Nearly every grad is walking out of college strapped with serious student loan debt. PricewaterhouseCoopers (PwC), an accounting practice with over 10,000 employees, decided to address this. In 2016, the PwC student loan paydown program was launched. In 2019, PwC announced it had paid off $25 million dollars worth of student loans under this program.

The PwC student debt paydown program is an incentive for new hires to join the company, but that doesn’t mean it's the right choice for your student loans. If you’re on the PwC payroll or about to be, you’ll want to compare this PwC perk to your other student loan options.

Get Started With Our New IDR Calculator

What’s the PwC student loan paydown program?

PwC claims to be the first in its industry to offer student loan paydown as a benefit for employees. Its goal is to remain competitive in the field and set its employees up with a financially healthy start — especially millennials leaving school with tons of student loan debt. But like any student loan debt forgiveness program, you need to meet certain criteria.

To be eligible for the PwC student loan paydown program, you must be a U.S. associate or senior associate. The PwC student loan debt paydown program offers:

- $1,200 of student loan forgiveness per year

- A max of $7,200 paid toward your student loans

You can only participate in this program for six years or until you leave your role as an associate.

The program is run through Gradifi as an employee benefit. Eligible employees enroll on Gradifi’s platform. PwC makes a bulk payment to Gradifi each month, which Gradifi then distributes to the employee’s loan account. Taxes on the loan repayment are deducted from the employee’s net pay.

How does the PwC student loan debt paydown program work?

You can’t find many details about the PwC student loan paydown program on the PwC benefits page. It does provide a brief video describing the process. For more information, you need to talk to a PwC recruiter. In general, this is how it works:

- Enroll for direct payments to be made to your lender as soon as day one on the job

- PwC then pays $100 a month directly to your loan provider

- PwC will pay $100 a month for up to six years or until you get promoted to manager

The amount paid — a max of $1,200 per year — will still count as income. So you’ll be responsible for paying taxes on it. Payments can be applied to both undergraduate and graduate debt.

On the PwC Benefits page, PwC claims that this loan program could shorten your loan payoff by three years. It sounds exciting, but you have other options for student loan debt paydown.

Is the PwC student loan paydown a good fit for your loans?

Money to pay off your student loans is a PwC perk of the job. The $100 a month is generous, and there isn’t any mention of refinancing your student loans affecting your eligibility for it. The only question is whether or not you can combine this PwC employee benefit with your own debt payoff strategy.

When you work in the private sector, Student Loan Planner® has two main strategies for tackling your debt:

- If you owe less than 1.5 times your income, refinance your student loans for the lowest rate possible. Aggressively pay for them back in a matter of 10 years or less.

- If you owe more than 1.5 times your income, then pursue the income-driven repayment (IDR) plan forgiveness program. Make payments for 20- to 25 years while saving some money for taxes and get your student loan balance forgiven.

If you can use the $100 a month provided by PwC in addition to one of these strategies, then by all means, take advantage of it.

The concern is that PwC is partnered with LendKey through Gradifi and will offer you multiple refinancing deals. These can sometimes not be in your best interest and might not be the most suitable for you. Anytime you’re refinancing, you need to shop around among multiple lenders to find the best deal. And the fewer lenders featured in these programs, the more likely you are to get a less attractive interest rate for refinancing.

Worst-case scenario with PwC student loan paydown

The worst-case scenario is that while enrolled in the PwC student loan paydown program, you can’t refinance or pursue IDR. This means your only option is the current Standard Repayment Payment plan, plus the taxed employee contribution.

