Making monthly loan payments to pay off student loan debt can feel like a huge burden for college graduates. Whether you’re already in repayment, or are still in school and dreaming of being student debt-free, you might wonder, “Should I pay off my student loan early?”

With federal student loan payments set to resume on February 1, 2022, you might be on the fence about whether paying off your student debt quickly is the right decision, and whether there’s a penalty for doing so (short answer for federal loans: no).

Though paying off federal student loan debt early can seem like a no-brainer, it’s not as straightforward as you think. Read on to learn the pros and cons of paying off student loans early.

5 Benefits of paying off student loans early

Student loan debt can cause mental health distress and be a huge stressor on your financial and personal life. That’s why paying off debt early can feel like a worthy strategy to change your circumstances. Here are a handful of benefits to paying off student loans early.

1. Say goodbye to monthly payments

One of the main advantages of aggressively paying off student loans is shedding those pesky monthly student loan payments. You might be paying hundreds of dollars each month to your loan servicer, which significantly affects your budget.

Ditching monthly payments increases your cash flow which can be a financial and emotional relief if you have other obligations that can use the money instead.

2. Save money on student loan interest

Student loan interest is what makes paying down education debt so hard. Your interest accrues daily and adds up fast, making it feel harder to get ahead. If you’ve ever seen how much your loan payment goes to interest versus principal, it can be discouraging. Paying off student loans early can effectively lower the total cost of your loan.

