Editor's note: The TEPSLF program was effectively replaced by the vastly superior PSLF Waiver program. While the PSLF Waiver has expired, most public servants can get all of the same benefits through the one-time IDR Adjustment. Go read that link first and then check out this success story about TEPSLF, which we expect will go back into place once all the pandemic era waivers are over.

I recently received an email from a reader named Jamie who had her loans forgiven under the TEPSLF Program. She was lucky enough to have two Direct Loans issued in 2001. That’s well before 2010, when everyone got Direct Loans issued to them by default.

While Jamie had enough credit working full time at a qualifying employer, she did not have enough income-driven payments to qualify for Public Service Loan Forgiveness. But Jamie was determined, followed instructions to the letter and didn't get discouraged during the drawn-out process.

Jamie’s experience is a wonderful case study of how to successfully apply for loan forgiveness under the Temporary Expanded PSLF Program.

What is the TEPSLF Program?

When the Public Service Loan Forgiveness program was created, it was naively assumed that all borrowers would voluntarily join an Income-Driven Repayment plan, or IDR for short. Why? Because the 10-Year Standard Repayment plan would be useless, as you'd pay off your loans before qualifying for any loan cancellation anyway.

But the 10-Year plan and IDR plans aren't the only options for federal loan student loan borrowers. Other non-income-based plans take longer than 10 years of payments to finish, such as the Extended Repayment Plan that Jamie happened to be in.

Someone like Jamie could spend 10 years paying their federal Direct Loans while working for a qualifying employer, only to have their PSLF form rejected because they were on the “wrong loan repayment plan.” But this doesn't line up with the spirit of why the IDR requirement was included in the first place and is terribly unfair to our public service workers.

Congress passed the Consolidated Appropriations Act in 2018, to remedy some of the mess created in 2007 when they horribly designed PSLF. Under this bill, Congress created TEPSLF and set up a $350 million fund to help folks get forgiveness by expanding the qualifying repayment plan criteria. The expanded list of qualifying plans now includes:

- Graduated Repayment Plan

- Extended Repayment Plan

- Consolidated Standard Repayment Plan

- Consolidated Graduated Repayment Plan

Democrats wanted about 10 times as much money allocated to the TEPSLF fund. But Republicans controlled Washington at the time. Hence, they settled on a much lower figure. Furthermore, once that $350 million gets used up, there won’t be additional funds for relief.

TEPSLF requirements make it tough to qualify for forgiveness

TEPSLF forgives student loan debt for borrowers who meet the following requirements:

- Have at least 10 years of full-time work experience for a qualifying non-profit or government employer

- Had Direct federal loans during this entire public service employment period

- Made at least 120 on-time qualifying payments (payments for the full payment amount due no later than 15 days after your due date while working full-time for a qualifying employer)

- Applied for PSLF using the PSLF Help Tool or by downloading and mailing the employment certification form (ECF) to MOHELA. Then, you must get denied and submit a Request for PSLF Reconsideration

Note that only student debt via the Direct Loan program qualifies for TEPSLF. That means you won't be eligible if your only federal student loans are Federal Family Education Loan (FFEL) Program loans or Perkins Loans.

These requirements apply to a very small group of folks. When PSLF was created in 2007, less than 20% of borrowers had Direct Loans.

When I received Jamie’s email, I was rather shocked to see her disbursement date said 2001. She not only had to do everything correctly, but she also had to get a little lucky as to what institution issued her debt. Before 2010, Direct Loan issuance depended on where you went to school.

Jamie’s experience with the TEPSLF Program

I asked Jamie to share her story with our readers, and she graciously agreed, saying she wanted to help as many people as possible. Here’s our edited exchange.

Q: What was your first step in the TEPSLF application process?

A: I sent in my application for PSLF forgiveness on November 10, knowing it would be denied. I did not request forbearance on my application, knowing I would be refunded any overage. On the same day, I sent the following email to TEPSLF@myfedloan.org with my name and date of birth:

“I request that ED consider my eligibility for public service loan forgiveness. I’m uploading my application for PSLF. I was in the extended repayment plan prior to getting on the IBR plan in 2009 and believe I’ve met all the requirements for TEPSLF.”

Q: When did FedLoan contact you next about TEPSLF?

A: I received an email on November 13 stating that they have received my application, and it said it would take 30 to 90 days to review. Some time in the middle of November (I don’t know the exact date), I contacted them to make sure they had everything they needed from me. On November 30, I received the following email:

Thank you for contacting FedLoan Servicing!

Your Public Service Loan Forgiveness (PSLF) Application was received and processed. Unfortunately, your application was denied because you have not yet made 120 qualifying payments for PSLF. Although you do not meet the requirements to have your loan debt forgiven yet, we were able to consider the time verified as qualifying employment.

Your request to be considered for the Temporary Expanded Public Service Loan Forgiveness (TEPSLF) program was received also. Your account is currently being reviewed to determine your eligibility. You will receive a notice regarding the approval or denial after we have completed the review.

Please use the “Contact Us” link through your online account at MyFedLoan.org to submit inquiries via a secure email form. You may also call us toll-free at 1-800-699-2908 to reach our Customer Service Department, which is open Monday through Friday, 8:00 AM – 9:00 PM (ET).

Sincerely,

Elizabeth

FedLoan Servicing

Q: When did you first realize your loans were forgiven?

