Editor's note: The Biden Administration's American Rescue Plan is the latest COVID-19 stimulus package and included a major provision that eliminates taxes on student loan forgiveness for the first time. Currently, the measure expires at the end of 2025. Read what the American Rescue Plan stimulus means for borrowers pursuing forgiveness under an income-driven repayment plan.

The United States government has passed three COVID-19 economic stimulus packages thus far. These are the CARES Act (passed in March 2020), the Consolidated Appropriations Act of 2021 (passed in December 2020) and the American Rescue Plan (passed in March 2021).

The majority of the relief for student loan borrowers was included in the CARES Act. But new benefits have been added with each subsequent bill. And President Joe Biden signed a White House memorandum in January 2021 that extended the CARES Act's payment and interest pause by eight months to September 30, 2021. The pause was set to expire on January 31, 2021.

A final extension has been issued to expire August 30, 2023, unless the courts rule on lawsuits sooner than that.

Get Started With Our New IDR Calculator

In this article, we'll take a deep dive at the current stimulus package for student loans and break down all of your options for receiving coronavirus aid. Here's what you need to know.

What is the current stimulus package for student loans?

Here's what's included in the stimulus packages that might benefit current or future student loan borrowers:

- Suspension of all payments through September 30, 2021 (extended to January 2022)

- No interest will accrue until September 31, 2021 (extended to January 2022)

- The suspended payments count towards loan forgiveness programs, including PSLF and IDR forgiveness (PAYE, REPAYE, IBR)

- Taxes are eliminated on forgiven student loans through December 31, 2025

- Employers who contribute to their employees’ student loans receive a tax break up to $5,250 (through 2025)

- Borrowers in default will have their months of suspended payments count towards the nine months needed for loan rehabilitation

- No collection, wage garnishment, or seizure of tax refunds will happen (backdated to March 13, 2020)

- Slight increase in maximum Pell Grant

- Incarcerated persons can now receive Pell Grants

- Over $1.6 billion in institutional debt of HBCUs has been discharged

- Students may now continue to receive a subsidy on certain subsidized Stafford loans for undergrad for a longer period of time

- Employers may contribute up to $5,250 each towards their employees' student loans, with this program set to expire in five years now instead of at the end of this year.

Here's what's not been included in any of the stimulus packages.

- Canceling student loan debt

- Changing income-driven repayment programs

- Capping the amount students can borrow for undergraduate or graduate degrees

The stimulus package is amazing if you have federal student loans

Many politicians and workers groups were clamoring for student loan cancellation to be included in one of the stimulus packages.

While that did not come to pass, the CARES Act and subsequent executive orders and bills have been extraordinarily generous for borrowers with federal student loans.

There were already protections in place to reduce your income-based payment if you lost your job.

However, millions of people were about to lose their jobs at the same time, and this is clearly not what loan servicers are built for.

Borrowers needed federal help because many don't know how to recalculate their payment

Servicers like FedLoan Servicing shut down many of their operations at the beginning of the coronavirus pandemic.

So even if borrowers knew they could recalculate their income-based payment to a number as low as $0 a month if they lost their job, they couldn't get someone on the phone to do that in many cases.

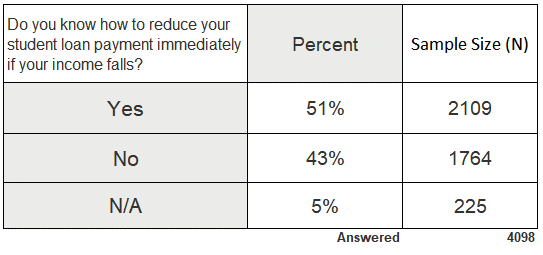

Also, our survey of 4,100 readers suggested that at least 43% of borrowers didn't even understand how to pause their federal student loan payments if their income fell. See the table below.

Our readers tend to be graduate degree-holding professionals who are more informed than average on student loan rules. Hence, the true number of borrowers who know how to recalculate their payment is likely much lower.

When I saw this data, I knew an across-the board payment freeze was going to be needed. That's exactly what has happened. And federal student loan borrowers have benefited immensely as a result.

During this forbearance period, borrowers have continued to accrue credit towards PSLF, IDR, and other forgiveness programs. In the case of PSLF, you would need to maintain a full-time job at a not-for-profit or government employer. But these $0 a month payments would count.

And, remember, there are no employment conditions for 20-year PAYE and 25-year REPAYE forgiveness. So suspended payments count for that type of forgiveness too.

Some federal student loan borrowers were originally left behind

Originally, only loans held by the Department of Education qualify for this interest and payment freeze, thanks to the stimulus plan language. So that means loans made under the Federal Family Education Loan Program (FFELP) didn't qualify if they were held by a commercial lender.

The federal government stopped issuing FFELP loans in 2010. So anyone who graduated or went to school before that time likely has this kind of student loan. The good news is that the Department of Education announced on March 30, 2021 that it was expanding the COVID-19 emergency relief to borrowers who had defaulted on a privately-held FFEL loan. It said that the expansion would provide help to 1.14 million borrowers.

Related: Privately Held Federal Student Loans: When and How to Get Forgiveness

The Department of Health has a large student loan program too. Dentists, physicians and nurses often take out Health Professions Student Loans (HPSL) or Loans for Disadvantaged Students (LDS). These loans carry a 5% interest rate and usually show up under the loan servicer Heartland ECSI if you have them.

You can actually consolidate these loans into a Direct Consolidation Loan to receive forgiveness. However, most borrowers assume Health Professions student loans are private and thus were ineligible for forgiveness programs. This is an extremely common five-figure mistake our clients make when managing their own student loans.

When lawmakers left out the Department of Health student loans from any relief, it affected many thousands of healthcare practitioners. Thankfully, the HRSA announced in February 2021 that it had also decided to retroactively waive is waiving interest and extend administrative forbearance to Health Professions Student Loan and Nurse Faculty Loan borrowers through September 30, 2021.

The stimulus bill provides help for borrowers in default

Millions of student loan borrowers are in default on their student loans. One way to exit default is to make nine months of consecutive payments.

Unfortunately, borrowers often miss a payment and cannot get their loans rehabilitated. And that can lead to wage garnishment and seizure of tax refunds.

Importantly, if you're trying to rehabilitate your federal student loans, with the stimulus plan you can now count the months of suspended payments towards the nine months needed to exit default.

That's big news as most student borrowers will be able to rehabilitate their loans right away when the forbearance ends on September 30, 2021.

When you rehabilitate your student loan, you remove this negative event from your credit score and get enrolled in an income-driven plan so that the loans are affordable for the future.

The other way to manage default is to consolidate your student loans. However, that does not remove the default from your credit score.

Tax refund seizure, collections, and wage garnishment is on hold

The COVID-19 relief bill pauses collections efforts on federal student loans. It also stops collections, wage garnishment, and seizure of tax refunds retroactive to March 13, 2020.

Importantly, this includes defaulted FFEL borrowers who didn't have access to stimulus package student loan benefits until March 2021.

This is big news for borrowers struggling the most. If you had your wages or tax refund seized on or after March 13, 2020, you need to make sure your address is current in the Department of Education system. Call 800-621-3115 to make sure they mail your check to the right address.

Employers can now deduct student loan payments made for employees' student debt

Employer student loan repayment assistance is now tax-free (for both employees and employers) until December 31, 2025. Lobbyists for large employers have wanted to make this a tax-deductible benefit for years. The hope was that it would incentivize younger workers to stay with their companies.

By extending this benefit for five years instead of one, Congress is essentially communicating to large employers that this benefit will be permanent. I expect an explosion of employer student loan assistance programs as a result.

I've gone on the record that employer student loan assistance doesn't help as much as you think. And it can actually hurt you in some cases.

