Random question: Did you know how much debt you were going to be in when you were applying to veterinary schools? You likely knew you'd be studying things like physiology, biology, medications, vaccinations, and more but didn't know how much debt you'd accrue.

You probably didn’t learn the steps to becoming a rich veterinarian, but you probably thought you’d have enough to live on. After all, everyone else was graduating and dealing with their loans somehow.

Most of my 100+ veterinarian clients and in related professions have said that they really didn’t understand how fast their loans would grow both during and after school. Many contact me five years post-graduation and wonder how their loan statements have a $300,000+ balance on them when they only borrowed $200,000. Having debt from undergraduate studies like a Bachelor of Science degree (BS) only adds to that.

Others have said student loans were more theoretical until they graduated. Then their loan servicer sent them a piece of mail that said their deferment ended in November, with the first payment was due a month after. That’s when the loans from College of Veterinary Medicine got real. Being a veterinarian isn't just dealing with a cute puppy or mastering feline medicine.

This might sound crazy, but no matter how high your debt, it’s possible to follow the steps to becoming a rich veterinarian within a couple decades. That’s true even if you owe the $100,000 to $500,000 that many borrow to finance their Doctor of Veterinary Medicine (DVM) education.

Step 1: Watch out for fancy cars and big houses

Whenever I see a budget from a veterinarian, I can look at what they spend on their car and house and have an instant idea of how healthy their finances are.

Here’s a dirty secret in personal finance: you can buy as many lattes as you want from Starbucks. What will make you or break you is how much you spend on the big-ticket items in your life.

Don’t believe me? Compare driving a brand new Subaru vs a 2010 Honda Civic. Let’s say the new Subaru costs about $600 a month to drive with a car payment, insurance, gas, regular maintenance, etc. We’ll say the old Civic costs $200 (I’m including a higher budget for repairs than with the Subaru).

How much is a Starbucks latte? Maybe like five bucks. With a difference of $400 between the new car and old car, if you drove the old Honda you’d have to sip 80 lattes a month just to be even. Your bladder would give out before that.

With housing, you want to try to keep your purchase price at no more than twice your household income. If you want to be super conservative, then go for something between one and one and a half times your household income.

A bank will approve you for up to three and a half times your income. Asking a financial institution how much house you can afford is like asking a kid how many cookies they want to eat. The answer is always MORE. The bank makes more money the more house you buy, so naturally, they’re going to be inclined to suggest something on the higher end of the range.

I’ve never seen a case out of the 100+ veterinarians I’ve consulted with where something besides housing or cars were torpedoing their budget. Be careful with these two categories and you’ll have an abundance of resources to use on other things that could make you wealthy. Don't go down the rabbit hole of trying to keep up appearances. Ultimately, you want to be spending time on other things in your life and doing a good job at your vet clinic.

Is financial planning with SLP Wealth right for you?

Looking for student loan aware financial planning custom tailored for professionals like you? Check out the discounts below for becoming a client of SLP Wealth (our SEC Registered Investment Advisory firm).

Step 2: Credit card balances are dangerous – protect yourself against them

Another temptation for veterinarians is to let credit card companies ease the financial burden of living on a lower income, especially during the beginning of your career with an internship or as a resident at a facility. I often see new veterinarians burdened by credit card debt they picked up during school too.

If you have credit card debt, it’s an emergency. You want to do two things. The first is pay it off as aggressively as possible. The second is save up at least $10,000 in the bank to use for future emergencies so you never have to fall victim to plastic money ever again.

Why is credit card debt so bad? Besides the obscenely high interest rates, you could easily damage your credit score if you can't keep up with payments. This could impact the rate you're quoted when it comes to your mortgage. Then you’ve cost yourself 30 years worth of extra finance charges.

Credit card debt is an indication that extreme sacrifices need to be made over a short period of time. That usually means dumping an expensive car, taking on a roommate, limiting dining out, or going on a shopping fast.

The sacrifice needs to last as long as it takes to get a secure pile of cash. Follow these instructions and you’ll not only be insulated from personal emergencies. You’ll also have leverage in being able to take new jobs, pursue special interests, and negotiate higher salaries as a practitioner of animal science.

Step 3: Decide if you’re paying your loans crazy fast or strategically slow

Our reason for our existence around here is helping veterinarians figure out exactly how to repay their student loans.

We tell folks there are two ways to pay student debt. You can pay as fast as you can with a goal of getting rid of it in less than 10 years, or you can stretch it out as long as possible with a strategically passive repayment.

The right approach depends on your personal preferences, math, your family status, spousal income and more.

Here’s a simple rule to use. If you owe less than 1.5 times your household income (or will soon) and work in private practice with internal medicine or surgeries, then go ahead and pay down your debt. Refinance with one of our cashback bonus links and start having more of your money go to principal instead of interest.

