The student loan refinancing ladder strategy is relatively simple. Since you can get huge bonuses to refinance student loans through Student Loan Planner®, you should always be willing to refinance if you've already done so and you can find a lower interest rate.

However, sometimes borrowers are afraid to choose a short repayment term like 5 years even though it comes with the lowest interest rate. The reason? Because the required payment for a 5 year loan is about 4 times as much as the required payment for a 20 year loan.

The pandemic brought long-term loan rates down, and lenders are offering extremely low interest rates. So that means there's not that much of an interest rate penalty for starting out with a 15 year or 20 year fixed term on your newly refinanced student loan.

You'd then refinance multiple times to a ten year, seven year, five year, and eventually five year variable.

This student loan refinancing strategy is all about minimizing your required monthly payment while maximizing your interest savings. The refinancing ladder also allows you to buy houses, medical or dental practices, or other big purchases without compromising your cash flow.

We surveyed more than 3,000 Student Loan Planner® readers in February 2021, and about 30% of our audience did not know that you could refinance student loans more than once.

We also discovered from this survey that borrowers very rarely refinance more than one time. However, if you use the student loan refinancing ladder strategy, you might become excited to refinance early and often.

Get Started With Our New IDR Calculator

What is a student loan refinancing ladder?

When you refinance, you’ll have a minimum payment that you must make every month. While most of our top lender partners on our refinancing page give you the option to pause payments for up to three months, that’s nowhere near as good as up to three years of forbearance protection you have on federal student loans.

Of course, federal student loans also have a very high-interest rate that can often approach 8%.

In our survey, 85% of borrowers feared refinancing for various reasons like potential job loss, recession, having kids, buying a house or practice, or new government forgiveness programs.

How can you mitigate the fear of refinancing while also benefiting from cutting your interest rate?

Student Loan Refinance Ladder Steps

This is where a student loan refinancing ladder comes into play.

- Generally, you start off with a 10, 15, or 20-year fixed rate loan term. If you're not getting at least a 0.25% lower interest rate, go with the longest loan term available.

- Make extra prepayments over and above what the lender requires. This knocks your principal balance down faster than scheduled.

- Then refinance to a shorter repayment term with a new lender, such as 7, 10, or 15 year fixed. As long as you can find a better rate, you should do this. Your monthly payment will likely not change very much because you paid down extra principal.

- Once the balance is one-third or less than what you started with, refinance to a 5 year variable with yet another lender so that almost all of your payments will be going to principal.

If these prepayments are very high, you’ll reach a point where you could refinance again to a shorter term at a similar monthly payment with a lower interest rate. This allows you to reduce your interest expense and pick up another cash back bonus if you use our referral links I linked to above.

The benefit you got by starting out with a longer term was increased flexibility to pay less towards your loans if you need to because of a big life event.

Example of a Student Loan Refinance Ladder

You'll see this is more detail below, but here's how a student loan refinance ladder might work out in practice. This strategy works best when you make large extra payments on your student loans when you have the money available.

- You refinance $400,000 to a 20 year fixed rate of 4.00%.

- You pay down about half to $200,000 and refinance with a different company to a 10 year fixed rate at 3.5%.

- You pay that loan down by half to about $100,000, and you refinance again to a 5 year fixed or variable rate.

The required monthly payment would stay about $2,000 to $2,500 a month throughout, but you would get out of debt very quickly as long as you made big prepayments.

And if you use the Student Loan Planner® referral links, you'd earn over $3,000 in cash back bonuses too. See the bottom of this article for more details on that.

Using the student loan refinancing ladder to buy a practice or a house

Imagine you owe $400,000 and earn $300,000 per year. You’ve been out of school for three years, so you know that your REPAYE interest subsidy is over. You also know that you eventually need to pay back your loans in full because your debt to income ratio is well below 1.5 to 1.

However, maybe you just became a practice owner, or perhaps you're hoping to buy or remodel a new home. Having anything get in the way of your dreams if it doesn't save you a ton of money would be counterproductive.

You might only save 1% to 2% by refinancing, which in this case would be $4,000 to $8,000 per year, declining each year you pay down the principal.

Imagine if refinancing got in the way of buying a house or a dental practice. You’d be pretty upset.

Your first inclination might be to choose the 5-year term since that one has the lowest interest rate. However, you’d be looking at a monthly payment of $7,152 assuming a 2.8% refinancing rate. That's around a third of your pay.

