Veterinarians are some of the most highly trained professionals out there. If you think being a physician and medical school is tough, try learning and practicing medicine on a bunch of different anatomies. All this with more limited funding, resources and technology. Given these barriers, is vet school worth it?

These hard-working, intelligent people have a tough go if they want to earn a Doctor of Veterinary Medicine degree, or DVM for short.

First of all, there are a limited number of vet schools in the United States. Therefore, the admissions process is intensely competitive for vet school applicants. Those accepted into a DVM program are in for a grueling four-year education, which isn’t cheap due to the complexity of veterinary medicine.

Finally, once they become a DVM, the veterinarian salary isn’t quite where it should be given their training. As an outsider, I would think DVMs would make a better income than they do. Here’s the problem: People love their pets, but pet owners are often unable to spend unlimited funds on their loving animal like they would on themselves if they had a health issue.

The median veterinarian salary is $103,260, according to the Bureau of Labor Statistics (BLS). And the average vet school debt is around $150,000, according to the American Veterinary Medical Association (AVMA). Some vet students reported debt loads over $400,000.

We’ve seen this high average vet school debt here at Student Loan Planner®. That’s a lot, especially considering the median veterinarian salary for the top 10% of earners is $164,490.

Even the top earners in the veterinary profession are barely making more money than the amount owed by the average graduate.

Veterinarians graduate with more student loans than anticipated

It takes about four years to get a DVM after completing a four-year bachelor’s program. Those four years can be extremely costly.

For example, in-state tuition and fees at Ohio State University's College of Veterinary Medicine is about $160,000 for a resident. But higher living expenses can also contribute a significant portion of student debt. Ohio State estimates an average cost of about $85,000 over the life of vet school.

Add that to tuition increases each year, interest accruing on the loans and leftover loans from any undergraduates studies. It pushes the cost of becoming a DVM well above what’s anticipated.

We’ve worked with over 250 veterinarians here at Student Loan Planner® with an average vet school debt of $273,000.

So, is vet school worth it financially?

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

How much do veterinarians make?

The average veterinarian salary is about $103,000 per year. But how does that compare to the average college graduate without an advanced degree?

According to the BLS 2022 report, the median wage for a college graduate is about $84,240.

So becoming a veterinarian leads to an extra $20,000 in earnings per year by the averages.

Let’s assume that $20,000 in extra income sustains throughout the entire 30-year career of a DVM which works out to an extra $600,000 in lifetime earnings for a veterinarian compared to someone with a bachelor’s degree. That seems like a big number.

Taking out $273,000 in loans to make an extra $600,000 tends to make financial sense on the surface. But remember, those extra earnings will be taxed.

If we assume a combined 40% tax rate for federal and state, then we can reduce that $600,000 in earnings down to about $360,000 in extra take-home pay.

So now we’re talking about a veterinarian having an extra $360,000 to pay off the $273,000 of student loan debt that made it possible for the higher veterinarian salary.

Seems like vet school is worth it financially on the surface, but those numbers are missing a few key facets:

- These numbers don’t show that many veterinarians spend the first 20 to 25 years of their careers saddled with loan payments, staring at student loan balances that don’t seem to change and, in many cases, continue to grow.

- The other piece of the equation is that the cost of paying back the loans will be higher than the actual loan balance.

- Loan forgiveness options are extremely limited for veterinarians. Sure, the AVMA has many options listed. But they aren’t that easy to get. I’ve worked with only a couple of vets who work for the Department of Agriculture and would qualify for Public Service Loan Forgiveness (PSLF).

DVM student loan repayment options

Our experience at Student Loan Planner® shows there are two optimal ways for veterinarians to pay off student loans. But they’re on opposite ends of the spectrum.

- Aggressive Pay Back: For people who owe 1.5 times their income or less (e.g., someone who makes $100,000 with loans at $150,000 or less), their best bet is to throw every dollar they can find into paying back their loans as fast as possible for no more than 10 years.

- Pay the least amount possible: For people who owe more than twice their income (e.g., someone who makes $100,000 and owes $200,000 or more), the goal is to get on an income-driven repayment plan that will keep their payments low and then maximize loan forgiveness, whether it’s PSLF or taxable loan forgiveness. PSLF options are limited for most veterinarians.

Loan repayment for veterinarians

Let’s say Rachel has $225,000 in student loans at 6.8%. Her veterinarian average starting salary is $75,000 and will grow about 3% per year. She’s not married.

