Disclaimer: This content is for informational purposes and is not meant to be tax advice. We recommend reviewing the IRS website and consulting a tax professional to ensure you understand any tax implications you may face.

With tax season in full swing, it’s important to understand your student loans and the tax laws relevant to your individual financial situation. If you aren’t aware of the various deductions and student loan loopholes that exist, you may be leaving behind significant savings.

Here’s a comprehensive guide to filing taxes when you have student loans in 2024.

How student loans impact your taxes

Although you’d probably prefer to spend your money elsewhere, paying back your student loans can benefit you during tax season. As a student loan borrower, you may qualify for student loan-related tax deductions or other education tax credits.

Claiming the student loan interest deduction

The student loan interest deduction applies to the interest payments on both federal and private student loans. You may be eligible to claim up to $2,500 for tax year 2023 (and 2024) if your modified adjusted gross income (MAGI) is within certain income limits.

For example, the deduction begins phasing out if you earn between $75,000 and $90,000 as a single taxpayer. The phaseout bumps up to $155,000 to $185,000 if you’re married and filing jointly. Unfortunately, if you earn more than those thresholds, you won't be able to claim the deduction.

Use Form 1098-E from your loan servicer to claim this deduction. It will help lower your taxable income, but keep in mind that deductions aren’t a dollar-for-dollar reduction of your tax burden.

Education tax credits

You may be eligible to claim one of these tax benefits for education on this year’s tax return:

- American Opportunity Credit. Claim up to $2,500 per eligible student for qualified education expenses. You must be pursuing a degree or qualifying educational credential and be enrolled at least half time for at least one academic period during the tax year. You can only claim this tax credit for up to four tax years.

- Lifetime Learning Credit. You can claim up to $2,000 per tax return for qualified education expenses. There are no limits on the number of years that you can claim this credit.

Both tax credits are used as a way to offset the cost of higher education by reducing your income tax. Unfortunately, you can only claim one of these two tax credits in each tax year.

Student loan forgiveness isn’t necessarily free

Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness programs don't tax you on forgiven student debt. If you’re pursuing loan forgiveness through an income-driven repayment (IDR) plan, however, you can expect a higher income tax bill when your loans are forgiven.

Any forgiven loan balance after 20 to 25 years of payments with an IDR plan is considered taxable income. You should begin planning and saving for a tax bomb now to help reduce its impact when the time comes.

Editor's note: Borrowers receiving a discharge on their student loans will no longer have to pay income taxes on that discharge through December 31, 2025, thanks to the American Rescue Plan. Read more.

Filing jointly vs. filing separately

If you’re married, your default filing status is probably to file a joint tax return. But if you or your spouse have student loan debt, there may be a better strategy to save you money.

How filing separately could lower your student loan payment

Under an IDR plan, your federal student loan payment is based on your household discretionary income. In general, your loan servicer will use the income reported on your most recent tax return to calculate your monthly payment.

Therefore, if you file your taxes jointly, your payment is based on both spouses’ incomes. The more income, the higher your student loan payment.

But if you file separately, your student loan payment is calculated using only your own income, which could significantly reduce your payment each month. Note this strategy is only applicable if you're enrolled in Saving on a Valuable Education (SAVE), Pay As You Earn (PAYE) or Income-Based Repayment (IBR).

A married couple’s tax filing status impacts their overall tax amount in many ways, and student loans are part of that equation.

Potential risks when filing separately

Filing separately could lower your monthly student loan payment, but you could also end up owing more in taxes.

The most common tax benefits you’ll lose by filing separately are the student loan interest deduction and eligibility for Roth IRA contributions. You may also limit or forgo being able to claim:

- Affordable Care Act (ACA) subsidies

- The Earned Income Tax Credit (EITC)

- The Adoption Credit

- The Child and Dependent Care Credit

- Traditional IRA deductions

- Deductions of capital losses

But, it may be worth taking on this “tax hit,” depending on your financial situation. For example, it might cost you an additional $2,000 to file separately, but you might also save $5,000 annually on your student loan payments. In this case, you’d end up coming out ahead by $3,000 overall.

Keep in mind that filing separately doesn’t always make sense for everyone. It’s best to crunch the numbers based on your family’s financial situation each year and then weigh your potential student loan payment savings against the higher taxes you may face.

Get Started With Our New IDR Calculator

How filing taxes with student loans in a community property state works in your favor

If you live in one of the nine community property states in the U.S., you want to pay close attention to this next part. Depending on your student loans and financial situation, it could save you thousands.

Community property states dictate by law that married couples jointly own all property, assets, income and debt that are amassed during the marriage. These states include:

- Arizona

- California

- Idaho

- Louisiana

- Nevada

- New Mexico

- Texas

- Washington

- Wisconsin

Breadwinner loophole

Because your income is shared in these states, you may be able to take advantage of the breadwinner loophole if you or your spouse make significantly less than the other.

In a community property state, under the Pay As You Earn (PAYE) or Income-Based Repayment (IBR) plan, you can choose to have your student loan payment be based on your equally divided income rather than your collective amount — but only if you file your taxes separately.

