As Americans continue to deal with the COVID-19 crisis, many are starting to feel the financial pressure. From layoffs to reduced hours for workers, and less foot traffic and sales for business owners, nearly every person has been affected in some way.

It’s in times like these that, in theory, Americans should be able to rely on their emergency savings. The Federal Reserve recommends that families have enough money in their “rainy day” fund to cover at least three months’ worth of expenses. Other financial experts recommend having three to six months’ expenses saved.

But the fact of the matter is that emergency savings for a large swath of American households won’t be able to last long. According to the Federal Reserve’s 2018-2019 Economic Well-Being Report, only about half of people in the United States have rainy day funds. Additionally, one-fifth of Americans would need to borrow or sell assets to cover a three-month loss in income.

Contrary to what some might expect, a lack of emergency savings isn’t just a problem for low- or moderate-income households.

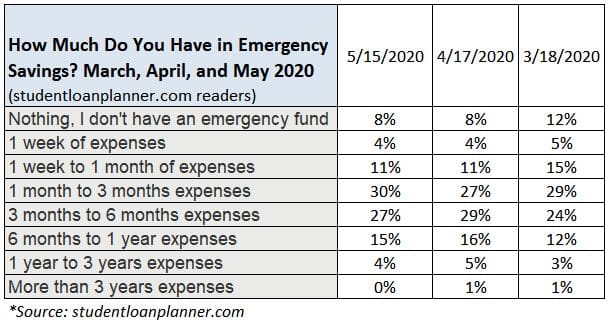

Student Loan Planner® conducted 3 surveys of our readers approximately 30 days apart each: the first of over 4,000 readers on March 18, the second of over 3,000 readers on April 17, and the third of over 3,400 readers on May 15. The samples were statistically equivalent.

High-income earners won’t be able to last long on their emergency savings either. That said, we are seeing emergency funds rapidly grow as workers have fewer places to spend money. Here’s what our data uncovered.

Most Professionals Barely Have 3 Months of Expenses Saved

Student Loan Planner®’s March 18 survey found that nearly one in three respondents had one month or less of expenses in their emergency fund. Sixty percent had three months or less of expenses stashed away.

These emergency saving numbers align with those published by the Federal Reserve for the entire United States population. Student Loan Planner®’s survey demographic skewed heavily toward high-income earners. Over 70% of respondents had individual incomes of over $50,000 per year, and about 30% had annual incomes of $100,000 or more.

Student Loan Planner®’s survey demographic reflects our readership; many of our readers are from professions that are known for having high average incomes and high student debt. Forty-one percent of respondents worked as physicians, veterinarians, dentists, lawyers or in the corporate world.

Yet only 40% had more than three months’ worth of expenses in savings in March. That number in mid April had improved to 50%.

And, even more alarming, nearly 1 in 6 had less than a week’s worth of expenses saved. These numbers reveal that if the COVID-19 crisis drags on, it's going to cause financial distress for Americans across all income levels.

That said, our readers have battened down the hatches and reduced their spending. Here's what their emergency funds look like.

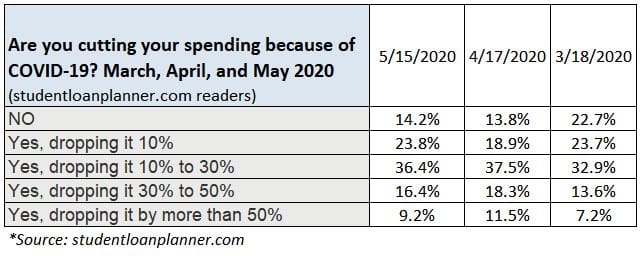

Where Are These Increased Emergency Funds Coming From? Spending Reductions

Check out the numbers on spending cuts due to COVID-19 among our thousands of readers.

The number reporting that they've cut their spending by 50% has soared.

The number saying they haven't cut their spending at all has cratered.

The good news is now we're past the “buy guns and hoard toilet paper because the world is ending” phase. So we see some recovery in spending patterns although we've got a long ways to go.

Clearly, the increasing emergency funds might be simply attributable to consumers not spending anywhere close to what they used to.

Student debt makes it difficult for high-income earners to save

What is keeping high-income earners from being able to put more money away in emergency savings? One common issue that most respondents are dealing with is crushing student debt.

Student loans can be an obstacle to building up emergency funds in two ways. First, the monthly payments cut into cash flow. Second, some borrowers feel like every extra dollar in their budget should go toward paying down these interest-bearing loans.

One respondent with over $200,000 of student debt had only one week’s worth of expenses saved. He says he now regrets the decision to prioritize debt reduction over bolstering his emergency savings:

“I do not have a savings built up because I just graduated in 2019 and have been paying off debt since. I will be changing my priority to saving an emergency fund once we make it through this crisis. I know I should have been doing it but it felt wrong to save money when I had plenty of debt to pay down.”

But when you’re dealing with high student debt, saving can be difficult — even if you want to make it a priority. That circumstance can be especially true for single parents, like this respondent who is a nurse and dealing with $50,000 to $99,000 of student debt:

“I'm a nurse and currently I'm working. When (or if, if I'm lucky) I get sick, I'm concerned about my ability to have enough sick leave and still rely on other family members for childcare. As a single parent and single-income household with children, I don't have many external supports.”

And when asked how much she had in her emergency fund, she responded, “Nothing, I don’t have an emergency fund.”

Business owners are running out of cash fast

While hospitals and doctor’s offices are dealing with maximum patient capacity, other healthcare professions have been negatively affected by the COVID-19 crisis in different ways. According to Student Loan Planner®’s survey results, there may be no group hurt more than dentists.

Dentists graduate on average with $292,169 in student debt. Even with full-time incomes, that’s a huge financial burden. Our survey found that an astounding 68% of dentists have suffered a significant income drop during the coronavirus crisis. As dental private practice owners struggle with their own cash-flow issues, that problem trickles down to the number of staff they’re able to keep on payroll. In fact, 29% of dentists who responded to the survey said they had lost their incomes completely.

Here’s what one dentist had to say who has only one week to one month’s worth of expenses saved and just lost his job:

“This is completely devastating to the dental profession. Many practices will likely go out of business or take 1-2 years to recover. Insurance does not cover things like this. There will be many unemployed dentists if this goes longer than a month.”

While dentists may be dealing with the worst effects of this crisis, plenty of other business owners are struggling too. Here’s what one veterinarian practice owner said:

“I am a solo vet practice and if I don't work, my staff doesn't work either. I am one year into practice ownership and have minimal cash reserves. Tough times!”

And here are the comments shared by a solo lawyer with one month to three months’ expenses in emergency savings:

“(The) majority of my clients are photographers and photojournalists. All have lost some to all work over the past 2 weeks. This trickles down to less to no work sent my way. Belt tightening is very possible in the short term. But an ongoing economic crisis kicked off by COVID-19 … is going to hit us hard before long.”

Student loan borrowers and business owners need financial help

As members of Congress went back and forth on the $2 trillion stimulus package, relief for student loan borrowers and business owners became a major focus.

Student Loan Planner®’s survey results indicate that there’s good reason to focus on these two categories of people. A chiropractic clinic private practice owner with one week to one month’s worth of expenses saved put it bluntly:

“Small business owners are screwed. We need help.”

He’s right. And student loan borrowers need help too. Hopefully, lawmakers are listening and provide sufficient financial assistance to those who need it the most before emergency savings run out.

During this crisis and as the country works toward recovery, Student Loan Planner® is here to help. We know exactly what student loan relief provisions have already been put in place. And we can show you step by step how to take advantage of these resources to stretch your emergency savings further. Book a consultation today.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).