It's the same thing as giving a tax break for employer-provided health insurance. It makes the workforce less mobile and more tied to their job. And that's in the interest of the employer more than the employee.

Importantly, student loan contributions replace money that might have gone towards higher wages, which continue after you have $0 student loans.

Even some non-profit hospitals require that payments they make for student loans be applied directly to loans held by the loan servicer. And that just doesn't make sense in the case of a borrower working towards PSLF.

At least now you can apply lump sum payments to PSLF IDR monthly payments, which was not always the case.

Student loan forgiveness is tax-free for five years

Perhaps the biggest impact of President Biden's American Rescue Plan is that it dictated that no federal borrowers will pay income taxes on a discharged student loan through the end of 2025.

Some programs like the Public Service Loan Forgiveness (PSLF) program already provided tax-free forgiveness. But it was unclear if the IRS would tax borrowers for the student debt forgiveness they received after completing one of the income-driven repayment plans. That's why we've traditionally advised our clients who are hoping to earn IDR forgiveness to save up for a potential tax liability 20-25 years down the road.

But anyone who earns IDR forgiveness over the next five years won't receive a tax bill on the forgiven student loan debt. Unfortunately, there won't be a significant number of student loan borrowers who will be eligible for forgiveness until the 2030s. We'll have to wait to see if Congress considers making this a permanent change at some point down the road.

Learn more about the student loan tax relief act.

The coronavirus stimulus is extremely unfair for borrowers with private student loans

Full disclosure: this website receives a large portion of its revenue from readers who decide to refinance their student loans to a lower interest rate.

Federal student loan borrowers receive an interest freeze. But private student loan borrowers receive a slap in the face.

By setting federal student loan interest rates at 0%, you effectively kill any student loan refinancing (except for refinancing loans that are already private).

Our company has cash reserves. And people will refinance again in the future when federal student loan interest is no longer at 0%. Plus, borrowers needed student loan relief during this crisis, and I'm glad some of our readers are getting that help.

I'm incensed though that huge numbers of borrowers who refinanced their student loans with private lenders will get absolutely no help from Congress.

They seem to be bailing out everyone else.

What message do you send to borrowers who wanted to responsibly pay down their student debt when you rescue all federal student loan borrowers but leave private student loan borrowers out of any relief package?

A critic might ask what Congress could have done? It's simple: reimburse private companies for the interest just as they did for a host of other industries.

Make this short-term student loan relief lead to a long-term plan

Suspending payments and interest for many months is a great step for federal student loan borrowers.

Obviously, we wish more borrowers had been included in the relief package.

Unfortunately, student loans will still be there after the payment and interest freeze is over.

If you need a long term plan on how to get to $0 of student loans forever, that's what we specialize in.

What do you think of the student loan coronavirus stimulus bill? Sound off in the comments.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments

Comments are closed.

I am scheduled to make my very first PSLF payment on April 12th set up with automatic debit. I got receipt that my employment certification was approved. I know you said in the email that I don’t need to do anything to enroll in this to allow my 6 months of no payments count towards my PSLF; however, since I haven’t technically paid my first payment, do you think it will still count for me since all of the paperwork is in? Thanks Travis!

I have about 3,000 dollars left to go, with a required payment of 50 bucks a month with navient. I pay more each month, and thankfully still employed during all this, but my question is thoughts on the Dems pushing to get the 10,000 dollar forgiveness per borrower. As I said for me not much has effected me as things go and I will pay the rest of what I owe sooner than later but feel for those with more hanging over their heads so to speak.

Mohela is telling me I do not have to fill out my annual recertification paperwork for an income driven plan I am on. They said they will notify me closer to September to do paperwork then. However, when I logged into to department Olof education site, it says recertification is due now. Which is it?

Hi Lana, if you can get MOHELA to confirm this via documentation that may help if you run into future issues. Here is a good listen to top common servicer mistakes you should be aware of. As for recertification content, I encourage you to use our search bar online to see if there is a blog out there that is similar to your inquiry.

My wife has 2 FFEL loans left totaling $75k at 2.625% fixed. While I’m bummed we won’t get 6 months of no interest, they aren’t really accruing much interest at that rate. While we have something like 25 more years to pay them off, we’ll likely knock them off in less than 5, once we kick the $50k we have at 1.76% (variable) to the curb.

JB actually you can consolidate your FFEL to a Direct loan and put them on a 30 year repayment term and probably lower the required payment and get it all put to principal instead of interest. studentaid.gov just consolidate it and select the Standard Plan. It’s the biggest money saving opportunity we’ve found.

Can I beat the current 2.625% rate by doing that?

I think we’ll stay with the FFEL loans for now, I ran the consolidation simulator. Our monthly payment would jump from $360/month to a minimum of $1200. I’ll keep the low payment amount and just pay in addition to it to knock it out early. That way, i keep the option of letting it be a $360/month payment if needed. I guess the low payments are because it’s a FFEL loan with something like a 35 year repayment term?

I have mail coming today from the treasury department, God willing its the refund from the student loan offset

I applied last week to have my IB repayment recalculated to due to a loss in income..they have until the second week in April to give me an answer. Should I contact them and try and cancel that application ? Or just go with what they say?

Leave it alone it probably takes care of itself

Just to be clear, I’m on PSLF, I don’t have to make ANY payments for the next six months (through sept 30th) and those month WILL COUNT towards my 120 months? (As long as I’m employed)

Thank you!!!

Yes according to the bill

Great Lakes is saying that the payments do NOT count towards loan forgiveness plan.

They’re wrong it just passed so there’s confusion

Hi Travis,

Thanks for all of the great content.

According to the guidance from my Servicer (MyFedLoan) in order to skip payments during this period the borrower needs an administrative forbearance, which will NOT qualify for PSLF. Please update your post to avoid any confusion.

From studentaid.gov/announcements-events/coronavirus:

Is there any reason why I would not want to suspend my payments?

If you are pursuing Public Service Loan Forgiveness or Income-Driven Repayment (IDR) forgiveness, you may not want to go into an administrative forbearance because the time spent in an administrative forbearance does not count toward the required payments.

Like most times, FedLoan is behind us on publishing the contents of the bill. You need to be on an IDR plan and it’ll be suspended and will count

Hi Travis,

You ROCK! Thanks for all your knowledge and assistance.

I am on PSLF and just checked my loan details on FedLoan. While the website does state that the $0 payments will count toward PSLF, my estimated date to apply for loan forgiveness was just pushed back 6 months…the conflicting information is worrisome! I was on track to apply in April 2022 and now, it says I am on track to apply in October 2022. This makes me feel like I should keep paying just to be super safe.

Don’t be worried they’ll figure it out later.

So, I should have waited to file my taxes until the last minute.

Unfortunately yes

I unfortunately have an overwhelming $92,000 debt from myself and two kids. Been paying some for 10 years still with an estimated 20+ years until payoff. Any help would be greatly appreciated. Would love to be saving for my future instead of paying off my past.

My thoughts are it’s junk for a small business owner with 85% loans in private….

I just found your website and thank you from the bottom of my heart for it. So very helpful. I have gone through the refi process for every company you have listed. Question is this, last year I was approved. I am a small business owner so I had to put myself on payroll to prove income. I did. And now I am being denied by everyone when nothing changed. 85% Private loans in repayment, 15% federal at $0 in IBR. 220,000 total. Trying to get ahead in life through refi and seem to be hitting roadblocks at every turn. Thoughts? (Happy to invest in a session with your team if you believe its helpful).

If you have all private then we can’t help you if you’re not finding deals with anyone on the refinancing page: https://www.studentloanplanner.com/refinance-student-loans/

I can only encourage you and also you’ll need 2 years of tax returns to refinance normally if you arent a physician or dentist (they need 1 year). Even so, lenders are skittish right now

Hello and thank you for your diligence always and invaluable information. How can I reach your team to get a consultation on a complex student loan scenario for which we are probably handling all wrong and need a strategy badly!

