What if I told you there was a way to send all your kids to any college of their choice in the USA for almost free? Sounds like a scam, right? It might be hard to believe, but middle-class families might soon be able to do this due to arcane changes in federal student loan policy.

For more than a decade, undergraduate students have only been able to borrow a few thousand per year for college, far less than the cost of attendance. To cover the balance, families turn to private student loans with no federal protections, expensive Parent PLUS loans, or even home equity or retirement savings.

In this post, we’ll show you how a middle class family could use the New Biden IDR loophole combined with the Double Consolidation loophole to send 4 children to college for almost nothing.

Editor's note: Attention parents! New regulations will sunset the Parent PLUS double consolidation loophole as of July 2025. If you're a parent with a higher income, you should anticipate repaying the bulk of new student loans taken out on behalf of your children.

What is New IDR?

Let’s cover New IDR first. Biden announced this plan in early January 2023, and it will likely take effect July 2023. This plan is an extremely generous new version of Income Driven Repayment (IDR). Undergraduate borrowers will only need to pay 5% of discretionary income, defined as taxable income above 225% of the poverty line.

This new plan is being created by modifying the terms of the existing IDR plan called Revised Pay As You Earn (REPAYE). We will call the new plan “New REPAYE” to distinguish this plan from the old REPAYE.

We will see later how easy it could be for an undergraduate borrow to pay back a fraction of what they borrow with this new plan.

However, Parent PLUS borrowers cannot get access to this new IDR plan due to statutory restrictions. The good news is that there is a work around called Double Consolidation.

What is Double Consolidation?

Undergrad debt is capped, but Parent PLUS debt is not.

Legal statutes say that both Parent PLUS loans and Consolidation loans that paid off Parent PLUS loans cannot get access to any income driven repayment option besides ICR (Income Contingent Repayment).

Presumably this is to discourage parents from borrowing hundreds of thousands of dollars and then paying back a percentage of very low retirement income.

This ICR plan is lousy. You must pay 20% of all income above only 100% of the poverty line. One reason so few borrowers have received forgiveness after decades of repayment on IDR plans so far is this ICR plan was the only income driven payment option until the late 2000s. Mathematically, it’s very hard to get forgiveness when you must pay 20% of your income.

But there’s a big loophole in the statute. While you cannot get access to the best IDR payment plans with Parent PLUS loans or a consolidation of Parent PLUS loans, you CAN get access by consolidating Consolidation loans.

Confused? We’ll show you an example later of how this works, how amazing this loophole is, and how it’s key in the free college strategy we’ll explain.

10 Steps to Free College with Income Driven Repayment

Now let’s get into some cold hard math using the Park family. Steven and Sarah Park are 55 years old, and they have 4 children, Madison (18), Tyler (16), Riley (14), and Lisa (11).

Madison got accepted to Georgetown starting in Fall 2023, but Steven and Sarah are very worried about paying for it due to their large family and middle class income. Steven earns $80,000 a year and Sarah also earns $80,000 a year, making them solidly middle class in their high cost of living city.

We’ll go into great detail so show how the Park family could get all 4 children through college for a pittance. This is directly due to the generosity of the New IDR plan.

Note that if I used a lower middle class family as an example, their total family college costs would be far lower than the already ultra low costs we'll show for the middle income Park family.

Step 1: Fill Out the FAFSA Every Year

In order to take out student loans, the Park family will need to fill out the FAFSA annually. This will allow them to qualify for undergrad and Parent PLUS debt as well as any potential need or merit based aid offered by their children’s schools.

Step 2: Max Out Dependent Stafford Loans in Undergrad

Next, all the Park children will be taking out the maximum amount of Stafford loans for a dependent student. This will leave them with about $28,000 in debt each. This debt can stay in deferment until the children graduate.

These Stafford loans are in the names of the individual students (Madison, Tyler, Riley, and Lisa).

Step 3: Take Out Parent PLUS Loans, But Only in One Parent’s Name

This is a very important part of the free college plan. Steven decides that he will take out all of the Parent PLUS loans for his children’s education in his name alone.

This way, if he were to pass away before his wife Sarah, the family would not be expected to pay any of it back as this debt will be only in his name.

There are no cosigners on Parent PLUS debt, unlike most private student loans.

