You’ve never lived if you haven’t been sued, according to a popular saying. I was recently threatened with a libel lawsuit after I expressed my opinion on a federal student loan forgiveness strategy. The idea is that you can set up your own nonprofit to get access to the Public Service Loan Forgiveness (PSLF) program. In my view, starting your own nonprofit for PSLF is a sign of desperation in the world of six-figure student loan borrowers.

There are numerous reasons why I believe this approach will fail long-term for most people. You might get certified by the current loan servicer in charge of managing the PSLF program. However, remember that the determination doesn’t mean that you qualify (see the ABA PSLF lawsuit).

When the government starts getting a bill for the hundreds of thousands of borrowers who qualify for PSLF, you better believe there'll be auditing for eligibility requirements. Many folks who have falsified documents or engaged in shady practices will be denied. Those who knowingly misled the government could even go to jail. After all, you promise not to commit perjury in your income-driven repayment (IDR) and PSLF certification forms that you submit annually.

This PSLF scheme is being pushed heavily in the chiropractic, naturopathic and alternative medicine communities. I think these groups are fertile ground for schemes like this because of the extremely high student debt loads these folks face with limited incomes to tackle them. In desperation, borrowers turn to anyone who claims they have an answer.

Why starting your own nonprofit for PSLF could be tax fraud

I’m not a tax attorney or CPA, and you should consult with your own professional. That said, we've advised on over $2.6 billion in student loan debt. I consider myself, at the minimum, better informed on the student loan rules than your average borrower.

One of the most common approaches to this PSLF “set up your own 501c3” scheme is to set up a nonprofit inside your own private practice as a medical professional.

The argument in favor of this strategy is that you can offer discount services for low-income or special groups such as military veterans and thus be a nonprofit. The patients who can pay full freight go in the private practice. To me, this is ridiculous.

Just because you offer lower prices to certain customers does NOT make you a 501c3 nonprofit.

It’s called price discrimination, and it’s a basic tenet of economics that private businesses do every day. Have you ever received a student discount? Maybe you’ve gone to the movies and seen the senior special on the booth?

Businesses know that certain groups of folks cannot afford to pay as much as others. If you can give special discounts to groups that are broadly diverse, then it could be legal and smart business. Instead of only getting the higher paying customers, you get business from everyone. Just because your business provides services to people in need does not mean you’re not operating in a for-profit capacity.

If you locate your nonprofit at the same address as your private business, I believe you’re asking for it. Isn't it a private benefit if you gain positive word-of-mouth referrals from these poorer patients that pay full freight? If your nonprofit assists with the costs of rent, utilities, malpractice insurance or anything else, then you’re subsidizing a private business.

Private inurement rules could make Public Service Loan Forgiveness a private benefit

IRS rules prohibit setting up and maintaining a 501c3 if the earnings go to benefit a private party. There are numerous restrictions preventing a 501c3 from doling out money and compensation to insiders.

Of course, you can set up and run your own nonprofit and take a fair salary. That’s not the issue. Rather, it’s the interaction with this not-for-profit and PSLF that could be considered a private benefit. This concept that your nonprofit is supposed to have purely charitable motives and not benefit a private party to be legal is called private inurement.

To explain this, let’s pretend that Sarah runs a naturopathic medicine private practice and has $200,000 of student debt. Sarah makes $60,000 per year. She decides to set up a 501c3 alongside her private practice to treat single expectant mothers.

Sarah sends about 60% of her patients through the 501c3 and gets paid about $20,000 per year. Her other patients go through the private practice and make up $40,000 of her earnings.

If Sarah certifies her employment for the PSLF program, she's stating that she's a full-time employee of that organization. How can she be working more than 30 hours a week and running a private practice located at the same location full-time?

Additionally, aren’t the services she provides going to her as the owner of the private practice regardless of which organization is paid? She can maintain separate bank accounts, file her forms with the IRS, and certify her credit for PSLF. She will probably be successful for a few years too.

However, what is the real purpose of the nonprofit? It’s to get hundreds of thousands in tax-free loan forgiveness. There’s little doubt that when PSLF happens and were Sarah successful in getting it, Sarah would shut down her 501c3.

If that’s not a private benefit, I don’t know what is.

Setting up your own nonprofit for student loan forgiveness doesn’t pass the smell test

I consulted with numerous CPAs on this strategy. All of them said they wouldn’t recommend it to their clients in any circumstance. The attorneys I consulted with said the same thing.

Remember when the Trump Tax cuts came out, and a bunch of blue states attempted to allow high-income taxpayers to make payments to charitable organizations to try and bypass the limits on state income tax deductions? It was a great idea, but it obviously was trying to circumvent the intent of the tax law, and the IRS ruled that strategy was not allowed.

Another idea was to “crack and pack” your income into service businesses and non-service businesses to take advantage of the 20% small business deduction. The IRS ruled against that too.

