Demand for a psychology career has been booming. With limited Ph.D. opportunities, PsyD enrollment has exploded and so has PsyD student loans.

There are more than 106,000 licensed psychologists according to the American Psychological Association. Right now, 25,000 are people enrolled in accredited programs and on track to become psychologists within the next five years. The field is booming!

With this much growth, funded Ph.D. opportunities are getting more competitive and not growing fast enough. The result is that many are now pursuing the much more costly PsyD degree.

In fact, of the 25,000 currently enrolled, there are more PsyD candidates than Ph.D. candidates. That’s a big flip considering 70% of the American Psychological Association’s (APA) membership have a Ph.D. and only 16% have a PsyD.

Student Loan Problems Facing Psychologists

So how much does PsyD cost? According to a 2016 survey in Training and Education in Professional Psychology®, the median debt for PsyD was $160,000 of student loan debt while a Ph.D. candidate could have half of that. The average cost of PsyD psychology programs can vary, but it is usually at or over six figures. Tuition costs are on the rise and trends show that it's not slowing down.

For the Ph.D. candidate starting at $60,000 in compensation, student loan repayment is doable but the PsyD graduate could have more than 2.5x their income in loans which is a much taller mountain to climb.

We’ve seen much worse situations with our PsyD clients after exploring loan options. Combined undergrad loans and graduate student loans, extra money borrowed for living expenses, credit card debt, and higher than anticipated tuition, the average PsyD we work with has $247,000 in average student loan debt. That’s 4x a typical starting income. These debt levels can make it tough for borrowers to pay back federal loans and private loans related to graduate school.

How are PsyDs expected to pay back this huge amount of loans making only an average salary of $60,000 to $70,000?

It would be one thing if income were growing rapidly, but it’s actually stagnating especially for those in private practice working as mental health professionals, counseling, or in clinical psychology. They face the headwind of insurance companies not raising their reimbursement rate over the years. Their only options to make more money are to take on more hours or turn down clients simply because of their insurance plan.

With so many confusing options to repay their student loans and a high ratio of loans to income, it’s hard to navigate the landscape. Just about all the PsyDs we’ve worked with were on a repayment plan that is projected to cost them tens of thousands more than the best repayment option.

Is it better for psychologists to refinance and pay them off, sign up for an income-driven repayment plan and make payments for 20 to 25 years, or get a job that would qualify for Public Service Loan Forgiveness Program (PSLF)?

The truth is that the best loan repayment strategy depends on their career path.

The majority of PsyDs work in either a group or private practice, for a government employer or for a non-profit and loan repayment could look different on each path. The wrong path could cost them tens of thousands (and even hundreds of thousands) of dollars more than they have to spend paying back their student loans. It's best to use a repayment calculator to see what each path really costs.

Psychologist in Private Practice and Student Loan Repayment

Jill has $240,000 in student loans at 6.5% and is married to John who is student debt free (lucky duck!). She just finished her PsyD program and got a job in a group practice making a median salary of $60,000. John makes $70,000 in the healthcare field and they are filing taxes jointly.

Jill’s long-term goal is to go into private practice but wants to wait about three to five years so that she can learn the ropes and gain valuable experience.

Her salary will have low growth at first but she plans on making $100,000 in 10 years in her private practice. John anticipates making $100,000 in 10 years also.

Jill and John would absolutely love to have their loans paid off quickly, but they can only find about $1,500 in their budget to throw at her loans.

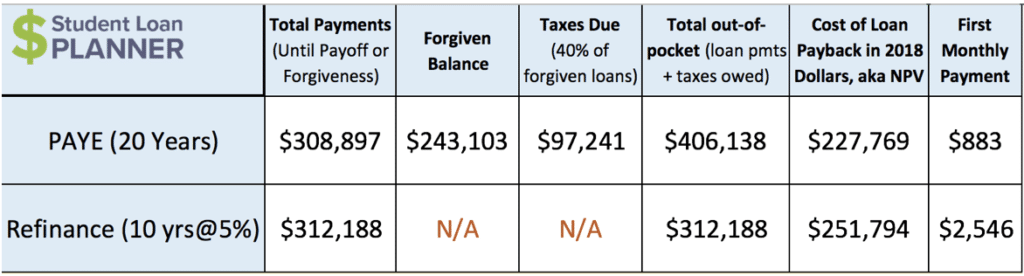

Let’s take a look at refinancing vs income-driven repayment on Pay As You Earn (PAYE).

