According to 2022 Department of Education data, about 9 million borrowers out of the approximately 43 million total use an income driven repayment plan (IDR). Under the Biden IDR plan, it is almost certain that millions more will sign up, but the question is how many?

Assuming no additional borrowers sign up for IDR, experts at the Wharton Budget Model find the Biden IDR plan would cost over $70 billion over 10 years. However, with a far more generous IDR plan, you cannot assume no additional borrowers would sign up because that’s an absurd assumption.

Millions of borrowers will see huge savings on the Biden IDR plan, particularly these three groups:

- Borrowers earning between $40,000 to $100,000 a year with undergraduate debt

- Borrowers with larger families

- Graduate and professional degree holders who plan to pay off their debt eventually

To come up with an accurate estimate of the benefit and cost of the Biden IDR plan, we must look at how many additional borrowers would sign up, how much lower their payments would be, and how much interest would be subsidized.

How the old IDR plans compare to the new Biden IDR plan

One very underappreciated part of the Biden IDR plan is the increase in income protected before any payments need to be made.

The ICR plan from the 1990s protected 100% of the poverty line. The IBR, PAYE and REPAYE plans protected 150% of the poverty line.

The new Biden IDR plan will protect 225% of the poverty line.

For example, under the best 2022 IDR plans (PAYE and REPAYE), a single borrower could earn $20,385 before owing anything on their student loans. Under the Biden IDR plan, a borrower could earn $30,578 before owing anything on their student loans (using 2022 poverty line numbers).

For undergraduate borrowers, their payments would drop from 10% of discretionary income to 5% of discretionary income. For a single borrower with $70,000 of income, he would only pay 5% of the amount above $30,578. His monthly payment would be $164 a month instead of $413 a month on REPAYE.

Under the old IDR regime, this borrower would have no chance at forgiveness. But if the borrower got married or had children, the payment would fall to as little as $50 to $100 a month, given the increase in family size.

If this borrower earning $70,000 a year had two children, his payment would fall from $164 a month to $76 a month.

The average starting salary of the class of 2020 was $55,260, according to the Society for Human Resource Management. Under the Biden plan, a borrower earning this income would pay $103 a month. We’ll use this estimate for the average IDR payment going forward in our analysis.

Additional borrowers signing up for Income Driven Repayment under the Biden plan

As stated above, 9 million borrowers use an IDR plan as of 2022.

How many additional would sign up for IDR?

If you increase the poverty line by 50%, presumably, you would see a 50% increase in the number of borrowers who could receive forgiveness on their student loan balance.

If you decrease the percentage of income payments from 10% to 5%, you might double the number of borrowers who could benefit.

This analysis is difficult, but consider that the average student loan debt is $37,013, and the average borrower is an undergraduate borrower making too much to get forgiveness on an IDR plan.

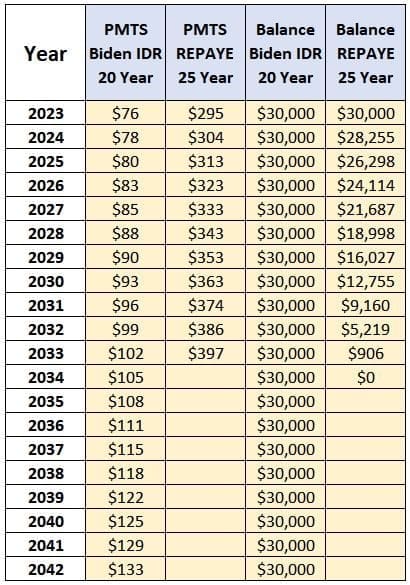

That average borrower is now an excellent forgiveness case. Consider a borrower with two kids earning $70,000 of income with $30,000 of student debt. He would pay $24,429 over 20 years. When accounting for inflation, the cost would be even lower. Here’s how his payments compare to the REPAYE plan currently.

IDR adoption also depends on how easy the Department of Education makes it to sign up.

A reasonable estimate would be anything between 50% to 200% more borrowers would sign up for an IDR plan under the Biden rules.

If there are 9 million borrowers on an IDR plan, that means the new number would become anywhere between 13.5 million to 27 million. A reasonable estimate might be that the number of borrowers on an IDR plan would double to 18 million.

According to the Federal Reserve Bank of Cleveland, the average student loan payment is $393 a month.

Assuming that the average IDR payment under the Biden plan would be $103 a month, the total cash flow difference to the Treasury would be the marginally increased number of IDR borrowers times the difference in what they’re paying now and what they would pay on an IDR plan.

9 million borrowers * (393 – 103) *12 = $31,320,000,000 per year in reduced cash flow to the student loan program and net savings to borrowers.

It would be reasonable to assume the large increase in IDR adoption would occur primarily with undergraduate borrowers as graduate borrowers would have a similar payment under the new plan, although many new graduate borrowers might sign up temporarily for the interest subsidies (more on that later).

