Refinancing is a common strategy for paying off medical school debt. Whether you’re a doctor in residency, an attending physician or a fellow, you need to know your medical school loan refinance options and how they affect your finances.

When refinancing student loans, a new loan is created with a private lender. You’d only refinance if you could get a lower interest rate — and even then, many doctors with federal loans might want to avoid refinancing due to some major drawbacks.

Student Loan Planner® estimates that refinancing medical school loans is the right choice for only 20% to 30% of physicians. The rest would come out ahead by going for federal loan forgiveness, such as with income-based repayment or Public Service Loan Forgiveness (PSLF). Be sure refinancing is the right move before taking steps to switch your loans to a private lender.

Top 4 lenders for medical student loan refinancing

Here are our top 4 lenders for medical student loan refinancing:

Laurel Road: Best for medical professionals

- Positives: Flexible repayment terms, profession based discounts

- Allows cosigners: Yes, cosigner release available after 36 months

- Deferment or forbearance available: Yes, up to 12 months

- Interest rates: Fixed starting at 5.44% APR; Variable starting at 5.49% APR

- Student Loan Planner® bonus: $300 for refinancing 50k to 100k, $1,050 for refinancing over 100k, OR interest rate discount if applicable.

While Laurel Road serves all borrowers, it is a must check for medical professions as well as Parent PLUS loan borrowers. They offer residency and fellowship refinancing and an additional 0.25% rate discount based on membership to different medical and dental associations. Laurel Road will automatically apply the better of our bonus up to $1,050 OR an applicable professional association discount you qualify for when you use our link to apply. *See disclosures

Earnest: Best for flexible repayment

- Positives: Flexible repayment terms, custom loan payments

- Allows cosigners: Yes

- Deferment or forbearance available: Yes, up to 36 months

- Interest rates: Fixed starting at 4.99% APR; Variable starting at 5.89% APR

- Bonus: $200 for refinancing 50k to $99,999; $1000 for refinancing 100k or more.

Payment flexibility and consistently low rates make Earnest a top lender Student Loan Planner® readers use when refinancing student loans. Earnest also services its own loans and has a Rate Match program that matches competitors' contractual interest rates. If you refinance $100,000 or more, you can get a $1000 bonus ($500 Earnest bonus + $500 from Student Loan Planner®). *See Earnest disclosures

SoFi: Best if you're unsure where to apply

- Positives: Competitive rates, flexible terms and view rates in just two minutes

- Allows cosigners: Yes, but no cosigner release offered

- Deferment or forbearance available: Yes, in limited situations

- Interest rates: Fixed rates 5.24 – 9.99% APR; Variable rates 6.24 – 9.99% APR (rates include optional 0.25% AutoPay discount)

- Bonus: $500 for refinancing 100k or more.

SoFi continues to be one of the top companies by total refinancing volume. They offer residency, fellowship and Parent PLUS refinancing. Currently, SoFi is offering rate discounts for medical and dental professionals. In addition to a 0.25% autopay discount, there's 0.25% off for those with an MD, DO, DDS, and DMD degree as well as 0.25% off for refinancing at least $150k in loans. Get up to a $500 SoFi bonus when you use our SoFi link to see if you qualify and refinance your student loans through them. *See disclosures here

Splash Financial: Best for easy application

- Positives: Compares multiple lenders, good customer service available

- Allows cosigners: No

- Deferment or forbearance available: Yes, length and availability varies based on lender

- Interest rates: Fixed starting at 4.99% APR; Variable starting at 5.28% APR

- Bonus: $300 for 50k to 99k or $1,000 when you refinance $100,000 or more

Splash searches multiple lenders at once and provides a rate estimate very quickly. Their site provides one of the best user experiences, and you can get a rough estimate of how good your rate will be in the market as a whole by applying with them. Get up to a $1,000 bonus when you use our Splash Financial link to apply and refinance. Note that if you refinance $100,000 or more, $500 of the $1,000 bonus comes directly from Student Loan Planner®. Lowest rates displayed may include an autopay discount of 0.25%.