For example, let’s say you live in California and you make $100,000 annually while your spouse manages the home without an income. You have a total of $200,000 in federal loans with an average interest rate of 7%.

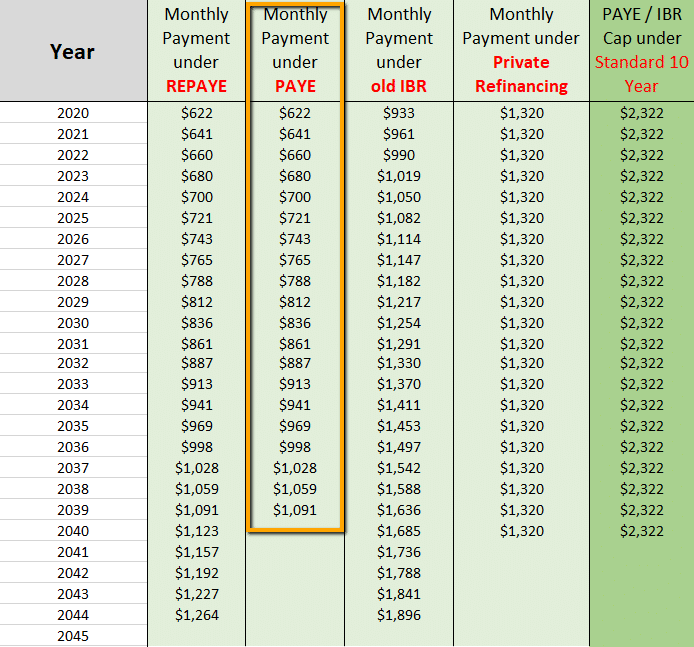

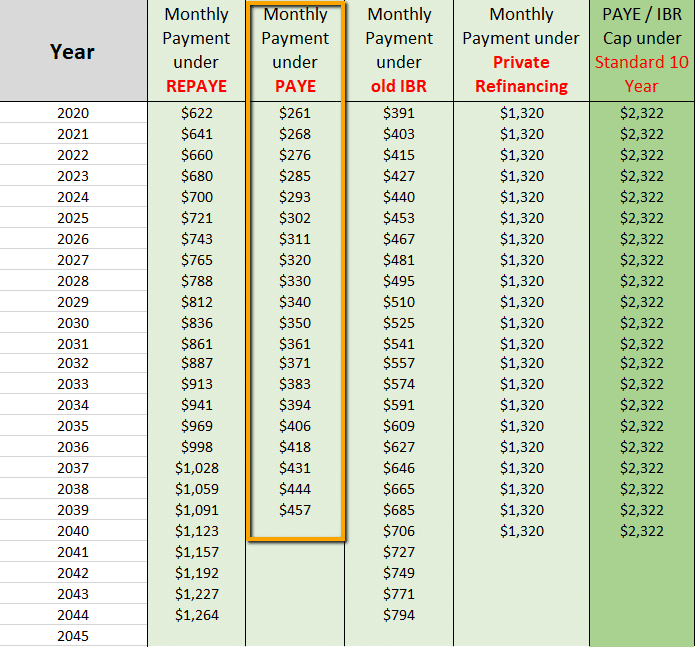

If you file jointly, your payments start off in the $600 range under the PAYE plan.

If you choose to file separately in a community property state, however, you’ll equalize your income using Form 8958. For our example, each of you would report $50,000 of income on your own tax return. This, in turn, would lower your monthly payments to the $200 range under the PAYE plan.

Additionally, living in a community property state may help dramatically reduce the tax penalty for filing separately — eliminating one of the main arguments for not choosing to file separately.

This is another one of those cases where everyone’s situation is going to be different. Use our Student Loan Calculator to better evaluate your situation or schedule a consult with a member of the Student Loan Planner® team to get expert help about your student loan repayment options.

Additional tax-saving strategies

Here are some additional money-saving tips you can implement this tax season:

- Reduce your adjusted gross income (AGI). You can cut your tax bill and lower your student loan payments by strategically using pretax accounts to reduce your AGI. This strategy includes making contributions to your retirement account and health savings account.

- Amend your tax returns. You can recoup the costs from filing separately by amending your tax returns after they are no longer needed for your student loans. Once you recertify using this year’s tax return, you can go back and amend your previous return from separate to joint and get your money back. You can use this strategy for returns that are two to three years old. Because they are old returns, amending them shouldn’t matter for your student loans going forward.

Need help filing your taxes?

Student loans and taxes are arguably two of the most complex financial systems to navigate. The specialists at Student Loan Tax Experts can help you figure out the best strategy for your situation and then prepare your tax forms on your behalf. Mention Student Loan Planner® referred you, and you can score a discount.

Hi Caitlin,

In regards to your suggestion of amending taxes after they are no longer needed for recertification… I have read on other personal finance outlets that this is not legal and constitutes tax fraud, and may void any qualifying payments made.

Do you have anything to back this up–that this is acceptable to do without having negative consequences on PSLF?

We don’t have any reason to believe it’s fraud but we always recommend you check with a tax pro about tax-related strategies.