Periodontists receive extensive training beyond dental school to address challenging cases that involve severe gum and bone disease and other complex periodontal procedures. But this extra training and expertise comes at a price.

Fortunately, there are a variety of repayment strategies that can help manage dental school debt. For example, periodontists can refinance student loans to receive a lower interest rate and save thousands over the life of their loans. But refinancing isn’t always the best route for dental professionals.

Here’s what you need to know about periodontist student loan refinancing.

Periodontists debt vs. salary

Dental school isn’t cheap. In fact, it’s one of the most expensive graduate programs out there.

The American Dental Education Association reported that dental school graduates in 2019 had an average student debt of $292,169. And those who attended private institutions had an average student loan balance of $321,184.

However, many dental professionals end up with even more debt hanging over their shoulders for years to come.

Student Loan Planner® periodontist clients reported student loan balances ranging from $298,000 all the way up to $926,000.

Even with this high debt burden, dental programs are in high demand. Especially when you consider the high earning potential for dental specialties like periodontics.

According to ZipRecruiter, the majority of periodontist salaries across the country range from $200,000 to $300,000; whereas, the same source lists the majority of general dentist salaries between $130,000 to $194,000.

This premium on an already high salary for general dentistry often offsets the cost and training demand that comes with being a periodontist.

Student loan refinancing for periodontists

Periodontist student loan refinancing can help borrowers in several ways. Refinancing can potentially:

- Lower your interest rate

- Reduce your monthly payment

- Consolidate multiple loans

- Release a cosigner from an existing loan

Let’s look at how student loan refinancing for periodontists can benefit you if your goal is paying back your student loan balance in full.

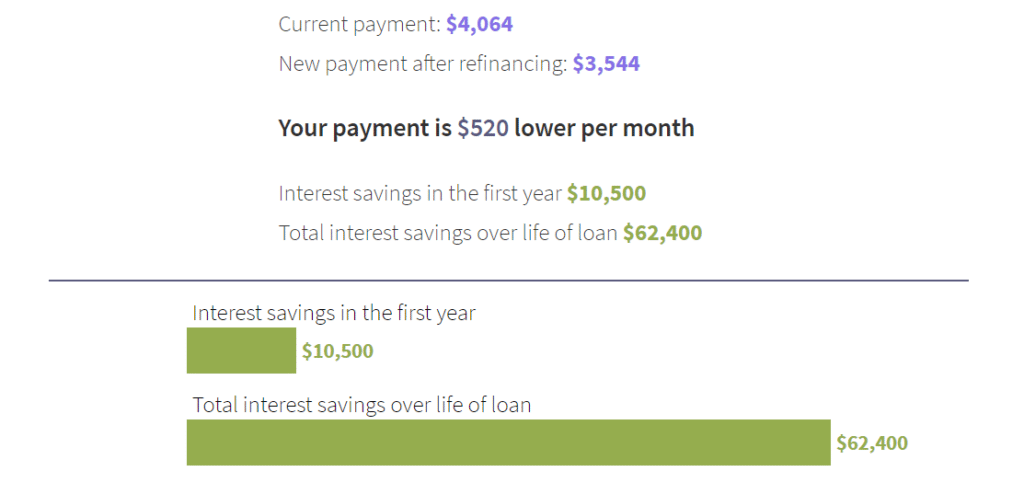

With $350,000 in student loans at a 7% interest rate, a borrower would pay $4,064 per month. If they refinanced with one of the top refinancing lenders at 4% with a 10-year term, they’d save $520 per month.

This would save the borrower more than $10,000 in interest in the first year alone. And more than $62,000 over the life of the loan.

Use the Student Loan Planner® Refinance Calculator to plug in your own numbers and see how much you could save.

Potential negatives of periodontist student loan refinancing

Although refinancing can save you money and help you pay off your loans faster, it isn’t always the best repayment strategy.

If you have federal student loans, decide whether refinancing is worth the potential savings. Federal student loans come with certain benefits and protections that you won’t receive with a private lender.

This includes options for:

- Flexible income-driven repayment (IDR) plans

- Various loan forgiveness programs

- Forbearance or deferment if you have a financial hardship

When used strategically, federal repayment programs can secure a more manageable monthly payment. It also lets you avoid paying back an overwhelming amount of student debt so you can focus on your patients and pursue other financial goals.

