Thanks to the American Physical Therapy Association’s Vision 2020 statement, all new physical therapists need to have the DPT degree in order to practice.

While the additional education will probably have positive outcomes for patients, what’s guaranteed is that schools have been able to charge ever-increasing amounts of money for the education. This often leads students to take out expensive DPT student loans.

Yes, the growth in the PT job market is expected to be above-average. Every media outlet and industry publication will remind you of that.

What they don’t like to talk about is the huge numbers of huge programs that continue to open to ensure that demand is met with more than enough supply. Schools won’t discuss the alternative motivation they had (revenue) to ensure that the DPT degree was mandatory.

The student loan racket affecting DPTs is a house of cards that will eventually fall. After all, when your tuition continues to escalate at a rate much faster than inflation even though salaries aren't growing at the same rate, something has to give.

We’ll diagnose the state of student loans in the DPT profession, show why physical therapists get the short end of the stick and discuss strategies on how to tackle expensive DPT student loans.

Get Started With Our New IDR Calculator

Why suggesting frugality as a strategy for managing DPT student loans is hilarious

How often has a financial aid employee or an administrator at your school suggested the key to keeping your student loans down is to live frugally like a college student. “If you live with roommates and stop buying new cars, then everything will work out.”

It’s true that keeping a strict budget and minimizing big living expenses will help. However, the biggest expense you’ll face in a DPT program involves handling the cost of physical therapy school including tuition and fees, and that’s not negotiable.

How Vision 2020 increased the cost of becoming a physical therapist

The Vision 2020 statement was the catalyst for increasing degree requirements in the physical therapy field of study. The APTA's vision has since been updated but it doesn't appear that it has turned away in any significant manner from Vision 2020's priorities.

One of those priorities was that all physical therapists would have a DPT degree instead of a master’s degree. The APTA followed through on this commitment in 2015 by requiring all future physical therapy students to have a DPT in order to be eligible to sit for the licensing exam.

Of course, this means longer periods of training, fewer years of earning money and more tuition revenue for schools. It also protects current physical therapists by slowing the addition of new entrants to the profession.

The Commission on Accreditation in Physical Therapy Education (CAPTE) has an excellent report on metrics for PT education.

In this report, it lists the median total direct costs of becoming a DPT at $66,074 for a public in-state program and $113,497 for a private school program. These figures do not include the cost of borrowing to pay for rent, health insurance, food, transportation and other expenses. The figures also do not include the costs of interest and origination fees.

Since there is a long history of physical therapy salaries increasing at roughly the rate of inflation, I do not expect to see a huge payoff for the student on the switch to the DPT degree. My guess is that most of the economic benefits will go to established players in the physical therapy profession.

How a physical therapist leaves school with so much debt

Finance charges are a big deal because those costs accrue while you’re in school. DPTs frequently leave with 25% to 30% more in debt than what you borrowed. For the median public in-state DPT grad, you might have taken out the $66,000 for tuition and fees but you borrowed $15,000 for each of the three years of your program. Now you’re at $111,000.

Tack on another 25% for finance charges on the loans, and you leave with about $138,750 of debt. That figure is what you graduate with if you’re:

- Cautious with your budget while in school

- Have no debt from undergrad (most people do)

- Don’t get slammed by an unexpected increase in tuition from the college

- Don’t have dependent children to pay for while in school

Now imagine you went to a private or public out of state DPT program. You could easily leave with debt levels of $200,000 of more.

What is the average physical therapist income?

According to the most recent data from the Bureau of Labor Statistics, the median PT makes $89,440 per year. The average is close to that level as well.

Of course, that number is after you’ve been working in the profession for a while. It also includes all different sectors that employ PTs.

The range of physical therapist incomes that I’ve seen is $60,000 to $100,000. The amount you earn will depend on the region of the country you work in.

What is the average debt for a physical therapy student?

According to a survey conducted by the APTA, the average total debt of physical therapists is about $116,000.

However, the average debt for physical therapy students that we've seen in our student loan consulting practice has been about $154,000. To be fair, the average debts of our clients tend to be higher than the average overall.

That said, I’ve seen debts over $200,000 for physical therapists from private schools. This debt loads balloon even more for a student who had to do a post-baccalaureate program to meet the prerequisites for the DPT program.

Can the average physical therapist afford to pay back her student loans?