The other route is using the new Saving on a Valuable Education (SAVE), formerly known as REPAYE, to make your Doctor of Veterinary Medicine Degree more affordable. Alternatively, you might benefit from Pay As You Earn (PAYE) in certain cases.

Notice I didn’t say Income-Based Repayment (IBR), Extended, Graduated, or Standard. That’s because they’re awful plans yet I constantly see veterinarians using them. If that’s you, please contact us as I’m almost sure we could save you money. I’ve seen dozens of vets throwing away thousands of dollars with extremely inefficient student loan repayment. Don’t be one of them.

Get Started With Our New IDR Calculator

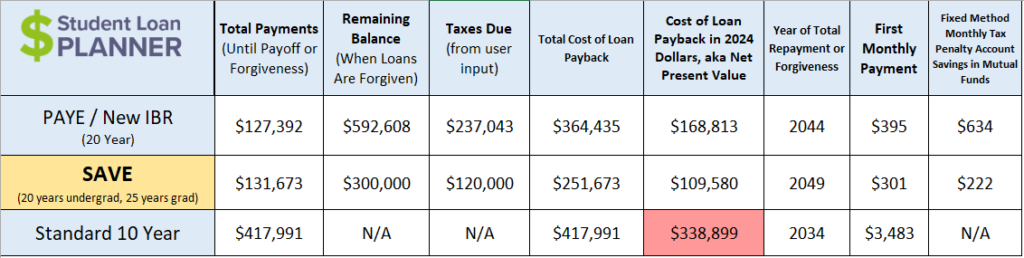

With the new SAVE plan, monthly payments are based on 10% of discretionary income for graduate borrowers with loan forgiveness after 25 years of repayment. In contrast, PAYE allows for only 20 years of repayment before the remaining balance is forgiven. However, the SAVE plan comes with a higher poverty line deduction and generous interest subsidies, allowing for lower monthly payments to maximize loan forgiveness.

The catch is that you owe tax on the forgiven amount as if it was income. But the American Rescue Plan made student loan forgiveness tax-free through 2025, and there's a political debate on whether this borrower benefit should be permanent or not. So, you should still financially plan to pay taxes on any future forgiveness amount.

With these IDR plans, the total cost over a couple decades or more could be less than the total cost over a shorter 10-year period. That makes income-driven options superior to alternatives when you owe a whole lot relative to income.

Look at the cost to a vet with a $300,000 loan balance at 7%. She earns $70,000 adjusted for inflation.

Notice that the total cost even after summing the payments and the taxes is less than the repayment on the 10 Year Standard Plan. Even if those numbers were the same, you’d much rather pay over 20 years than 10 years because of inflation.

Of course, if you have a “good debt to income ratio,” then you won’t receive forgiveness and refinancing is best.

It’s really important to get the student loan part of the equation right when you're working as a veterinary technician. If you’re not the kind of person that would use our student loan calculator to figure out the math for yourself, we can do it for you.

Step 4: You and your 401k / IRA should be best friends

Many veterinarians do not have access to a 401k at work. Mom and pop type places like a small animal practice typically don’t offer them. If you do have access to a 401k, consider yourself lucky.

While most people just put in around 4% of their paycheck, I’d challenge you to consider putting away the maximum allowed by law. That is currently $23,000 for 2024.

It’s easier than you think because you can deduct the contributions on your taxes. Saving that much might only cost you $10,000 to $15,000 in take-home pay.

What’s the difference between saving the max and putting in whatever your employer will match?

Consider this illustration. We’re assuming you put in about $3,000 per year versus $23,000 a year with a 5% rate of return over a 30-year period.

| 30-Year Period with 5% Returns | Ending Retirement Savings |

|---|---|

| Small ~4% contribution | $209,282 |

| Max 401k contribution | $1,604,777 |

If you earned higher returns than 5%, this difference would be even more pronounced. I just wanted to show you how much money you could have at even a modest rate of return.

What if you don’t have access to a 401k at work? You would then be able to contribute to a Traditional IRA and deduct the contribution. The only downside is that the limit on IRA contributions is low at $7,000.

You must open an IRA on your own at a place like Vanguard. The 401k you just use whatever your employer offers. For those of you without 401k plans working in small animal medicine, first, encourage your employer to offer one. Second, be ready to save in regular investment accounts that aren’t specifically earmarked for retirement.

Any investment company like Schwab, Vanguard, Fidelity, etc. will be able to explain this to you if you call their number you’ll find online.

Step 5: Consider being your own boss by running your own practice

What if you had over $1 million in retirement savings AND a business that you owned outright near the end of your career?

