Some states use community property law to regulate marriage income taxes and assets. These states are California, Texas, Arizona, New Mexico, Louisiana, Nevada, Idaho, Washington, and Wisconsin. If you live in one of those states and are thinking about going for student loan forgiveness, you might be able to save a lot of money with the tips in this article.

When married federal student loan borrowers desire to exclude their spouse's income from their income driven repayment, most simply just select “married filing separate” as their tax filing status.

However, residents of community property states (AZ, CA, ID, LA, NM, NV, TX, WA, WI) have unique rules pertaining to how to split income when filing taxes separately. This applies to about 3 in 10 married Americans with student loans.

On a federal tax return, when you file separately in a community property state, you “must report half of all community income” per the IRS.

And most borrowers will need to use their 2023 tax return to recertify their IDR payments in 2024 for the first time in several years.

So how should you certify your income if you pay student loans on an Income Driven Repayment (IDR) plan? We'll explain.

What Does Living in a Community Property State Mean for Student Loans?

Community property rules in the US can generally be traced to some states operating under Spanish civil law when they used to be a part of Mexico and others that operated under English civil law.

In a community property state when you file taxes separately as a married couple, you must split income on your tax return equally between spouses.

For example, if two spouses make $60,000 and $40,000, you would make an adjustment on the tax return and both would show as earning $50,000.

Which income should you report for your IDR plan? Each individual income? Or perhaps the income that represents 50% of your joint income?

Filing Taxes Separately For PSLF Tax Implications for Married Couples in a Non-Community Property State

Let’s look at a simpler situation in a state with normal common law marital tax rules, such as Florida. Pretend a physician (Sarah) is married to a teacher (Dwayne) with no student loan debt.

Sarah the physician owes $400,000 of student loans at a 7% interest rate. She has five years of credit towards the PSLF program.

If Sarah the physician files jointly with her teacher spouse Dwayne, who earns $50,000 a year, then she can use SAVE married filing jointly. Both will result in the same monthly payment amount of about $2,000 a month.

If she files separately, then Sarah’s payment on SAVE would be about $1,700. That difference is about $300 a month. An inexperienced person might look at that payment difference and conclude, “we should file separately to get a lower monthly payment!”

However, in non-community property states, which is most of the country, you’d pay more in taxes by filing separately if you have a big income difference.

This is because the higher earning spouse is often placed into a higher tax bracket.

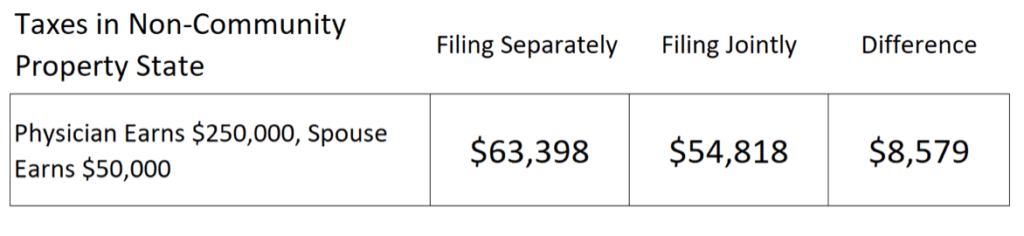

Here's an example of the multi-thousand dollar extra tax bill that often comes with filing separate outside of community property states.

In this case, Sarah and Dwayne would pay $8,579 extra for filing taxes separately. This happens because Sarah gets put into the 35% tax bracket while filing separately but would only be in the 24% bracket if she filed jointly. That higher bracket creates an additional tax liability.

Since the student loan payment savings are much lower than the tax costs, this couple would file jointly.

Now let's look at an example in a community property state to see why many borrowers won't need to worry about the additional tax costs of filing separate.

Tax Implications of Filing Separately in the Community Property States

Recall that the only reason to file separately when you have student loans is to exclude your spouse’s income from your income-based repayment amount on an IDR plan. When you’re in a community property state, your Adjusted Gross Income (AGI) is going to be split evenly.