If you graduated from an in-state public university and owe less than $100,000, you have a legitimate path to paying off your DPT student debt.

Assuming you’re working in a private sector setting, you can refinance that debt to a 10-year fixed rate. Making extra payments could also help you pay it off even sooner. And you could sign up with the National Health Service Corps to receive benefits for serving in a high-need area.

However, if you owe more than $100,000, the route to debt freedom becomes trickier. You could always live on rice and beans, and try to pay the debt off rapidly. But what if that pathway is not open to you? Perhaps you have aspirations to have a family, buy a house, save for retirement or other financial goals.

In this case, more strategies have to be considered to avoid being debt-free at 40 with nothing to show for it.

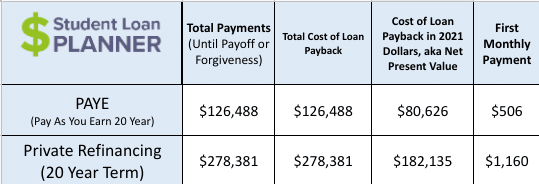

Case study: DPT grad from a private school uses PAYE

Pretend Jan just finished her DPT and owes $200,000 at a 6% interest rate. She earns about $80,000 per year in a private physical therapy clinic. She has no desire to start her own clinic. In fact, she would love to work at this site for most of her physical therapy career.

Assuming Jan remains single and doesn’t have children, here’s what the cost would look like under PAYE vs. refinancing at a 3.5%.

You’ll notice that the cost in today’s dollars is about $45,000 less. That’s the case because PAYE is paid over 20 years. If Jan saved the max in her 401(k), the savings presented here for PAYE would be even better.

Of course, Jan would need to run the numbers with something like our free student loan calculator and determine what would happen if she got married and needed to include her spouse’s debt and income in the calculations.

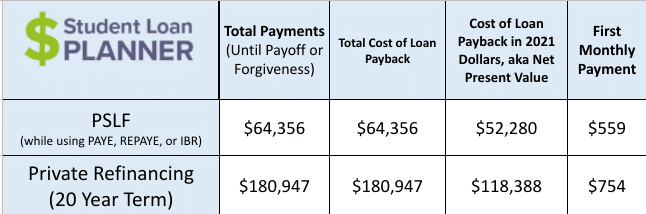

Case study: physical therapist uses Public Service Loan Forgiveness

Let's explore student debt forgiveness for physical therapists. For this example, let’s assume Jim has $130,000 of 6% student debt from his in-state DPT program. We'll also assume that he's the primary breadwinner for his family.

I’ll assume his spouse doesn’t work and he has two young children. Jim just got a job at a hospital employee and qualifies for the PSLF program that also provides student loan forgiveness for therapists.

He can use this to pay 10% of his discretionary income and have the balance forgiven tax-free after 10 years of employment and student loan payments.

We’ll assume Jim makes $100,000 per year, which is well above average for a hospital employed DPT. We’re pretending Jim works in a geographically underserved area but doesn’t qualify for the NHSC program.

Jim might be tempted because of his high income to refinance, but that would be a big mistake. Here are the costs compared to a 10-year refinancing at 3.5%.

Not only is PSLF cheaper, Jim could save over $116,000 compared to refinancing. That’s equivalent to $11,000 extra per year of take-home pay.

Why physical therapists get a bad deal under federal student loan policy

Paying back your student loans shouldn’t be incredibly hard. Doctor of physical therapy programs should be a reasonable length. And it should put you no more than 100% of your expected first-year income in debt.

However, the federal student aid system enables schools to charge whatever they want. And students pursuing physical therapy, dentistry, optometry or other healthcare-related careers outside of actually becoming a physician often get the worst deals.

Any university can add a new DPT program. And while there are limits on how much can be borrowed in subsidized or unsubsidized loans while pursuing a bachelor’s degree, there are no such limits for the graduate PLUS loan program.

To prove this point, there were 25 new accredited or developing PT programs added from 2015 to 2020, according to the CAPTE.

A similar phenomenon already happened in the pharmacy profession. An influential federal report declared a massive shortage of pharmacists was imminent and the only way to stop the doom was to drastically increase the supply of graduates.

I believe we’re in the middle of that explosion in new DPT grads. The schools can charge anything they want, so they do.

While physical therapists always have options, they pale in comparison to the setup that physicians have. You might not know this, but most physicians qualify for the PSLF program. Their training during residency and fellowship counts, too. Many DPTs, however, work in private practice clinics which aren't eligible for PSLF.