There are new ideas and schemes for how to avoid taxes that pop up all the time. Some stand the test of time and are entirely legitimate, like maximizing your 401(k) plan. Others eventually get stopped when enough people use them that the IRS rules on the issue. Of course, this takes time as the issue must pop up on the IRS radar, which takes numerous cases involving the same scheme to be investigated.

That’s what I believe we’re dealing with right now on the “set up your own nonprofit for PSLF” issue. The IRS has control over 501c3 status, and the Department of Education has control over the PSLF certification process.

That means someone could look innocent to the IRS in setting up a 501c3 and then turn around and use that legitimate paperwork for private benefit purposes with the current PSLF servicer, which is not testing for private inurement rules for a 501c3 status like the IRS does.

It’s brilliant until someone gets caught. At some point, my bet is that the Department of Education and the IRS will communicate and make a ruling on this.

How can you certify that you’re a full-time employee and the employer for PSLF?

Think about this for a second. You set up your own nonprofit and are executive director. You have board members who are your friends and family. Now, you must send in the PSLF certification form stating you’re a full-time employee at a 501c3 or government organization for PSLF. How can you be both the qualifying employer and the employee signing the form?

Perhaps you get your board to certify your employment as a workaround. But won’t it look suspicious that you’re the one who set up the organization that’s certifying your employment?

In a more obviously troubling scenario, what happens when your or your spouse’s signature is the one on the employment certification form (ECF)? What do you expect an auditor will think one day if the signatory is either you or your spouse on the PSLF form?

Something that blatant screams of fraud or, at the very least, sketchiness.

Also, the form specifically requires that you work full-time or 30 hours a week, whichever is greater. If you work less than 30 hours a week, you in no way shadow of a doubt do not qualify.

What if you certify yourself for credit where you’re not really working the required minimum hours in the office the 501c3? If you attest to this and it’s not true, that’s perjury, and you just committed a crime.

When setting up a nonprofit organization for PSLF could actually work

If you have a 501c3 organization that you set up and run full-time, my first suggestion is that you make it larger than just you. Get formal employee agreements, benefits, have additional nonprofit employees, and for goodness sakes don’t let a family member sign off on your PSLF form. In Boy Scouts, they wouldn’t even let a family member sign off a merit badge requirement.

Make sure that the primary purpose of the 501c3 is obviously charitable. As in, you don’t locate it at a private practice, it’s obviously not run for private benefit, and the leadership of the organization does not have a deep interest in the Public Service Loan Forgiveness program.

For example, if a rich 50-year-old dentist set up a nonprofit clinic with its own building and hires a bunch of young dentists to work there for 10 years serving Medicaid patients for PSLF, that might work. If you set up that organization and it’s run by a 27-year-old who’s certifying all the employment forms for his friends with PSLF, that’s more questionable.

In other words, be conservative with your PSLF strategy. If it seems sketchy, it probably is.

What to do if you’ve signed on to run your own nonprofit

If you’ve paid an organization to set up your own 501c3 so you can get PSLF, you have a decision to make.

In my opinion, these groups range from the misguided to outright scam level.

Some of these businesses even charge upwards of $5,000 for showing you how to set up your own nonprofit to qualify for PSLF. They flaunt money back guarantees. However, consider what the guarantee is worth.

If they help you get successfully certified for PSLF, it could be years until the Department of Education does an audit that reverses that decision. It might even take 10 years when you send in the final PSLF application that gets examined. At that point, how likely do you think it is that you’ll get your $5,000 back?

Let’s be real. An organization set up as an LLC that has paid out hundreds of thousands or millions to its owner is set up in such a way that if everyone demanded refunds, it would simply declare bankruptcy and the owner walks away scot-free.

It’s why there are so many fly by night “student debt relief” places set up in South Florida and Southern California. They’re run by guys (yes, it’s mostly men) who’d be selling some other shady product as long as the commissions were good.

If you used the services of an organization like this, I personally would request a refund while I still can. Since they offer a money back guarantee, a refusal to honor this request could alert authorities to their activity. Of course, you should give them the opportunity to give you your money back. If they refuse, I’d report them.

How to report an organization that you suspect is committing nonprofit or student loan fraud

Providing advice on student loan repayment programs and modeling different strategies you could use is a legit activity. There are services out there that I disagree with that overcharge for their work. They don’t answer any deep questions about student loans and just go over details about what the Saving on a Valuable Education (SAVE), Pay As You Earn (PAYE) and Income-Based Repayment (IBR) plans are.

Overcharging though is not a scam. It means they’re just lousy. There are also good businesses out there that compete with Student Loan Planner®. I say good for them. We need more legit people in this world full of folks who want to make a quick buck.

Giving legal and tax advice as a non-attorney or CPA and charging as much as 10% of someone’s annual income is something I personally have a problem with.

