We don't pretend to have a window into the lives of all Americans, but we have a very good idea of how coronavirus is affecting the personal finances of professionals with big student loan debt.

We surveyed 4,100 readers from the Student Loan Planner® community on March 18, 2020 about the impact of coronavirus on their personal finances. We then did a follow up survey with the same population and received over 3,100 responses on April 17, 2020. The populations statistically were close to identical despite the smaller sample size in the second survey.

This gives us one of the few accounts of how professionals with student loan debt have been impacted by the COVID-19 economic crisis.

Here's how our audience is different from Americans in general:

- 1/3rd earns more than $100,000 a year.

- 2/3rd owes more than $100,000 in student debt

- 40% are men, 60% are women

- 85% are in their 20s and 30s

- The majority holds a graduate degree

The “coronavirus recession” has clearly has a significant, negative financial impact on the average American. But even among our readers, a significant proportion have been affected financially as well.

Where possible, I've also included anonymous quotes from our readers to get a sense of what people are experiencing.

However, though our findings show a lot to be concerned about, there are some very hopeful signs that Americans will bounce back from this economic calamity no matter how bad it gets.

When Would Professionals Run Out of Money During this Market Panic?

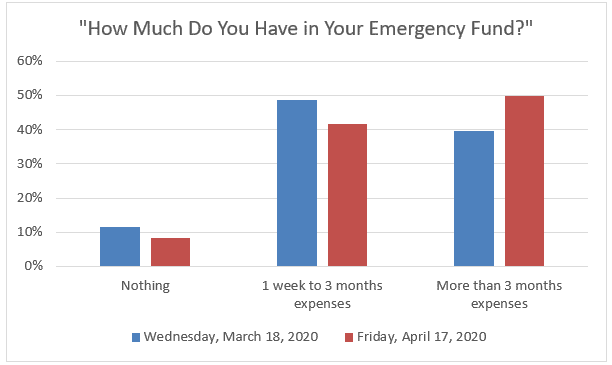

Despite the economic disaster, our readers' emergency funds are getting better, not worse.

Back on March 18, 2020, 60% of our readers had less than 3 months of expenses. Now only 50% have less than that amount.

Workers everywhere are battening down the hatches and cutting spending in anticipation of a long economic downturn.

Here's the representation graphically:

About 1/3rd of our above average income readers would run out of emergency savings in only one month. After 3 months, the majority would be hurting.

Compared to our readers, however, the general American public would clearly be in much worse shape.

While you could turn to credit cards or home equity for short term cash needs, that's only possible in a normally functioning economy. My guess is that if the recession deepens, lenders would further tighten their standards as they have in student loan refinancing and mortgage refinancing.

This result underscores the importance of direct cash aid to Americans to prevent a severe economic crash.

Additionally, while many bills out of Congress have focused on Americans earning under $100,000, our results suggest higher earning Americans will be facing severe economic pains as well.

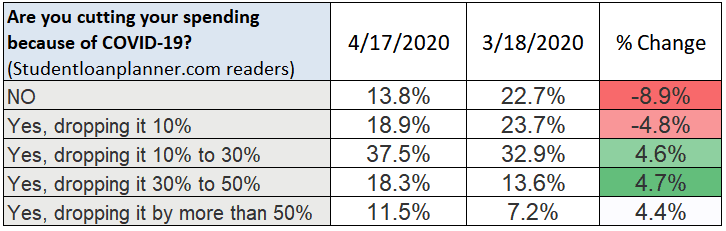

Are Families Cutting their Spending?

This answer is a resounding yes. 77% of our readers are cutting their spending due to coronavirus back in March. In April, 86% reported cutting their spending.

Hence, declines in consumer spending seem to be getting even worse.

You'd imagine that there would be a stark difference between folks who are genuinely afraid of this pandemic versus those who are not that worried about it.

However, we found that a clear majority of every group cut their spending. The only question was by how much.

Many of the comments in the survey mentioned that the spending cut was not intentional. Families just cannot go out and spend even if they wanted to, hence spending is being cut involuntarily in many cases.

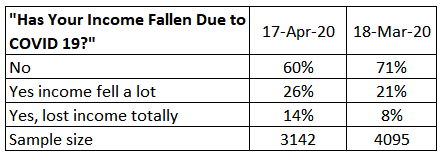

How Many People Are Seeing Their Incomes Drop Due to COVID-19?

Our audience has a diverse group of occupations, but most have a graduate degree.

Clearly our sample is biased towards higher earning professionals, but are our readers' incomes changing in response to this pandemic?