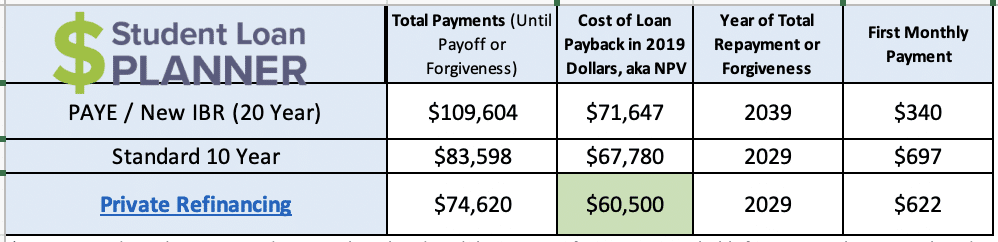

Let’s say you owe $60,000 of student loans with an average interest rate of 7% and work as a tax associate for PwC making the average $59,000 a year. We’d tell you to look into refinancing your student loans and aggressively paying them off.

Even if you get the complete $7,200 of loan repayment through PwC for six years, you’ll still come out ahead if you refinance on your own. The private refinancing option here estimates a 4.5% interest rate and 10-year loan term. If you can get an even lower interest rate, you’ll definitely end up ahead.

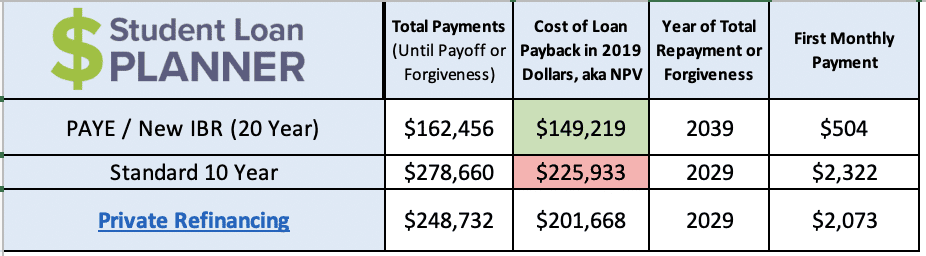

Let’s look at another scenario. If you went to grad school and received an MBA, you’ll likely have six figures of debt. Let’s say you have $200,000 of student loan debt and work for PwC as a Senior Tax Associate making the average $78,669 salary. You owe more than 1.5 times your income and should strategize your cash flow for the IDR forgiveness program.

In this example, the Standard Plan is the worst-case scenario for your student loan debt payoff, even if we included the extra $7,200 from the PwC employee benefit.

Again, if you can combine the PwC student loan paydown program with any debt payoff strategy, then sign up. But if you can’t, strategize how to pay off your debt on your own. It could also be a PwC perk if you can choose which loan to put in the PwC program individually. You could choose a private student loan and focus on a different plan for your federal student loans.

The bottom line is that the PwC student loan debt paydown program is really only ideal if you have a very small amount of student loan debt. Otherwise, you’re better off using the IDR program or shopping around for your own refinancing deals.

PwC isn’t the only company offering this perk

PwC isn’t the only major corporation looking to help its employees with student loan debt. Aetna and Penguin Random House are two of the many companies that are also adding student loan debt repayment as an employee benefit.

It’s a noble cause. But a word of caution: Look at the fine print. Companies can partner with one refinancing company and offer a tiny discount, whereas if you shop around, you'll likely find a better refinancing deal.

These companies are offering an employee benefit, not a personalized plan. The team at Student Loan Planner® is here to look at your student loans and give you that personalized plan. You can start with our SLP calculator; if you still have questions, please reach out to our team for a consultation. Our goal is never to offer one option laced with strings. It’s to get you on the road to feeling in control of your debt.

*Editor's note: We've received this information from a reader: The PwC student loan payout program is only available to employees within certain salary and internal “grade” bands. Lawyers or those in specialized fields (or those with several years experience) more often than not fall outside the scope of the benefit, so although it seems like an attractive offer – it’s really only available for recent college grads making below 100k(ish).

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Why can’t you do IBR or refinance into another loan on the PWC plan? Can’t you enroll your new loan into their program?

You probably can. But our two main concerns are 1) that all these employer assistance programs are designed around traditional norms of paying off debt when forgiveness is actually a good option in a lot of cases, and 2) some of these programs preference only 1 or 2 lenders to their population and that can result in employees paying too much in student loan interest by not shopping around.