There’s a sea change in higher education finance happening before our eyes in 2023. President Biden announced his New Revised Pay As You Earn (REPAYE) plan on January 10, 2023. Once this IDR plan becomes available, it could lead to a clear majority of undergraduate borrowers rationally paying as little as possible on their student loans.

The current status quo of undergraduate borrowers mostly paying down their debt would be radically altered, which would have major implications for loan counseling, borrowing, tax filing status, tuition rates, and more.

Contrasting Old REPAYE and New REPAYE for Undergraduate Borrowers

The current REPAYE plan requires an undergraduate borrower to pay 10% of income for 20 years until forgiveness. Notably, spousal income cannot be excluded if you are married, although that spousal income is applied proportionally if both spouses have loans.

Additionally, borrowers may only deduct 150% of the poverty line before having to pay 10%.

The formula for New REPAYE allows a borrower to pay 5% of income instead of 10%. It also allows a borrower to file taxes separately and exclude his spouse’s income. The poverty line deduction jumps from 150% to 225%.

Perhaps the only “negative” chance for most borrowers under New REPAYE is that family size would exclude a spouse if a borrower filed taxes separately. In current rules for PAYE and IBR for example, which allow a borrower to file separate, family size is based on the persons in a family regardless of tax filing status.

But the larger deduction of 225% of the poverty line in every case results in a larger amount of excluded income, so this point is largely moot.

Related: Will Borrowers Need to Enroll in PAYE to Remain on It?

Why So Few Undergraduates Get Forgiveness Currently

Both Old REPAYE and New REPAYE have no partial financial hardship requirement. Your payment is unlimited based on this 5% or 10% of discretionary income formula.

Under current IDR rules, it’s very difficult to get a low enough payment as an undergraduate that results in any forgiveness after 10 years on the Public Service Loan Forgiveness (PSLF) program or 20 years on the PAYE and REPAYE programs.

Consider a borrower with an income of $50,000 and student debt of $30,000.

Under the Old REPAYE plan, this borrower would pay $247 a month.

After 13 years, the borrower would have paid off her loans completely.

If this borrower pursued PSLF over 10 years, the borrower would have paid $33,950. There would still be a small $9,600 balance to forgive, but the borrower is not really saving much money at all compared to the time and effort required to manage repayment and apply for PSLF.

If this borrower owed less money, say $12,000, the REPAYE payment would still be $247 a month.

She could opt for the Standard 10 Year plan for a lower payment, but there would be no loans left to forgive since that’s a fully amortized payment schedule resulting in 0 loans after 10 years.

Hence under current rules, getting forgiveness as an undergraduate applies to very few individuals.

As a result, undergraduate borrowers are incentivized to borrow as little as possible and to keep their balances manageable.

Because it is so hard to get forgiveness on undergraduate loans, a high share of undergraduate students default, approximately 19% according to the Department of Education.

This is all about to change with New REPAYE.

How Many Undergraduates Would Pursue Forgiveness Under New REPAYE?

Answering this question requires a lot of guesswork and assumptions. We will seek to disprove that a high-income borrower with below average student debt could receive forgiveness under Biden’s new plan.

If that borrower could receive forgiveness, then we are setting a floor on the percentile of borrowers who could seek student loan forgiveness under Biden’s New REPAYE plan.

Assumptions for New REPAYE Undergrad Forgiveness Example

According to the data from the Census Bureau’s American Communities Survey, the 75th percentile of earnings for a bachelor’s degree holder is about $79,000 a year.

The average family size according to the Census is 3.2.

In terms of family size, borrowers generally start out with a family size of 1, which grows as they age and have children.

Since more than 50% of borrowers have children and would file taxes separately if married to an individual with no student debt, based on the New REPAYE rules, we will use an average family size of 2 for these calculations.

This is again likely an understatement. If this borrower could receive forgiveness, then the true percentage of undergrad borrowers who would pursue forgiveness is likely even higher than 75%.

Borrower Payment Examples

Many individuals earning almost $80,000 are married to spouses who also earn significant income.

Let’s assume the borrower here could max our her 401k plan at $20,500 per year.

Her AGI would only be $56,500.

One could further model maxing out an HSA plan, but let’s assume she only has access to a 401k.

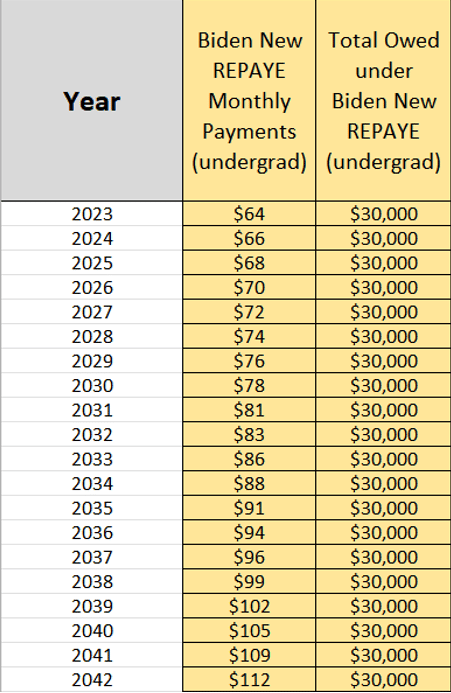

Here’s what her payments would look like over 20 years under New REPAYE on $30,000 of student debt, assuming $79,000 of income adjusted upwards at 3% a year.

Over 20 years, this borrower would pay $20,559. Note that the balance owed under New REPAYE does not increase as all interest above the required payment is subsidized.

How Borrowers Could Get Even Small Balances Forgiven under New REPAYE

Assume this borrower only took out $12,000 of loans for school.

