If you’re thinking about refinancing your student loans, you’re probably hoping to lower your interest rate. But if some of that interest is deductible, how could refinancing your student loans affect your taxes? Could paying less student loan interest actually have a negative impact on your tax bill?

These are questions that many student loan borrowers want answered before moving forward with applying for a refinance loan. After all, if refinancing results in a higher tax bill, it will reduce your total real savings.

Let’s take a look at how student loan interest deduction and how refinancing could affect the amount of interest that you’re able to deduct. We’ll also look at other ways that student loans and federal income tax are related and how to take advantage of any tax breaks you may qualify for.

How do student loans affect taxes?

The tax break that student loan borrowers are most often able to claim is the student loan interest deduction. Here’s how this deduction works and how much it could save you on your taxes.

How the student loan interest deduction works

The current IRS tax code allows eligible student loan borrowers to deduct up to $2,500 of the interest that they pay on their student loans per year. This deduction only applies to interest payments, not any money that you paid toward the principal. Also, it’s important to point out that this is a deduction, not a credit. So it can reduce your taxable income but won’t provide a dollar-for-dollar tax bill reduction.

On the plus side, though, the student loan interest deduction is an “above the line” deduction. That means you can use it to reduce your tax bill even if you don’t itemize your deductions (unlike the mortgage interest deduction).

In 2017, a proposal was made to repeal the student loan interest deduction as part of the Tax Cuts and Jobs Act (TCJA). Thankfully (for student loan borrowers), that particular provision was not included in the final version of the TCJA.

Who qualifies for the student loan interest deduction?

Not every U.S taxpayer who happened to pay interest on a student loan will qualify for the student loan interest deduction. You’ll only be eligible for the deduction if you meet the following requirements, according to the IRS:

- You paid interest on a qualified student loan during the same tax year as your tax return.

- You're obligated, legally, to pay interest on a qualified student loan.

- You’re not filing your taxes as “married filing separately.”

- Your modified adjusted gross income (MAGI) is below the limits set each year.

- You can't be claimed as a dependent on someone else's return. This also applies to your spouse if you’re filing jointly.

You can claim the full student loan interest deduction if your MAGI falls below $70,000. The amount gradually phases out for taxpayers with incomes between $70,000 and $85,000 ($140,000 to $170,000 if filing jointly). If your MAGI is above $85,000 ($170,000 when filing jointly), you won’t be able to claim the deduction.

There are no restrictions based on loan type. Whether you have federal student loans, private loans or both, you can claim the student loan interest deduction if you meet the above criteria.

Related: How to get the student loan interest deduction on your taxes this year

Calculating your student loan interest deduction

The student loan interest deduction can reduce your taxable income by a maximum of $2,500. But if, for example, you only paid $1,000 in student loan interest last year, that’s the most you’ll be able to deduct.

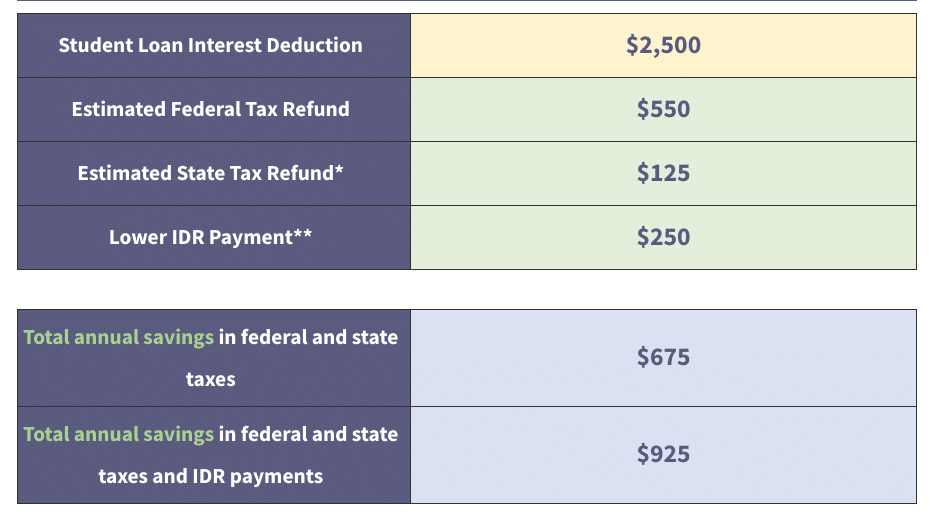

You can quickly calculate your estimated student loan interest deduction by using the Student Loan Planner® interest deduction calculator. For sake of example, let’s assume that you make $60,000 per year — placing you in the 22% tax bracket for 2021 — and you qualify to claim the full $2,500 deduction.

