Student loans are rapidly becoming part of everyday life for many people. When paying down your student loan balance, student loan interest, your monthly payment and your principal all interact through a process called amortization.

As a borrower, understanding how your amortization schedule works can help you pay down your debt faster, whether you have federal loans or private student loans. Let’s take a look at how amortization works.

Amortization 101

The process of paying a loan down over time is called amortization. It’s a way of taking an installment loan and breaking down how much of your monthly payment goes toward interest and how much pays down the principal balance. It takes into account the interest you’re expected to pay over the life of the loan—including compounding interest.

With simple interest, you only pay interest on the principal balance. With compound interest, you’re paying interest on your interest charges. For example, with a student loan, any unpaid interest that accrues while you’re in school is added to your total loan balance after your grace period, and you pay interest on that total.

Additionally, if you’re in deferment or forbearance, or if an income-driven repayment plan (IDR) results in payments that don’t cover your interest, your accrual can be added to your student loan debt.

Your amortization schedule takes all of this into account to give you an idea of how long you’ll be making a set payment.

How amortization works

In general, amortization works when a lender or loan servicer looks at the life of the loan and calculates how much interest would be included over the life of the loan. You can use a student loan payoff calculator to estimate your own information. At the beginning of the schedule, the full balance of the debt is reported. Then you can see the schedule to get a feel for what the balance will be after each payment until the final payment is made.

What you’ll see is that, at the beginning of the loan, more of your payment goes toward paying the interest. As you progress through the loan term, more of your monthly payment is allocated toward reducing the principal. But at first, a lot of your payment goes toward the calculated interest on your loan.

Are student loans amortized

Because student loans are installment loans, usually with a fixed rate, similar to mortgages and auto loans, that require fixed payments over time, they are amortized. The student loan amortization schedule looks similar to a mortgage amortization schedule, whether you have federal loans or private loans.

This is different from revolving loans, like credit cards or a line of credit, where you can borrow more money, up to your limit, without filling out a new loan application. You’ll also find that accrued interest is added to your balance regularly, based on how much you borrow and your current balance. Student loan borrowers can get a feel for how much they are putting toward interest and principal each month by looking at an amortization schedule or using a loan calculator.

Get Started With Our New IDR Calculator

The life cycle of a student loan payment

When you make a student loan payment, your payment amount is divided between student loan interest, principal and any fees that you might have. The length of your loan term and your interest rate matters as well. As a simple example, let’s say you have $40,000 in student loan debt. Your interest rate is 7%.

With the standard repayment plan of 10 years, your payment is $464.43 per month. During the first month of your repayment, $231.10 would go toward the principal, with $233.33 going toward interest charges. Your last payment, though, would see $461.74 going toward the principal with only $2.69 going toward interest.

Compare this if you have a Direct Consolidation loan for 25 years. You’d have a smaller payment — $282.71 per month — but more of it would go toward interest in the first years of your loan term. In your first month, only $49.38 goes toward the principal, while the rest goes to interest. At the end of the term, only $1.64 of your payment goes to interest. However, you’ll have paid roughly $30,000 more in interest.

Another possibility is refinancing your student loans to a private loan. You lose access to IDR options and Public Service Loan Forgiveness (PSLF), as well as other federal loan protections, but your amortization schedule might look much different.

For example, if you could refinance to a 15-year loan at 5%, your monthly payment would be $316.32. Your first payment would be $149.65 going toward the principal, and your last payment would see $315 going toward the principal. However, with the lower interest rate, you’d end up paying a little more than $1,000 in interest versus the 10-year standard repayment.

How to read an amortization table

Reading an amortization table can feel a little challenging at first, especially since student loan interest rates are often different year-to-year. What you end up with is a table that essentially reflects your average rate. Student loan refinancing privately, results in a table that reflects your entire rate, as long as it’s a fixed rate and not a variable rate.

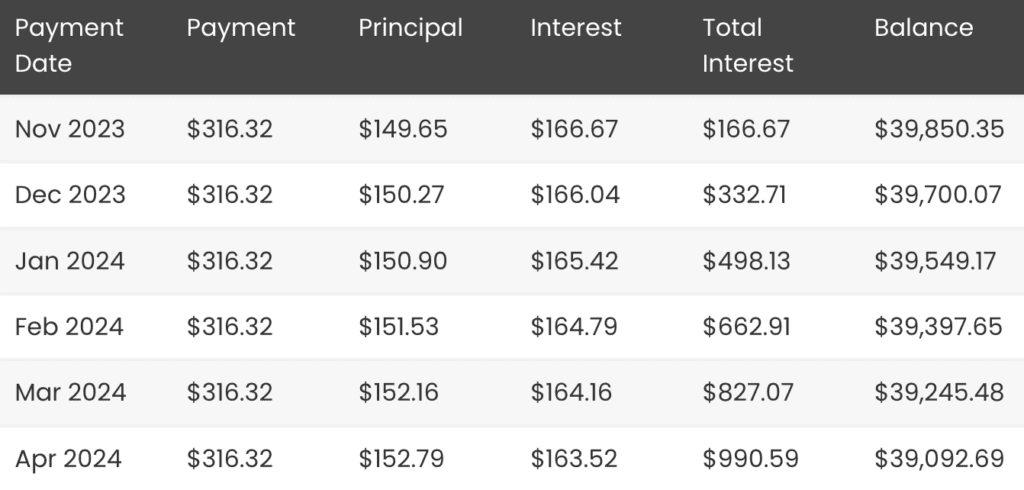

Here’s an example of an amortization table:

Above, you can see the monthly payment date, the payment you’re making and how much is going toward principal and interest. Then, you see how much total interest you’ve paid until this date, and the remaining balance on your loan.

Once you get to the bottom of the amortization table, you can see, in the columns, how you’ll have paid down your debt and the total amount of interest you’ll have paid overall:

Manage your student loans wisely

As you consider your options, think about what student loan repayment option likely works best for you. Your student loan payment is based on your interest rates and the type of plan you choose (and its length).

You can also make extra payments, but specify that they go toward reducing your principal. With federal loans, extra payments go toward future interest and fees on your next payment, rather than outright reducing the principal — unless you specify otherwise.

Compare different plans, and don’t forget to consider refinancing if that makes sense for you. You can contact Student Loan Planner to discuss potential student loan plans based on your loan amount, situation and goals.

FAQ

Basically, any type of installment loan with a regular payment schedule is amortized. This includes mortgages, student loans, personal loans and auto loans.

Student loans are amortized based on their repayment period. If you have a standard repayment period, your loans are amortized over 10 years. For Direct Consolidation Loans and loans on an IDR plan, your schedule can be amortized over time, up to 30 years.

Negative amortization takes place when monthly payments don’t cover interest charges. That interest is added to the loan balance through a process called capitalization and means that your principal balance actually grows over time.

No, there’s no way to avoid amortization. It’s a term that describes the process of paying down the balance of your loan. To some degree, loan forgiveness gets you out of this process by paying off your remaining balance on your behalf if you meet the qualifications.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).