Every portion of the website. Schedule a consultation based on loan balance or if you are like me I specifically paid a premium for Travis

Ha thanks Chris!

Thanks for asking Lauren. https://www.studentloanplanner.com/hire-student-loan-help/

The irony in this is that, for those on track with PSLF (me, fingers crossed), this Republican proposal is actually MORE generous than the Democrats’ hope to forgive up to $30,000 of federal loans. Forgiving $30,000 does absolutely NOTHING to reduce my 10 years of payment, nor the amount that I pay each month—which is based on my income, not my loan total.

But offering 6 months of free PSLF credit? That does nothing to reduce my timeline or my payments—but it puts about $1500 into my pocket over the next 6 months.

I mean, Travis, correct me if I’m wrong here, but this sounds like a weirdly sweet deal for PSLF folks, especially coming from Republicans.

Yes exactly. This does a lot more for higher income borrowers than it does lower income borrowers.

Yes, it is actually a sucky deal. My loan is only 13K and my monthly payments are only $61. So this deal sucks and does NOTHING for me. That $10K – $30K of forgiveness would have been way better than this crap! Congress didnt want to make payments and that is why they went the way of the dodo!

I am on PSLF and my regular payments are $775 a month. I’m very happy to have the opportunity to finally build up a legit emergency fund, as this bill resulted in nearly $5,000 added into my savings over these 6 months. I always felt so weirded out by the fact that I make a lot of money on paper but never feel like I have money. Well. $775 extra a month HELPS!

It’s a huge help to many borrowers! I’m glad you’re able to use the money to build a financial cushion and get some breathing room.

It all depends on your total loan balance, monthly payment, years left on PSLF and other factors. For some, 30K would save them more than the 6 months we got. For lower wage and newer PSLF folks with high balances, this 6 month credit/0% interest/0 payments may be slightly more valuable over the long run. That said, given the severity of the economic shock from coronavirus, this 6 month reprieve for everyone with DL is a relief.

If I have automatic payments should I stop them once this is official, or will they just not collect for the next 6 months and I can leave everything as is?

They just wont collect

Can I still make payments toward my loans during this six month period? Would I be able to pay more heavily toward student loans with higher interest rates during this 6 month period? Thanks!

Yes and yes

Would any payments made during the next 6 months on these federal loans all go directly to principal? Would you recommend doing this if able?

Only if you’re not pursuing forgiveness

If my tax refund check was offset in February for student loans would I be able to get my tax refund back?

Ppl are saying March 5 is the cutoff

Yeah my tax refund was offset in Febraury too, why do we get punished for filing early, they took my whole refund- $1000

I filed early for my taxes this year, what crap it is that since my taxes were garnished earlier I won’t be able to get that money back. Although I need it badly due to this ridiculous pandemic. Is there a way to request this money back for hardships? It makes no sense to me for them to have the cut off date to be March 15, total crap.

Yes you can come for hardship. It will take time to get it back but you will. Match 5 was the deadline to get it automatically sent back but you can still file for hardship it will work..

Good luck. I just filed mine 3 weeks ago since I seen they wont take my whole tax this year

Does this mean that any payments made during this period go completely toward your principal?

Yes unless you already had accrued interest

Can you explain your statement that “Even if you didn’t lose your job, you would get 0 a month payments until September that would count towards whatever forgiveness program you’re working towards.”

Does everyone’s loans go to 0 per month automatically regardless of the income of the borrower? So even if I did not experience a change in my income my payment goes to 0?

Thanks for the clarification and all your helpful work.

Correct

Great but do those ‘payments’ of 0 per month count for PSLF payment months?

Is it that just the few FFEL loans that I have won’t receive the relief. Or is it that I will not get any relief on all of my federal loans because I have a few loans that are FFEL?

Just the loans that are not FFEL will have the 0 payment; however depending on your interest rate, current situation and where you are in repayment or forgiveness, you could consolidate the FFEL loans with a direct consolidation in order to qualify for the stimulus 6 month benefit, but if you consolidate it would cancel out any credit that you have already put toward the repayment forgiveness time period… that time period starts over. So you have to weigh the pros and cons.

I don’t believe FFEL loans are eligible for repayment forgiveness for PSLF, so it doesn’t really matter that the time period starts over.

Only the ones held by commercial lenders.

Although I have a 1/4 of a million dollars in student debt and am going for PSLF, there is a part of me that knows deep down inside that any forgiveness and interest wrote-offs is not good for the long haul for our country and economy. Eventually the tide will go out and we will see how badly our country had her pants down, financially speaking. I’m very nervous for our economy. It’s hanging on a shoestring.

Kind of sucks the tax refund garnishment for defaulted loans doesn’t backtrack further. I have always tried to do my taxes as early as possible and now I regret that…

I am in the same position. Mine was garnished February 26th. I called the DOE on Thursday and they said that I was not eligible for the repayment. I always file my taxes early, I assumed that was the responsible thing to do.

I’m assuming that’s how they are making sure not to give everyone a refund. I also filed pretty early but it was not accepted until later the week of March. Sadly, had I not just lost a job and been quarantined along with 2 other family lost of jobs I would of been fine with it. But now I’d like to appeal it.

Same thing happened to me mine was garnished in Feb they took $1600, then i had to file an amendment which gave me less of a refund and now I owe irs $650, i wrote them a letter asking if they could just get the $650 back from the offset but they didn’t because I just got notice that I owe the $650 irs

They will likely not refund it since it happened in Feb

My Federal Refund Was Withheld on March 11th. Amount of 3541 is there any chance I will recieve a refund? I recieved a letter saying I am owed a refund and will recieve one but when I call the number listed it states my account shows no refund initiated. What does that mean? I am a single mother of two children currently laid off and need it more than ever now!

It’s not clear but because it was before March 13 it’s unlikely youll get it

Sooo angry that my wife and I recently refinanced our gov’t loans to Sofi and shaved 2% off interest.

I know. I’m sorry about that Andrew. No one dreamed of this happening until it did

My husband and I both have federal student loans that will qualify for this 6 month suspension. We also have a much smaller private student loan. Would it make sense to put the $1500/month we pay toward our federal student loans toward the private student loan for 6 months? We are both employed full time and have 6 months of savings in the bank (if that information makes any difference).

Yes! That would be a great idea

Thanks – one other question. The Fed Loan Servicing website is very vague. It states that loans can go into an Emergency Forbearance for 60 days, but that the time will not count toward forgiveness. I assume this will be updated once the stimulus is signed into law?

How does this affect those who have just entered their grace period? I finished medical school two weeks ago and have entered the 6 mo. grace for my federal loans, which ends in September. Does this extend the length of my grace period?

No if you’ve graduated officially then you should likely consolidate to a Direct Consolidation loan.

Will the borrowers still be able to make payments during the suspension period until September 30, 2020, if they can afford the payments?

Thank you for your updates!

Yes itll all go to principal and any already existing accrued interest.

I’m interpreting some of your replies as contradicting. Previously, you said it was not necessary to alter your automatic payments as the servicer will not be collecting/processing your payment. But here you are saying if you keep paying it will go towards your principal. What next steps are required to ensure you’re payments are suspended. Do we need to change our automatic payment setup to prevent accidental payment?

I dont think you need to, and if you do get charged you could always ask for a refund when things have calmed down

Will this start for Student loan payments in March or April?

Probably April but might be retroactively applied to March. We’ll see in the next 15 days as that’s the required implementation period in the law.

I was faced with an offset due to student loans. With this bill would the stimulus payment be subjected to offset as well? Thanks for the updates.

No it shouldnt be

So if my taxes were taken and I fall within the grace period who do I contact to get my taxes back?

