Considering moving away from BigLaw and using your Juris Doctor degree (J.D.) in another way? Here’s what you need to know about how the potential dip in income could affect your approach to student loan repayment.

It can be a dream scenario for law school graduates to get an amazing six-figure offer from a BigLaw firm. It’s the whole reason they studied hard in undergrad and worked their tail off in law school.

But after a few years of grueling work, they feel burned out and like something is missing in their life. Sure, the money is great, but the amount of work and lifestyle leaves much to be desired. There’s a way to use their law degree that could add more fulfillment in their life. But often the side effect is taking a job at a significantly lower income.

We know how that can affect the budget, but what about law school loan repayment? Should a different repayment strategy be implemented? Is there anything that can be done in preparation for leaving?

Lawyer Student Loan Repayment Options

Let’s look at this from a higher level first and examine the best ways we’ve found to attack student loans. This comes from our one-on-one work with nearly 150 lawyers totaling more than $33,000,000 in student debt.

There are essentially two ways to attack student loans:

1. Taxable loan forgiveness using an income-driven repayment (IDR) plan for federal loans

For households that owe more than two times their income in student loans (e.g., lawyers who owe $200,000 and earn $100,000 or less), selecting an IDR plan like Pay As You Earn (PAYE) or Revised Pay As You Earn (REPAYE) for 20 to 25 years could be the best option. In the end, the remaining loan balance is forgiven, though taxes will be owed on the forgiven amount.

The idea is to keep student loan payments as low as possible, save up for the tax bomb and work toward other financial goals along the way.

2. Aggressive repayment with refinancing to get a lower interest rate

This usually applies to lawyers in BigLaw. If a lawyer owes 1.5 times their income in student loans or less (e.g., owe $225,000 and make $150,000 or more), their best bet could be to pay off the debt as quickly as possible.

The goal is to pay as little interest as possible and to eliminate the debt in 10 years or less — hopefully much less. This may also include refinancing to get a lower interest rate.

Someone working in BigLaw might want to go with option two, aggressive repayment. But depending on the loan balance when leaving BigLaw and the difference in income, it might make sense to switch to option one, especially if they’re going to be working for a nonprofit or government employer so they qualify for Public Service Loan Forgiveness (PSLF).

Either way, the shift in income may require a different strategy.

Law school loan repayment working for BigLaw

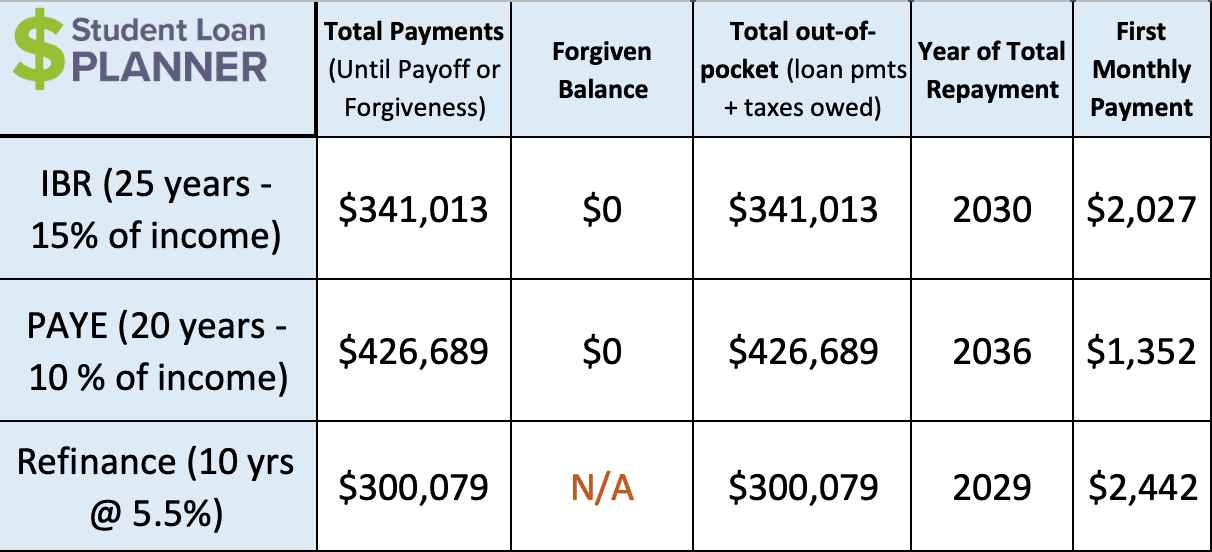

Let’s say Jason has been working in BigLaw for three years and is making $180,000. He expects to get 5% raises each year. He currently has $225,000 in student loans with a 7% interest rate from a top law school.