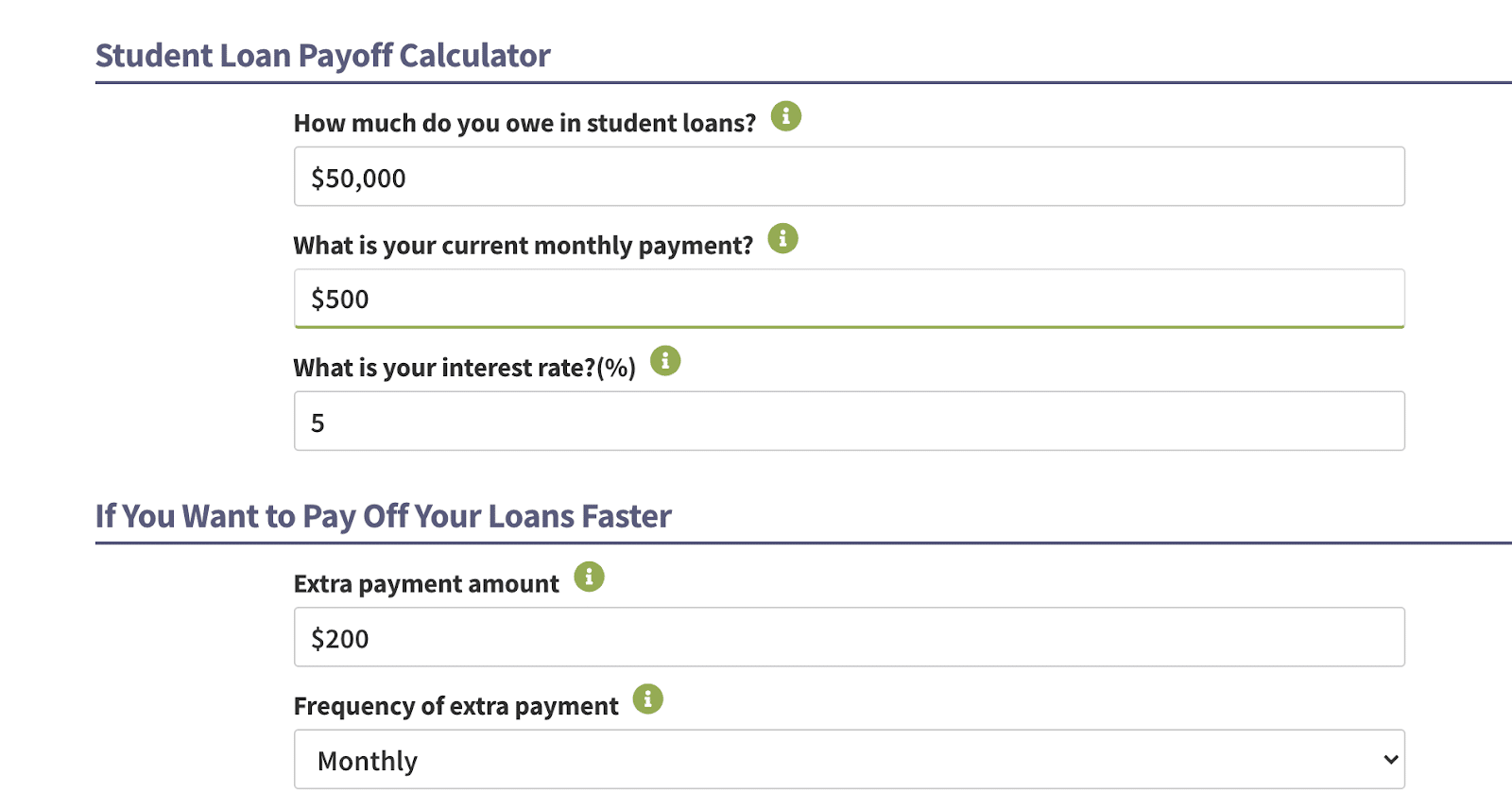

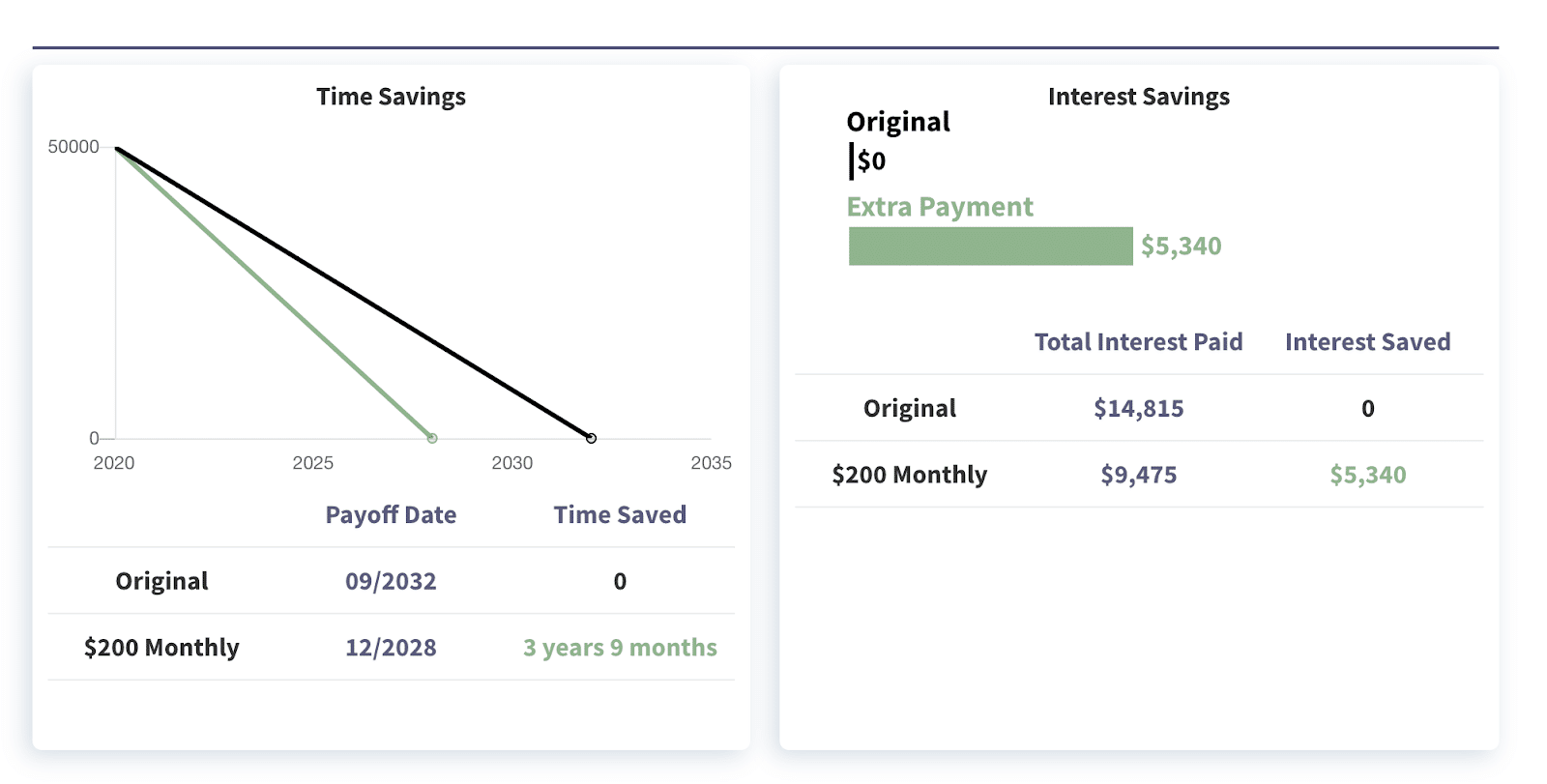

Let’s say that you have $50,000 in student loan debt, with a $500 per month payment at 5% interest. Assuming you want to throw an extra $200 per month at your student loans, you’ll save $5,340 in interest, according to our student loan payoff calculator! This payoff strategy also shaves close to four years off of your repayment timeline.

3. Lower your debt-to-income ratio

If you’re looking to get approved for a mortgage, your debt-to-income ratio (DTI) is an important number. To get approved for a mortgage, you typically need to have a DTI of 43% or lower.

If your student debt is looming large compared to your income, that might be an issue. One of the benefits of paying off student loans early is that you can lower your DTI, which opens up other financing opportunities for you.

4. Put money toward your future, not your past

When you’re paying down debt, you might feel stuck, because you’re paying for educational expenses from your past. If you’ve already graduated school, you might be paying for your degree over the next 10 to 25 years! By paying off student loans early, you get to put money toward your future-self instead.