That kind of a cash flow commitment might restrict your options in life for the next few years.

First rung of the refinancing ladder: A long-term loan

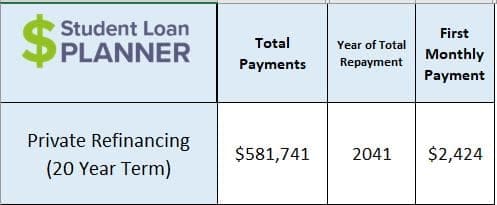

Instead of the five-year, let’s assume you select a 20-year fixed rate at 4% through Laurel Road. Instead of a required payment of $7,152 a month, your payment would be $2,424 a month.

As long as you have 5% to 10% of the practice purchase price in liquid assets, no mortgage or practice loan banker is going to bat an eye at a student loan payment well below $3,000 a month.

I’ve actually seen a borrower who refinanced to a 10-year rate only to have to contact the lender and refinance to a 15 year at a higher rate because his bank didn’t want to give him a mortgage. The percent of his income going to debt was above the 40% threshold that gives some banks concern.

If he had used the student loan refinancing ladder, he wouldn’t have had this issue.

Here's what the payment and total interest would look like if he stuck with this term.

Next rung of the refi ladder: refinancing a second time after big prepayments

Let’s assume our borrower chose that 20-year note and paid $9,000 a month instead of the required $2,424. You can do this with all Student Loan Planner® refinancing partners because none of them charge prepayment penalties.

After two years, your balance would be at about $211,000 down from the original $400,000.

Rather than continue making these big payments, let’s assume you check our refi partners again and you find a 10-year fixed rate of 3.5%.

Your required payment would now be $2,086 a month instead of $2,424.

However, you cut your interest rate by 0.5% and you picked up a $1000+ cash back bonus if you used our link. That means more of your payments are going to principal.

Final step of the ladder: choosing a five-year term with a fixed or variable interest rate

Assume you continue those large over payments of $9,000 per month even though your required payment is much lower. You do this for several months and now have about $120,000 remaining.

While you could ride down that 3.5% ten-year rate to $0 debt, you might as well try refinancing one more time for a five year fixed or variable interest rate.

When you’re down to a low six or high five-figure sum and you’re making rapid progress towards debt freedom, you can probably afford to take variable interest rate risk. Not so much when you still have your original debt amount and you earn less than you owe.

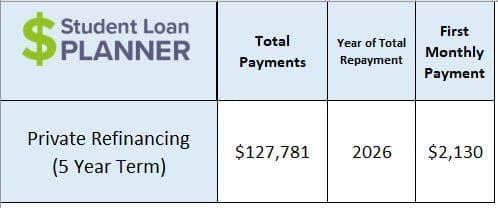

Assume you could refinance to a five year fixed rate of 3% with Earnest or a five-year variable rate of 2%.

While variable rates scare people, you should only be afraid if you’re not in a position to rapidly pay down the principal balance. My wife Christine and I refinanced with a 5-year variable rate twice on her $124,000 of student debt.

We could’ve used the excess cash flow to invest instead, but we wanted to be debt free so we used prepayments to rapidly eliminate what she owed since almost all our money went to principal instead of interest at a low five-year variable rate.

We would not have taken that risk if she owed a lot more than her income.

You might even add an optional fourth rung of the ladder where you refinance from a five-year fixed rate to a five-year variable rate. It’s completely up to you.

So let's say the variable rate would be an average of 2.5%. Here's what the required payment would look like after you've paid down so much of the loan. Now it's only $2,130. You've dramatically reduced the time it's going to take you to be debt free while minimizing your required monthly payment.

Why is Having a Small Required Student Loan Payment Helpful?

Think about what would happen if we had a repeat of 2008, but you had committed to a $8,000 per month student loan payment.

At a minimum, you would miss out on being able to make large investments in beaten down stocks and real estate. At worst, you'd be at the mercy of lenders to provide you with a forbearance or pause on payments.

Once you've lowered your student loan interest significantly, then the primary concern should be having balance in your financial life so that you don't feel overextended.

It's also important to not put big dreams you have on hold solely because of your student loan payments.

Why do so few people use a student loan refinancing ladder?

I have to tell you this strategy is awesome for folks who want to minimize their required payment while steadily improving on their interest rate over time.

However, few people use this strategy. Why is this? Allow some data from our refinancing survey of our readers to shed some light.