While we're seeing huge variability by profession, here's our overall readers' income change:

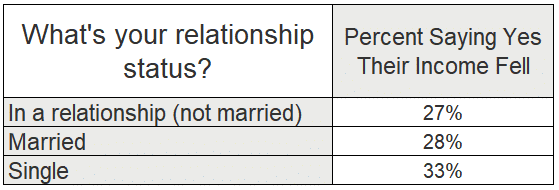

We looked at other demographic information based on those who said their income dropped.

We found that single people were slightly more likely to have had a drop in their income than those in long term relationships or marriages, but the difference based on relationship status is likely minimal.

Other Demographic Info About Readers Whose Income Had Fallen

We found the following additional information based on those who answered that their income had fallen:

- There was no difference between men and women

- Out of all those with student debt, readers with more than $200k of student debt were slightly more likely to report that their income fell (34%)

- Readers with more than $300k of income were more likely to answer that their income had decreased (44%)

- Readers with less than 3 years of job experience were slightly more likely to answer their income had fallen (33%) compared with workers with more than 3 years of experience (28%) .

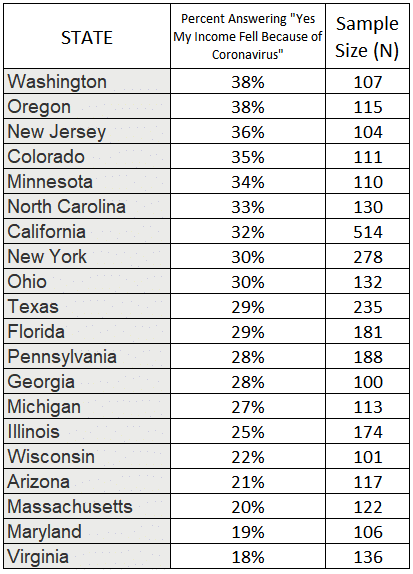

What States Are Seeing the Biggest Income Drops from Coronavirus?

We looked at what states suffered the biggest share of respondents reporting income drops from coronavirus.

We included states that had at least 100 responses.

Things are changing daily from when we did this survey on March 18. We might get very different results if we did the survey today.

That said, the hardest hit areas clearly have a high share with a drop in income, with Washington State at #1.

Also, the least affected states appear to be those with a large concentration of government workers (Maryland and Virginia).

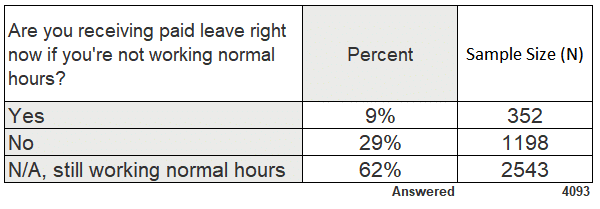

Are Workers Getting Paid Leave?

At least among our pool of highly educated, mostly professional workers, of those who are not working, only a quarter of are receiving paid leave right now.

Some of the workers at the biggest corporations reported receiving 2 weeks of PTO, but most are not getting income replacement.

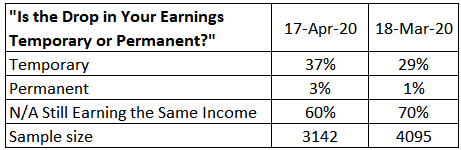

Notable Increase in Workers Responding Their Income Losses are Permanent

You'd be really afraid if workers who lost their incomes thought that it was for the long term.

That's when workers severely cut spending, let their cars get repossessed, allow short sales on their homes, and significantly cut back orders for bigger ticket items long term.

One silver lining in our survey is that most workers whose incomes fell really believe this will be a short term impact. Although the number reporting a permanent impact has tripled from a small number in March.

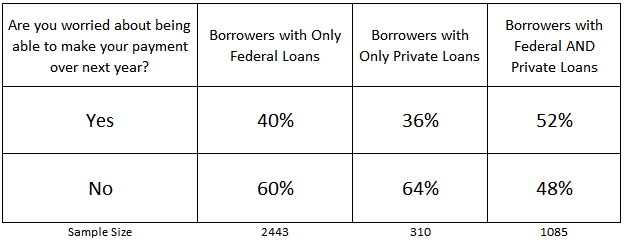

Are Borrowers Ready to Handle Their Student Loans in this Crisis?

We initially thought that private student loan borrowers would be the most afraid of making their monthly payments.

After all, federal loans can always be paid as a percentage of income. If you lose your job, your payment is zero.

That is not what we found at all.