Right now, Jason is a clear case for refinancing.

If he chooses either PAYE or Income-Based Repayment (IBR) where the payments are based on his income, he’d pay off his loans in full anyway. There would be no forgiven balance. That’s because the payments on IDR plans are based on income, not how much he owes. Meaning his income is high enough compared to his loan balance that the calculated payments would be large enough to pay off the loan.

In the end, Jason would end up paying off a 7% interest loan over a long period of time, which would cost him a lot more in interest. PAYE would end up costing him more than $426,000 and extend loan repayment an extra seven years versus refinancing.

But even though refinancing would offer a huge savings, if Jason is considering leaving BigLaw, then it might not be the best way to go at this point.

Refinancing is a permanent, irreversible process that would remove his loans from the federal program. His only option after refinancing would be to pay back the loans in full. Loan forgiveness would be gone for good.

Quit BigLaw for PSLF

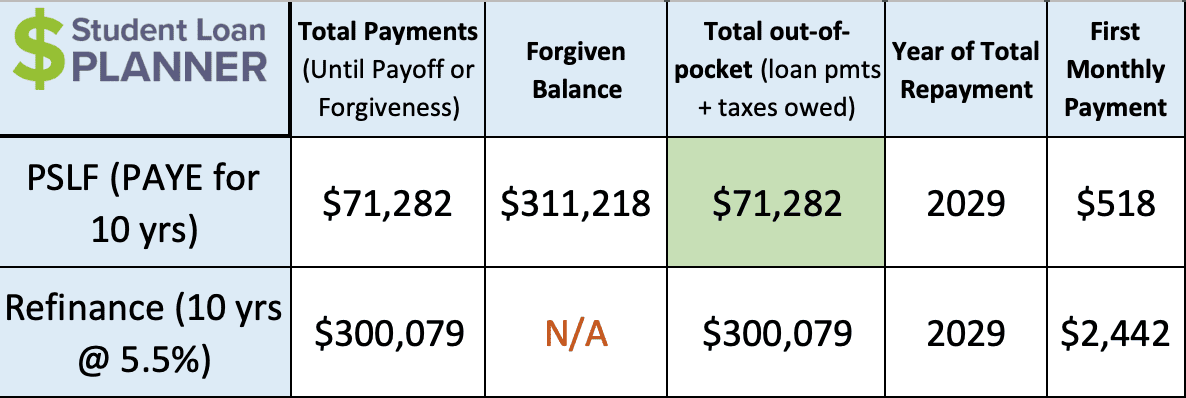

Let’s say Jason wants to leave BigLaw, but he’s only going to do it for an employer that would qualify for PSLF, be more fulfilling and give him a better quality of life where he’d be working less hours.

He got a job offer working for the government that will pay him $80,000 per year with 3% raises each year. He’d also qualify for PSLF, which seems like a great benefit.

Loan repayment looks extremely compelling with PSLF. Rather than spending $300,000 paying back the loan while staying in BigLaw, he would go onto PAYE for 10 years, make a total of $71,282 in payments and then have the balance of his loans forgiven tax-free. Seems like taking the pay cut is worth it because of the student loan savings alone, right?

Not necessarily.

Jason was taking home about $10,000 per month working for BigLaw but will be taking home $5,000 per month with the new government job. That’s a $60,000 difference in take-home pay per year.

We know PSLF is projecting to save him $230,000 paying back the loans over 10 years. That works out to be $23,000 per year on average. In the end, Jason would be taking a $60,000 per year pay cut to save $23,000 in loan repayment, giving up $37,000 per year in extra take-home pay.

From a purely financial standpoint, there’s a greater cost to leaving BigLaw. Even if the financial argument isn’t the most important part of the decision, Jason now knows the numbers and can make a more informed decision while taking into account the quality of life that will best suit him.

