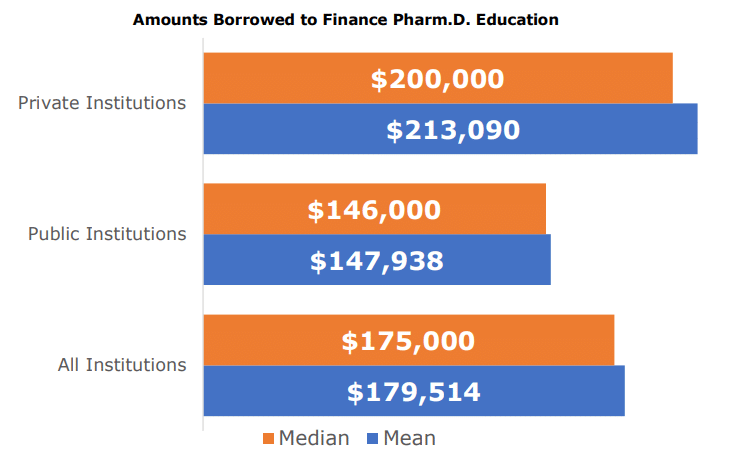

Pharmacy school debt is highly variable between individuals. Public universities produce far lower total costs than private universities. Here's a look at the pharmacy school debt profile for the class of 2020:

Median Pharmacy School Debt for the Class of 2020

Source: 2020 AACP Graduating Student Survey

I haven't looked at education statistics showing the entire distribution of pharmacy school debt. But I would guess you would see two big clusters of folks depending on where they went to school. The first group would include graduates from public institutions who would have $50,000 to $150,000 in loans. The second group would be the private school graduates who owed between $150,000 to $300,000 in student loans.

The highest pharmacy school debt I've seen in a client consult was around $412,000. The typical debt loads for pharmacy school graduates I've seen since I founded Student Loan Planner in 2016 have continued to grow at an alarming rate. In fact, I now get ads served to me on many websites from online distance-learning pharmacy programs that charge tens of thousands per year in tuition. Many nonprofit schools in the pharmacy space are responding to the declining applicant pool with aggressive marketing techniques.

Pharmacist starting salaries are a bit more predictable — if you can get one

The average pharmacist salary is $102,396 for those just starting out. Most folks start off making between $90,000 to $110,000, depending on if they're in a retail or hospital setting. Obviously, if you do a residency, the pay is much lower.

There's a troubling trend developing where employers will only give part-time hours to pharmacists because of labor surplus in large metropolitan areas where pharmacists want to live. I hear stories of pharmacists in CVS- and Walgreens-type stores being required to work through lunch. When you're grateful to have a job, it's much more difficult to push back against that kind of expectation.

While some employers pay better salaries than others, pharmacists overall have a relatively tight band of possible compensation outcomes after graduation compared to other professional degree programs (if you get full-time hours). This works to pharmacists' benefit when managing federal and private student loans. I've never seen a debt-to-income ratio above five for a full-time pharmacist earning a non-resident salary. Unfortunately, I see this happen all the time in other professions.

The most common debt-to-income ratios make pharmacy student debt manageable

Most pharmacists will graduate with pharmacy school debt of around $50,000 to $250,000. And most pharmacists' incomes will be between $80,000 and $120,000, unless they do a residency program. Most graduates will have debt-to-income ratios of 1.5 to 2.5.

Some pharmacists will want to use private sector loan forgiveness

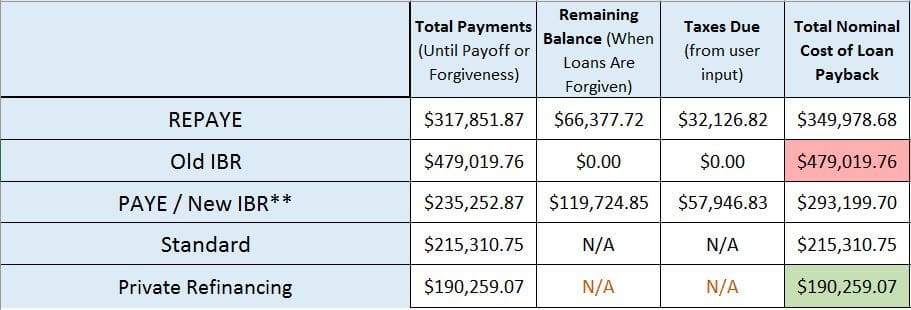

Let's run a simulation to see what I'm talking about. Assume that Kim graduated in 2018 with a pharmacy school debt load of $150,000 at a 7% interest rate. She makes a starting salary of $105,000 working at a retail pharmacy.

