A Certified Athletic Trainer (ATC®) credential requires a bachelor's or master’s degree from an accredited professional athletic training education program. If a student has obtained a bachelor’s degree in another field, they’ll need to obtain a master’s degree in professional athletic training.

After obtaining the necessary education, an athletic trainer must pass an exam and complete continuing education to maintain the designation.

We’ve worked with athletic trainers with student loan debt balances ranging from $50,000 to $200,000, largely dependent on their chosen program or path. If you are one of these borrowers, how should you figure out the best way to pay back your debt?

How to become an athletic trainer

According to the National Athletic Trainers Association, “Athletic trainers (ATs) are unique health care providers and an essential member of any health care team skilled and trained in the prevention of injury and illness, examination, diagnosis, treatment and rehabilitation of emergency, acute or chronic injuries and medical conditions. Found on sidelines, military bases, warehouse floors, performance halls, clinics, and hospitals, ATs provide a safer approach to work, life and sport.”

On average, it takes at least five to six years to obtain the athletic trainer certification, plus continuing education.

There are more than 350 accredited athletic training education programs.

Athletic trainer career opportunities

Once certified, athletic trainers can work in a number of fields:

- School of University settings.

- Professional and Olympic sports.

- Hospital settings.

- Private clinics with sports medicine specialties.

- Health departments.

- Police and fire departments.

- Performing arts, including dance companies and music.

ATs often work in teams, and there may be evenings and weekends involved depending on the specialty.

Over 35% of ATs work at Universities or Secondary Schools, and 17% work in a hospital setting. Only about 2% work in a professional sports setting.

Athletic trainer career outlook

According to the Bureau of Labor Statistics, the 2021 Median pay for an athletic trainer was just under $50,000. The range depends on your field and could be from $40,000 to $60,000.

The career is growing at about 17%, faster than the average of all occupations.

Student loan debt for athletic trainers

When leaving a bachelor's or master's degree program and assessing a borrower’s debt situation, at Student Loan Planner®, we frequently look at your level of debt vs. your income potential.

For example, if you borrow $50,000 and make about $50,000, that’s a 1:1 ratio of debt to income. It’s probably best, in this case, to pay the loans off completely either by remaining in the federal system or by refinancing.

If you are one of the not-so-lucky borrowers who leave your program with $180,000 of student loan debt and expect to make $50,000, then your debt outweighs your income, and it’s worth looking into income-driven repayment plans.

Getting a master’s or doctorate in athletic training is getting increasingly expensive as tuition rises.

Most states require a master’s degree but not a doctoral degree. Depending on your career path and where you live, a bachelor's or master's program is likely sufficient, especially since continuing education is necessary as part of the certification. You’ll never stop learning!

Best repayment strategies for athletic trainer student loan debt

In our experience, athletic trainers have more than one option to save money on their student loans.

- Pay off their loans aggressively with a goal of being debt-free in 10 years or less. They can consider refinancing student loans depending on the interest rate environment.

- Work for a nonprofit hospital or government employer (like a university) and go for Public Service Loan Forgiveness.

- Work in private practice for a home health or nursing care facility and go for taxable loan forgiveness on an income-driven repayment plan.

Deciding which of the three options above would be best for an AT depends on their specific situation.

As mentioned above, you should first look at your total student loan debt compared to your income potential. Your loans shouldn’t be your life, so it’s also a good idea to focus on a career path that interests you.

There’s no point in being miserable in a job for 10 years to achieve public service loan forgiveness. Ten years is a long time to work a job you hate.

Get Started With Our New IDR Calculator

Case study: An athletic trainer saves a bunch of money with a student loan plan

Tommy owes $180,000 in student loans with a 6.5% interest rate. He just took a job with a starting salary of $50,000, and his wife makes $70,000 and has no student loan debt.

Tommy just left school and is unsure of what to do. He can pay his loans off over 20 or 25 years to qualify for forgiveness on an income-driven plan. If he works for a non-profit organization, he could have his loans forgiven tax-free in as little as ten years.

Tommy and his wife have a baby on the way and plan to have one or two more kids over the next five to 10 years. He’s very concerned about affording his student loan payments with a growing family.

