Disability insurance policies come in many flavors, some of which can leave a sour taste when it comes time to file a claim. The smallest policy nuance can change your disability coverage in a big way.

For example, choosing an own-occupation definition of disability allows you to collect benefits based on your ability to perform your medical or dental specialty duties. But optional policy riders can also further define the parameters of your coverage, as is the case with the partial disability rider.

Not every injury or illness results in a total disability. So, it’s important to include partial disability benefits when buying long-term disability insurance. But what exactly is a partial disability? Let’s explore the differences between the partial disability rider vs. qualifying for a total disability.

Partial disability vs. total disability: What’s the difference?

Generally speaking, a total disability refers to an injury or medical condition that prevents you from working. However, your policy’s definition of disability determines whether you must be unable to work in any occupation (e.g., desk job, retail, etc.) or whether you can file a claim based on your inability to perform job duties specific to your specialty.

That said, the gist of a total disability is that you’re unable to return to work temporarily or permanently.

But becoming disabled doesn’t necessarily mean losing the capability to work entirely. You might just need to reduce your workload in terms of fewer hours or fewer job duties to adapt to your new disability. In which case, a partial disability rider provides additional income protection.

What injuries or illnesses qualify for a partial disability?

There isn’t a list of injuries or medical conditions that qualify for a partial disability vs. a total disability. Instead, eligibility comes down to whether your disability limits your ability to work in your previous capacity or pre-disability earning level.

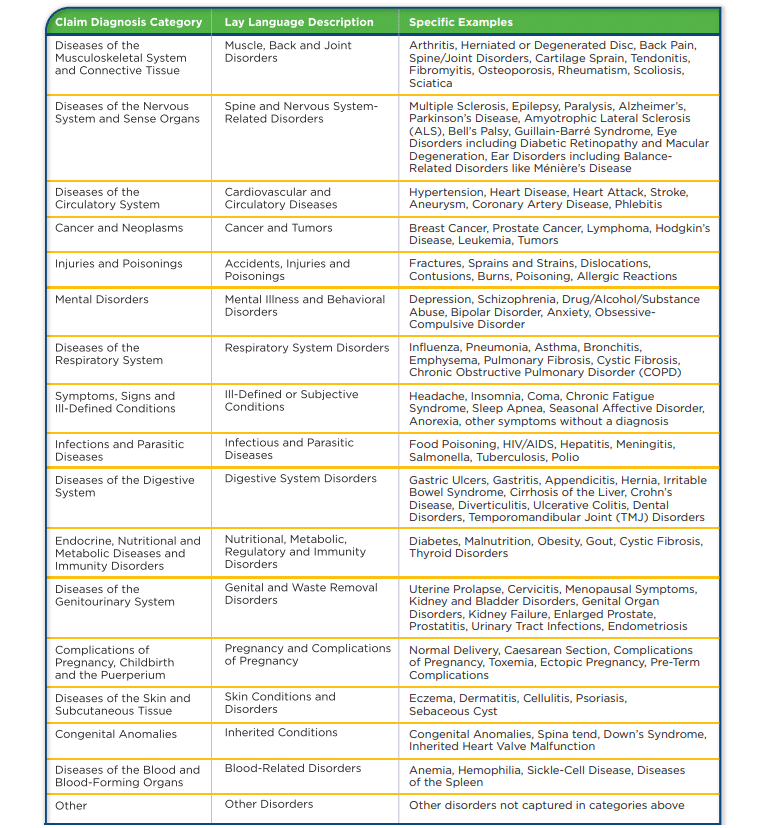

Here’s a chart from the Council for Disability Awareness to help demonstrate the wide spectrum of injuries and medical conditions that can result in a disability claim, regardless of whether it’s a partial disability vs. total disability.

Source: Council for Disability Awareness

For example, let’s say you have a significant back or neck injury that prevents you from standing for prolonged periods of time. You might not qualify for a total disability if you can perform other essential duties of your occupation. But you might be able to cash in on your partial disability rider if your workload, and therefore your earnings, are affected.

Other common causes of disability include musculoskeletal disorders, cancer, injuries (e.g., fractures, sprains and strains), mental health issues and circulatory diseases, such as heart attack and stroke.

How does the partial disability rider work?

You can claim residual disability benefits if an injury or illness impacts the key functions of your occupation, resulting in loss of income, job duties or time. Most policies require a drop in income of at least 15% to 20%. But each insurance carrier has a different threshold, depending on what you’re willing to pay for coverage.

For example, The Standard — a “Big 5” disability insurance company — has multiple tiers of partial disability coverage. Its basic level requires a loss of at least 20% of your pre-disability income and a loss of time or duties Whereas its enhanced level requires that you only meet one of those criteria.

In comparison, Guardian (another “Big 5”) offers an enhanced partial disability rider that only requires a 15% loss of income. Alternatively, you can qualify if you can’t work as many hours or perform all the same job duties as you did before your disability.

Partial disability vs. total disability: What's the payout?

Long-term disability insurance generally pays around 60% of your gross income, if you opt for the maximum benefit amount available. If you’re a primary care physician bringing in $250,000 a year, you might be looking at a total disability monthly benefit of $12,500. But the partial disability rider works a little differently.

Your partial disability benefits will generally be proportionate to your loss of income (note this varies by partial disability rider). Let’s say your partial disability requires you to drop below full-time hours, resulting in a 30% loss of income. If your base benefit is $12,500, your partial benefits would be proportional to your 30% income loss, resulting in a monthly payout of $3,750. This benefit payment is in addition to your normal pay you’ll continue receiving while working with a partial disability.

Who should consider a partial disability rider?

A partial disability rider allows for residual benefits to supplement your income while you live with or recover from a partial disability. Without it, you don’t receive a payout unless you're totally disabled. Although people become totally disabled every day, you’re probably more likely to experience a partial disability that limits your ability to work versus sidelining you completely.

Because of this, SLP Insurance recommends everyone have some level of partial disability coverage. Therefore, our team automatically includes the partial disability benefit rider in all of our disability insurance quotes.

Additionally, we can walk you through important decisions, such as including a future increase option rider as a resident. This includes choosing a benefit period, elimination period and optional disability insurance riders (e.g., cost of living adjustment, catastrophic disability benefits, etc.) that make sense for you.

Fill out the form below, and our team will reach out to discuss your existing coverage and policy preferences.

Compare disability insurance quotes and save

SLP Insurance will find you the best price on own occupation coverage, even if it's not with us. Fill out the form below for a quote with up to 30% discounts.