If you have student loans, it may feel like getting rid of them will take forever. But there are student loan success stories of people who have successfully paid off student debt. In general, though, how long does it take to pay off student loans? The answer can vary — but read on to learn more about the average time to pay off student loans.

Average student loan debt

How long does it take to pay off student loans? This depends on the amount of student loan debt. For context, let’s dive into the average student loan debt amount.

Currently, U.S. student loan borrowers owe a total of $1.5 trillion dollars in federal student loan debt. On top of that, it’s estimated that there are an additional $119 billion dollars in private loans as well, according to data from the Center for American Progress.

When it comes to median amount of debt by borrower, Pew Research Center offers data based on educational level as of 2016:

- Some college, no degree: $10,000

- Bachelor’s degree: $25,000

- Graduate degree: $45,000

The amount of borrowers who have six figures in debt is actually lower than you might think. According to Pew Research Center, only 7% of borrowers (equivalent to 1% of the population) have $100,000 in student loan debt or more.

As of Q2 2019, there’s $580.8 billion in repayment among 15.7 million borrowers. Among that, $9.8 billion was more than 270 days in default among 0.40 million borrowers.

A look at repayment terms

How much time it takes to pay off student loans can vary by borrower and balance. However, how long you get depends on the repayment terms of your repayment plan, which should also be considered.