Before you refinance medical student loans

Before tackling your student loans, you have to figure out what kind of loans you have. The average medical student carries six figures of student loan debt. It’s not uncommon to have a combination of federal loans and private loans.

You can check what federal student loans you have by logging into the National Student Loan Data System (NSLDS). Any loan listed in this database is federal debt that you still owe. And if you ask for a credit report from AnnualCreditReport.com, you can download a free summary of your entire credit history, including any private student loans you owe.

You might have taken out medical-specific loans as well. These could be housed under the Health Resources and Services Administration (HRSA). These loans won’t always show up on your credit report or in the NSLDS. If you have questions about these loans or need to review which ones you have, contact the HRSA directly.

Once you have all of your student loans mapped out, you should also be aware of your credit score. If you choose to refinance, having a healthy credit history will help get you the lowest rates available.

Physician student loan repayment options

Let’s look at this from a higher level first and examine the best ways we’ve found to attack student loans. This comes from our one-on-one work with more than 1,683 physicians, 1,124 dentists and 709 veterinarians totaling more than $1.2 billion in student debt.

There are essentially two ways to tackle student loans:

1. Taxable loan forgiveness using an Income-Driven Repayment (IDR) plan for federal loans

These loans from the federal government provide qualifying borrowers with amazing federal benefits such as forgiveness. For households that owe more than two times their income in student loans (for example, doctors who owe $400,000 and earn $200,000 or less), selecting an Income-Driven repayment (IDR) plan like Pay As You Earn (PAYE) or Revised Pay As You Earn (REPAYE) for 20 to 25 years could be the best option.

In the end, the remaining loan balance is forgiven, though you may owe taxes on the forgiven amount. The idea is to keep student loan payments as low as possible with IDR plans, save up for the tax bomb and work toward other financial goals along the way.

2. Aggressive repayment with refinancing to get a lower interest rate

This usually applies to doctors working in private practice. If a doctor owes 1.5 times their income in student loans or less (for example, owe $330,000 or less and make $220,000 or more), their best bet could be to pay off the debt as quickly as possible.

The goal is to keep the interest low and eliminate the debt in 10 years or less. This may also include refinancing to get a lower interest rate. An interest rate reduction could provide massive savings.

Many doctors might want to go with aggressive repayment. But this depends on their loan balance and whether their employer is a nonprofit or government employer that could make them eligible for Public Service Loan Forgiveness (PSLF).

How refinancing medical student loans can cost you

Refinancing might not be the best path for federal student loans. This is especially true if you're currently in residency. This is because refinancing means your loans will no longer be in the federal system, and you’re giving up benefits and flexible options forever. These include:

- Income-driven repayment (IDR) plans.

- Extended forbearance or deferment in periods of hardship.

- Federal loan forgiveness programs, such as the tax-free Public Service Loan Forgiveness (PSLF) program.

PSLF, in particular, is an amazing student loan forgiveness program that can wipe out all your federal loans in 10 years. You can enter PSLF as soon as you begin your residency training. This way, you can be on your path to forgiveness before you’re an attending physician.

PSLF is also a tax-free forgiveness program. This is especially important for anyone with large amounts of student loan debt. IDR forgiveness, on the other hand, treats all forgiven student loan debt as income, so you have to pay taxes. You’ll owe a hefty amount after you reach forgiveness, whereas PSLF lets you off the hook with Uncle Sam.

While on PSLF, you’re required to sign up for an IDR plan. Whether you’re in residency or already an attending physician, sign up for a plan that offers the lowest monthly payment amount. Your student loan balance will grow, but since you’re pursuing forgiveness after a few years, it shouldn’t be an issue.

Two payment options to consider are Pay As You Earn (PAYE) and Revised Pay As You Earn (REPAYE). Each of these repayment plans takes 10% of your discretionary income to calculate your monthly payment. After signing up for either PAYE or REPAYE, follow up on all needed paperwork for PSLF, then plan on forgiveness in 10 years.

When does it make sense to refinance medical student loans?

