Key Takeaways:

- Although veterinarians have high earning potential, many carry veterinary school debt $400,000 and higher.

- Disability insurance can be especially important to have for veterinarians, due to their increased risk of harm from exposure to zoonotic diseases, as well as potential injuries from frightened animals.

- Despite the obvious potential benefits of disability insurance, less than half of veterinarians buy disability insurance for themselves, in addition to their employer-provided or AVMA policy.

Your love for animals and dedication to learning complex veterinary medicine has been rewarded with a solid veterinarian salary and passion-driven employment. But what happens if you can’t perform procedures due to an injury or illness? How will your family pay for living expenses and medical bills if you can’t work as a veterinarian?

This is when disability insurance for veterinarians becomes essential. Disability insurance serves as income protection if health issues or a disability threaten your livelihood.

You might have disability insurance through your employer, and assume you’re covered for the unexpected. However, this is often not the case as many veterinary clinic group policies have limited benefits, are taxed as income and have narrow coverage definitions.

Read on to learn how a personal disability insurance policy can protect veterinarians.

Veterinarian disability insurance premium cost

To give you a better understanding of how much disability insurance costs for veterinarians, we’ve run cost estimates through multiple insurance companies.

Generally, disability insurance will cost more for women. However, some insurance companies offer unisex discounts.

Veterinarian own-occupation disability insurance monthly cost

(Age 34, resident/fellow)

| Company | Male | Female |

|---|---|---|

| Guardian | $162 | $236 |

| MassMutual | $136 | $208 |

| Principal | $143 | $246 |

| Ameritas | $145 | $207 |

| Standard | $145 | $228 |

Note that where you work as a veterinarian also matters. For example, small animal veterinarians generally secure better rates since they’re less likely to get hurt on the job. Whereas if you work with large animals in a rural area, there’s a greater risk of injury.

This is called your risk classification. Even though the coverage can be expensive for the riskiest classifications, if you’re insurable at a reasonable rate, it’s a smart investment to make.

If your budget doesn’t allow for the maximum benefit, you should choose a disability benefit that at least covers your living expenses and basic needs. Once you become financially independent, you can cancel your disability coverage (and your term life insurance while you’re at it), if desired.

For your own veterinarian disability insurance custom quote, fill out your information in the form below, and we'll get back to you promptly.

Get the best price on own occupation disability insurance

SLP Insurance will find you the best price even if it's not with us. Fill out the form below to get discounts of up to 30%.

Why veterinarians need disability insurance

Serious medical conditions, like cancer or mental illness, can affect all ages and accidents can occur at any time. According to the Social Security Administration, you have a one-in-four chance of becoming disabled before reaching traditional retirement age. Therefore, your family’s financial security can change in a blink of an eye.

If your family relies on you as their primary source of income, disability insurance can help maintain their financial security. Veterinarians in this situation should make disability insurance a top priority.

Veterinarians have high six-figure student debt and high earning potential

Your education and training to become a veterinarian came at a high cost, making it even more important to protect yourself with disability insurance.

The average veterinary school debt is around $150,000, according to the American Veterinary Medical Association (AVMA). But many carry a debt burden reaching $400,000 or more.

Additionally, depending on where you work, you’ve likely secured a higher salary than the average college graduate. This can make it more challenging to find an equivalent salary outside of the veterinary profession if you became disabled.

Between your student debt and high earning potential, you’d need to find an alternative way to fill any financial gap caused by an injury or illness.

Workplace considerations for veterinarians looking for disability insurance

The care veterinarians provide spans many different species and work environments. If you work at a zoo with exotic animals, in a small clinic with pets or in rural areas with livestock, your profession presents a greater risk of injury.

Workplace hazards unique to the veterinary field include:

- Injuries induced by frightened or stressed animals.

- Exposure to infectious diseases that spread from animals to humans.

- Injuries from lifting or handling animals.

If a horse kicks you in the shoulder or a dog bites your hand and causes significant damage where you can’t do procedures anymore, you’d want income protection so that your educational investment is still secure.

Additionally, the physicality of your job requires overall good health, which means any number of injuries outside of the workplace could ultimately affect your livelihood. For example, you could get into a car accident on the way to work, causing chronic back pain or other serious injuries.

You can’t control when or if an unexpected injury or diagnosis could significantly limit your ability to perform certain tasks or end your veterinary career completely.

Veterinarians and disability insurance: Views versus reality

Our 2022 Student Loan Planner Insurance Survey generated about 1,500 responses from our community. Seven board-certified veterinarians and 88 general practice veterinarians gave details about their views and experience with disability insurance. Here’s what we learned.

Veterinarians know the importance of disability insurance but aren’t taking action

The vast majority of surveyed veterinarians believe they need disability insurance as part of their financial plan. Specifically, 93% of general practice veterinarians valued disability income protection.

However, only about 40% of veterinarians as a whole bought their own disability insurance policy. It’s clear the veterinary profession understands the benefits of having disability insurance, but they aren’t following through by finding the coverage they need.

Instead, you might just be relying on your employer or an AVMA policy to provide the coverage you need, or worse — tempting fate with no disability coverage at all.

Breadwinner veterinarians should reassess disability insurance coverage

The majority of responding veterinarians are breadwinners, with 86% of board-certified vets and 69% of general practice vets earning the primary income for their household. This suggests that many veterinarians are underinsured if an illness or injury prevented them from working with animals.

Veterinarians are also disproportionately women. Females tend to have a higher incidence of disability, and you don’t want to be relying on your partner for income security because life events like separation happen. That means whether you’re single, partnered, or happily married, most veterinarians need this coverage.