It’s sounding like March 5 is the cutoff date. IF it was seized after that, you’re getting a check. Before you’re out of luck.

Will I get a check ?My refund was taken due to an tax offset

If it happened after March 5 then yes

Hi Travis,

Thank you for the very helpful breakdown. Do Parent + loans qualify for the stimulus bill relief as well or is it just student loans?

Thank you.

Yes those qualify too

All of my paperwork is in and I was set to make my first pslf payment in a couple of weeks. Even though I haven’t officially paid a payment under pslf yet since I’m enrolled I’ll still get the 6mo $0 to count?

from fedloan this morning(3/26), for PSLF…

“The time spent on the emergency administrative forbearance will not count toward your required payment count.”

That’s bc Trump signed the new bill into law this afternoon

Yes and also if you look at the date that was posted it still says March 13th. It’s out of date.

If I’m in default on student loans would I still be able to receive the individual stimulus check? Aren’t we the people who are likely to need it? :O

Likely yes you would still get it

I have two FFELP loans that are owned by Navient Federal Loan Trust and guaranteed by American Student Assistance. It says my interest rate, which is low, is set by Congress. I guess I’m still unclear what this means for me. It’s showing that my next due date, in April, has $0 due, but I would think, based on your article, that I might not be covered under this stimulus bill. Any ideas?

That doesn’t sound like it’s covered. Loan Trust would probably be a commercially held FFEL loan, which wouldn’t have a 0% interest rate. You could consolidate it at studentaid.gov as long as you have no IBR credit towards forgiveness. That would set the interest rate to 0%. If you wanted our help determining this, it’s what we do professionally https://www.studentloanplanner.com/hire-student-loan-help/

Thanks- just to be clear, my interest rate isn’t showing as 0%. It’s the amount due, like Samantha below. I guess i’m curious why it says $0 due in April!

I also have 3 loans through Navient and 1 of them is a FFELP loan. Mine also has a $0 due vs. the actual payment amount but still shows my interest rate as normal. Wondering if I will have to continue making payments on this one or not?

We can figure that out if you hire us https://www.studentloanplanner.com/hire-student-loan-help/

If I have refinanced my Fed Loan to a SoFi in the past 2 years, would this be a good time to try and refinance again since all Fed borrowers will have 0% interest for next 6 months and won’t be refinancing? My current rate is 4.25%.

Yes I’d suggest applying with Laurel Road most of the other lenders have raised their fixed rates by a lot more than they have so far studentloanplanner.com/refinance-student-loans/

Thanks for all of your work explaining this. As someone with very high student loan to income ratio currently (medical resident) pursuing PSLF now but not guaranteed depending on job taken after training, will interest capitalize after this forbearance period?

That’s a great question. Right now the answer is no in theory, but in practice I wouldn’t be surprised if mass chaos happens at the servicers and it takes them months to undo it.

Per the fedloan site, it will capitalize:

” Any remaining unpaid interest from prior to March 13, 2020, should it exist, may be capitalized (added to your principal balance) at the expiration of this forbearance period.”

https://myfedloan.org/borrowers/covid/

Yikes

They may have removed this. I can’t locate this message (as of 4/7/2020).

I just called FedLoan because I am worried about the interest I had on my account prior to March 13th as well, I’m on the 20-year forgiveness strategy under PAYE. I spoke to someone at the ombudsman line that seemed more knowledgeable than the regular loan counselors and she assured me that it would not be capitalized. She said if I was in repayment prior to the government putting me in administrative forbearance under the CARES act then there should not be any capitalization of previous interest. Crossing my fingers this was the correct information.

That’s our understanding, too.

Hi, thanks for this helpful info for my 2 college graduates who are paying their student loans themselves. My husband and I also took out Parent Plus Loans which we have been paying back for years. Do these loans also qualify for deferral under the stimulus package? Thank you.

Yes they’re title IV loans under the Higher Education Act owned by the government.

Has there been any talks about how this will impact those that may not have student loans now, but will need to take out a loan for the Fall 2020 semester?

This will not affect those borrowing in fall, unless COVID lasts a lot longer than we all hope it does.

Are Parent PLUS loans included in interest rate relief? Can’t find mention of this anywhere. Thanks!

Yes

Can you touch on whether or not after forbearance ends any previous unpaid interest will be capitalized. Seems to be a major point of confusion right now. Thank you.

It’s not supposed to be, but I wouldnt be shocked if the servicers did that.

Does that mean capitalization of interest (accrued prior to CARES act) when leaving this forbearance after September is at the discretion of the servicers? Just trying to figure out who we should be bugging about this very key detail for those of us with large sums of accrued interest. Thank you!

Supposedly no they arent supposed to capitalize it according to Dept of Ed

I have my loans through MOHELA as my servicer. Does this mean they are still help by the Dept of Ed?

I ask because I went to Mohela’s website and they describe the relief, but then say this:

“Caution: Payments made during the National Emergency forbearance do not count towards Public Service or Income Driven Repayment Loan Forgiveness. Please visit studentaid.gov for more information regarding forgiveness programs.”

Or is this something separate from the new bill?

That’s the executive order he signed which is pre this bill. You might have direct loans but its hard to know for sure unless you look at your raw data file which we do for clients https://www.studentloanplanner.com/hire-student-loan-help/

Travis, thank you so much for always keeping us up to date. I have a dumb question though. This stimulus package its supposed to stop collections, wage garnishment, and seizure of tax refunds retroactive to March 13, 2020. How will that work? What I mean is if my Tax Refund is currently has a tax offset scheduled for today. Does that mean that my refund is no longer being sent to the Dept of Education? And being direct deposited in my account instead? I checked the IRS Refund Status page and it says its still in process and the refund hasn’t been sent. I’m sorry for the lengthy comment, question but I’ve been looking for answers and haven’t found any. Please advise. Thank you.

It will probably get returned if they take it but it’s so fluid right now can’t promise it will be

Hi, I’m curious what your thought process would be on altering payment allocation. I’m on a PAYE program and paying extra each month toward my highest interest loans. While the interest is zero, would it make more sense to put that money toward the larger principal loans? Or just toward whichever has the highest accrued interest? As long as I’m still working, I’d like to take advantage the best way I can at tackling down this debt!

Thanks for all the great info on your site!

The highest interest ones, but this could be a big mistake since PAYE doesnt have interest subsidies normally you might be in better shape to do forgiveness. It’s a common mistake that costs thousands when it happens, so if you wanted that evaluated by our team https://www.studentloanplanner.com/hire-student-loan-help/

My Great Lakes account shows the loans as Direct Consolidation ( 5.2011). When looking at the details of the 2 loans, one is Consolidation and the other is Stafford… Do they qualify for suspension or do they fall under FFELP?

If they’re direct they’re covered.

Maybe they are not as the interest rate still shows as 5.250% (fixed) instead of 0% and with the next draft date of 4/19.

Does anyone know what will happen to garnishment on wages AFTER the 6 months?

It’s start again unless you have a rehabilitation or consolidation plan to get out of default

Thank you. I guess I have some time to figure that out

Can someone explain the default refund? Is there a “grace period” for the retroactive date of March 13th? My treasury offset was dated March 11th..

I am hearing March 5 as a cutoff date but it’s up in the air currently

My first student loan payment is due today. Should I go ahead and pay that seeing as how I lost my job and don’t have the full payment anyway? Or should I not pay it and hope that this bill is actually passed?

I would not pay it and apply to have your payment recalculated at https://studentaid.gov/app/ibrInstructions.action “Recalculate my monthly payment”

Travis, I have a number of direct undergrad and grad loans (135k). They are all sitting at interest rates between 5.5 and 7 percent. I’m on the PAYEE plan. Even though the interest is high I’ve never refinanced them to private . Are there any strategies to drop the rate other than going private?