There are a few scenarios where student loan refinancing might make sense for your medical school loans. Let's take a look.

1. You don’t need PSLF or a federal loan forgiveness program

Not everyone with medical student loans is eligible for loan forgiveness. For example, only federal loans are eligible (private student loans don't qualify).

If you complete your residency at a for-profit hospital, you’ll set yourself back about five years on PSLF. You may decide to aggressively pay your medical student loans off instead. Know that if you refinance federal student loans, you’re giving up a lot of options. If you’re unsure and still in residency, don’t refinance. If you are sure, then you can refinance medical student loans.

2. You plan to work in the private sector

If you plan to work in the private sector — or already do — this means you qualify for PSLF because your employer isn't a 501(c)(3) not-for-profit organization. In this case, your situation is very straightforward.

If you have a good credit score, you should refinance your medical student loans and get rid of them as fast as you can. Because you won’t qualify for any of the federal forgiveness programs, it’s a no-brainer to refinance and save interest over the life of the loan.

Related: How to Start a Medical Practice

3. You have high-interest private student loans

Doctors with private medical student loans have very little to no flexibility with repayment.

Since the loans aren't in the federal program, there’s no opportunity for income-driven repayment or loan forgiveness. Forbearance is usually unavailable as well, except in some cases. The only thing that can be done is to pay back the loan at the terms laid out — or faster.

The good news is these loans can be refinanced. Any physician with private student loans should take a look at refinancing to see if you can find a lower rate. If you have private loans and have a cosigner, check to see if you'll need a cosigner to refinance or if it'll help with cosigner release.

4. You have a high-income-earning spouse

If you’re married to a high-income-earning spouse, your payments on REPAYE could be very steep. You’ll want to run the numbers on this using a student loan repayment calculator. Look at what your monthly payment would be if you filed taxes jointly versus separately. If you’re in residency and make less, filing separately can lower your payment. However, you may pay a larger amount when you file your federal tax return.

If you’re sure you can’t benefit from a forgiveness program like PSLF because your spouse makes a high income, then it might make sense to refinance medical school loans.

The bottom line? Refinance medical school loans if you’re confident in these scenarios:

- You can meet the financial obligation of making your monthly payments after student loan refinancing.

- Your new employer is not a not-for-profit 501(c)(3).

- You can’t or don’t want to go for loan forgiveness.

- You have private student loans and a healthy credit score.

There are many companies out there that refinance med school loans, and each will have its own offers. Look at all your refinancing options before making a decision.

Refinancing examples

The goal is always to spend as little as possible repaying student loans.

If a doctor’s student debt-to-income ratio is low enough, chances are they’ll end up paying off their loans in full if they choose an IDR plan since the payments are based on income, not the loan amount.

High income compared to loans could mean there won’t be any loans left to forgive as the loans would be paid off before the 20- to 25-year repayment term on an IDR.