More complex analysis using present value might be performed, with most borrowers under this model reducing their costs of repayment between 33% to 50%.

Increased discretionary income for borrowers already on an IDR plan

Almost all borrowers currently on an IDR plan would see reduced payments under the Biden plan.

A more complex analysis would ask what the average family size is per borrower, but a simpler analysis is to just look at the savings for a single borrower, even though that figure understates the savings borrowers will experience.

A single borrower would see their protected income rise from $20,385 to $30,578 before they needed to make a payment. This would save approximately $1,020 per borrower per year for the 9 million current IDR borrowers.

That figure would be 9 million * 1,020 = $9,180,000,000 per year.

Decreased payments for borrowers already on an IDR plan

According to the Richmond Fed, 24% of undergraduate borrowers and 39% of graduate borrowers had opted into an IDR plan as of 2017.

Graduate borrowers have historically signed up for IDR plans at higher rates because undergraduate debt has strict borrowing limits and graduate debt does not because of the Grad PLUS program.

The Biden IDR plan allows undergraduate borrowers to pay 5% of their discretionary income. Graduate borrowers could pay a weighted average depending on their mix of undergraduate and graduate debt.

Using a borrower earning the average starting salary of $55,260, he would have paid $291 a month on the REPAYE plan.

He would save $85 a month from the increased definition of discretionary income we already accounted for.

So, the difference between $206 and $103 (the payment under the Biden plan) is his cash flow savings.

The average graduate borrower might have half of their debt from grad school and half from undergrad. Under the weighted average approach that the Biden IDR plan takes, his payment would be $154 a month.

Then, the difference between $206 and $154 is $52 a month.

To estimate this cost of decreased IDR payments for current borrowers, we need to know what the split is for graduate and undergraduate borrowers on an IDR plan.

To keep things simple, let’s assume two-thirds of IDR borrowers have graduate debt, and one-third have only undergraduate debt.

Let’s also assume the average borrower earns $55,260, the average 2020 starting salary.

This would result in savings to current borrowers of:

2/3 * 9,000,000 * (206-154) *12 + 1/3*9,000,000* (206-103) *12 = $7,433,640,000.

Interest subsidies for borrowers using an IDR plan

Under the current REPAYE plan, most borrowers would receive a 50% interest subsidy on all interest that their monthly payment does not cover.

The new Biden IDR plan is ultra-generous when it comes to interest subsidies, as current borrowers have higher REPAYE payments, resulting in less leftover interest to subsidize.

Additionally, borrowers with large debt from graduate and professional schools receive the largest interest rate subsidies under the Biden IDR plan.

A resident physician earning $60,000 a year with a $250,000 balance at a 6% interest rate might pay $245 a month, with the remaining interest subsidized. Their effective interest rate would be approximately 1.18%, below the interest rate for subsidized loans for undergraduates.

Only during school and a couple of years out of training would their interest rate rise to the statutory rate in their promissory note.

A teacher with $60,000 income and $60,000 of debt at a 5% interest rate (half of which was from grad school) would also receive an interest subsidy, but not as big of one.

This teacher would pay $2,207 a year. Their $60,000 loan throws off $3,000 a year of interest charges, so about $800 is subsidized. His effective interest would be 3.68%.

Of course, a high earning attending physician would have an interest rate similar to their statutory rate, but only a couple of years out of training once their AGI had been reported on a previous year's tax return.

Assumptions of interest subsidy cost for current IDR borrowers

To add to the confusion, these interest subsidies would not be relevant except for borrowers who used an IDR plan temporarily to receive large interest subsidies before refinancing or paying them off.

Traditional budgeting metrics, though, would likely measure the entire interest subsidy as a cost, as did estimates of the cost of the COVID student loan payment and interest pause.

To measure these interest subsidies, many assumptions would need to be made.

Using the $55,260 income “average borrower,” his payment would be $103 a month, or $1,236 a year.

Assume he has an average $37,000 student debt balance and that this is representative.

If that debt has a 5% interest rate, he would owe $1,850 a year of interest. The difference between his payments and the interest is his interest subsidy, which is $614 a year.

Even though the REPAYE offers a 50% interest subsidy, the payments are high enough for most undergraduate borrowers that there is no interest left over to subsidize.

So, 9,000,000 * 614 = $5,526,000,000.

Assumptions of interest subsidy cost for new IDR borrowers

The big unknown is if the highest debt borrowers will strategically switch to the Biden IDR plan for the first 2 to 3 years of their careers while their income is low to receive a very large interest subsidy.

For example, a Big Law associate starting salary is about $200,000.

Most Big Law lawyers start approximately in September each year.

IDR payments are based on the most recent tax returns.

So, someone graduating in 2023 would have a prior year income of $0 (or roughly $30,000 if they did a summer internship). Their interest subsidy in year 1 would be 100%.

In year two, they only earned income for 3 or 4 months out of the year, so they would receive a near 100% interest subsidy in year 2 as well.