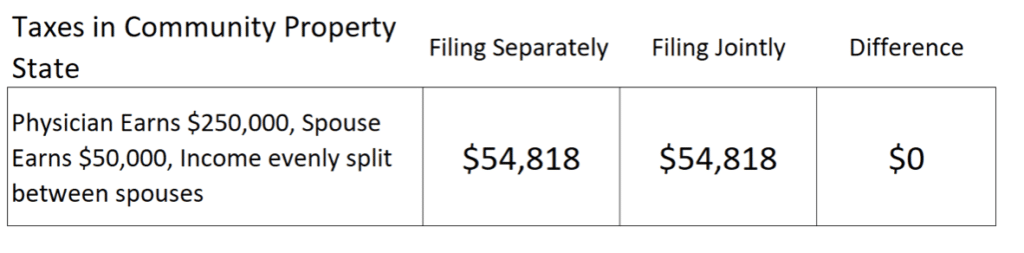

That means the cost of filing separately and filing jointly will be very similar as neither spouse will get placed into a higher tax bracket. The only exception would be if you claim certain less common tax write offs.

If Sarah and Dwayne lived in Arizona, they’d be subject to community property rules.

Let's look at their taxes again.

In this new case, the difference in tax payments between filing jointly and separately would be minimal.

For Sarah's student loans, Sarah’s new SAVE payment would be about $1,000 a month.

Compared to the filing jointly payment, this filing separate approach saves her about $12,000 a year on her student loans.

Since Sarah is the higher earner and she’s going for loan forgiveness, she could save a ton of money through this strategy, which we call the “breadwinner loophole.”

However, if Dwayne was the one with the student debt, they’d be hit with a higher payment filing separately than they would if they lived in a non-community property state.

How can a lower earning spouse pay less and still exclude his spouse's income on his IDR payment?

Meet the “alternative documentation of income” approach.

Related: How to Decide When to Use Married Filing Separately on Your Tax Return

Get Started With Our New IDR Calculator

Using Paystubs or Alternate Documentation of Income for a Better Student Loan Payment in a Community Property State

Here are the two acceptable ways to verify your income with a loan servicer if you’re on an income-driven repayment option:

- Your tax return showing your AGI

- Alternative income documentation, such as a letter testifying to your income or paystubs

Your plan should be to use your tax return or your paystubs.

The way a lower earning borrower in a community property state can use the alternative documentation method is to check a box when recertifying income that says “my income has declined since my last federal tax return.”

This should be checked every year, since every year, your income would be lower than what your 50/50 federal split income tax return shows.

Considerations for Married Couples Who Both Have Student Loans in a Community Property State

Due to new changes in the student loan rules under the new SAVE income driven plan, you can earn 225% of the poverty line before having to pay anything.

This deduction is determined by the size of your family if you file joint, or the size of your family excluding your spouse if you file separate.

Here's a quick example. A family of 5 would deduct about $78,000 of income before paying 10% under SAVE.

If they both have loans, they could file separate and each claim a family size of 4, allowing a deduction of about $67,000.

Since both borrowers would get this deduction, the savings would be 10% times $67,000*2 – $78,000 = $5,600 per year.

This is enormous savings, and many families with children will want to file separately even if there isn't much IDR benefit.

Families with Spousal Borrowers Who Have Large Differences in Debt to Income Ratios

Imagine a dual debt couple. One has $800,000 of loans from orthodontics residency and dental school. The other has $100,000 of loans from law school. Each earn about $300,000 per year.

Because the debt to income ratio is so high for the orthodontist, he should consider filing separate and pursuing an income driven repayment plan. The lawyer earning $300,000 who has $100,000 of debt will not be able to get forgiveness with income much higher than her loans.

Hence, the high debt to income ratio spouse should pursue forgiveness, the low debt spouse should pay off her loans, and both should file taxes separately while splitting income to give the high debt spouse a low payment.

Why Tax Advisors or CPAs Might Give You Incorrect Information About Filing Taxes Separately in a Community Property State

If you ask your tax preparer or advisor about what filing status to choose based on your student loan balance, he or she will most likely have no idea.

Student loans are not taught in CPA curriculum.

And a tax professional's job is to minimize your tax burden. Filing taxes separately is usually useless for taxes, and it can often be negative, particularly outside of community property states.

Hence, tax professionals generally do not understand these types of requests.

It's also common for software built for professional tax preparers to not make this easy. Even though the IRS clearly expects community property state returns to split community income across both spouses, software does not make this easy or straightforward.