Long -term, you have two choices as a veterinarian. You can work for somebody else or you can work for yourself. Option two can be scary because you will likely have to take out a practice loan from a bank and run a small business.

You’ll have to do the hiring and firing, make sure you’re earning enough revenue to pay your business loan and will have business decisions on top of existing clinical decisions.

That said, veterinary medicine is a relatively stable industry. As long as you don’t lose your ability to practice, you are more likely than not to be very successful especially with so many people with new pets due to the pandemic. Business loans don’t last forever. Eventually, you will pay off what you owe and own an asset that could be worth hundreds of thousands of dollars.

When you become your own boss instead of work for a company like VCA or Banfield, you have control. For some, the added stress isn’t worth it because not everyone has a business mindset or personality. I totally get it when some clients tell me they just want to help their patients (aka injured animals), turn the lights off, and go home.

However, I believe far more veterinarians are capable of being owners than they realize. Aside from the financial benefits, you could create your own lifestyle. Few things are as fun as being your own boss. The extra wealth you’d create is just icing on the cake.

We actually have an extensive practice loan marketplace for veterinarians if you'd like to check that out.

Step 6: Don’t give your savings away for free — invest it

I’ve found that a lot of DVMs haven’t heard about a brokerage account. They don’t teach you many financial concepts in vet school or with your bachelor's degree, so I get it.

A lot of frugal people are savers, but they could be investors. If you put $100,000 in a savings account, you might earn 1% interest. After taxes, that’ll be more like 0.75%. In 10 years, that $100,000 might be worth about $107,700.

What if you could earn 7% instead? That’s below the long-term return of stock index mutual funds. Also, remember that stock earnings are taxed at a lower rate than your savings account.

| Year | Wealth in the Bank at 0.75% | Wealth in Stock Mutual Fund at 7% |

|---|---|---|

| 2024 | $100,000 | $100,000 |

| 2025 | $100,750 | $107,000 |

| 2026 | $101,506 | $114,490 |

| 2027 | $102,267 | $122,504 |

| 2028 | $103,034 | $131,080 |

| 2029 | $103,807 | $150,073 |

| 2030 | $104,585 | $160,578 |

| 2031 | $105,370 | $171,819 |

| 2032 | $106,160 | $183,846 |

| 2033 | $106,956 | $196,715 |

| 2034 | $107,758 | $196,715 |

After 10 years, the person who earned a higher return and invested instead of saved has twice as much money.

Of course, investments are subject to loss, but that’s mostly over the short term. Over 10 years or more, you’re almost certainly going to have more money from investing than saving it in the bank.

If you’re interested in learning more about these concepts, check out our investing course.

Step 7: Become a Homeowner with a DVM Mortgage

A DVM Mortgage is a special kind of mortgage with exclusive benefits for veterinarians. More broadly known as a “doctor mortgage,” a DVM Mortgage allows you to put a low down payment on a home with no private mortgage insurance (PMI).

Why would you want to put down a small down payment when you can afford more? Because cash is king. If you've saved for a down payment, you can use that money instead to increase your home's value with needed renovations. You could also furnish the space you purchase, beautify the outside, or build a barn if you're in a rural area and want to keep animals (I've had a lot of clients like this).

A home can be a helpful way to build wealth, but try to keep the purchase price below 2.5x your household income if you want to be able to name your retirement date instead of needing to work into your 60s.

Also note that the house at step 7. If you take the steps in this order, you'll be buying from a position of financial strength and will be able to enjoy your new home without worrying if the furnace or AC breaks down.

You can check out our DVM Mortgage quote form here.

What does the rich veterinarian look like?

If you follow the steps to becoming a rich veterinarian in this article, you’ll have the option to live whatever life you desire by your late 40s (including retiring early if you so desire).

If you decided to work until your mid-50s, here’s what your life could look like. You’d have around $1.5 million in your retirement plan. On top of that, you’d have about $500,000 of equity from owning your business. Your modest house wouldn’t really be a huge asset, but let’s say you paid it off with a 15-year mortgage and thus you have $200,000 in worth from that.

On top of these sources of wealth, you also put away about $500 a month in a brokerage account and invested it since you didn’t need the money with your plentiful emergency savings. You hold about $500,000 in this account.

In total, your net worth would be about $2.7 million. If you met with a financial planner, she would tell you that you could live on $108,000 a year for the rest of your life. If your expenses are less than that, you could afford retirement.

Not everyone will want to incorporate all these tips into their lives, and that’s okay. Take what you like and leave the rest. If you use some of it, I bet you’ll be in the top 10% most financially secure veterinarians in the country.

If you have a bunch of student debt and just want help figuring out how to take action on these steps, contact us and we can get you set up with an appointment with one of our student loan planners.

Comments are closed.