Hence, a physical therapist and a physician might end up paying a similar amount to their student loans even though the MD will have significantly greater lifetime earnings and substantially more debt.

Related: How to pay for your PT or PTA education

Get a plan for your physical therapy student loans

If you're feeling overwhelmed by your DPT student loans, know that there are many student loan repayment options to explore. I’ve never met a DPT for whom our team couldn’t craft a custom student loan plan.

If you feel like your loan repayment strategy is straightforward, feel free to use our refinancing links to get a cash back bonus.

Do you fall into the “how will I ever pay off my massive student loans and live a normal adult life” category? If so, you should consider our student loan consult. We’ve made multiple plans for borrowers, and we can help physical therapists like you save money.

The forces arrayed against you are immense and we can certainly help with your expensive physical therapy student loans.

Rehab centers want a cheap supply of labor. The schools want to continually raise tuition. And the APTA wants more members who can afford to pay more dues. Someone has to look out for your financial interests, and it might as well be you (and us, if you feel like we’d be able to help).

Have an outrageous story about your DPT student loans? Comment below (and feel free to use a pseudonym if you’re worried about anonymity).

This! All of this! My husband has a DPT, having graduated three years ago from his private-school program. I have been saying all of this for years!

The APTA essentially taxed their own by forcing the DPT across the profession. We were mindful of my husband’s options after graduation and opted to live in a low cost of living location in Northern CA. He is making over $100k in a non-profit hospital that provides $6,500 a year for loan forgiveness (in addition to going for PSLF), whereas friends of his are making $75-80k in Southern CA or the Bay Area for private companies. He took out about $180k for the program and living expenses. We found the public, in-state options to not be drastically different in cost. The APTA estimates of DPT loans are incredibly low.

What’s crazy is that if that hospital is non profit, then the loan balance is projected to be forgiven and the hospital is throwing away money! You should ask for that 6500 in salary instead.

most likely what is happening is the hospital made him sign a contract to stay for so many years after the first disbursement of student loan forgiveness and the contract extends for every year that money is being applied. Also most hospitals and private companies give performance raises every year and a 3% raise would be less if the 6500 was given as a bonus.

I graduated from a private DPT program in 2015. I had an excellent education and I enjoy working in my field. However, I left with over $200,000 in debt and it is crippling. I regret every day getting my DPT.

Sorry to hear, but if you enjoy being a PT the good news is that your debt is basically like a tax. If you can utilize a forgiveness strategy, it doesn’t have to affect your happiness.

Have you heard about the PSLF not being honored by some of these loan servicing companies? People work for years and suddenly realize (informed by the loan servicer, not the gov.) they don’t qualify perfectly for loan forgiveness – then end up having to pay of the rest. What are your thoughts on this?

Happens mostly to ppl who have FFEL loans issued before 2010. Not common but yes it happens. That’s why we started doing a consulting business to try and prevent that for people who get a plan from us

What’s your opinion on student loan debt and for forgiveness on loans and default on physical therapy and chiropractic? I’m looking at these 2 career options..Thanks…..

I would choose physical therapy over chiropractic. Incomes and career track is far more stable based on our sample size. That said be careful both fields are high debt

my son has been accepted for a DPT program however the cost is $120,000. He is quite anxious about the amount but doesn’t want to wait to reapply somewhere else. he has no debt from under grad fortunately. The loans he is looking at are 6.5%. Does this look like his best option. I hate for him to be straddled for so long repaying these

Is he positive he wants to be a DPT? If he’s sure and there’s no other alternatives he’s remotely interested in, he can go and we’ll be able to help him figure it out when he graduates. That said, I’d suggest taking a year off to travel and get some perspective if there’s any doubt. There will always be plenty of DPT programs you can go to for that price.

I graduated from a private DPT program in northern California at 40 years of age w 260k of debt. I am single and have no chance of saving for retirement. Prior to this, I was a completely broke teacher living hand to mouth and thought earning a doctorate would mean I could finally rest easy. After all the blood sweat and tears it took me to get through the program, I can’t believe I now have to face this. My body is aging and I can’t take on a second job like the younger grads are doing to pay this off!