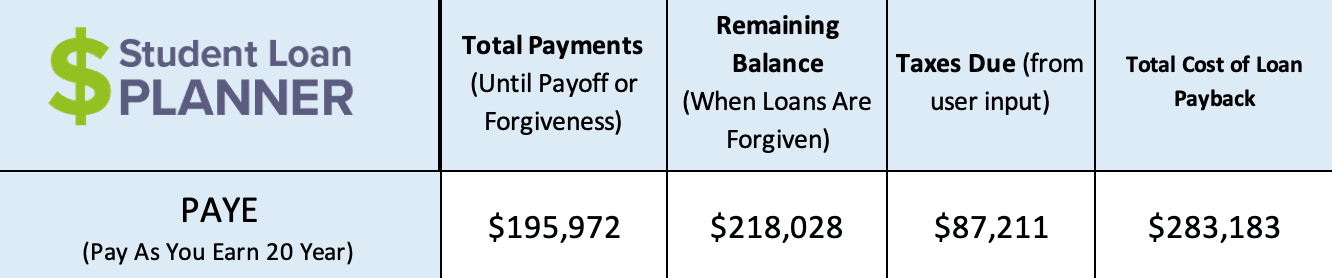

Tommy and his wife plan to file their taxes jointly. Here’s his projected cost on PAYE (Pay As You Earn, a 20-year plan based on 10% of Tommy’s discretionary income):

This plan includes total payments of $195,000 and a nearly $100,000 tax bomb. That’s a lot to prepare for when your family is growing. Money will be tight.

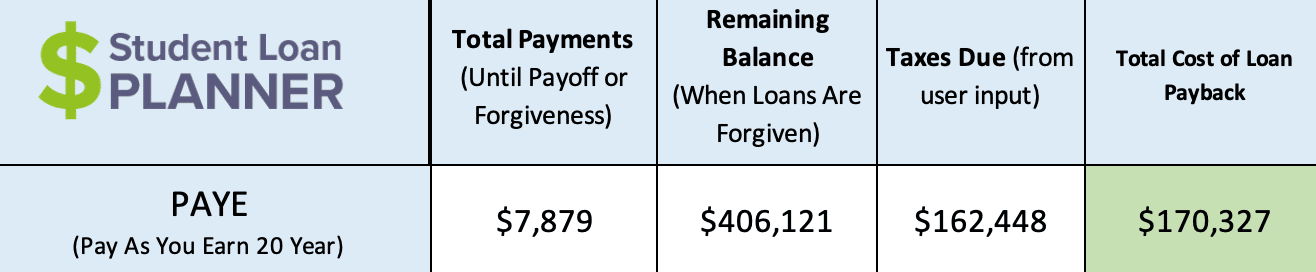

If Tommy and his wife file their taxes separately, we paint a different picture.

Tommy will pay about $8,000 over 20 years by filing taxes separately. Yes, you read that right. Tommy and his wife can save money preparing for a potential tax bomb. If we look at the total projected out-of-pocket cost (total payments + taxes owed), Tommy might save over $100,000 on PAYE filing taxes separately versus jointly.

More tangibly, he’d have incredibly low student loan payments along the way, but how on earth would he prepare for that monster tax bomb?

Planning for the tax bomb

PAYE and filing taxes separately is looking pretty good to Tommy at this point. The problem is that owning a projected $162,448 in 2042 is terrifying. Let’s look at how to attack it.

Though tax-free loan forgiveness would be better, an income-driven plan with the tax bomb is the next best thing. Tommy would pay about 40% in taxes on his forgiven loan balance. That means he’d only owe $0.40 for every $1.00 of student debt that gets forgiven. The other $0.60 is wiped away.

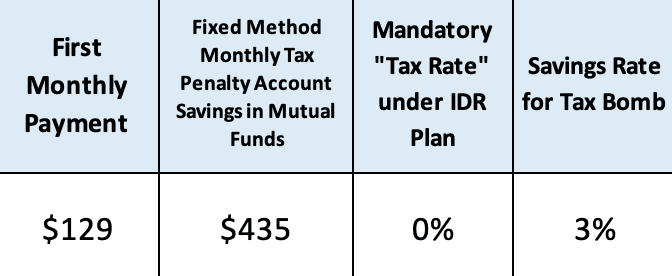

Here’s how Tommy can save for the taxes. By filing taxes separately, he saves about $600 on his monthly payment. He can use some of that savings to prepare for the tax bomb.