We legally of course have to tell you to consult with your tax professional, but if you book a student loan consult with our team, we can suggest language and examples to provide to your tax professional to make tax time easier for both of you.

Figure Out Your Best Tax Filing Status as a Community Property State Resident for Your Student Loans

Now that you know the tax implications for married couples filing separately in community property states, you still might have some questions about your student loans.

If you’re confused about your student debt, then we can help with our flat fee student loan consult. You’ll understand all your options and all the questions you should be asking, many you probably didn’t even know about.

If you have experience with filing separately to get a lower student loan payment, whether in a community property state or not, let us know in the comments.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

This is a very helpful article. I do have one additional wrench to throw in. My hubby is the one with the student loan…currently… I make slightly more money than he does, but I also officiate volleyball and have a lot of 1099’s that I will have to own money for. I am currently a student and will max out for the 8863 tax return for student tuition. That money would help cut down on what I would have to pay in. If my hubby and I file married joint, his payment will increase about $200, but if we file married separate, I cant do the 8863 for tuition. What should we do?

Depends what kind of state you live in Alexis. Our calculator is a helpful starting point. studentloanplanner.com/free-student-loan-calculator/

This is a very helpful article. We currently live in a non-community property state; I have significant student loan debt and am trying for PSLF under PAYE. My soon to be spouse has no debt and earns almost 3x my salary. We had planned to move to a community property state at some point in the future, looks like that may be delayed until post PSLF. Keep up the good work

You can do alternative documentation of income if you live in a community property state and your spouse earns more. that would allow you to pay based on your much lower income instead of 50/50

Hi Travis! Thanks so much for all the helpful info. This situation you described is ours exactly. My husband has student debt from law school, we live in a community property state (TX), and we file married but separate. His monthly loan payment has increased significantly since I make more then him. He has tried calling his student loan processing company (Nelnet) and was told tax returns were the only acceptable income documentation – are you certain that there should be alternative forms of income documentation? Or is this subject to the loan processors discretion? Any advice is much appreciated….

Technically the loan servicers have wide discretion but alternative documentation of income is acceptable proof for IDR plans. I would just call and say your latest tax return isn’t an accurate reflection of your earnings anymore and request to use alternative documentation of income, and they’re supposed to accept it.

Update! It worked! His monthly payment was reduced by$200. Thanks again for all of your help!!

That’s great to hear Steph!

I’m currently on REPAYE and going for PSLF. My partner makes about 20% more money than I do, and we live in a community property state (he has a very small student loan balance and is not eligible for PSLF). If we get married, it seems that the best option for me is to switch to PAYE and for us to file taxes separately. I realize that this means that (1) being in a community property state, my payments will still go up, and (2) the unpaid interest on my loans will capitalize when I leave REPAYE For PAYE. Since I’m going for PSLF, does that capitalization really matter? Or is there something else I’m missing here?

No capitalization doesnt matter at all. You could look at doing alternative documentation of income instead of tax returns if you believe your tax return doesnt reflect your true income.

Hi Travis,

Thank you for your article. Unfortunately I’m still struggling to understand how/if using paystubs to verify income might work when married filing jointly in a community property state. If only person has the debt and they make 90% less than the other, can they still use this method?

Thanks for clarifying your article!

Yes it’s called alternative documentation of income. You just have to claim that your tax return isn’t an accurate reflection of your income then send in proof of all income sources. Most people in community property states that dont have investment income just use paystubs.

In a similar situation as OP JEssamine. What is the best way to “claim that your tax return isn’t an accurate reflection of your income”? Is it talking to the service rep/supervisor? Or is there a certain checkbox that should be filled out in the re-certification form to force them to re-certify using pay stubs?

You just have to check the box that your tax return isn’t an accurate reflection of income on the IDR recertification. Then they’ll usually ask for proof of all income sources, usually paystubs.

I am in a community property state considering filing MFS. The spouse with higher student loan debt and a lower income is on track for PSLF. There is not a check box to indicate my tax return isn’t an accurate reflection of income on the IDR annual recertification from Nelnet. Instead, in Section 4D, question 17 asks, “Has your income significantly decreased since you filed your last federal income tax return?” If I answer “yes,” the form prompts me to go to question 18 that asks, “Do you currently have taxable income?” Answering “yes” for this question prompts me to provide documentation of income using a pay stub. This seems to be the only way to document income using a pay stub unless I indicate I am unable to reasonably access my spouse’s income information (which isn’t true).