If you're a pharmacist in the private sector and using one of the income-driven repayment options for federal student loans, make sure that's the right path. The total cost for your education will likely be higher on one of these programs if you owe less than 1.5 times your income. One reason is that pharmacist incomes are high enough that the monthly income-based payments aren't cheap. The other reason is that after years of high payments, you'll need to pay a tax penalty on the leftover pharmacy school debt balance.

That said, if you went to private pharmacy school and want to work in a saturated area, income-driven student loan forgiveness over 20 to 25 years actually might make a lot of sense. It depends on what the numbers show on a student loan spreadsheet.

Most private sector pharmacists should refinance their debt with a private lender

Note that the above private refinancing example was for a 10-year term and an interest rate of 4.5%. If you have great credit, high income and little debt outside of what you borrowed for your education, you might get a rate even lower than that. Thus, the savings would be higher.

While I think it would be worth the flat fee to double-check whether you should refinance instead of going for loan forgiveness, it's your call. I'll include my referral links here so you can check what your rate would be through a private refinancing company. They give both you and me a cash bonus, and you could get thousands of dollars a year in interest savings.

So many pharmacists have no idea they're giving the government free money by paying back their loans on the standard 10-year plan. Please reach out to me by email if you fall into this category. There are so many better options available.

What if you work for a nonprofit employer?

This is one reason why getting a plan for your pharmacy school debt is so valuable. We don't just look at private refinancing companies. We do a holistic evaluation of your debt profile and try to find every dollar of savings we possibly can. For pharmacists working at a nonprofit organization — such as children's hospitals, community health centers, etc. — you might be eligible to have most of your pharmacy school debt forgiven tax-free. If you work for a nonprofit, then you need to know about the Public Service Loan Forgiveness Program (PSLF).

PSLF allows for tax-free loan forgiveness after 120 monthly payments made on a qualifying federal repayment plan while working for a qualifying nonprofit employer. If you're unsure whether you qualify, we can help clear that confusion up. You can also see if you're eligible by submitting the PSLF Employment Certification Form.

The pharmacists who could benefit the most from PSLF are the ones who go through with a residency and/or fellowship. If you complete this training and go to work in a nonprofit hospital setting, you might be able to pay as little as 20% of the cost of your education over time. You would make whatever the minimum monthly payment is on an income-based program and track your progress toward PSLF by submitting the employment form annually.

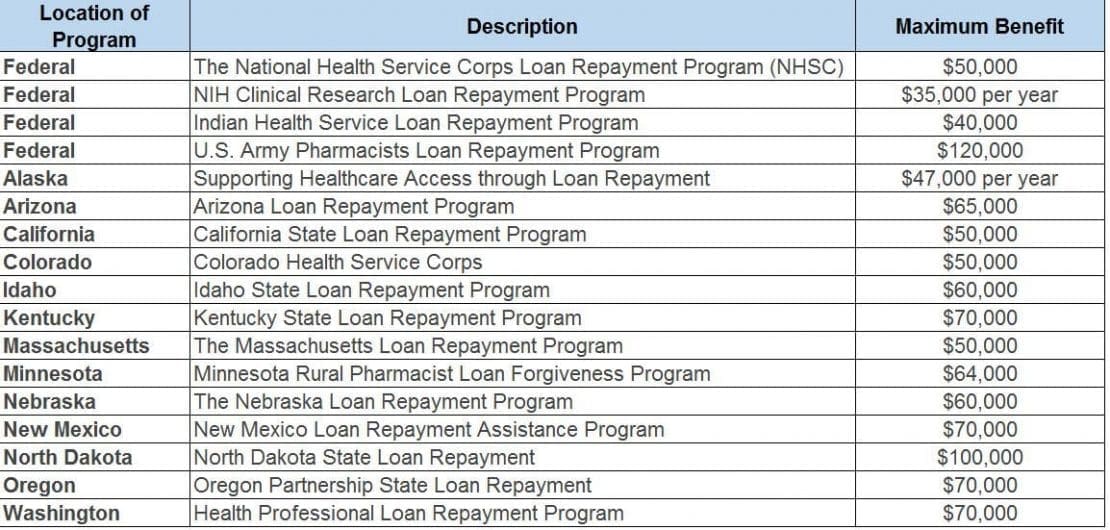

Another important resource is federal and state pharmacy school debt forgiveness programs. PSLF is the largest and most wide ranging. However, check out this list over at Credible on the various programs available for pharmacy school debt.