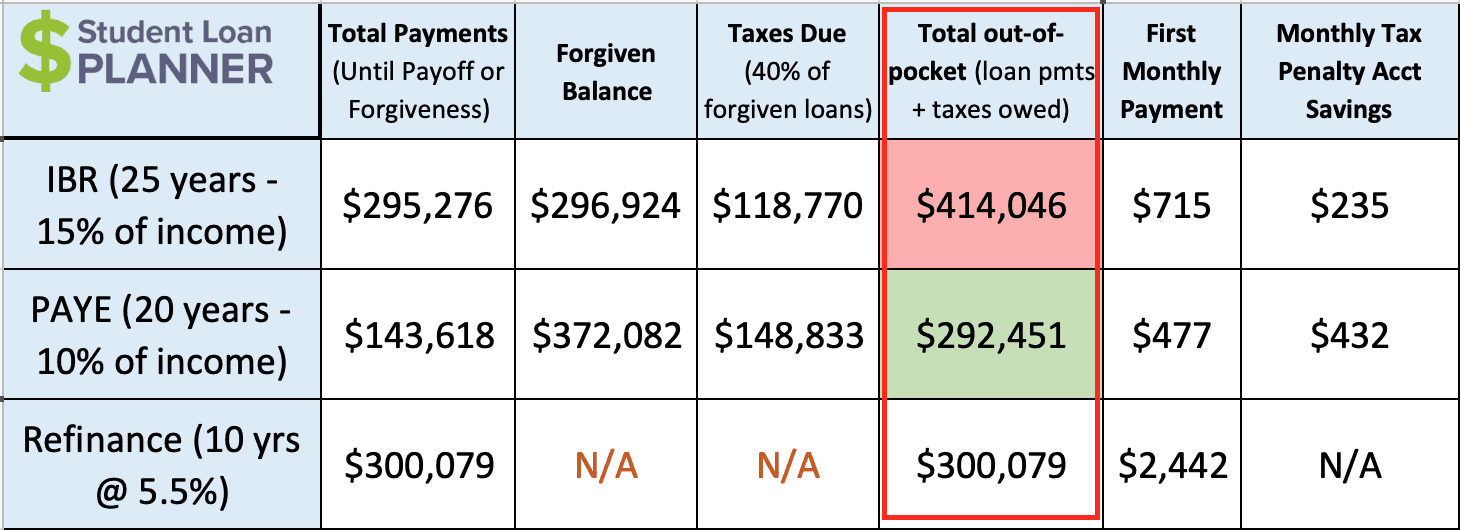

So let’s compare Income-Based Repayment (IBR), Pay As You Earn (PAYE), and veterinarian refinancing to a 10-year fixed rate.

Remember how either aggressively attacking the loans (refinancing) or keeping payments as low as possible and maximizing loan forgiveness (PAYE) would save money? IBR is neither of those.

As you can see, IBR is by far the worst option. It’s going to end up costing Rachel over $120,000 more than PAYE and nearly $114,000 more than refinancing.

As for PAYE versus refinancing, the options look relatively close from an out-of-pocket cost. Here are the pros and cons for each option:

PAYE

- Pro: Affordable monthly payments which will allow her to save, invest and put money toward other financial goals.

- Pro: Has 20 years to save up for the taxes owed.

- Con: Loan balance will grow from $225,000 to $372,000.

- Con: It’ll take her 10 years longer compared to refinancing.

Refinancing

- Pro: She’ll be out of debt in 10 years or less.

- Con: Total out-of-pocket cost is about $8,000 higher and paid back in half the time.

- Con: She loses access to federal loan benefits once she refinances.

Considering she'll also be stuck with $2,442 of refinancing monthly payments for 10 years with little to no flexibility, PAYE is going to be her best option.

Is vet school worth it?

The purely financial answer is yes, vet school is worth it — but barely. The projected lifetime earnings of a veterinarian compared to the average college grad is $360,000 after taxes versus the $292,000 in cost of paying back student loans.

To me, that margin is way too close.

The spread between a veterinarian salary and the average college graduate just isn’t all that compelling. Not to mention they start earning a living four years later due to extensive veterinary education and training.

Then there’s the psychology between making student loan payments for 20 to 25 years without making a significantly higher salary versus the average college grad.

Although it's a popular career choice in the animal industry, you need a true passion for it because making student loan payments will also be a way of life. It might get especially tight if the extra costs of getting married and raising kids comes around.

If veterinarians can keep that long-term perspective and still feel compelled to become a DVM, they’ll have a nice, long career with great earnings remaining after being student debt-free.

Vet students should only choose to pursue this path if they’re all in and won’t let student loans make them regret their decision after projecting what life will look like 10 and 20 years after graduation.

Having a clear understanding of how loan repayment works and how to mitigate both the financial and psychological aspects of carrying that amount of debt are both a must.

Veterinarians need a plan for student loan repayment

For veterinary graduates who have six-figure student loans, having the debt doesn’t have to feel like a heavy weight. There are plenty of great student loan repayment options for veterinarians.

It’s critical to have a path that could not only save significant money but also a clear understanding of the actions steps to get it done.

Student Loan Planner® has done over 5,300 student loan consults for clients with over $1.34 billion of student loans. We can help you figure out the optimal path in just one hour.

Income & Student Debt by Profession

How you compare to other

accountants stats*

| Average student debt | |

| Average income | |

| Average Debt-to-Income Ratio |

Statistics represent the population of Student Loan Planner clients in the respective profession referenced in the chart from 2017-2023. Sample excludes those in school or in training.*

Comments

Comments are closed.

Federal vet here weighting in. While I plan to use PSLF myself (I’ve got 5 years left), I have numerous colleagues who have taken advantage of the Veterinary Medicine Loan Repayment Program (https://nifa.usda.gov/program/veterinary-medicine-loan-repayment-program) which offers $75K over 3 years towards student loans if you serve in a hard-to-fill area, which can include serving as a federal vet in some locations. Also, the VMLRP can be renewed for an additional 3 years, for a total of $150K over 6 years paid towards federal student loans. I used to think this program was a myth, but I think it’s being utilized more often nowadays, for federal vets and vets in private practice both.

There are a collection of other student loan repayment programs, and cash bonus programs, for federal vets. Some are more beneficial than others, and I think PSLF will still be the way forward for most government vets.

Yeah we actually have a post on it: https://www.studentloanplanner.com/veterinary-medicine-loan-repayment-program/ That’s a great option for vets