That’s what I’d do for now but the paper form shows specifically a spot to submit alternative documentation

In a recent post you had mentioned that there could potentially be a concern about answering the question NO about having reasonable access to a spouse’s tax return. Every loan servicer has said to answer No and to submit a pay stub. How does Student Loan Planner now weigh in on this particular issues?

Someone recently told me that the Dept of Ed told Navient to stop doing that, which confused the Navient rep into saying that you could never exclude your spouse’s income by filing taxes separately, which isn’t true. So we still believe that it’s mostly FedLoan Servicing that is structurally telling people to do someone that could be fraudulent.

My wife and I just got married in June 2019 and live in a community property state. I make approximately $100k and she made approximately $60k in 2019. Our AGI are approximately $94k and $55k, making our total AGI about $149k. Since we are in a community property state, will they subtract the 150% poverty level of about $25k from this total AGI and then split that into two, leaving each of us with approximately $62k in “disposable income?” We assume that we should file jointly since we are both on PSLF plans. Does this sound reasonable or am I missing something with the subtraction of the 150% poverty level?

You can file jointly if you’re both in PSLF that’s the easiest path

I make approx $250k/year and she makes $80k/year. She has about $220K in student loan and works for a qualifying non-profit org, so she is taking advantage of the Student Loan Forgiveness Program and Pay As You Earn program. Her monthly payment is about $1,900/month. Jokingly, but somewhat seriously, we were wondering if we should get a “paper divorce” to lower her payments down to $500. Would it be legal? It’s be ~$150k in savings over the next 10 years!

Probably would be legal but instead you need to consider filing taxes separately as it might save you about $15,000 a year. Get a plan with us on this studentloanplanner.com/help you’re clearly paying more than you need to.

Can you file married filing jointly in a community property stare and then also submit alternative documentation of the lower earning spouse’s paystubs? Is there any way to submit alternative documentation without representing that you do not have reasonable access to the spouse’s tax return?

The only way is to file separately then use alternative documentation with paystubs. You can’t use it if you do married filing jointly.

So I am the spouse with student loans on a IDR plan .student loans of 48,000 and no degree. 🙁 We just got married last year. My husband made about 65k

And I made 8k .

We have children and live in a community state .

If I file separately they take away the earned income credit.

Is there a way to file jointly and not have his income with mine ?

You can do something called amending tax returns. File separately and use alternative documentation of income, meaning submit paystubs. After your return is 2 years old, have a tax person amend it from separate to joint. Then you should get the EITC back as a refund.

Travis, thank you so much for the informative article. I’m still having a little trouble understanding the implications of filing separately. We live in a community property state (Texas), I owe $62,000 in student loans and she has $0. We have two children and I earn roughly $10k/yr more than she does. I’m currently on PAYE and pursuing PSLF. Should we plan on filing separately then send in my alternative documentation of income or should we file jointly since I make slightly higher income than she does?

Thanks for your help.

You should file separately and use form 8958 to equally distribute your income, and your student loan payment should be much lower than if you filed jointly. You dont need to send in alt documentation. I’d listen to the Student Loan Planner podcast episode 6 for a detailed account of how this works https://www.studentloanplanner.com/breadwinner-loophole-dr-quinn-interview/

We attempted this and they asked for alternative documentation to show who makes what. Seems they’ve caught on to the loophole and are trying to shut it down

That’s interesting Fedloan asked that? I haven’t heard that to be widespread yet.

Yep! It asked for the most recent pay stubs for me and my spouse or a letter from both employers stating how much is made and how often it is paid.

My wife has 400k in loans, makes 60k as a resident, and I have no loans and make 150k. We live in a community property state. Additionally, I have a 50k AMT from ISO exercise this year. I assume we should file separately, she should use pay stubs to verify her income, and we’re all good?

Is there any risk in using the alternate payment documentation? Do capital gains realized through my ISO exercise and sale affect her income, or can I claim them all on my returns? I was awarded the ISOs before we got married, if that makes a difference. Thanks!