What do I do with my pharmacy school loans during a residency or a fellowship?

Pharmacists make a lot of mistakes with their student loans when going into postgraduate training. Whatever you do, please do not use forbearance or deferment if you plan on doing a residency or fellowship. The interest continues to accrue, and you'll lose out on federal loan benefits.

For example, say a new Pharm.D. takes a postgraduate year one (PGY-1) position and that she has $200,000 in pharmacy school debt. Assuming all of the loans are unsubsidized at a 6% average interest rate, they'll accrue $12,000 of interest by the end of their first year. Imagine they add on a PGY-2 year and a one-year fellowship. If they do the income-based repayment paperwork perfectly and prevents any of the interest from capitalizing, they would add another $24,000 in interest for pharmacy school for a total of $36,000.

If instead the borrower used the Revised Pay As You Earn (REPAYE) plan, they would pay about $185 a month on their loans during training. In addition to having this amount credited against their total balance, they would receive an interest subsidy of 50% of the remaining interest not covered by her monthly payment.

The interest accrual is about $1,000 a month. The government would take $1000, subtract $185 and get a remainder of $815. Then, the government would pay 50% of that leftover interest. In other words, Uncle Sam pays about $407.50 a month in interest costs. In total, our new Pharm.D. only has to deal with $407.50 of interest each month instead of $1,000 a month. That's a huge benefit that most pharmacists doing postgraduate training do not know about.

REPAYE is not always the right repayment plan. It depends on your family size, spousal income, spousal student loan burden and cash flow available for student loan payments. Even so, the worst decision is electing to pay nothing during pharmacy residency or fellowship. I help correct these mistakes during pharmacy school debt consults.

Make a plan to tackle your pharmacy school debt and save thousands of dollars

One of my friends from undergrad went to pharmacy school after college. We always do a fantasy football league every year with some of the guys from our college church group. I asked him some questions in preparation for writing this article, and he mentioned he had some pharmacy school debt.

We took a look at his loan profile, and he said he worked at a not-for-profit county hospital. I took a look at his loans, and he was making payments under the standard 10-year repayment plan. His interest rate was north of 6%.

He had made payments for three years on this plan. Luckily, payments made on the standard 10-year repayment plan still count for PSLF. We switched him to REPAYE. Now his payments will be 10% of his discretionary income instead of the far higher standard payments. Furthermore, after another seven years of payments, his balance will be forgiven by the government tax-free. I saved him about $100,000 compared to the strategy he'd been using that would have resulted in complete payback.

If he had worked at a CVS or Walgreens, instead, I would have made sure he got a lower rate than the less than 6% he had been paying through private refinancing. Either way, he'd been paying thousands of dollars every year in unnecessary student loan payments.

Have a well-thought-out strategy to deal with your pharmacy school debt

Whether you learn the loan rules and come up with a strategy yourself or hire Student Loan Planner to help for a one-time flat fee, most pharmacists lose out on thousands of dollars in savings on pharmacy school debt. Don't be one of them. If you have thoughts on pharmacy school debt, questions on how to manage it or just want to vent about the high cost of education, hit up the comments section below, and I'll reply.

Student Loan Planner can help figure out your pharmacy school loans

Our business model is helping pharmacists like you conquer huge student loans with flat-fee consultations.

The consultant you work with will perform a holistic loan analysis to see what your best available repayment options are. They'll simulate what the future looks like, including how to plan for a potentially massive tax penalty. We also look at married filing separate scenarios, whether you should consolidate and if you have to worry about making too much money and getting kicked off your income-driven plan.

The worst thing you could do is to ignore your pharmacy school loans, so get a plan, whether you use the knowledge you gain from our site or decide you want a professional to figure it out for you. Check out our other articles for pharmacists while you're at it.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.