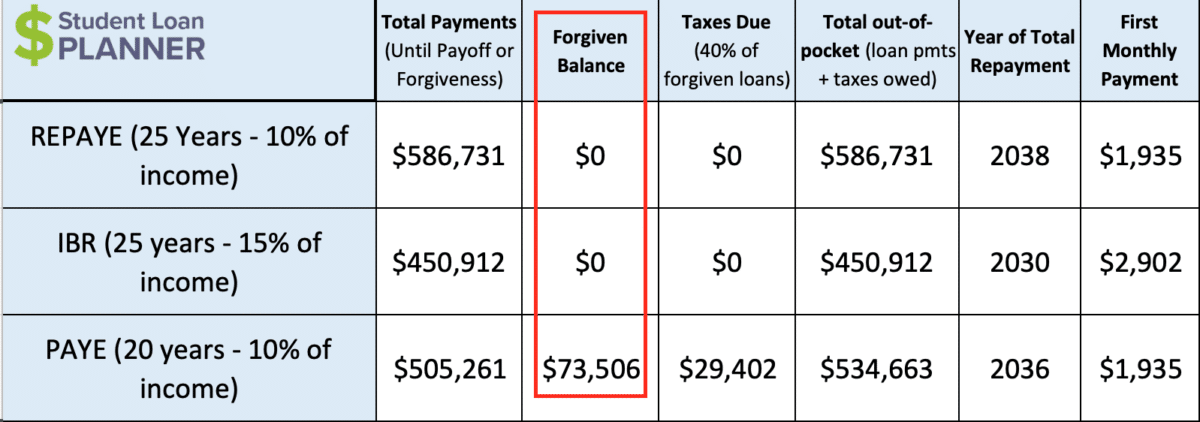

Let’s say that Sara is a recent med school graduate with $300,000 in student loans at 7% interest. She’s been on REPAYE for three years and is now an attending physician making $250,000 in private practice with projected raises of 3% each year.

As you can see here, if she stays on REPAYE, she’ll end up making $586,731 in total payments and will pay off the loan in full within 20 years, two years before she’d be eligible for taxable loan forgiveness. That’s because her calculated payment on REPAYE is high enough to pay down the loan. Paying off a 7% loan over 20 years is a very expensive way to pay back student loans and should be eliminated as a permanent option.

Even if she switches to PAYE and gets $73,506 of loan forgiveness, her total out-of-pocket cost is going to be $534,663 when you add the estimated payments and taxes due. Not even PAYE provides enough taxable loan forgiveness to make it worth it.

If a physician is going to end up paying their loans off in full anyway, the key is to keep the interest paid to a minimum. In other words, Sara wouldn’t want to stick with a 7% loan if she could do better.

The two main ways to do that would be to refinance to get a lower interest rate or to pay them off quickly.

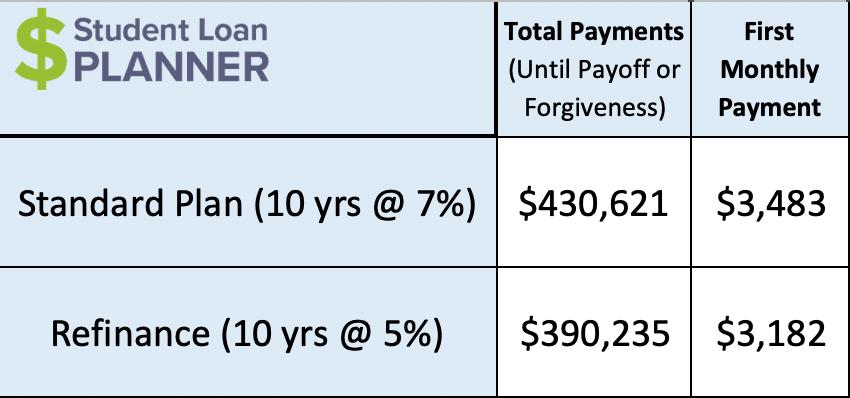

Let’s say Sara starts looking at the standard 10-year plan since staying on one of the income-driven plans is going to be expensive. She’s also considering refinancing down to 5% on these loans.

The standard plan is less costly than any of the income-driven plans, but refinancing is even better because it’s going to save her a bunch of money on interest. As you can see, refinancing from 7% to 5% would save about $40,000 in paying back the loans.

By Sara switching from REPAYE to refinancing, her out-of-pocket cost will go from $586,731 to $390,325. That’s $196,406 in savings — a monstrous number!

Plus, she’d be debt-free in half the time. We would rather Sara keep that extra money in her pocket and be debt-free much sooner. Kind of a no-brainer to refinance here.

Should you consolidate your med school loans?

During our consults, there’s a lot of talk and confusion around what consolidation means. That’s because “experts” mix up the terms all the time.

Are refinancing and consolidation the same thing? No!

Consolidation means keeping the loan in the federal program. This keeps the loan eligible for income-driven repayment, possible loan forgiveness, forbearance, etc.

Refinancing is different. It pulls the loans out of the federal program and makes them private loans. Basically, the bank pays off the federal loans, and then you have to pay back the bank. All of the federal loan program perks are gone for good. This is worth it if there’s no loan forgiveness on the table and if there’s significant savings in paying back the loan.