ISOs are pretty complicated so you’d want to work w a CPA who has experience in dealing with them. Correct in that youd file separately w Form 8958 and then use paystubs to verify. There might be some limited risk but it’s a risk that we’re comfortable with advising clients to take. Yes your capital gains would probably impact her income if it’s all realized this year bc you split all income evenly. but it shouldnt show up on her return because you’re claiming alternative documentation of income because you’re saying all that income is not really hers.

In this case, couldn’t a married couple file jointly and still use paystubs/alternative documentation to calculate IBR payments? Seems like you could use the same rationale that your married, jointly filed tax return does not accurately reflect your income — is there a reason why you would need to file separately in order to file alternative documentation?

Yeah based on the definition you need to file separately to do it legally.

I recently tried doing this and it did not go in my favor. I make roughly $130K and my spouse makes $45K. We filed taxes married separately to take advantage of the community property state and get a lower monthly payment for my $200K in student loans while I pursue PSLF. When I filed the paperwork to have my payment recalculated, it had my spouse sign and both of us submit our most recent tax return (married filing separate), it got bounced back and asked for us to show our pay stubs and differentiate who makes what. Seems like they’ve caught on and this loophole won’t work anymore. The only way I could see maybe getting around this is checking the box that I can’t access my spouse’s income information?

I’d be curious if others are experiencing this. One thing I’ll say is I’ve seen this happen a lot for folks using 2018 taxes but haven’t seen it yet in this case for people using 2019 taxes.

Also haven’t seen it for folks using form 8958 to equally divide income like a CPA would, so curious if that got kicked back for that reason bc maybe something was filled out not perfectly or if it’s just that they’re catching on.

Yep! Our CPA filled out all the appropriate forms. The only way we could get them to not ask for proof of who makes what is checking the box that says can’t access income info, which in part is true as we keep finances separate and just send to the CPA for returns. This is the first time we’ve done married filing separate to try and take advantage of the loophole.

Thank you for this article. The information is fantastic and the practical advice in the comments are very helpful. Thank you!!

My question is: Is there anything you can do in a community property state to get your income AND your pre-tax retirement contributions to be considered when determining how much your IBR will be? An example to illustrate the situation may be helpful. Example: 1 spouse with $150,000 income and $0 student debt and one spouse who is a resident making $50,000 and $300,000 in student loan debt going for PSLF. If they live in a non-community property state they can file separately and the resident spouse could contribute 19,000 to a traditional 401k, 6000 to a traditional ira and 3500 to an HSA bringing their AGI to 21,500. Making income based repayments on a 21,500 will be a small amount…which is the goal, yay. However, in a community property state this couple would file separately but each spouse would be considered a 100,000 AGI. I (now) understand you can submit pay stubs to get your income based repayment(IBR) plan to reflect the actual residents salary. For this couple, the resident would submit their pay stubs and (hopefully) Fed Loan would recognize their AGI is 50,000 instead of 100,000. But, my question is: Is there anything you can do in a community property state to get your income AND your pre-tax retirement contributions to be considered when determining how much your IBR will be? It is great that you can get your IBR to reflect your actual, lower income. But, it seems to me that those in community property states are still missing out on opportunities to optimize the income based repayment strategies when going for PSLF.

Is there a way, in a community property state, to get the true salary and the pre-tax contributions considered as my true AGI and thus, the basis for my IBR?

I appreciate all you do for the student borrower community! Thank you

If the spouse making less files separately he or she will have to use paystubs which will not consider AGI reduction from 401ks. So you’d only get the benefit w the higher income spouse who would use tax returns.

Great article! We recently moved to a community property state. I earn $100,000 and have $100,000 in student debt; husband earns $395,000 and no longer has any student loan debt. We have always filed separately because I made between $56-70K a year until recently.

I thought I was 16 months away from PSLF and now it looks like I am 4 YEARS away – apparently I was under the ‘wrong’ repayment plan although I recall speaking to a loan rep several times to make sure I was in the right plan years ago.

This will be our first year filing taxes in a community property state. This article seems to suggest we file separately and I use paystubs for income re-certification with FedLoans. I am currently under the IBR repayment plan. Will this work?

We go through this exercise every year – whether to file jointly or separately – but end up filing separately since we both brought in some different debt and assets at the beginning of our marriage.