Related: How to Strategically Choose Which Parent Should Apply for Parent PLUS Loans

Step 4: Keep the Parent PLUS Loans in Deferment Until the Last Child Graduates

Since Lisa is only 11 years old, when Steven starts borrowing, he won’t be finished until his final child Lisa graduates at 22 years old. That means he will be able to keep his loans in deferment between age 55 and 66.

Step 5: When Each Child Graduates, Certify Income at $0

When a student finishes college, most keep their loans in deferment for 6 months. This is done automatically and the technical term for this is the “grace period.”

Say Madison graduates in May 2027. She stays in grace period until November 30, 2027. At this point, she certifies her income, which is based on the tax return from 2026 when she earned $0 all year as a student.

In her second year of work, let’s assume her annual salary is $60,000 per year.

She started her job in early August, and thus for her second year of New REPAYE / IDR payments, she only reports an income of $25,000 (August to December income).

In year 1 and 2 of repayment, her New REPAYE monthly bill is $0 a month. Furthermore, all of her interest is subsidized.

Step 6: When Children Earn a Higher Income, Keep Paying at a Very Low Rate

She graduates in 2027. In November 2029, she finally reports her first full year of taxable income for her income driven repayment plan from tax year 2028. Her payment at 5% of income over 225% of the poverty line comes in at $105 a month.

Let’s assume she remains single for 6 years after that and has 2 children at 30 and 32 in 2035 and 2037. For modeling simplicity, we will assume all the children have their own kids at the same respective ages of 30 and 32.

In 2035, her payment drops due to the growth in her family size from $141 a month to $90 a month. In 2037, her payment drops again to $40 a month. We assume she files taxes separately to exclude any income from her spouse being counted. If she saved for retirement, she could cut this monthly payment to $0 a month.

In total, over 20 years, she would pay $18,875 on her $28,000 Stafford loans. If she saved 15% of her income to retirement, she would only pay $4,598.

Step 7: Fully Optimize Repayment for the Children

The children might not earn an “average” income. Some might choose to work part time, explore a career in the arts, teaching, entrepreneurship, or other path that does not result in high, stable income.

To the extent that was the case, many of the kids could pay $0 a month on New REPAYE or even less.

Other children might have the ability to contribute more to retirement. If they contributed the max of $22,500 to retirement, their student loan payments would be $0 a month.

Hence, some of the children might choose public service jobs and pay for 10 years instead of 20. Others might make low incomes and pay $0 a month because of that. Still others might make a higher income but could rationally choose to hide most of it through aggressive retirement contributions.

Assume one child pursued PSLF, one earned less than $60,000, another maximized her retirement, and one had a normal payment schedule, instead of $18,875 times 4, we might have a total of $40,000 of payment costs for all 4 children in undergrad.

Step 8: Max Out Parent PLUS Loans Every Year for Each Child

Steven (the parent) opts to max out Parent PLUS loans that he is eligible for each year. Luckily, that allows him to borrow the difference between what the student can borrow / contribute and the total cost he is expected to pay.

Since all of his kids chose schools with $50,000 per year tuition, we’ll assume that after merit and need based aid, he’s left with $30,000 of tuition costs plus $20,000 of living expenses per child.

He thus borrows $200,000 of Parent PLUS loans per child.

By 2034 when Lisa graduates (she’s 11 years old currently), he will owe $800,000 of Parent PLUS loans plus accrued interest.

Given how high the interest rate on Parent PLUS loans is, we assume in total he owes $1 million of Parent PLUS in 2034.

Step 9: Consolidate Twice to Gain Access to New REPAYE for Parent PLUS

When his youngest child graduates in 2034, he finally can use the “double consolidation loophole.”

Steven sends 10 loans to one servicer and 10 loans to another servicer by a paper application.

After the process is complete, he now has 2 Unsubsidized Consolidation loans.

Then he goes to studentaid.gov and consolidates the two unsubsidized consolidation loans together into a new consolidation loan at yet another servicer.

His new loan now has access to the New REPAYE plan, because it did not directly repay a Parent PLUS loan.

Step 10: Sign Up for New REPAYE and Know Your Backup Plan

Steven is 66 years old when he finally gets access to New REPAYE and starts paying.

We’ll assume he is retired by this point. He earns $50,000 in taxable retirement income, and his wife earns $50,000 as well.