Strategy is do nothing and theyll move the rate to 0 til Sept and after then you might want to visit the site to refinance it for a lower rate but not before

Dear Travis,

Thank you for the above information. I have one request. When speaking about our President of the United States, the correct way to address him is as President Trump or Mr. Trump but certainly not as just Trump. During this time of crisis, let’s take every opportunity to show kindness and respect. Thank you.

Hey Travis. Thanks for the info! I am in IBR and make two payments to Navient each month (one larger and one smaller). I believe the loans within the larger payment are covered with the stimulus (I see 0% now for interest). The smaller payment consists of two consolidated loans that are FFELP loans (still shows interest). My big payment is due on April 5 and the smaller loan (which is non ED owned) is due April 6. I want to continue moving forward toward forgiveness. I’m not on auto pay. Do I just pay the small payment (non ED) but do nothing with the other one? I hope I made sense.

You might want to get that evaluated by our team https://www.studentloanplanner.com/hire-student-loan-help/ I dont want to give out inaccurate information unless I can see your NSLDS file showing your loan data.

Are parent PLUS loans included on the 0% interest rate and suspension of all payments?

If not, can I consolidate the parent PLUS loans to a Direct Federal Loan and receive all of the regular federal direct loan benefits?

Yes they’re included. If you plan to refinance them after this leave them alone. Otherwise, you would consolidate if it’s a large amount that you plan to get forgiveness for.

I have only 5 months left on my PSLF DOE loan with FedLoan (July 28th is my 120th payment) and make automatic payments due on the 28th each month. The one scheduled for tomorrow, March 28, 2020, is already in process and cannot be canceled according to FedLoan.

If the bill is signed and enacted into law today (March 27th), will my payment be reversed? Should I request a reversal in that case? Will I be able to get an extra 5 months of payments forgiven or likely just 4?

It indicates on the FedLoan website that application of COVID-19 student loan relief will generally be retroactive. I’ve been lied to so many times by FedLoan during the process of qualifying, making payments under applicable income-driven loans, changing income-driver loan programs on their advice to only see my payments increase substantially that I’m barely getting anything forgiven. So it would be nice to have the remaining full balance of approximately $7k forgiven instead of the $2k I was expecting before I retire from my government job at the end of the year.

I would continue the payment and just try to get the loans forgiven on time by submitting your PSLF application. Then you could make the argument that you should be refunded the payment on the 28th.

Thanks for all the information Travis. My husband’s student loans are held with the Default Resolution Group and the interest is still accruing every day. We can’t seem to talk to anyone competent at the Default Resolution Group (if we aren’t hung up on) and the Ombudsman Group is now waiting on the Default Resolution Group to respond. Any contacts that I am able to reach out to for help? We are at a point where we feel so desperate and are also dealing with the Default Group also taking fees out of payments we have been making inappropriately. Any contact or information would help greatly.

You’re only eligible for rehabilitation once. You make 9 consecutive payments of generally 15% of your income, and the good news is that rehabilitation can take the default all your credit score and keep any IBR credit you already had. Consolidation is another option that’s much easier at studentaid.gov. You can use that to create a new loan with the government and sign up for something like REPAYE and pay 10% of your income. That also removes the default and gets you 6 months of credit towards forgiveness during the interest and payment freeze. So just depends if you’re ready for a fresh start and taking the hit to your credit to do that vs the harder path of rehabilitation.

I am aiming for PSLF. Naturally, I want to skip payments for the next 6 months and save that money, but LF hasn’t been all that reliable. How can I be sure that I am on track for LF?

Keep sending in your ECF form to PSLF maybe in July to see if they counted it

Are FFEL loans Guaranty Agency held included in the forbearance/no interest accrual loans?

It depends. Some FFEL loans are privately held, and those don’t qualify.

two questions.

1) My wages are currently being garnished out of each paycheck. Am I understanding that the garnishments will temporarily stop?

2) My tax refunds are usually completely taken by the gov to pay back my student loans. I just filed my 2019 taxes a week ago – Does this bill mean that I will get my tax refund this year?

Yes and yes, so good news there.

Would this apply to any type of loan ? If not which ones ?

Only Direct and federally held FFEL. The rest are not included but that is about 80% of the total

I pay my student loans to SoFi. Does anyone know if that qualifies me for the six month suspension?

It does not, private loans are not included. If you need relief they might put your loans on pause but interest will continue. You might try refinancing those loans with another lender like Laurel Road studentloanplanner.com/refinance-student-loans/

Hi Travis! Thank you for the information, but I still am slightly confused on one subject: treasury offsets! I have a treasury offset due to my loan default. Earlier this month, I had a positive result from a case and all of it was taken. My loans are through the federal ED. Would that offset money be refunded per this new bill? I could really use that $! Thanks in advance!

If it happened after March 5 it probably would be returned.

My IRS refund was seized due to a defaulted loan I received notice about March 15,2020 for tax year 2019. It’s a federal student loan. Despite my call to Department Of Education they still took it 3/28/20, should I get a refund to my direct deposit account?

Yes or you’ll get a check.

I am not sure your reply is correct. While I do not know not the exact dates, my understanding is that there is a six-month reprieve running through September 30. If so, his April-September payments amount to the six months and a March payment is not included. Can you clarify?

To be honest they havent finalized rules so we’ll know more in the coming week

I’d like to know how JB14’s wife got that low of an interest rate on her FFEL loans?

I’ve been working on getting a lower rate and have had NADA luck. At present the rate is 6.75% and no one will even consider anything less even with a Excellent credit score. HELP!

Hi Travis,

Are Perkins loans through my law school (serviced by Heartland ESCI) considered federal loans subject to interest and payment freeze until 9/30? My research isn’t coming up with a definitive answer! Thanks!

No they are not

Thanks for the reply, Travis! I appreciate all your time and effort in sorting through the new policies!

Hello, I just had my whole income tax refund today March 28th go to my defaulted student loan? Will I get this back? Thanks

Yes you probably will

This is unbelievable news! My husband and I are both on PSLF through FedLoan and we initially waved away any talk of the student loan payment suspension since we knew we only get credit for the months of service if we make the allotted payment. We never figured they would say the months still counted and let us catch a break! We figured this was just another way the higher-earning people, non PSLF people win (not entirely a fair belief, but certainly how we have felt things have gone for us in the 7 years (him) and 9 years (me) we have dealt with FedLoan and student loans). This will be a savings of $1200 a month for us! We plan to be very smart and pay off the remainder of my small private education loan (down to $5k on that)!

Hello if my son filed taxes Jan 28 2020 and department of education took his 2020 refund will he get it refunded. he got letter on Feb 26 2020 saying is was paid to department of education . At the the he was getting ready to be evicted because of back rent . Made arrangements to pay with tax return so he and his son with disabilitys would not loose their home. Not given 60 days to come up with back rent what can he do? Thank you!

No he probably wont get it back

Hey Travis, Thanks for taking the time to answer these questions. If I have been getting my Tax refund taken for years due to a student debt, will I get my refund this year? Thanks

Yes you probably will get it back, but please fix this by consolidating your loan at studentaid.gov and get on REPAYE and stop having the refund seized. You could pay 0 a month on REPAYE possibly

Is there an easy way for me to find out how far along I am in IBR. Nelnet has a really hard time with that question. My loan has been moved around 3 times since I graduated from Graduate School in 2007. My two loans do not qualify for the new relief package. I am considering consolidation so I can get in on the no payments and no interest.

I am considering a consult with your service but I am suspicious that one hour will be sufficient to get me any answers or a plan that is any different than waiting on hold with Nelnet.

There’s no easy way you would need to read your raw NSLDS data file from studentaid.gov. I understand the skepticism. Read our reviews I’m pasting here. We’re the highest rated company in the student loan industry https://www.shopperapproved.com/reviews/studentloanplanner.com

My loans are currently in forebearance. Before I was pursuing PSLF and plan to continue once I can make payments. Do I need to take my loans out of this forbearance to have the $0 payments count toward PSLF and to save this forbearance time?