Refinancing works best when people can commit to making the 10-year payment or more, don’t have any other consumer debt and have a cushion in their budget to do it.

In Jill and John’s case, they are short about $1,000 per month if they wanted to refinance at 5% with a 10-year term. Yes, they would pay the lowest amount out of pocket with refinancing, but this could put them in a whole lot of trouble if they can’t afford to make their payments. If they refinance, the loans are no longer in the federal program and aren’t eligible for loan forgiveness or forbearance.

PAYE looks to be more palatable. Jill’s first monthly payment would be $883 per month vs $2,546. Her payments would grow with her income, but she would have plenty of breathing room to save up for a private practice and perhaps a short-term drop in income when the time comes.

The PAYE Tax Bomb Savings

Jill is estimated to have $243,103 of loans forgiven after making 20 years of payments on PAYE. If her tax rate is 40% that year, then she’d owe $97,241. This makes some people sweat and be fearful of this path. But often it’s much better than the alternative.

Is it better to pay $97,000 in year 20 or pay off an extra $243,000 spread out over 20 years? The lower number in year 20 is much more affordable than the higher number along the way. In reality, it takes about $260 a month set aside in an investment that would earn about 5% a year for the next 20 years to save for the tax bomb.

It’s important that Jill understands that her student loan balance is projected to grow each year on PAYE. This is something that many have trouble getting their head around and I have to admit that I was the same way. It’s hard to grasp that student loan debt growing can actually save money in the long run.

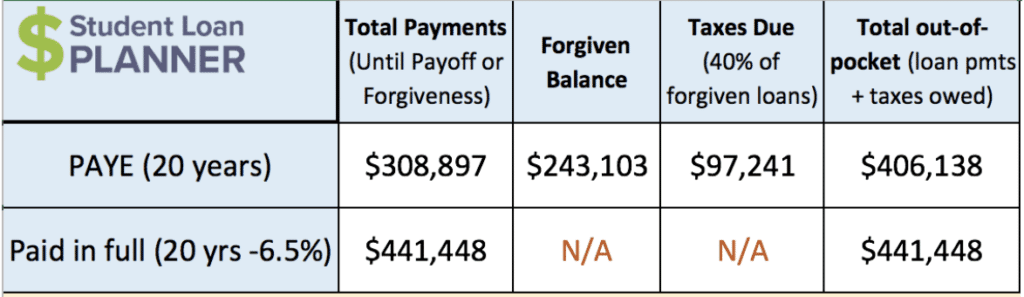

Let me show you the math behind the savings:

Both options on this chart get Jill to be student debt free in 20 years. The top row is PAYE with taxable student loan forgiveness for psychologists, and the bottom row would be if she paid off her loan in full on a 20-year repayment plan.

As you can see, over the next 20 years, PAYE would cost $308,897 in payments and pay in full would cost $441,448. That’s a $133,000 difference! My guess is that Jill would rather not spend that money on her student loans if she didn’t have to.

Yes, she would owe $97,241 in taxes but she’d have 20 years to save up for that and get some potential investment returns on it. Even without saving for it in advance, she’d still save $35,000 by being on PAYE vs paying her loans off in full over 20 years ($441,448 vs $406,138).

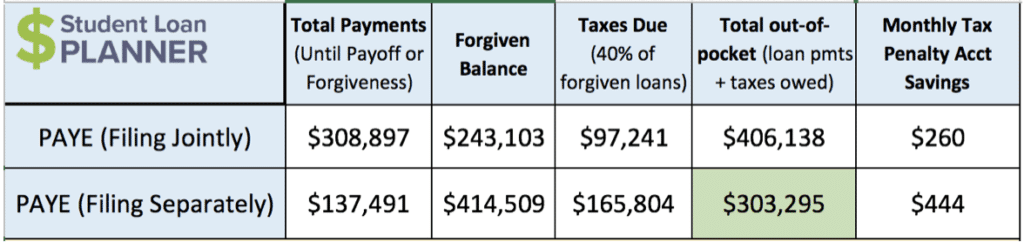

PAYE Filing Taxes Jointly vs Separately Comparison

Perhaps we should take a look at how PAYE would change if they were to file their taxes jointly vs separately since Jill and John’s individual incomes are going to be quite similar.

How they file for taxes will affect Jill’s PAYE repayment. If they file jointly, then Jill’s payment is based upon their combined income. If she files separately, then her payment is based upon her salary alone on PAYE.

Here are the numbers:

Now, this is powerful stuff! Filing separately would reduce Jill’s total out-of-pocket cost of paying back her loan by $103,000 over the next 20 years. That’s almost real money!