In requesting a refund, I would first just ask. If they don’t comply after a couple of attempts on your part, then you have a couple options.

If you believe that an organization is acting fraudulently to obtain tax-exempt status, then you can report them with Form 13909 from the IRS.

This form allows you to state why you believe an organization violates the private benefit rules required to run a 501c3. After all, if organizations are run for private benefit but set up as a nonprofit to compete with your business, then this is an illegal setup.

If you believe someone is running an illegitimate PSLF scam, then you can report them to the U.S. Department of Education Fraud Hotline. This number is 1-800-MIS-USED. You can also send in an online form.

Explain what’s going on and why you think a specific business is defrauding the Department of Education. If enough people do it, then the government will be sure to investigate.

Use legitimate PSLF or loan forgiveness strategies

You know what’s an easier path to getting PSLF than paying thousands to set up your own not-for-profit? Joining one that is already doing something you’re passionate about.

Why pursue an aggressive strategy that may or may not work when you could choose one that will almost certainly work out? I mean working for an established 501c3 as an employee for 10 years to get PSLF.

Of course, there’s another path besides PSLF. It’s 20 to 25-year student loan forgiveness programs under the PAYE or SAVE plans. The PSLF schemes promoting starting your own not-for-profit usually misrepresent this strategy. They say you’ll have to pay one to three times what you borrowed.

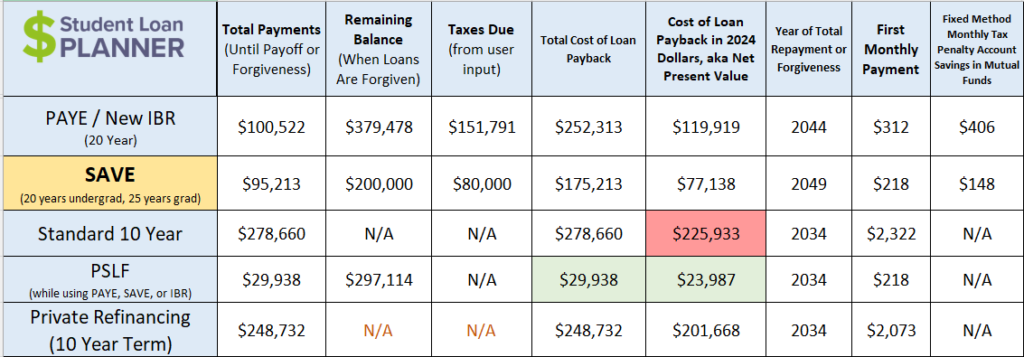

Let's look at a chiropractor earning $60,000 per year with a $200,000 loan balance with a 7% interest rate. Here’s what the real cost would be under PAYE and SAVE in the private sector compared to refinancing over 10 years and PSLF.

Is PAYE and SAVE student loan payments over 20 to 25 years more expensive than PSLF? Of course. However, the difference in present value is only about $50,000 (SAVE) to $90,000 (PAYE). That’s a lot. But is it enough to warrant potential legal trouble with the IRS, working in a not-for-profit when you’d prefer not to, or dealing with all the hassle?

Any of these places promising loan forgiveness better be able to model the mathematical implications of their advice. Otherwise, they need to shut up and stop spreading misinformation designed to enrich their own pockets.

Use free resources, get help if you need it and ask for refunds if you’ve been scammed

While I would love to make a plan for every reader of Student Loan Planner®, we’re not a good fit for everyone. If you want to use our free resources including our student loan calculator to self-provision, go right ahead.

There’s no minimum time to act or high-pressure sales tactics here. We also don’t offer a money back guarantee. It’s because we are professionals with certifications like the CFP, CFA, and others and we charge for our time.

If you read our stuff and realize we know what we’re talking about, then you don’t need a guarantee.

Also, we can’t guarantee there will be no changes to loan programs. We will try to provide you with a backup plan in case Plan A doesn’t work out. I believe that’s a lot more useful than deceptively telling you to come to get a refund from me in 20 years.

If you have dealt with a company you believed has scammed you, take charge of your own student loan future. Request a refund and try to figure it out on your own. If you’d rather not, we’d love to help you out as would a number of other legitimate companies. I can help you answer questions like if starting your own nonprofit for PSLF is a good idea, give us a try.

Whenever I decide to use someone’s services or not, I ask a couple of questions:

- Is this fee way above average or out of place?

- Does the person working with me seem primarily like a salesperson?

- Does this sound too good to be true?

- Are there any high-pressure tactics to pressure me into buying?

If the answer is yes to any of these questions, I avoid working with the person. I might miss out on some good people, but it’s steered me right so far.

Have you been scammed by a student loan company? Disagree with my view on using your own nonprofit to qualify for PSLF? Share your stories and opinions in the comments.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.