Yes I would apply for an IDR plan just to be safe

I had my taxes offset by the US Dept of Ed. The money was to be put onto my turbo tax card on February 27th. It did not post to the USDept of Educ until March 9th, does this mean I will be receiving this money or not?

I can’t tell you

With the new provision for employers who contribute to their employees’ student loans to receive a tax break, does that mean physicians on 1099 income who file as S-corp can then deduct their student loan payments from their taxes, or does this get into shady territory? Thanks for all you do.

Sounds questionable but you should definitely ask your accountant say after tax filing deadline in July

Hi. My refund was seized on February 27th. I appealed due hardship. I haven’t received a notice but I didn’t get an eviction notice at the time. The articles I read says if the offset process was completed before 3/13. Does completed Process mean when seized or after the 30 days I had to appeal? It would suck if I missed it by a few days.

You either just made the cutoff or just missed it. Wont know for a couple weeks

Hi, I just wanted to say I am impressed that you are answering everyone’s questions. Well done!

Thanks Kurt!

So at the bottom of fed loan website it says “ The time spent on the emergency administrative forbearance will not count toward your required payment count.” in regards to PSLF. But the actual legislative bill says it will count.

How does Fed Loan get away with this?

They’re going based on the executive order 2 weeks ago from the President

If you look at the date above that statement (couple paragraphs above) it’s as of March 13th, not the new bill March 27th.

I’m currently on an extended graduated repayment plan. Every 24 months, my minimum payment increases by 9.6% (I call it “leveling up”). Will this 6 month freeze on payments push out the date the minimum amount increases to the next tier? Before this, I was supposed to “level up” in January 2021. Will it be pushed out to July?

I have two real old FFELP loans that were consolidated 20 years ago. Currently serviced By PHEAA. I hope this can help me some.

two questions.

1) My wages are currently being garnished out of each paycheck. Am I understanding that the garnishments will temporarily stop?

2) My tax refunds are usually completely taken by the gov to pay back my student loans. I have not filed my 2019 taxes Yet – Does this bill mean that I will get my tax refund this year?

Yes the garnishments stop and youll get your refund. But please get it out of default by consolidating at studentaid.gov and signing up for REPAYE

Just to be clear. Because this is unbelievable if true. My FFELP loans Currently serviced By PHEAA. Do qualify for the 6 month garnishment stop? Do I need to do anything? How will I know my garnishment is stopped prior to my next paycheck? Thanks again for the info !!!!

Even if they were consolidated years ago all of this still applies ?

Can someone please confirm if the above is all accurate.

I’m hoping so!

Hey, you said retroactive until march 5th, but department of education and other sites state march 13th as cut off date. My refund was issued on march 11th, department of education says they received the payment on march 21st. So ive been scouring the internet. Can you please explain the “cut off date” in detail please.

We’re just going based on unconfirmed reports right now. We’ll know more in the coming days but you will probably be safe

[…] The massive economic stimulus package includes a provision for some borrowers who have the right kind of federal student loans. Are you eligible for six months of interest-free forbearance? Student Loan Planner digs into the details of What the $2 Trillion Stimulus Plan Means For Your Student Loans. […]

My parent plus loan is in default with Michigan guaranty agency. Do I have to make a payment this month? Also my tax refund was already taken on the 24th. How are they going to give it back if it has already been deducted from the balance?

It’ll be mailed to you. You need to consolidate the parent plus loan to get it on ICR

I have student loans from graduate school totaling 40k. On paye plan and in PSLF 3 years now but getting married in August… should I stay put or change to other plan?

stay put you might need to amend your tax filing status

Lol Travis I presumed I would be changing from single to married filing jointly with my husband?

If I filed at the begging of February and my refund was seized due to defaulted student loans will I receive it back? Or are they only refunding from the ones they took from March forward? If that is the case, why? Either way I’m still struggling so why would they only reimburse those who they seized from March forward? It’s as if I’m being penalized for filing promptly. The one yr I did.

They will probably not refund it

Hello

I still have subsidized and unsub stafford loans (back in 2000s), consolidated with AES at a low rate 2.65%. Can I take advantage of deferred payment?

Also as a business owner, are there advantages to myself (business expense) and staff (tax free) by offering student loan repayment? I heard about 5K. Is this a one time thing only?

For now it’s a one time thing but itll probably become permanent. Yes you could take advantage of it but youd need to consolidate w the government. We do this analysis for clients who hire us https://www.studentloanplanner.com/hire-student-loan-help/

Thank You Travis, for all your advice and good information, you are Awesome

The FedLoan website states: “Special Considerations for Borrowers Pursuing Public Service Loan Forgiveness or Loan Forgiveness Through an Income-Driven Repayment (IDR) Plan The time spent on the emergency administrative forbearance will not count toward your required payment count.

If your income has changed as a result of COVID-19 you may be eligible for a new lower IDR plan repayment amount. Find out if you qualify for a lower payment at StudentAid.gov/idr.”

Does this mean that we need to keep paying our normal monthly payment if we are still working (I am a government employee) and receiving normal pay? Thank you!

No just do nothing theyll take care of it

Travis,

Have you heard from anyone trying to recertify their IBR during this mess? My recertification deadline was 3/27/20, and I submitted my paperwork several weeks before the deadline. I received an email from FedLoan saying my recertification had been rejected with no reason stated, and I have been unable to contact anyone at FedLoan by either phone or email at this point. I’m afraid I’ll be kicked out of the program right as the 6 month forbearance begins and ultimately lose PSLF.

I have not heard of that yet

I did not file taxes this year yet nor last year because I defaulted in my student loans. I tried twice with the rehabilitation program but failed due to two different pay increases witin the separate 9 months. Now they are garnishing 15 % of my paycheck bi weekly. If I file soon would I be eligible for my tax refund and this stimulus package?

Consolidate at studentaid.gov and get on the REPAYE plan. That will fix your problem

I am paying $839 per month under REPAYE, working towards PSLF (2 years down, 8 to go). I am fortunately still employed during this pandemic and would be able to make my normal contributions regardless of this 6 month forbearance. A previous blog article discussed the SECURE Act and using 529 fund distributions to make payments towards student loans. Would it be wise to open a 529, make my next 6 months’ worth of loan payments into that, and then let that $5,034 balance grow over the next 8 years, eventually taking distributions to cover the final months of PSLF payments? If I am thinking about this correctly, some tax-free interest would accrue on the balance, and if I continued to funnel the normal monthly $839 payment through the 529 each month after normal payments resume in September, I could also claim the modest $1,000 annual Mass state tax deduction for 529 contributions. Is this viable?

Wow very specific. I think I’d wait on everything right now given how weird society is. Also this wont get you to financial independence it’ll just help a bit

I have old FFELP Consolidated loans that are now with Phiaa that are in default and being collected by wage garnishment. Will I have 6 months of no wage garnishment with these loan types. Also am I eligible to also get my 2019 tax refund which is usually offset.

Will I get notification if the garnishment is suspended ? Do I need to contact HR ?

You’ll be notified

Why are the only back dating the garnishment to March 13 due to the coronavirus?

The virus has been inflicting us since before then. So only “nearly late filers” get to benefit from the halt on the garnishments? Thats pretty terrible and motivates me to file my taxes on april 14th every year from now on.

Yeah there’s a lot of things that arent great about the bill but cant change it

Travis et al,

Do you think that IBR payments will still be recalculated on time this year due to the delayed federal tax return date? I got a notice from FedLoan that they would be recertifying my payment in April (I’m currently on REPAYE) but I would think that they should wait until the end of summer as taxpayers get until July to file their returns.