Proof that borrowers aren’t using this strategy right now

I mentioned earlier that half of SLP readers had no idea you could refinance more than once. That knowledge is pivotal to using a refinancing ladder strategy. Pretend you know this though, what else holds up borrowers from using this approach?

We asked borrowers who had refinanced how many times they had done so. Here’s the result below for over 200 readers.

| Number of times | Percent |

|---|---|

| 1 | 87% |

| 2 | 10% |

| 3 or more | 3% |

Refinancing twice is uncommon, and refinancing three times or more is pretty rare. Clearly, our readers are not doing this right now, even though I’ve shown you how much you could benefit by keeping your payments in check all while reducing your interest rate and picking up additional cash back bonuses.

How much lower of an interest rate would you need to refinance again?

We asked people in the survey how much of an interest rate improvement they’d need to refinance again. Keep in mind these are Student Loan Planner® readers. You are more sophisticated than the typical borrower.

| Improvement needed | % who answered |

|---|---|

| 0% to 0.5% | 3% |

| 0.5% to 1% | 10% |

| 1% to 1.5% | 26% |

| 2% to 2.5% | 26% |

| 2.5% to 3% | 13% |

| Over 3% | 22% |

A staggering majority of you said that you’d need over a 2% interest rate improvement to refinance again. This is highly irrational. Not only are there no costs to refinancing except perhaps 30 min to a couple hours of your time, but there are also negative costs.

You’re saving money on interest and getting a cash back bonus of $200 to $500. If you can find a lower rate of even 0.5%, you should refinance a second time (or third, fourth, etc.)

For the student loan refinancing ladder to work, you need to know about several lenders to be able to facilitate shopping around to find better rates. The majority of our readers only knew about 2 or fewer lenders before discovering this site.

That means you should acquaint yourself with the six partners we primarily work with so you can do a two minute rate check with each one six months to two years after refinancing for the first time.

Use a refinancing ladder to save money in these situations

If you are worried about having to make your monthly payment, you should probably not be refinancing in the first place because of superior government protections given to federal loans.

That said, you might be able to easily cover the 20-year payment without breaking a sweat while the five-year would give you pause.

Any professional going through big life changes like having a baby, moving to a new city, starting a new business, or looking to buy a house could benefit from the flexibility of a well-constructed student loan refinancing ladder.

Sometimes the lender you’re already at will let you refinance again without even leaving, especially if you show them a competitor’s offer.

Never refinance if you should be relying on loan forgiveness. That said, I hope this new strategy opens your eyes to the possibilities that exist thanks to the number of good lenders in the student loan refinancing market.

Have any questions about a student loan refinancing ladder or how to implement the concept in your situation? Comment below and ask!

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Can you refinance a student loan if you are a cosigner and the person stopped paying on their loan.

Yes you have to apply in your name alone Teresa and then you should be able to refinance it into your name. The exception is if you didnt pick up the payments when it went into default, then you might have some trouble bc nobody will refinance a loan in default. In that case you might be able to use another person’s name to refinance the debt. You might need to apply around to several lenders and have conversations with them about what is possible. https://www.studentloanplanner.com/refi is a good place to start.

If I refinance from one company to another can I come back to that same company? If so are their time lines I must wait to do so?

There aren’t timelines you can come back to them whenever you want. Some companies like Earnest only allow you to receive a cash bonus one time, but that’s to be expected. The most important thing after all is controlling your required payment and interest rate, and getting bonuses each time you do it is just icing on the cake.

With student loan interest front loaded, would it be dumb to refinance after a year for 0.5% lower interest rate with same 10 term? I plan to pay extra to the principal.

If you can get a lower interest rate and refinancing is part of your repayment strategy, then go for it!

Can you explain specifically how the cash back bonus works? Would the bonus be applied toward your loan? Or is the bonus given directly to the borrower to use at their discretion? Thanks

It depends on the lender. We partner with several that offer cash back offers for refinancing: https://www.studentloanplanner.com/refinance-student-loans/

For the first rung of the ladder would you select a loan based off term length thus maximized savings to use for principal or would you select a loan with the lowest interest rate? example you have an existing loan with 8 years left and are deciding between refinancing to a 20, 15 , or 10 year term length?

Hey McClain, if you’re not getting at least a 0.25% lower interest rate, go with the longest loan term available. Take our refi quiz to help you in your decision as well as the 9 Best Student Loan Refinance Companies (Bonus up to $1,275) we work with. If you need a second opinion on your strategy, it may help to book a consultation with the team.