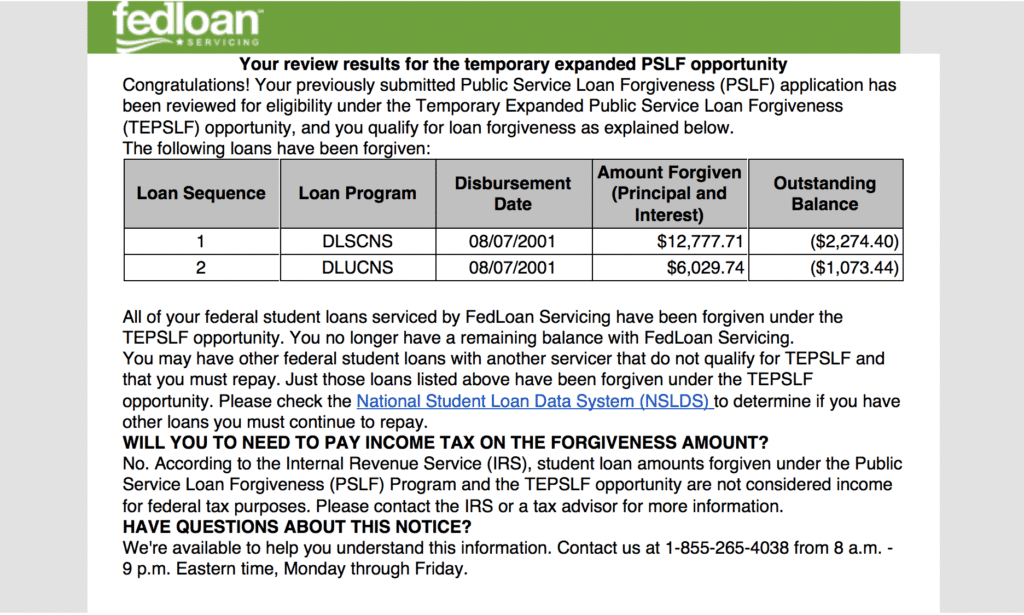

A: On December 15 or 16 (during the weekend), I checked my account, and it showed a remaining balance of negative $3,347.84, although I hadn’t received any notification from them. On December 17, I received the following email:

Q: How long did FedLoan say the refund of your excess payments would take?

A: I saw that the balance was equal to my last eight monthly payments. I called them to see how long it would take to receive the refund. I can’t remember if they said 60 to 90 days or 90 to 120 days.

Regardless, it sounded like it would take at least a couple of months. I’m pretty excited because it was almost $19,000 of loans forgiven. I was quite surprised at how quickly the TEPSLF process went.

What I learned about TEPSLF from Jamie’s story

One thing I noticed from Jamie’s experience is that she was very efficient in her approach to applying for loan forgiveness.

You’ve probably been on hold before for 20 minutes and experienced terrible customer service. It feels fantastic to get upset or vent. But the fastest way to get what you want is to avoid doing that.

Jamie’s email made me feel like she must have had ice in her veins dealing with FedLoan, which was the previous loan servicer responsible for managing the PSLF program.

For example, when she emailed FedLoan about TEPSLF, she didn’t send a long story about how messed up the program was. She followed instructions to the letter. For example, on FedLoan’s website, they told borrowers to follow this model for the TEPSLF email:

To: TEPSLF@myfedloan.org

Subject: TEPSLF request

I request that ED reconsider my eligibility for public service loan forgiveness.

Name: [Enter the same name under which you submitted your PSLF application]

Date of Birth: [Enter your date of birth in MM/DD/YYYY format]

This looked a lot like Jamie’s email.

Note that the process for submitting a PSLF reconsideration request is more streamlined now. It should only take about five minutes once you log in to your Federal Student Aid (FSA) account.

Are TEPSLF applications expedited for smaller loan balances?

The PSLF program was created in 2007. If you were in med school and did everything correctly, you would not have made payments until 2011, which would have made you eligible in 2021.

Most of the PSLF and TEPSLF stories I’ve seen thus far have been for folks with small undergrad or one or two-year master’s degree balances.

I secretly wonder if FedLoan (the previous exclusive TEPSLF servicer) addressed smaller balances like Jamie’s first. The speed with which they tackled her application for TEPSLF astounded me.

If you know you had Direct Loans only before 2009, you need to apply for TEPSLF and use Jamie’s approach as a template.

The government is giving people refunds for overpaying on their loans

What’s unreal to me is that the government is allowing people like Jamie to continue making regular student loan payments to make doubly sure she qualifies, but then refunding the overpayments!

That makes the TEPSLF opportunity an exciting one to me. It means that the government is not only forgiving borrowers’ loans, but they are sticking to their end of the bargain to take no more than required under the PSLF rules.

I’ve seen some pics online of the Treasury Department writing a bunch of checks for the months of extra payments.

TEPSLF could indeed be managed better, but I’m encouraged by stories like Jamie’s.

What TEPSLF tells me about PSLF

If you plan on repealing a government program, you don’t give hundreds of millions of dollars to expand that program. Yet that’s exactly what our legislators did when they passed the Consolidated Appropriations Bill.

If PSLF was going away for current borrowers, do you think they would’ve pumped even more money into expanding it?

Jamie’s story shows that while loan forgiveness can be difficult, it will eventually become commonplace, unless there is a massive change in federal policy. However, this isn't likely, given the PSLF Waiver opportunity that was put in place by the Biden Administration and expired October 31, 2022.

Borrowers who stay on top of their finances like you will benefit enormously, and those who ignore their loans will lose out big time.

If you’d like to get more TEPSLF information and a professional review of your loan situation, we’d love to work with you.

Update from Jamie: “I called them a few days ago wondering when my refund would take place. They said it would take about 90 days. Without warning, this morning I noticed 16 deposits into my checking account that add up to the 8 months worth of loans they are refunding.”

That's exciting!

What do you think of Jamie’s experience getting her loans forgiven under TEPSLF? Do you have questions about the program? Ask below!

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.