It’s anybody’s guess we’ll see

Hi Travis, thanks for the comprehensive post. I’m in an IDR plan and going for PSLF. I have automatic debit payments that happen on the 2nd of the month. Should I go ahead and turn that off even though myFedLoan shows that the bill is still due on 4/2?

I’m in the same boat, except my automatic debit happens on the 1st… If we go into forbearance, those payments wouldn’t count towards PSLF (which is the only option showing on the site rn). I think I’ll just wait and have my usual payment deducted 4/1/20 and see what they do with the remaining? Thank you so much Travis for writing this post and answering everyones questions- you are awesome and much appreciated!!!

So, I consolidated my federal loans through SoFI, and now make payments through Mohela. Is this considered “owned by a comercial lender” even though they are still federal loans? If so, is it possible to re-re-finance with a Dept of Ed loan?

And thanks for this site!

No you’ll need to apply to refinance them through another private lender if you want a lower rate. https://www.studentloanplanner.com/refinance-student-loans/

Does the new Stimulus Package only provide relief for those with current student loans? What if I take out a student loan this month. Will it be interest free until September 30?

Yes but not many are able to borrow right now under federal loans

According to this new bill tax refund garnishments will not happen but my entire tax refund was garnished, what who or how do I get answers on this situation??

If it was after March 5 you will probably get it back

Hi wanted to know what happens when my tax refund is garnished and the new bill states there will not be any refund garnishes??

Then youll probably get it back soon

I am reading that the automatic suspension goes into effect without any effort on the Borrower’s part. However, my Federal Loan website is asking whether I want to go into forbearance.

My question is – do I need to actually request forbearance to benefit from this stimulus package or is this a back door way of my servicer to prevent me from benefiting from this stimulus package and put me into forbearance – thus capitalizing my interest.

Thank you in advance.

No

When does the bill technically start? I have a late March 28th payment due- should I go ahead and pay it or might it fall under the above provisions? Thanks!

It could fall under the provision, I’d wait and see

So I may have stupidly jumped the gun and put in for forbearance already on Saturday after I read that the bill passed. Now I’m seeing that it would be automatic. Does anyone know of a way to cancel a forbearance request? I couldn’t easily find it on the site or app for my Fedloan. want to make sure I didn’t just shoot myself in the foot and have the payments disqualified from PSLF. Any advice or words of hope????

I would immediately submit an IDR request on studentaid.gov

Hey update: Spoke to customer service for FedLoan (they are mostly working from home, and actually answered pretty quickly around 9am EST) and she said I should be OK. She canceled my forbearance request, and I have to call back around the 16th when my next payment is due to make sure it still gets registered and I can even pay it and get reimbursed once they figure out how they are cancelling everyone’s loan payments across the board. Basically, if you’re enrolled in PSLF under the correct payment plan, don’t do anything for right now and they will be cancelling and reimbursing the loan payments from March 13th through Sep 30th. I don’t think my IDR status was impacted. (I was enrolled in that previously and re-certified in July last year).

Hello Travis,

I was just learning about the rehabilitation process for my defaulted student loans a couple of weeks ago. I haven’t worked since 2017 I also haven’t yet filed my 2017 taxes and am due a $6k return for those taxes. During the suspension of student loan collections due up Corona virus am I able to finally file my 2017 taxes without collection occurring?

Thank you for taking the time to answer my question.

Sincerely,

MM

Probably yes

1st, I am eight years into the IBR plan (65k in loans now down to 41k after 54k paid), and wondering if the 20yr IBR forgiveness is still available as when I started (not the PSLF). 2nd, less than half of my loans are DOE owned FFELP, the rest are FFELP owned by Navient Federal Loan Trust. It looks like Navient wants me to pay on all the loans during the DOE 0% period, which would prevent me from prioritizing the high-interest loans…can they do this? They say I have to make the same payments as before…? 3rd, all these loans were for ITT Technical Institute (2009 4-yr grad Electronics Engineering @ 40yrs old…they closed bankrupt in 2016) and apparently aren’t eligible for Defense to Repayment (even though the DOE itself sued them for fraud) and haven’t been cancelled by lawsuits because they aren’t Private. Now they don’t qualify for the Stimulus Plan benefits because they aren’t Federal…so what the heck are they, how did I wind up with them, and what can I do about it? I’ve been unable to get another engineering position (was laid-off after ITT closed) and now all the engineering firms require regional accreditation to even apply, so it’s unlikely that I’ll have loans paid off before they start garnishing my social security.

You can consolidate your FFELP loans at studentaid.gov and they will qualify then

Hi I have a FFELP loan that was a spousal consolidation done back in 2001. How do I tell if it is the type that will get 6 months of no payments?

Thanks!

It probably wont thats an old type of loan thats an awful one as I know you’re aware. I would plan to continue on IBR unless otherwise notified

I’ll admit I didn’t read ALL the comments, so my apologies if this is a repeat.

I currently have auto-pay on eligible federal student loans. Servicer is Navient. My payments are always due on the 1st of the month. Given the law was signed into effect on 3/27, all payments should have been suspended at that time. The text states that the 15 day period is for NOTICE, not for actually implementing the policy. However, Navient is saying I will still have a payment withdrawn tomorrow. Given that the act expires on 9/30, that means I’ll only have 5 payments suspended, not 6. I get that they’re backed up on forbearance requests, but they knew that this legislation was coming down in advance, so they should have been prepared to make the adjustments immediately.

I’ll be arguing with them today, and demanding that they refund the payment if it is indeed withdrawn tomorrow, but I’ve not had great luck with that in the past when they’ve messed up. Just wanted to let you know this, as I’m sure MANY others will be in the same situation. I’ll update if I get anywhere on this issue.

Update – the very nice Navient customer service rep confirmed there’s not much they’ll do to stop any auto payments in early April. He also stated that there is no plan for Navient to automatically refund any payments debited in early April and it is up to the borrower to file a refund request. Instead I issued a stop payment request with my bank, emptied the account, and ended my overdraft protection to avoid the payment coming out. Thankfully I don’t have anything else that comes out on the 1st. Frustrating though not surprising that Navient doesn’t have a plan for these folks.

Yeah just request a refund if it happens.

Thanks for all of your comments on this. In their communications and on their website, FedLoans only mentions the forbearance, suspension of interest and wage garnishment, etc. provisions. There is no mention of the automatic 6 month suspension of federally held loans and that those 6 months will count toward PSLF, etc., so the only guidance we have on that issue is from you and other secondary sources. Even though I’ve read the legislation, the fact that FedLoans does not mention the 6-month automatic suspension at all makes me nervous. Do you know of a source that confirms we should just do nothing and we should expect that our accounts aren’t debited as scheduled (my automatic debit is scheduled for the 15th)? Thanks!

SUper helpful article. I have loans eligibile for the 6 months of non-payment. when my laon payments resume in 6 months will it just pick up as usual with same payments or do I need to prepare for any interest accrual or capitalizing?

Should be no interest capitalizing and pmts resuming like normal

My Federal loan went into default. i miss read the dates. i called and put it into forbearance March 3rd. The Above states “Help for Borrowers in Default:

When you rehabilitate your student loan, you remove this negative event from your credit score. ” if i make 3 or 9 consecutive payments will the 90 late mark be removed from my credit report?

Yeah you can make 3 monthly payments based on agreed schedule w your collections agency and then the loans get put into repayment again w no default anymore.

I am pursuing PSLF. I continue to receive emails from FedLoan about my upcoming payment (scheduled for 4/12/20 at my regular payment amount). I am not sure how long it will take for the effects of the stimulus to come into place or if a credit will be applied retroactively, but nothing on the FedLoan site indicates a change in payment amount, only that there will be 0% interest. The FedLoan website also states that the payments made during the emergency administrative forbearance will not count towards the required payment count for those pursuing PSLF or loan forgiveness through an IDR. I am trying to diligent about all of this information and how the stimulus impacts my student loan payments but I am having a hard time sorting through conflicting information. Thanks for any help and insight you can provide! I really appreciate the emails you send out.