Looking at the calculator results below, your federal tax savings would be $550. And if you live in a state that charges state income tax, you could save another $125 for a total tax savings of $675.

If you also happen to be on an income-driven repayment plan (IDR), the student loan interest deduction could also reduce your monthly payments by virtue of lowering your MAGI.

So, after accounting for an estimated $250 per year in lower IDR payments, the student loan interest deduction could net you $925 in total annual savings.

How to claim the student loan interest deduction

Unlike other deductions, you don’t have to itemize the student loan interest deduction on a Schedule A form. Instead, it can simply be claimed as an income adjustment on your 1040 Form.

If you paid over $600 in student loan interest to any particular lender or servicer, the servicer should automatically send out a Form 1098-E, Student Loan Interest Statement to you and the IRS.

Even if you paid less than $600 to a loan servicer, it may still send you a Form 1098-E. But if you do not receive one, you can call your servicer and ask for the specific amount of interest that you paid so that you can claim it on your taxes.

How does refinancing student loans affect taxes?

Those who are considering a student loan refinance will be happy to learn that there’s a strong chance that it will have little to no effect on your taxes. Here are a few reasons why:

1. Income limits. You can only claim the student loan interest deduction if your income is below the levels outlined above. But borrowers who refinance often do so because they have high incomes and are no longer benefiting from IDR. And, in this case, worrying about taxes could be irrelevant as you may not qualify for the student loan interest deduction anyway.

2. Refinancing might net more savings overall. Even if you qualify for the student loan interest deduction, refinancing may still make financial sense. For example, if you save $2,500 per year in interest while losing $500 in savings related to the student loan interest deduction, you still come out ahead by $2,000. Remember, you'll never lose your entire student loan interest deduction benefit as you'll still be paying some interest on your student loans after refinancing.

3. IDR tax liability on forgiven debt. There’s one way that refinancing could actually reduce your eventual student loan tax liability if you’re on an IDR plan. StudentAid.gov says that IDR student loan forgiveness may be considered taxable income by the IRS. And, depending on the amount forgiven, that could generate a hefty surprise tax bill. So, by refinancing your federal loans into private student loans, you could not only get a lower interest rate but also avoid a potential student loan tax bomb down the road.

Other ways student loans can impact your tax bill

Claiming the student loan interest tax deduction isn’t the only way that student loans can affect your income taxes. Here are two more situations in which student loan debt could decrease or increase your tax bill.

Tax credits

The IRS currently offers two tax credits for students who are still enrolled in school: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). Student loans do count qualifying education expenses, so even if you’re funding your education entirely with loans, you can still qualify for these credits.

Of the two credits, the AOTC has the higher maximum benefit of $2,500 and higher income limits as well. It’s also the only education tax credit that is refundable. The tax refund limit is 40%. You must be an undergraduate with at least a half-time enrollment status, however, to qualify for the AOTC.

The LLC has a slightly lower maximum benefit of $2,000, and the credit is not refundable. However, its eligibility requirements are far more flexible. You can continue to claim the LLC while in graduate school. And you don’t even have to be pursuing a degree. Taking at least one course per year is all that’s required.

See a full side-by-side IRS comparison of the two credits to learn more.

Employer-assisted student loan repayment

Some employers offer student loan repayment as a workplace benefit to attract talent. While this might be a nice perk, employer-paid student loan payments typically count as taxable income. So if, for example, your employer paid $3,000 last year toward your student loans, this would raise your tax liability by $3,000 as well.

However, the CARES Act passed in March 2020 allowed employers to pay up to $5,250 annually toward an employee’s student loans tax-free through Dec. 31, 2020. And The Consolidated Appropriations Act (CAA) extended these provisions through December 31, 2025.

Related: Student loans and taxes — everything you need to know

Get a comprehensive plan for your student loans

Taxes are just one piece of the student loan puzzle you’ll want to consider when comparing refinancing options against other student loan repayment approaches like IDR or pursuing loan forgiveness.

Your income, where you work and even your marital status could impact your tax and loan repayment strategies. For example, if qualify (based on your employment) to join the Public Service Loan Forgiveness program, refinancing your federal loans could be a costly mistake.

Speaking of refinancing federal loans, there are a number of other benefits that you'd give up by doing so. For one, you'll no longer qualify for federal forbearance or deferment. You'll no longer have the ability to join income-driven repayment plans either.

Our Student Loan Planner® advisors are experts in helping borrowers create cost-saving strategies for student loans and income tax. They’ve helped thousands of borrowers build the right student loan plan to save more money. And they’d love to help you too. Book a student loan consultation today.