Leaving BigLaw for in-house counsel

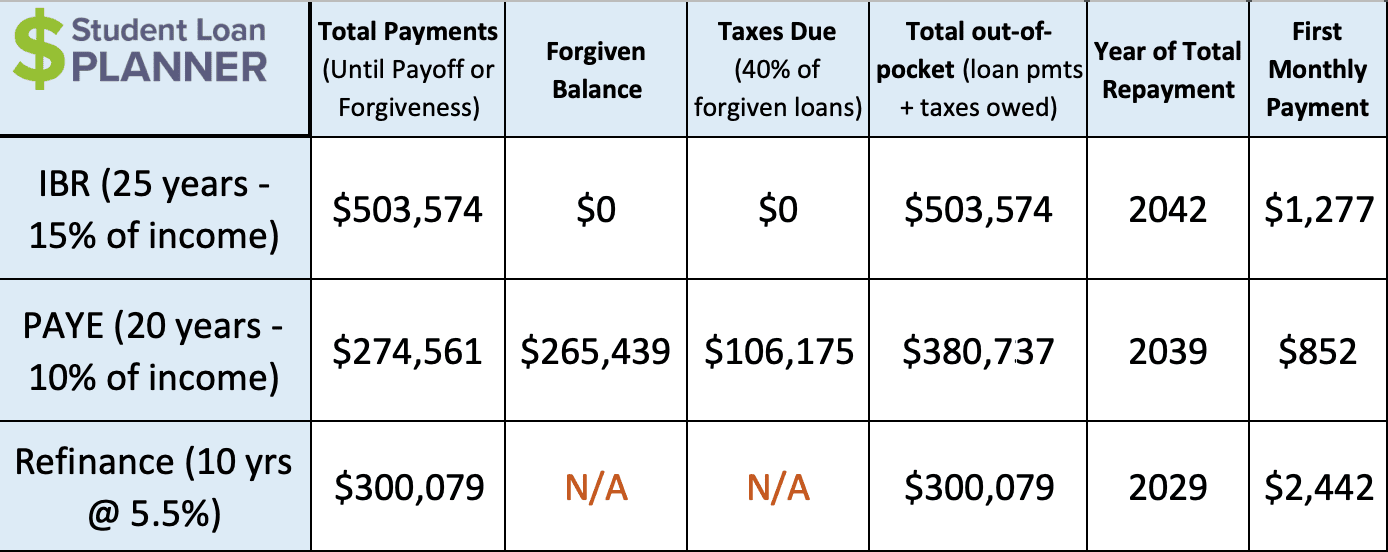

Jason also explores what it would look like if he quit BigLaw to pursue an in-house counsel job. He finds one where he’d be making $120,000 with 3% raises each year.

PAYE could be a solid option for him, even though it looks like it would cost him more than refinancing. It’s true that loan repayment would cost him more, but the lower monthly payment would allow him to save up for other financial goals along the way.

If Jason refinances in this situation, he’d have to make monthly payments of $2,442 per month for 10 years. It’s doable if he’s taking home $7,000 per month, but he feels it would be a little bit of a stretch.

If he were to choose PAYE, his monthly payment in the first year is projected to be about $852 per month ($1,590 less than the refi payment). He’d also want to save up for the taxes owed in 20 years, which would be close to $300 per month if it earns a 5% annualized return. In the end, he’d have an extra $1,290 per month going for PAYE compared to refinancing.

Let’s say Jason decides to save that extra $1,290 per month since he doesn’t have to put it toward his loans. In 20 years, he would have $530,000 in savings after his loans are forgiven and he pays the taxes on the loan forgiveness in 20 years (assuming a 5% annualized return)

What happens if he decides to refinance instead? When the loans are paid off, he takes that $2,400 refi payment and now saves that amount at the same 5% for 10 years. Ten years after the loan is paid off, that savings would grow to about $372,000, which would be $158,000 less than if he went on PAYE and saved the difference.

The key here is to save on the side while going for loan forgiveness and not spend the difference. Going on PAYE and saving the difference would make Jason wealthier than paying off the loans in full over 10 years and then starting to save at that point.

Get Started With Our New IDR Calculator

Stay in BigLaw to pay off loans

For lawyers who plan on leaving BigLaw after five years or so and owe less than 1.5 times their income, it may make sense to keep expenses low and pay off the student loans aggressively. I’m talking five years or less.

How great would it feel to have $0 student loans and have the flexibility to take the job you want, get married, buy a house or take a vacation without having to factor in student loan payments?

If that sounds appealing, then attack the student loans and get rid of them fast. Take increases in pay, bonuses and tax refunds to accelerate your way out of the loans. If you have a high interest rate, you could even look into refinancing to see if you can cut your interest rate.

Remember, refinancing is permanent, so only do it if you’re sure it’s the route you want to take and you’re not looking for any kind of loan forgiveness in the future.

Leaving BigLaw? Update your student loan repayment strategy

It’s critical to understand the implications of leaving BigLaw to your student loan strategy. This is often a six-figure decision, both in terms of student loan repayment and difference in salary.

We’ve done more than 2,100 student loan consults advising on more than $500,000,000 in student loan debt. Whether you want to leave BigLaw for a job that qualifies for PSLF, to start your own practice or go in-house, you have options.

We can show you the implications on student loan repayment and your best path forward, no matter which direction you’re considering.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).