That’s probably bc you shouldn’t pay it off Lizzy. You can use a forgiveness program, put 10% into retirement, and $500 a month into a Vanguard account for the tax bomb and work 1 job. If you want to retire earlier than 65, then save more in retirement and you’ll be ok.

I’ve been accepted into a private DPT program in August. I worked in a PT clinic for two years prior and absolutely love the field, but after calculating expenses, I’m extremely nervous about the amount of debt I’m going to have. I still really want to go into the profession, but am unsure how I will be able to manage my student loans afterwards. I estimate I will be in $250,000-$325,000 of debt by the time it’s all said and done. I haven’t completed my aid yet, but was wondering if you recommend anything to help ease debt before starting the program?

You can always figure out how to make it work once you have the debt under our IDR forgiveness programs in the US. That said, I’d probably take a gap year and do something crazy like travel the world bc PT school isn’t going anywhere despite what they tell you

I’m currently in my 2nd year of PT school and will probably come out with just under $100,000 in federal loans. If I start working at an average salary of $70,000, what’s a better strategy to try and repay it besides just making the monthly payment?

I’d try to get it consolidated and set up on REPAYE right when you graduate and work towards refinancing it after year 1 or 2 into a lower interest rate (assuming PSLF isnt on the table): studentloanplanner.com/refinance-student-loans/

Would you mind sharing the results that you saw of the APTA survey on new graduate debt? The link is broken.

The link has been updated — thanks for letting us know it wasn’t working!

What about the Public Health Service or the military for post degree total debt relief and reasonable salary during the 3-4 year required payback service time?

my son is facing 250K debt after graduating next spring – a high price tag if the Univ programs are indeed over-charging

there should also be a collective effort to work with the 31 new programs to put this issue on the front burner and assist their students.

an independent financial audit might help drive this issue into a favorable outcome for these new well-educated and needed health professionals.

I think public health and military are great paths for PTs who want to be debt free. That said asking the new PT schools to reduce their expenses is kinda like asking the fox watching the hen house to eat fewer chickens. There’s no incentive not to charge high tuition since that’s the financial reason the schools got opened in the first place is because of uncapped borrowing.

I just got accepted into a DPT program. My student loans will be up to $200,000. It has been hard for me to get accepted into a school but I am passionate about the field so I am willing to take on that debt. I know most PTs only make up to 90k a year. I was just wondering if there’s any options of forgiveness programs you could share with me. Just to ease my mind a little. I will definitely reach out to you when I’m close to graduating.

Most DPTs do PAYE or REPAYE and either have to pay based on income for 10 or 20 years depending on if they’re working in private setting or not. Many make more like 60 to 80k though some do have high salaries.

I am applying next year for the DPT program. By the time I finish undergrad I will have about 20K in debt. I am not sure if I’ll be able to take on the debt from DPT school. The program I want to attend is about 126K, but I would be able to live at home. Am I allowed to borrow that much in federal student loans? Is there a cap?

There’s no cap. You’ll get all the debt you want. That’s one reason why programs cost sit much money.

I’m 33, found out in my full battery evaluations, that this career path DPT may be the best fit. I have shadowed multiple occupations within the profession. I like the setting, the initial response I felt was that I liked… when I bring up questions, like was it worth it to each PT, they I think have no choice but to say they love it. Most have let me know the ugly side of the profession, the possible burn out, fatigue one gets from outpatient settings. Also the economics of it long-term have been conveyed as either owning your own cash pay practice or traveling. I’m going to be 37 by the time I’m done, and traveling may not be in the cards, maybe I will start a family, who knows. With added responsibilities in life like, kids, house, a car… all of what I expect when I’m 37… plus debt on top of that, makes me feel like I wont ever actually be able to enjoy the fruits of the profession. I think I may have missed this wave, the profession seems more fitting for younger people who can spend 8-10 years paying back the loan and saving a bit to then either decide cash pay practice or whatever else. Anyone have any insight or advice for me with regard to this ever lasting debate in my mind?

I think the way you should look at it is does it make sense to make 60k to 100k and lose about 20% of that to loans and give up income for about 3 years or do something like travel the world and try to find yourself or find another career path that could make you happy. It’s not as much a financial decision as you might think. It’s more do you want to be doing that work the rest of your life.

Would you say PTA is better option to do if able to graduate debt free? PT in general seems to quite dumb given ROI.

Take 20% off the income of a PT if that income is higher than PTA it’s better to go the PT route regardless of the debt since you can pay based on income