As the primary income earner of your family, you need adequate disability insurance coverage. If not, you risk needing to rely on family charity, community donations or an extremely low Social Security Disability Insurance (SSDI) benefit to get by.

The average SSDI monthly benefit is $1,222.75 as of January 2022. That’s simply not enough to live off of. Plus, qualifying for Social Security’s disability program is a lot harder than a private policy, with a stricter definition of disability and a much more complicated application process.

So, unless you’re willing to unexpectedly force your family to make dramatic changes to their lifestyle and standard of living, carving out funds in your budget for disability insurance is the way to go.

How much disability insurance should veterinarians have?

We recommend buying the maximum disability benefit allowed to ensure you have adequate coverage. This is typically around 60% of your income.

The exception is if you happen to already be financially independent, in which case, you don’t really need disability insurance since you can live off your investments or other assets.

Keep in mind, we encourage you to cancel your disability coverage once your investments produce enough passive income to live off of. This protection is only necessary until you reach that point of financial freedom.

Reported disability premiums from our community

Our survey determined that veterinarians are paying an average of $106 per month for disability insurance. But reported premiums ranged from $37 to $180 per month. However, this isn’t necessarily an accurate depiction of what you should expect to pay.

Many people don’t have adequate coverage, making their premiums much lower. Additionally, some of the responding veterinarians don’t have a disability policy at all.

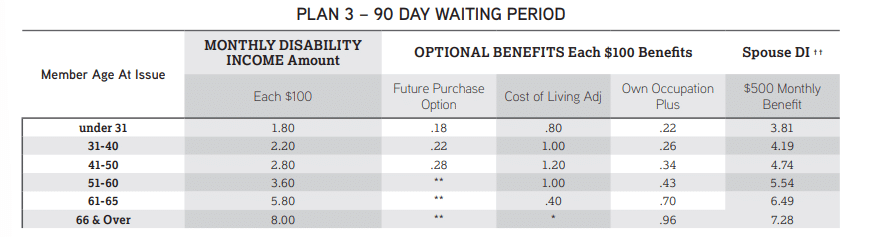

Insurance policy riders can affect your disability premiums

There are other ways to manipulate your premium costs besides lowering your benefit amount.

For example, you can extend the waiting period from when you make a disability claim to when you receive the first payment. A 90-day waiting period is generally recommended. But you could extend to 180 or 365 days if you have an emergency fund in place to cover your expenses during that time frame.

You can also make adjustments to optional add-ons called policy riders. This includes options like:

- Own occupation coverage. Applies if you’re still able to work in occupations other than being a veterinarian.

- Future increase option. You can get additional coverage later in your career without redoing the underwriting process.

- Partial or residual disability coverage. Protects against loss of income (e.g. reduction of hours) if your disability or illness doesn’t prevent you from working entirely.

- Non-cancelable. Your rates won’t increase and the insurer can’t cancel your policy if you’re paying your premiums.

Using the same example of a 30-year-old veterinarian, opting out of the future increase option will drop the premium by about $20 per month. If you’re at a point in your veterinary career where your salary won’t significantly change with more experience, this might be a rider you don’t actually need.

The nuances of each of these riders, as well as others, can be explained in detail by an expert independent insurance agent to create a policy that matches your needs and budget.

What disability insurance benefits do veterinarians have with their employer?

Our survey determined that 40% of general practice veterinarians and 29% of board-certified vets have disability coverage through their employer. However, many employer group benefits fall short of what’s needed when the time comes.

Limited disability benefits and narrow coverage definitions could prevent you from receiving the benefits you think you currently have.

For example, the Fort Worth Zoo offers its veterinarians disability coverage options of either 40% or 60% of their income through Unum. However, benefits are capped at $6,000 and $9,000, depending on which policy you choose.

Unfortunately, a capped benefit is common among employer disability insurance plans. Additionally, your employer might exclude overtime or other forms of additional compensation from your disability calculation, which will further limit your monthly benefit.

Furthermore, disability income from an employer policy is taxable. If you purchase your own policy, then the payments are untaxed, which shields them from income-driven repayment (IDR) calculations for your student loans, too.

The most likely disability is not one that incapacitates you. It’s simply a scenario where you’re mostly OK physically except you can’t do procedures anymore. In that case, your student loans wouldn’t be forgiven because you’re not completely disabled.

That said, your IDR payments would fall a lot since your taxable income would go down significantly.

The need for disability insurance is independent of whether you have student loans. If you’re refinancing your student debt, though, you can purchase a rider that covers your payments if you become disabled.

Where veterinarians can find other disability insurance options

Some professional associations provide insurance partnerships as part of their membership benefits. For example, the AVMA offers disability coverage ranging from $1,000 to $12,500, limited to 60% of your average earnings.

Source: AVMA LIFE

However, many association group benefit plans are very limited or costly. In other situations, the definitions in the policies might not be as good. And there’s no way to know if you’re getting the best rate with the policy you need unless you shop around with different disability insurance companies.

Compare disability insurance policies for veterinarians

Start the free quote process today by using the form below. You’ll receive a free one-on-one assessment of your disability insurance needs, which you can then use to compare options with your employer or association coverage.

Disability insurance is something that’s easy to put off. But if you’re a young veterinarian, soon-to-be graduating vet student, or resident, then you can lock in low pricing for something that you probably need to buy. So, submit your information in the form below for your own custom quote!

Compare disability insurance quotes and save

SLP Insurance will find you the best price on own occupation coverage, even if it's not with us. Fill out the form below for a quote with up to 30% discounts.