There are not that many Big Law lawyers compared to borrowers overall. But a small proportion of borrowers hold a very outsized share of the student loan debt overall. Any behavioral adaptations of this category of borrowers would save this group a lot of money, as this type of high income borrower currently does not choose an IDR plan.

If we simply assume that new borrowers will look like the hypothetical $55,260 income borrower above with the same average debt, then the interest subsidy would be similar. You could assume the 9 million new borrowers paying about $1,200 a month with $1,800 a year in interest would receive a similar net subsidy of $600.

So, 9,000,000 * 614 = $5,526,000,000.

Tuition increases at undergraduate and graduate degree programs

One study by the NY Fed finds that for every $1 increase in subsidized student loans, universities increase their tuition by 60 cents.

In a recording of the National Association of Financial Aid Administrators podcast, the hosts warned that schools needed to be careful about large tuition increases for the first 12 months of this new IDR program. The Biden administration could also list schools in a report on “schools that produce graduates with unmanageable debts.”

While some of the most dubious for-profit colleges have been shut out of federal aid, the vast majority of schools with bad outcomes, both non-profit and for-profit, feel absolutely zero consequences for raising tuition under this new plan.

What seems undoubtable is that schools will respond by increasing their tuition more rapidly than they did before. Cheaper undergraduate programs might catch on that there is effectively no difference between borrowing $20,000 and $40,000 under the new IDR plan for most of their students and refuse to offer tuition discounts or as significant merit aid.

These changes won’t happen right away. Borrowers will need to be convinced of the merits of this approach and schools will take a while to realize the opportunity and respond to incentives without making it appear they are acting immediately based on the new revenue opportunity a more generous IDR plan represents.

Approximately $100 billion of student loans are issued each year. Given the NY Fed’s research, it seems reasonable to assume that there would be a 1% increase in the total amount borrowed due to schools increasing their tuition at a rate higher than they would have otherwise. This number could easily be an order of magnitude larger.

So, 1% * $100 billion = $1 billion per year.

Additional students going to college and pursuing additional education

When the cost of college goes down for the borrower, more borrowers will pursue higher levels of education.

Borrowers might choose to go to some college as opposed to no college. Borrowers getting bachelor's degrees might be more likely to go ahead and pursue higher levels of graduate education.

Any estimate here is full of ambiguity and assumption. If only an additional 1% of the American population pursues college because of these changes, that’s 3 million borrowers. Assuming these borrowers take out $5,000 per year on average, that’s an additional $15 billion of student loans each year. That’s not the full cost as you would have to measure the subsidy rate.

The point is that if the price for a good or service goes down, you would expect consumers to become more likely to purchase that good or service. We'll leave this cost out of our estimate because it feels the most speculative.

Total 10 year cost of the Biden IDR plan

The Department of Education has never released statistics on the average income of IDR borrowers and average IDR payments. If they did, these assumptions could be tightened up significantly.

Also, many borrowers might not know to sign up for this new IDR plan. Without interest capitalization under the new changes, any borrower checking that they want the lowest payment would likely be switched into this new plan, so most will seamlessly be switched over.

Summing up each of the annual benefits and costs below, we have:

- Additional borrowers signing up for IDR: $31.3 billion

- Increased discretionary income: $9.2 billion

- Decreased payments for borrowers on an IDR plan now: $7.4 billion

- Interest subsidies for current IDR borrowers: $5.5 billion

- Interest subsidies for new IDR borrowers: $5.5 billion

- Additional Tuition Increases by Schools: $1 billion

- More borrowers attending college and pursuing higher levels of education: Undetermined

Summing up the above, we have $60 billion annually.

Over 10 years, which is the customary period to look at budgetary impacts, the total savings borrowers would experience would be $600 billion.

This figure exceeds the estimated $500 billion to $600 billion in cancellation under the Biden student loan relief plan.

And the cost savings for borrowers could be substantially higher if more borrowers and schools act in their rational best interest by optimizing their AGI, borrowing the max, raising tuition to maximize revenue, and more students realize there isn’t much of a downside to attending college from a financial perspective.

Costs would increase further if Stafford loan limits were increased, as they have not been for several years.

The plan would likely cause the average student loan borrower to go from paying back her debt to treating her debt like a tax and pursuing student loan forgiveness instead while paying the minimum possible.

What’s clear with the Biden IDR plan is that borrowers have rarely ever had the opportunity to save such a giant amount of money.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Will all 4 current plans (ICR in particular) be included in the newly proposed IDR plan? Thank you

Hi Glenn,

At the moment we are still waiting for official guidance and FAQs regarding the IDR plan. Stay tuned, we will be sure to update once we know more information.

Will parent Plus loans be included in new IDR plan?

Hi Angie,

We are waiting for formal guidance and information regarding the new IDR plan, therefore we can’t say for sure what will be included. Stay tuned for more information.