When we evaluated the same data for April, we found that there was no statistically significant difference between federal and private student loan borrowers in being worried about making payments over the next year.

The highest share of borrowers who were worried about being able to pay back their student loans had BOTH private AND federal student loans.

Borrowers frequently ask me if it's a good idea to refinance only a portion of their federal loans. We always tell them no.

You're either financially in shape to refinance, or you're not.

These numbers bear that out. When you refinance a part or you take out some private loans on top of your federal debt, you really just create two payments instead of one.

That's because your federal loans probably get put on an income-driven plan. That payment is the same regardless of what you owe.

Private loans have a minimum payment you must always make.

Borrowers with private student loans are likely the best financial shape, which is probably why, in our survey, they are group least worried about being able to make the payments over the next year.

Borrowers with federal student loans should only be worried about making their monthly payments if they're unaware of how to reduce these payments through income-based payment options, which we will talk about in the next section.

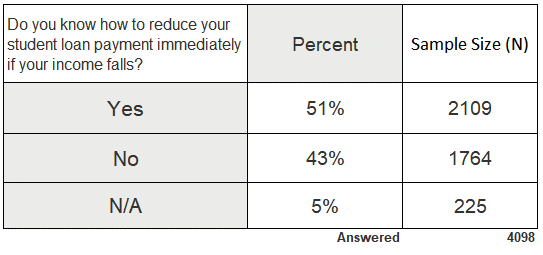

How Many Borrowers with Federal Loans Know How to Reduce Their Payment?

This next finding may explain why 40% of borrowers were worried in March about making payments on their federal student loans.

In April, only 31% were worried about making their payment over the coming year, a significant decrease.

When your income falls, such as during an economic contraction, you can apply to recalculate your monthly payment under an income-driven plan.

Apparently a lot of our readers still don't know how to do that, as 40% of are unaware of how to reduce their student loan payments.

This data would argue that the automatic national forbearance was the right call by Congress. Luckily, they give credit to borrowers pursuing student loan forgiveness programs such as Public Service Loan Forgiveness and 20 year taxable forgiveness.

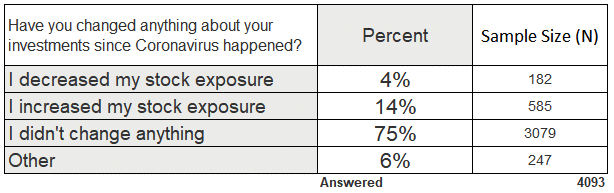

Good News: Young Professionals Overall Are Making Smart Investment Decisions

You'd be pretty depressed if you saw a bunch of 20 and 30 something individuals with above average incomes panic selling and fleeing the stock market for good.

Instead, we're seeing a much higher proportion of readers purchase stocks rather than sell.

The majority is also doing something smart right now: absolutely nothing.

We left an other category to describe changes outside the three multiple choice options.

The only unfortunate news is some young investors are gambling in options and cryptocurrencies.

That said, it's good news that almost 90% of respondents answered they were leaving their investing alone or buying more stocks.

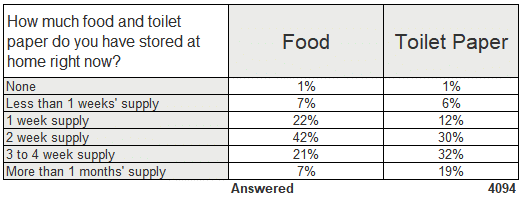

More Good News: Our Readers Have More Toilet Paper than Food

You would expect an audience of highly educated young professionals to prioritize the most important supplies in the midst of this economic pandemic, and they have not disappointed.

Clearly, our high debt student loan borrowers are better stocked up on toilet paper than most.

They even have a larger supply of “Very Important Paper” than they do of food.

Out of fairness, our local Whole Foods ran out of toilet paper very quickly. They've got more than enough kefir and cage free eggs.

We think people hoarded toilet paper because they saw other people hoarding toilet paper, and they realized there might be a limited stock left if they waited.

It's a good thing that we've maintained an adequate grocery supply chain, then!

What are you most surprised about? Comment below.

If you lost your job due to coronavirus, please check out this blog post to lower your student loan payments.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

For those with reduced income or anticipating reduced income, should we take advantage of the COVID-19 forbearance if we are on the IBR – 25 years or should we continue to make the monthly payment?

Thank you!

Keep making the payment it seems as if they’ll suspend payments

What are your thoughts for those that don’t have 1 years’ savings, putting their student loans into administrative forbearance and applying the monthly payments to savings during these uncertain times?

I think Congress is about to do that for you but yes I would beef up savings