Next time you hear someone is getting a consolidation loan at a private lender, they mean they’re refinancing.

Options to refinance your medical school loans

The interest rates of your loans are one of the first considerations when refinancing your med school debt. Most lenders offer you options for fixed interest rates and variable interest rates. Fixed-rate loans never increase (or decrease). Variable-rate loans are tied to short-term interest rates that fluctuate with the market.

Usually, loans with a variable APR start with lower interest rates. But they can increase (or decrease) over time. If you want the predictability of having a set monthly payment and knowing your rate from here on out, then choose an option with a fixed APR to refinance your med school loans.

When looking at lenders for student loan refinancing, consider what benefits they can offer you other than just a low APR. For example, some lenders offer unemployment benefits.

Below are three strong lending options for refinancing medical school loans. Each of these companies offers an autopay discount for enrolling in automatic payments, a hefty cash bonus and flexible repayment options.

Laurel Road

Laurel Road invented residency and fellowship refinancing and typically has competitive rates. The lender offers reduced payments as low as $100 per month for medical and dental residents. Notably, interest accrued during this period does not capitalize. If you’re looking for a relatively low required payment with significant interest rate savings, Laurel Road could be a great fit.

Laurel Road doesn't charge any application or origination fees. There are no prepayment penalties either. You can get up to a $1,050 bonus or 0.25% interest rate discount with Laurel Road by using our link. Student Loan Planner® negotiated an exclusive tiered cash bonus with Laurel Road, so the higher your refinancing amount, the larger your cash-back bonus. Learn more about Laurel Road in our full review.

SoFi

SoFi is another solid option for medical student loan refinancing, especially during residency. Like Laurel Road, SoFi offers $100 medical resident payments for up to seven years. However, it should be noted that the interest that accrues during residency will capitalize when regular monthly payments begin.

Both fixed- and variable-rate loans are available for SoFi's medical student loan refinance product. There are no fees, and borrowers can choose from a variety of repayment terms from five to 20 years. Plus, SoFi has options to defer or reduce payments in some situations.

SoFi is currently offering rate discounts for medical and dental professionals. These include a discount of up to 0.75% off fixed and variable headline rates:

- 0.25% off for those with an MD, DO, DDS, and DMD degree,

- 0.25% off for refinancing at least $150k in loans, and

- 0.25% off for setting up autopay.

Get up to a $500 bonus through our SoFi link. For more information about this lender, check out our SoFi refinancing review.

Earnest

Laurel Road and SoFi are two great student loan refinance options for medical residents. But Earnest could be a good choice for attending physicians.

Earnest's underwriting algorithms look at more than just your credit score (such as your employment and financial accounts) when determining eligibility and rates. So if you're already earning a solid income in the medical field, Earnest may be willing to offer you a lower interest rate than other lenders.

In addition to its comprehensive application process, Earnest offers a lot of payment flexibility. You'll have 180 repayment terms to choose from (between five and 20 years) and can even skip one payment per year without penalty. Plus, borrowers who refinance $100,000+ can get a $1,000 bonus when refinancing with Earnest ($500 Earnest bonus + $500 from Student Loan Planner®). See our Earnest Student Loan Refinance review.

You can also shop for refinancing lenders even if you refinanced in the past. Check rates and compare refinancing options from Splash Financial and more to help you wipe out medical school loan debt with a low-interest loan or one that has a more attractive loan term.

Ask us if refinancing medical school loans is right for you

When you refinance your medical school loans, it’s permanent. If you’re still unsure about your student loan refinancing options or want professional help to crunch the numbers, reach out to our consultants today. We specialize in helping individuals with large sums of student loan debt. We'll look at your forgiveness options and repayment programs to help you create a student loan payoff plan for wherever you’re at with medical school.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.99 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 4.99 - 9.74% APR

Variable 5.89 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.24 - 10.99% APR

Variable 5.28 - 12.43% APR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).