Here’s the thing though: It’s not free. Her loan balance is projected to grow up to $414,509 vs $243,103 so her tax bomb would be higher. Also, she and John would most likely end up paying more in taxes each year filing separately vs jointly.

So which way would be better?

Jill and John should talk to a tax professional to see the difference in taxes owed filing separately vs jointly each year and compare that to the student loan payment reduction.

For example, since the projections show that she’d save about $100,000 paying back her loans over 20 years, then we can average that out to about a $5,000 per year savings.

If Jill and John would owe only $2,000 more in taxes filing separately each year, then they’d get a benefit of $3,000 that year ($5,000 less student loan payments — $2,000 in higher taxes) by going that route. If they were to pay $6,000 more in taxes by filing separate, then they’d end up paying $1,000 more as a household to do it.

The other thing is that they’d have to up the tax bomb savings from $260 per month to $444 per month. According to the projections though, Jill’s first monthly payments would go down from $883 to $352 per month. That’s a $531 lower payment in year one which would more than absorb the extra $184 she’d have to put in for the tax bomb savings.

Pending a conversation with a tax professional, filing separately would save them a ton paying back her student loans.

PsyD Student Loans & Public Service Loan Forgiveness (PSLF)

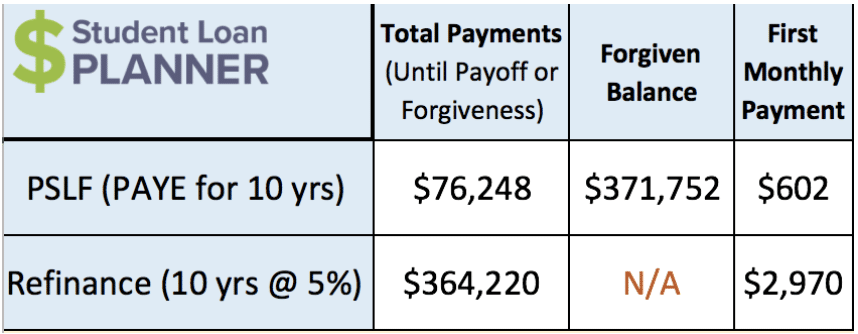

Bill just got a job with the VA as a psychologist making $90,000 and plans to work there for many years. He has $280,000 in loans at 6% and is single. Since he has federal student loans, forgiveness programs like PSLF are on the table but he’s skeptical that it will be there for 10 years. He lives on a pretty tight budget and has the ability to put $3,000 toward his loans.

We started off by comparing refinancing vs PSLF using PAYE as his repayment plan.

He can afford to refinance but after seeing these numbers, now he understands how compelling PSLF could be. He’d be debt free in 10 years with either program but PSLF would save him $290,000 paying back his loans vs refinancing ($76,248 vs $364,220).

Looking at the numbers Bill should choose PAYE as his repayment plan when going for PSLF. That way, if he gets married, he can file separately to keep his payments low if it makes sense tax-wise.

But how can we get Bill comfortable with going for PSLF to get these savings if he’s skeptical of the program? Here’s how.

If Bill is nervous about it, he shouldn’t throw that money at the student loans. He should save the difference in payment between PAYE and refinancing rather than throwing it at the loans.

In other words, put $602 per month toward the loan for the first year and save $2,368 each month for a total of $2,970 going toward student loans and savings.

If everything goes through with PSLF, Bill will have close to $300,000 more in savings (before investment returns) than if he had paid them off in full.

The side benefit is that this will also help him play defense if there are any changes to the program. Worst case scenario is that he’d have a boatload of cash to throw at it his student loans to pay them down. Best case scenario, he makes it the 10 years and gets his loans forgiven. That pile of cash he saved up? He gets to keep it after his loans are forgiven.

To him, it’s worth it to go that route to have estimated savings of $290,000 over 10 years.

How PsyDs Save Money Paying Back Their Student Loans

Whether a PsyD is going into group or private practice and trying to figure out if they should refinance and get a lower interest rate or go on an income-driven repayment plan, working for nonprofit organizations, or the VA, there is a clear path to pay back their student loans and ways to save oodles of money, especially if they owe $250,000+.

If you have PsyD student loans on a standard, graduated or extended plan and even IBR, there’s almost always a better option out there for sure. We can get to the bottom of it in just an hour.

Student Loan Planner® has done it for nearly 1,200 clients totaling more than $325,000,000 of student loans.