Additionally, periodontists may run into refinancing hurdles if they have 1099 income rather than traditional W-2 wages. If this is the case, you’ll likely need two years of tax returns as a contractor before you can move forward with refinancing.

Related: Protect Your Income with Disability Insurance for Periodontists: Costs and Coverage Decisions

When to consider student loan forgiveness as a strategy

If you have federal student loans, there are two primary ways to use loan forgiveness to your advantage:

- Public Service Loan Forgiveness (PSLF). If you work full-time for a public or nonprofit organization, you may be eligible for tax-free loan forgiveness after 10 years of qualifying payments.

- Longer-term forgiveness. If you work for a private employer or don’t otherwise qualify for PSLF, you can receive loan forgiveness after 20-25 years of qualifying payments under an IDR plan. But you’ll be taxed on the forgiven amount.

Most periodontists will benefit from pursuing loan forgiveness due to the high cost of dental school, especially if you attended a private school.

If you aren’t sure whether loan forgiveness or refinancing would be a better option for you, here’s a general rule of thumb:

If you owe less than two times your income, refinancing may be a viable option.

But if you’re a periodontist that owes more than two times your income, loan forgiveness is probably a better route. Here’s why.

Let’s say you owe $600,000 at 7% and bring in $225,000 annually. Under a standard 10-year plan, your loan payment would be almost $7,000 a month. Obviously, that’s not an ideal payment for anyone.

To make any significant reduction in your monthly payment, you’d likely need to refinance with a 20-year term — which is the same amount of repayment time as an IDR plan like Pay As You Earn (PAYE).

So, which repayment strategy would give you the most bang for your buck?

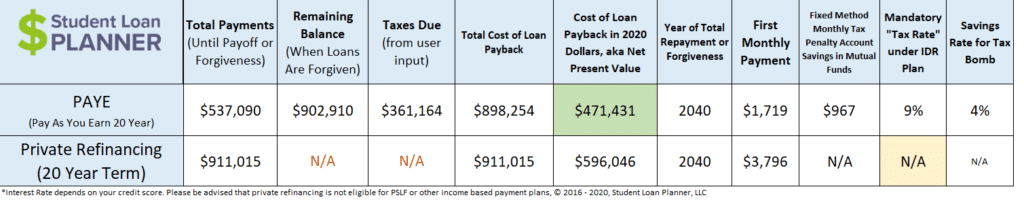

Using our free Student Loan Repayment Calculator, you’d pay significantly less each month under the Pay As You Earn (PAYE) plan at just $1,719 per month. That’s less than half the amount you’d pay if you refinanced at 4%.

And after 20 years of qualifying payments, your remaining balance would be forgiven.

By using loan forgiveness to your advantage in this scenario, you’d save over $120,000 on the total cost of payback. Just keep in mind that under IDR forgiveness, the amount forgiven is considered income and you’ll be taxed on that amount. Prepare for the eventual tax bomb by setting aside money in a non-retirement savings account each month.

Periodontists can use multiple repayment strategies over time

Periodontists can use different repayment strategies at different stages of their careers to maximize their finances.

For example, periodontists who are still in residency or at the beginning of their career may benefit from signing up for the IDR plan called Revised Pay As You Earn (REPAYE).

With REPAYE, your monthly payment is capped at 10% of your discretionary income. As an added benefit, the government pays half of all interest charges that aren’t covered by your monthly payment.

You could then stay on REPAYE until you open your own practice or become stable in your career to keep your monthly payments low. And then explore refinancing options to aggressively pay off the remainder of your student loan balance.

By the way, if you're thinking about starting the practice loan quote process, fill out our form just below and we'll send you some places to get started.

Practice Loan Quote Form

Get expert help for periodontist student debt

When you’re already dealing with a massive amount of student loan debt, a misstep in your repayment strategy can literally cost you thousands upon thousands of dollars. It can also cause ripple effects for decisions like getting married, having children or opening your own private practice.

Our team of student loan experts can walk you through various repayment strategies and help you navigate the process. Schedule a consult to receive a custom repayment plan that is tailored to your personal and professional goals.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|