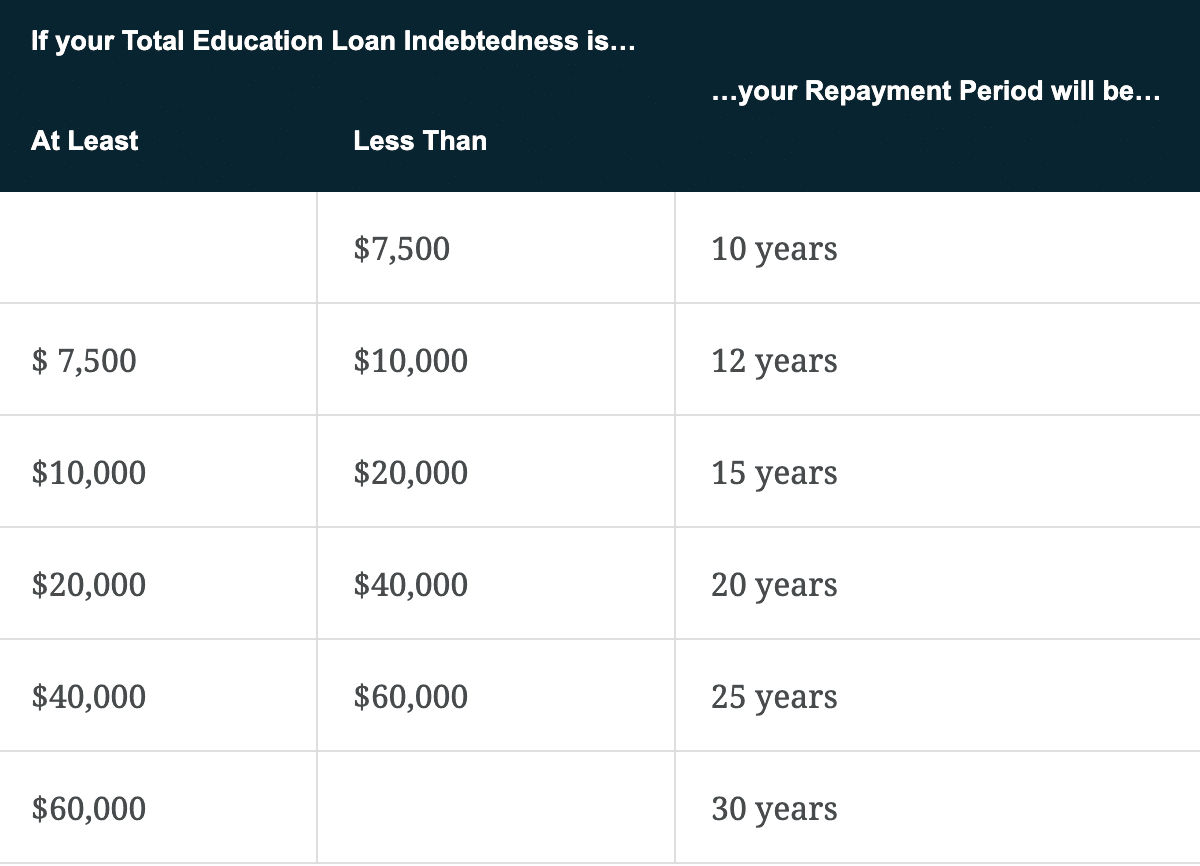

For example, the Standard Repayment Plan typically has a 10-year repayment term, while the options under income-driven repayment have terms of 20 to 25 years. The Standard Repayment Plan can increase up to 30 years if you consolidate with a Direct Consolidation Loan. Under that option, the available repayment period is based on how much you owe:

Source: Federal Student Aid

Repayment terms refer to how long you have to pay back your loans. The length affects your monthly payment. Shorter repayment periods have higher monthly payments, and longer repayment periods have lower monthly payments.

Get Started With Our New IDR Calculator

Average time to pay off student loans

Though the Standard Repayment Plan — the plan borrowers are automatically put on — is typically 10 years, it takes student loan borrowers much longer than that to pay off student loans. In fact, on average, repayment takes nearly double that time. According to data from One Wisconsin Institute, the average time to pay off student loans is 21.1 years. The data was compiled from a survey of 61,000 individuals.

Here’s the average time to pay off student loans based on education level, according to One Wisconsin Institute:

- Some college, no degree: 17.2 years

- Associate degree: 18.3 years

- Bachelor’s degree: 19.7 years

- Graduate degree: 23 years

Average time to pay off student loans by degree

How much you borrow and how much you make plays a big role in the average time to pay off student loans. An infographic from the Education Data Initiative offers some possible payoff times, based on typical tuition costs and paying 10% of salary to debt.

Here are some of the common degrees the EDI profiled, along with the prospective time to pay off student loans:

- Bachelor of Social Work: 10 years (likely with Public Service Loan Forgiveness)

- Bachelor of Science in Electrical Engineering: Seven years, three months

- Master’s Degree in Nursing: 11 years, one month

- Master of Business Administration: 22 years, 10 months

- Bachelor of Arts in English: 19 years, four months

These numbers, of course, assume that you’re getting paid the average salary and also that you found a career in your field. That’s not always the case, so how long it takes to pay off your student loans by profession and degree can vary.

Repayment stats for paying off student loans

The National Center for Education Statistics has a report on repayment statistics as of 2015 among borrowers from 1995-96 and 2003-4. According to the report:

- Among borrowers in 1995-96, 38% had paid off their loans within 20 years without defaulting.

- Among borrowers in 1995-96, 24% had paid off their loans within 12 years without defaulting.

- Among borrowers, in 2003-4, 20% had paid off their loans within 12 years without defaulting.

- Among borrowers in 1995-96, 25% defaulted on at least one loan within 20 years.

- Among borrowers in 2003-4, 27% defaulted on at least one loan within 12 years.

- Among borrowers in 1995-6, the average amount owed after 20 years was $20,000.

- Among borrowers in 2003-4, the average amount owed after 12 years was $24,000.

As you can see from this data, a minority of borrowers paid off their loans within 12 to 20 years without defaulting. Even so, the average amount owed after 20 years is still quite a lot, indicating that many people don’t pay off their loans within that time.

Given the repayment terms we have now and the repayment options available, many student loan borrowers aren’t paying off their loans. Now, in many cases, borrowers might be waiting for student loan forgiveness, either through Public Service Loan Forgiveness or an income-driven repayment Plan.

Pay off student loans faster with refinancing

The repayment term you get is simply the amount of time you have to pay off your student loans, not necessarily how long it takes to pay off your student loans. To pay them off faster, you need to pay more than the minimum. But even then, getting ahead with interest is tough.

One hack to pay off student loans faster and cut down your repayment time is refinancing. Through student loan refinancing, you apply for a refinanced loan at a better rate. If you score a lower rate, you can save money on interest, which can then be put toward your remaining principal balance. If you choose a shorter repayment term as well, you can save even more money, though you should note your monthly payments will be higher.

Want to pay off student loans faster? Get in touch with us about a custom plan!

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).