Under the New REPAYE plan, smaller student loan balances can get forgiveness. In this situation, her repayment period would be only 10 years.

Keep in mind that generally, an IDR payment in the first year out of school is 0 as it’s based on prior year AGI, and most people earn 0 in the year they graduate as a student.

The second year, the payment would almost be 0 too because the AGI would reflect working half the year.

If we take that into account, the borrower above earning almost $80,000 would pay $7,218 over 10 years and the remaining balance would be forgiven in year 10.

The forgiveness timeline goes up by 1 year for every $1,000 above the $12,000 threshold until hitting 20 years until forgiveness.

Examples Where Undergrads Would Pay Their Loans

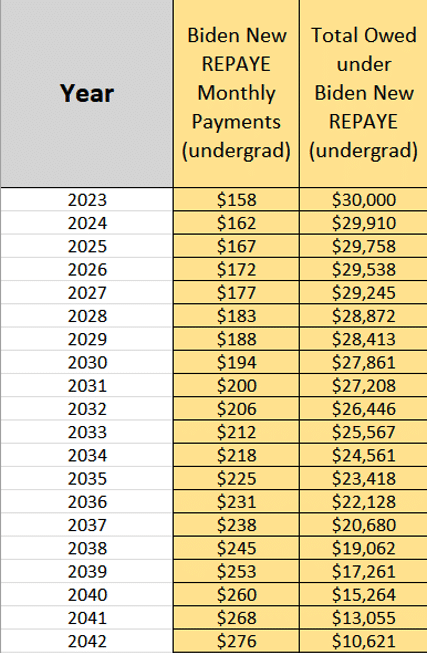

In the above example, if the borrower did not save for retirement at all, her full $79,000 AGI would count towards the New REPAYE formula. Here’s how her payments would look.

In this example, she would pay $50,788 and have her remaining balance forgiven. Notice That her payment barely covers the interest, so she receives no subsidy. She pays down her loan so slowly that she still has a balance left to forgive of about $10,000 after 20 years. In this case, she would be better off paying down her loan aggressively to lessen the total $20,000 in interest she would pay over two decades.

Examples of Borrowers with Larger Family Sizes

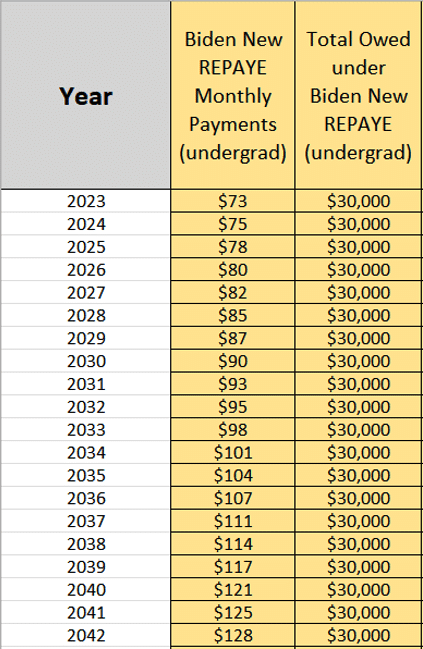

Due to the change in the 225% deduction for the poverty line, imagine a family of 5 with both spouses earning $80,000 per person who do not save for anything for retirement. Let’s say both of them have $30,000 of student loans.

If they filed joint, their total payments would be $529 a month, split into two. They would pay roughly $264.50 each monthly.

If they file taxes separately, under the New REPAYE rules, their family size cannot count the spouse anymore, but they each get to count the children. Thus, both borrowers get a family size of 4.

Here’s what one of their payments would look like.

Over 20 years, they would pay a total of $23,596. Both spouses would seek forgiveness and file taxes separately.

Changes in Borrower Behavior Could See 80% to 90% of Undergraduates Pursuing Student Loan Forgiveness

The creation of New REPAYE is a major safety net to lower income borrowers. That said, higher income and middle-class borrowers will rationally take advantage of the rules.

Borrowers who take out less debt than they qualify for that realize there is zero marginal cost to borrowing the maximum will be likely to pursue forgiveness.

Parent PLUS borrowers who take out $30,000 of loans might conclude it’s smarter to forgo claiming their child on their taxes so the child can borrow an additional $4,000 to $5,000 per year in the student’s name and have it all forgiven.

An increase in the generosity of federal student aid programs would likely lead to increased college enrollment as well. This would increase the share pursuing forgiveness as the added marginal student is far more likely than existing students to pursue forgiveness.

The New REPAYE Plan Will Make Traditional Advice About Paying Back Debt Archaic

Regardless of what percent of undergraduate borrowers end up pursuing forgiveness under New REPAYE, it’s clear that it will be a significant majority.

That reality will change the default advice of “live like a college student for a few years so you can pay back your loans.”

The new default strategy of paying back your student debt will be to lower your Adjusted Gross Income and strategically lower your payments while getting as much forgiven as possible.

This includes students and parents avoiding behaviors like tapping savings, home equity, and private student loans to fund college.

If you need help navigating the new rules, Student Loan Planner® would love to help. Just book a time with one of our expert consultants.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

I am currently in the PAYE plan based on a consult with SLP that I did in 2019. All loans were after 2014 for vet school. I have had $0 payments so far due to income and then Covid pause . Do you think I would better off staying in this PAYE plan or switching to the New REPAYE when available? I don’t want to go to 25 yrs but like the 225% poverty level and 100% subsidy on interest.

Any thoughts? Do I need to schedule another consultation?

Thanks

Hi Kieran,

Thanks for reaching out. I definitely think you would benefit from scheduling another consult to look at all the factors of your situation in order to find the best repayment plan for you.