They havent updated their site yet

Hi Travis, Thanks so much for your and your team’s work in this area. Hopefully a quick question: My wife got her REPAYE payment auto-debited today (4/1) and called the servicer (Navient) to resolve this issue, since it was our understanding April was the first month payments would be suspended. The loans are Direct Consolidations loans. She spoke with a representative who claimed you had to call to request the loans be deferred. She said she was putting a request to do so and to issue a refund for the April payment. Since my understanding was this is all automatic, I’m concerned that she’s getting put on some forbearance and won’t get credit for the 6 months toward the REPAYE forgiveness. Any thoughts on whether she should do anything, or assume this will all resolve itself and the rep was just confused? Thanks so much!

Rep was just confused

I’m on PSLF (REPAYE) and my next be is due 4/2 (tomorrow). I schedule each payment online (monthly, not automatic). Should I schedule my payment for tomorrow 4/2? I’d much rather save the $505 (and not run the risk that, though scheduled for 4/2, it be considered late and then it doesn’t count).

Dont manually pay it.

I recently graduated in December and am currently in the grace period. My loans (undergrad and grad school) are all from the ED totaling 220000. Luckily I am employed and am able to make payments but I have heard that because I am in the grace period the CARES act will not apply to me. Do you know if that is true and if interest will still be waived? Thanks!

The IDR credit wont apply. Which is why some ppl need to consolidate.

Here is the following I see when I went online to check on/ pay my Nelnet Student Loan. I was surprised to see that my account starts with J, meaning that I am not eligible for the suspension of payments. Any words of advice on how I can verify that this is indeed correct? Go to the raw data at NSLDS at studentaid.gov?

“The CARES Act applies to only those federal student loans owned by ED. To see if your loans are eligible, find your account number by either looking at your billing statement or by logging in to your Nelnet.com account and going to Loan Details.

• Accounts that start with an E are owned by ED and are eligible for a suspension of payments

• Accounts that start with a D or a J are owned by a bank, credit union, or other lender and are not eligible

For accounts that start with an E, payments will be suspended until 9/30/20. There’s no need for you to contact us. Nelnet will notify you of your suspended student loan payments within a few weeks. Log in to your online account at any time to see your loan status.

If you have an account that begins with a D or a J, you may want to review other options such as an Economic Hardship or an Unemployment Deferment as you may qualify for an interest subsidy with a deferment but not a forbearance. Log in to your Nelnet.com account and select Payments, then Repayment Options to start. Or, you can request a 90-day coronavirus forbearance at Nelnet.com/nelnetforms/emailus to temporarily suspend your payments.”

Yes NSLDS is the best place to see

I am working towards PSLF and have 29 months of qualifying payments so far under the REPAYE plan.

I have a small Perkins loan that is privately held by Heartland ECSI (should have done a direct consolidation on this one a long time ago for PSLF benefits!) I’m considering applying for a direct consolidation loan to get 0% interest, and $0 qualifying payments through September 30th.

I presume it will not be a problem to apply for PSLF on my other loans when it is time, even though this one will not be eligible yet, correct?

In order to get on a REPAYE plan with this loan I’ll need to update my income with the Department of Ed / my servicer (FedLoan) when I apply for consolidation. Typically, I send in my tax document in November, but if I do this now with my 2019 tax return, I suspect my payment overall will increase for all of my loans, since I made more in 2019, vs 2018 which is the most recent tax year my payments are based on. But given the $0 payments until after September 30th, I suspect that it is worth it.

Is there anything I’m missing here?

Hey Travis, I just got done watching the video on having IDR recalculated. Right now I qualify for $0/month payments but will have to reapply in June anyways. Am I understanding it correctly that I should apply for that to be recalculated ASAP so that I get these extra months that will count towards forgiveness on REPAYE? Knowing that I will no longer qualify for $0 payments after June anyways? Thanks.

Correct

The fedloan site has been updated, much clearer on if you get credit during the suspension. Further no more mention of capitalization. Updated April 3rd.

https://myfedloan.org/borrowers/covid/

1) I have fedloans and have my annual IBR recertification coming up in May. Should I proceed to file as usual? I already filed my taxes and so it will be based on my 2019 1040. Will this affect the 6 months of no pay?

2) If my husband’s pay has significant reduced given COVID, and as we do REPAYE, should I have that reflected for my upcoming recertification? Will it count given that it’s temporary?

It would count just recertify at studentaid.gov/idr

I had applied to have my PAYE amount recalculated due to a decrease in income just prior to the CARES Act coming into play. I was placed on the administrative forbearance with $0/month. Shortly after I got an email stating what my new, reduced payment was and that it does not go into effect until October once the forbearance period is ended. I previously had to re-certify every December, but now I re-certify March of 2021 since I had them recalculate my amount in March 2020. They adjust the amount, make it effective now for 1 year but your first payment is not due till October, and then move out the date for when you need to re-certify. Hope that helps!

I was required to switch my IDR plan from IBR to REPAYE due to income changes. This required a period of forbearance to be accepted for REPAYE. The forbearance month was March 2020. My REPAYE application was accepted on February 28 with first payment setup for April. The CARES Act states you need to be enrolled in an appropriate/qualifying plan prior to March 13 in order for the subsequent payments (now zero dollars) to count toward PSLF. Even though I was accepted into a qualifying plan prior to the March 13 date with payments setup for April, will the March forbearance be an issue as the plan was switched?

I dont think so

I’m in a similar situation except for my forbearance ends with a first payment in May 2020. I called today and asked to be moved from General forbearance onto COVID forbearance. The person on the phone said I wouldn’t get credit for PSLF for March, but probably would for April forward. It’s only one month, but I wish they would backdate the forbearance switch and allow March to count toward PSLF. Hopefully, they will switch me over quickly.

Just make sure you’re enrolled in an IDR plan studentaid.gov/idr I’d apply to be safe

Logged into FedLoan Servicing today, 4/6/20, and my loan is showing as Delinquent. I was on autopay and my last payment was due on 4/5/20 but the payment was never made. Although I’m guessing this is due to FedLoan implementing the CARES Act, it is unsettling to see the Delinquent status as I am pursuing Public Service Loan Forgiveness and don’t want to have anything screw that up as I’m a year out from eligibility. If anyone else is in the same boat, please let us know if and when this gets resolved by FedLoan Servicing or if you receive confirmation from FedLoan Servicing that PSLF will not be derailed by the Delinquent status.

Logged in today and saw the following update, appears that they are working to clear the delinquency status:

We are working on making all updates per the CARES Act, which includes clearing the delinquency on your account. If you see that you are showing delinquent, please disregard. We will have your account updated as soon as possible.

Another issue I found was my Estimated Eligibility Date for PSLF increased by approximately 6 months. I am guessing this will be fixed soon, an that it’s a temporary glitch due to putting everyone on a 6 month forbearance, but it’s something to be aware of and monitor.

I also talked to a FedLoan rep today about the estimated eligibility, they said since it is a forbearance everything is paused essentially (thus in the system making it think you are not making payments the next 6 months and will be 6 months further away from qualifying). This will all be updated once you are back in repayment and verify you employer like you normally would. You can send in your employer verification at any time or after the 6 month forbearance and get the number of qualifying payments updated. It is no different than prior to the administrative forbearance, they do not automatically add the number of qualifying payments each payment only after you send in a recommended yearly employer verification do they update the number of qualify payments.

I talked to a FedLoan rep today, they stated that my account is marked as current, in administrative forbearance. They said the department that deals with updating online accounts is out/severely limited at this time. So it is taking a long time for all the work they are doing behind the scenes to be reflected on the account itself.