If he saves $435 per month in an investment account for the next 20 years and earns a 5% average annual return after taxes, he’d have the money to pay the tax bomb when it’s due in 2042.

And what if Congress decides to make its temporary pause on taxable student loan forgiveness a permanent change? Well, then Tommy has a massive amount of savings that can pay down his mortgage, help with his kids’ college, or use for his retirement.

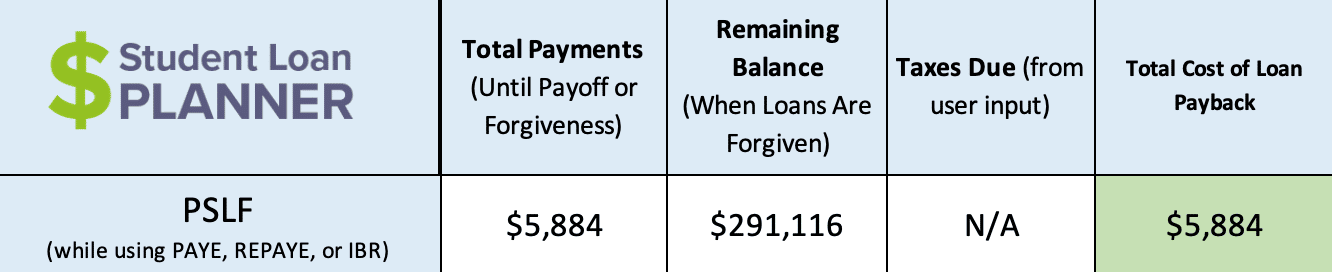

What if Tommy works for a University?

Let’s rerun those numbers considering a non-profit job. Just for fun.

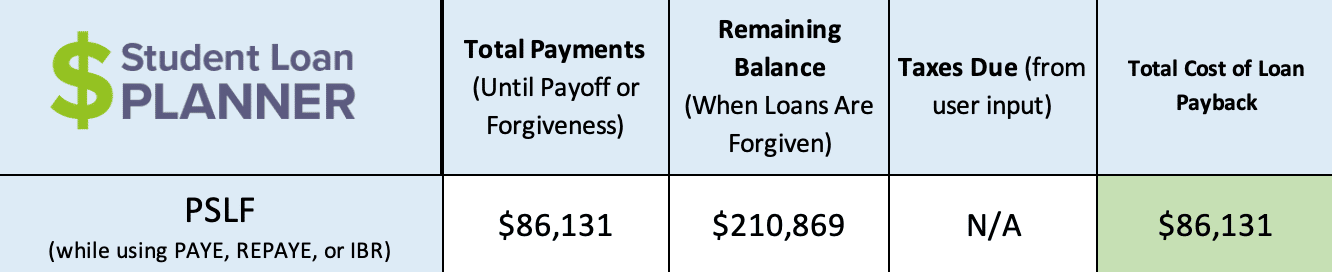

Tommy works for a University, gets on the Pay As You Earn repayment plan, and works there for 10 years (120 months) instead of the 20 or 25 years required for long-term forgiveness.

Tommy filing taxes jointly using PAYE:

Tommy files taxes separately using PAYE:

There you have it, folks. Working for a nonprofit and filing your taxes separately can be a game changer for an athletic trainer.

Tommy will pay about $6,000 for his $180,000 of student loans. Plus, there’s no tax bomb when pursuing Public Service Loan Forgiveness.

Certified athletic trainers can get a solid student loan plan

Your personal student loan plan may not look anything like Tommy’s. For example, Tommy’s loans are all federal loans. Private loans would require a different repayment strategy.

At Student Loan Planner®, we live for this stuff. We’ve consulted clients on over $2 billion of student loan debt. Book a consultation with us today. We look forward to helping you!