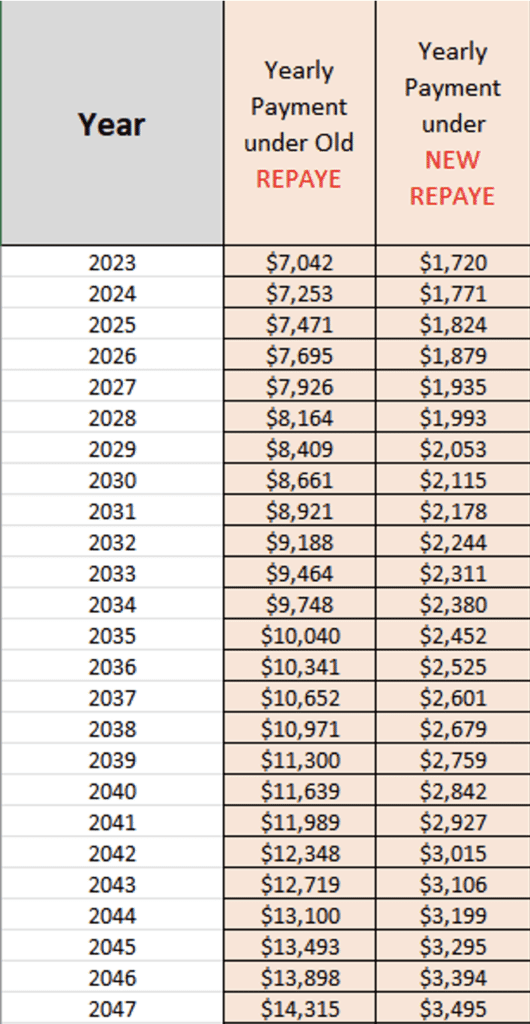

You’ll notice in the chart below that he pays a grand total of $62,691 over 25 years on $1,000,000 of Parent PLUS loans.

Could Free College Through New IDR End?

The New REPAYE plan could be overturned by a future Congress or White House.

If that happens, Steven and Sarah should know their options.

New IBR is a payment option available to borrowers who did not take out loans before July 2014.

This plan is statutory, meaning it would take 60 votes in the Senate to repeal.

The Double Consolidation loophole gained credibility when House Republicans sought to close it with the Prospect Act in 2017.

This bill explicitly stated that consolidations of consolidations would not have access to the best IDR payment options.

But that bill failed, and Congress is unlikely to do anything to block this loophole in the near term.

Total Cost for This Family: Less than 10% of the Amount Borrowed

$100,000 of joint income makes the Park Family middle class by most estimations, but families with that level of income have historically been forced to figure out how to pay for college directly.

In this example, the Park family pays back $102,691 out of over $1.1 million borrowed.

Under existing IDR plans like the Old Revised Pay As You Earn, the Park family still could have benefitted. But they would have paid back over $400,000 of the amount borrowed combined. This higher cost likely provides a strong incentive not to overborrow. Under the new IDR rules, not so much.

If the children and parents earned a slightly lower income, their total cost of repayment would be closer to $0.

This strategy is not risk free, but it’s a far better alternative than families stretching their finances to the limit to help their children secure the dream of higher education.

Why have Parent PLUS loans not been capped? Because universities themselves are important constituencies. Schools that serve lower income groups might be put out of business if Parent PLUS were ever limited, which is one important reason why parents can still borrow so much.

More Families Should Use These Loopholes to Pay for College

Consider Medicaid's 5 year lookback rule for nursing homes. Smart, middle income families move assets to a trust at least 5 years before mom or dad moves into the home, and Medicaid picks up the entire tab.

We have not seen such strategies used for higher education in the past because the existing income driven repayment plans were not as generous.

With Biden’s New IDR plan, parents who know the rules could use loopholes to maximum advantage and pay almost nothing for their children to go to college.

Time will tell how many families will make this behavioral modification.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

For refinancing 100k or more (bonus from Student Loan Planner®, not SoFi®)

|

Fixed 3.99 - 9.99% APR

Variable 5.99 - 9.99% APR with all discounts with all discounts |

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 3.99 - 9.74% APR

Variable 5.74 - 9.74% APR

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 4.99 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 4.99 - 8.90% APR

Variable 5.29 - 9.20% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 4.84 - 8.44% APR

Variable 4.86 - 8.49% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 3.99 - 10.98% APR

Variable 4.86 - 12.39% APR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).