You can start maxing out your retirement savings, invest in the stock market, or save up for your next big goal. Whether that’s a dream vacation, starting a family, or saving for a down payment on a home, you’ve freed up cash to make that an easier reality.

5. You can ditch your student loan servicer

Over the years, Student Loan Planner has surveyed borrowers about their loan servicers. Most student loan borrowers don’t love their loan servicer and some have faced consistent issues.

For example, some borrowers have experienced mishandled payments, poor customer service, and failures by their servicer in processing Public Service Loan Forgiveness (PSLF) payments, correctly. Paying off your student loans early means never having to deal with your loan servicer again.

5 Cons of paying off student loans early

There are numerous benefits to paying off student loans early, but there are also downsides to consider.

1. You might have little to no savings

If you’re putting all your extra cash toward your student loans, you miss out on setting that money aside to build a savings fund. Having an emergency fund is crucial because life happens — as do sudden bills, repairs, and expenses — when you least expect it.

The pandemic has taught us that having three to six months-worth of expenses saved up is the minimum we should strive for, if not more. If you don’t have sufficient emergency savings you can get stuck in a cycle of debt and turn to credit cards or other loans to get by.

2. You’ll lose IDR and forgiveness benefits

Federal student loans are chock full of benefits such as income-driven repayment (IDR) and student loan forgiveness. You can legally and easily lower your student loan payment amount to 10 to 20% of your discretionary income. This calculation is based on your adjusted gross income and family size.

If you have subsidized loans, you also get some interest subsidies as well. Under IBR and PAYE, if your student loan payment doesn’t cover all your subsidized loan interest, the government will cover the rest of the interest for three consecutive years.

Borrowers on REPAYE have even more benefits. Subsidized loan borrowers can get their interest covered for three consecutive years and half of it covered for an additional three years. If you have unsubsidized student loans and are on REPAYE, you’ll get half of the interest covered during all periods.

Forgiveness benefits

If you’re employed in the public sector and are working toward PSLF, or are generally eligible for an IDR plan, the remaining balance after completing your 20 to 25 year repayment term is forgiven.

Paying off student loans early means completely missing out on these benefits. If you’re on REPAYE or work in the public sector, paying off loans early is likely not a great idea as the benefits outweigh the pros.

3. You might have less money for other types of debt

Federal student loan debt offers protections that can catch you if you’re facing serious financial hardship. By throwing all your money toward your student loans, you might be neglecting paying off high-interest debt, like credit card debt.

Average credit card interest is about 16%, and the cost of borrowing adds up fast. There are also very little benefits and protections with credit card debt. It makes more sense to pay off credit card or other high-interest debt before your federal student loans.

It’s also worth considering how periods of high inflation affects paying off your debt. Instead of putting extra cash toward paying down your debt early, you could’ve used that money for other things since the value of your debt decreases in purchasing-power terms.

4. You’ll no longer qualify for the student loan tax deduction

Student loan interest can be a pain, but it’s a bit easier to handle because of the student loan tax deduction. The maximum deduction is up to $2,500 which might help your tax situation by lowering your adjusted gross income (AGI). This could mean paying less in taxes.

5. You can’t refinance and score a lower rate

Your federal student loans have fixed interest rates that won’t change on you. But if you have Grad PLUS Loans, it can mean paying a lot in interest with higher interest rates. Now that the federal payment pause is coming to a close, interest rates will rise back up from 0%.

If you pay off your federal loans early, you won’t have a chance to potentially score a lower rate through refinancing. Refinancing means giving up federal protections like IDR and forgiveness, but if you have a solid credit score and income, it can make sense. Lowering your interest rate through student loan refinancing may save you thousands of dollars.

Considerations for private student loans

We’ve outlined the pros and cons of paying off student loans early as it relates to federal loans. If you have private student loans, they don’t come with perks like income-driven repayment or forgiveness programs, so typically it’s best to pay private student loans off first.

Private loan lenders don’t offer as much flexibility with student loan repayment options and are sparse with benefits. Paying off private student loans early can make more sense than focusing on paying down federal loans. Another option is to lower interest rates through student loan refinancing.

Once private loans are out of the way, you can double down on federal student loans, if it makes sense for your financial situation.

The bottom line

If you’re asking, “Should I pay off my student loan early?”, consider these pros and cons of paying off student loans early first. You might not want to give up certain benefits that federal student loans afford you, but there’s less to lose for borrowers with private loans who aren’t pursuing forgiveness.

If you need help planning what to do next, get in touch with us for a debt consultation.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Hello,

I am enrolled in an IDR plan based on my consult with SLP. I recently had a consult with a financial planner regarding my overal finances,insurance and investments. He said that if I end up with ‘extra’ money that I should put it towards my principle on my studnet loans so that my tax burden will be less at the end of the 20 year term and at the point of forgiveness. He wasn’t really advocating for paying off the full balance but just reducing the principle with expendable funds. This seem to go against what SLP suggested if in an IDR. I thought the idea was to pay as little as possible and get as much forgiven as possible. Everything else he said seems to make good sense but I don’t know if the part about putting money towards the principle is the correct strategy. Please help.