If you filed separately in a community property state, it might work out great if you’re the higher earning spouse because you could get a lower payment. However, if you’re a lower-earning spouse, you could be left with a higher payment. It’s best to run the numbers with our student loan calculator to see – and check with a CPA to find out the advantages/disadvantages so you have the big picture to look at when making a decision.

If you are married and file jointly, can one spouse be on the standard repayment plan and the other spouse in income based repayment (one spouse works in public service)? Will they take into account the standard repayment monthly loans in calculating discretionary income or will they just take 15% of discretionary income no matter what repayment plan the non-PSLF spouse chooses? Or worse, do they force both spouses into income based repayment?

They won’t force both spouses into income-driven plans. One spouse can be on PSLF – your discretionary income is determined by the federal poverty guideline for your location and family size.

Amy or Travis,

I happened upon this article today while stressing about the current student loan situation that my wife and I are in…it appears based on the comments above that we are not alone. We live within a community property state. We both hold student loan debt as follows: Me – 84k private loans after consolidation, 120k/year income. Her – 200k federal loans on IBR working towards PLSF, 74k/year income. Now living in WI and not TN community property laws have resulted in a significant increase in her IBR monthly payments and do not take into account my student loan debt. How do we go about reducing her IBR payments short of getting divorced?

It’s tough when you’re in a community property state. In a consult, we’d run the numbers to see which scenario (joint vs. separately) would get you the lowest payment. Then you’d compare that with what a tax professional says your tax bill would be if you filed separately vs. jointly to see how you could come out ahead.

Hello,

I’m a physician 2 years out of training and going for PSLF. I have a question regarding how to ensure community property income is considered (i.e. taking the average of both spouse’s income) in calculating my IDR payment (we live in CA). We are married filing separately but I recently found out that our accountant has been filing our incomes as “separate-community” incomes (which isn’t what we wanted and thought this wasn’t even an option in the community property states). My spouse and I both have straightforward jobs with W-2’s only and share a joint account. So we went back to the accountant asking to file as community property income and he said it’s too complicated and advised us to get another firm to do it for us. We went into turbotax to try to do it ourselves and it seems like there is a community property income worksheet within the turbotax online interface where you can copy over the other spouse’s info after both spouses complete their own separate taxes. Is that essentially what we need to do in order to make sure the IDR calculation will be based on our average income and not just my income? I.e. file separately the normal way and then have that additional community property worksheet that shows the other spouse’s info. Or is there something more complex that only certain tax accountants have the capability to do?

Here are some quick facts for our situation that might help give context.

– I have $350k in student loans, spouse has $0

– My income was around $240k for 2020, spouse’s was $120k (not a physician)

– Filed separately every year since getting married 6 years ago

– I have 72 payments counting towards PSLF so far (4 more years to go)

– Been on IBR plan the whole time (i don’t qualify for PAYE and REPAYE didn’t seem like a good option bc spouse was making more than me until recently when i became an attending. our quick calculations tell us that it may still not be a good option even after considering the tax benefit from filing jointly)

– Whether community property is considered properly or not is projected to cost us about $700-800 per month in loan repayment (so nearly $10K a year)

Any feedback would be appreciated! Thanks.

Hi Michael, here is what our consultant Dan has to say: It sounds like if you’re looking to amend any returns from the past, you’re just looking to amend the 2020 return, because there wouldn’t be any retroactive benefit on the student loans side of things beyond that. And a few months of pre-2021 tax filing, now that the payment freeze has been extended, may not even be worth amending your 2020 return to “fix” the situation, since you would have to pay a “reasonable fee” to a qualified tax professional. In general, I would look for a CPA who primarily works with individuals and can say they work with a fairly large number of individuals in community property states who file separately (good bet if a large number of their clients are younger and have student loans). Under circumstances where you are filing initially (not an amended return), the accountant would need to use Form 8958 in the process of filing your Federal return MFS. Still, filing MFS as you have been is, as a strategy in a vacuum, a big “win” in the remaining 4 years that you have ahead of you (being able to exclude $120k of income from the income-driven calculation). Because you live in a Community Property state, being able to reduce your income even further than the Common Law states via the breadwinner “loophole” strategy is a possibility, but not a given and we can only speak from the experiences of other borrowers and their Accountants having done it through Form 8958. Thanks to the recent payment freeze extension, you can nearly start fresh and anew with your 2021 return.