Are you currently being pursued by locum tenens recruiters and are wondering how taking an assignment would affect your student loan repayment? We often receive locum tenens student loans questions from new physicians as well as CRNAs, PAs or NPs. Here are the main challenges I see if you’ve got a locum tenens lifestyle with a lot of student debt:

- Inability to access Public Service Loan Forgiveness (PSLF).

- Difficulty verifying your income.

- Uncertainty surrounding your long-term employment.

- Potentially harder time refinancing.

Luckily these challenges can be easily dealt with through a smart student loan plan. We specialize in helping folks working in a locum tenens physician role figure out their student loan debt, particularly if that debt is between $100,000 and $1 million.

Paying back medical school debt as a locum tenens doctor presents opportunities that others don’t have. Here’s some of those:

- Reducing Adjusted Gross Income (AGI) more easily than employed peers (good for 20-25 year loan forgiveness).

- Providing your own benefits.

- Income and location flexibility.

We’ll begin by addressing the challenges that locum tenens practitioners face before showing the opportunities that are available.

You can’t get PSLF with locum tenens

The biggest drawback I see to working a locum tenens job is similar to that faced by private practice physicians. You can't utilize the Public Service Loan Forgiveness program while engaged in a locum position. The reason?

The definition of locum tenens is from a Latin term meaning “holding a place.” That means you’re a 1099 independent contractor in a locum role. Only full-time employees can utilize the forgiveness offered under the PSLF program.

Hence, locum healthcare providers must pay back their medical school loans either through IDR loan forgiveness over 20-25 years or through using an aggressive payback strategy like refinancing.

How to get loan forgiveness with a locum job

Even though your locum tenens assignments don't count towards PSLF, you might eventually get a full-time job at a qualifying not-for-profit employer.

It would be a big mistake to immediately refinance your federal loans or pay them back aggressively unless you’re sure that this won't be a possibility for you.

I’ve seen plenty of stories of physicians who do some locum work during residency, fellowship or early in their attending careers only to switch to permanent roles a couple of years later.

Keep in mind that qualifying PSLF monthly payments do not have to be consecutive. That means you could make payments on the REPAYE or PAYE plan while doing locum tenens and if you switch to an eligible job, you might eventually get PSLF.

Also, if you’re a fellow or doing a small amount of locum work on the side, you can still qualify for PSLF if your primary job is full-time at a 501(c)(3) or government employer. In other words, a small amount of locum tenens work doesn't derail you.

Verifying your income with loan servicers is a pain with locum tenens

Do you need to include all of your 1099 income as a locum tenens doctor when applying for income-driven repayment programs? The answer is yes, according to the definition the government uses for taxable income. If you look at the IDR verification form that you’re required to submit annually, here’s what the government wants to know:

“You must provide documentation of all taxable income you and your spouse (if applicable) currently receive. Taxable income includes, for example, income from employment, unemployment income, dividend income, interest income, tips, and alimony.”

Clearly, income as an independent contractor constitutes income from employment. However, that income varies a lot depending on your current employment arrangement. For that reason, I suggest checking the box that says “My income has not significantly changed” unless you feel a strong need to say otherwise.

Using your tax return to certify income-based payments as a locum tenens worker

When you say that your income hasn’t significantly changed, you’ll be asked to provide your tax return to the loan servicer. They’ll then use your adjusted gross income (AGI) to figure out what your loan payment should be.

If you called your loan servicer with updates every time your income changed while doing locum tenens, you’d be spending a huge amount of time doing so. Hence, I view submitting tax returns only as the best method of certifying payments.

The temporary nature of locum jobs can make planning difficult

If you’re not working in a position for the long term, you might have a hard time planning your future.

The reason this matters if you have student loans and accept a locum tenens opportunity is that you may or may not be employed full-time by a not-for-profit or government hospital one day.

For example, say you do locum tenens for two years. There’s a solid chance your full-time position when you leave could be at a not-for-profit institution. If that’s the case, you’d still be eligible for PSLF if you completed 10 years of service. Your total repayment length, in that case, would be 12 years if you did two years of locums and 10 years of full-time service.

If you try to make a full plan before you know what your future will look like, you might make the wrong decisions.

In general, never refinance your student loans from med school until you’re sure a 501(c)(3) or VA job isn't in your future.

How to refinance in a locum tenens role

Many of the student loan refinancing companies I work with have an easier underwriting process for W-2 employees. Employee incomes tend to be more stable than independent contractors, so that makes sense. But it's definitely possible to qualify for refinancing as a locum tenens doc.

If you’re a dentist or a physician, you’ll be able to qualify more easily for student loan refinancing. Needing only a single year of tax returns is a pretty low bar to clear.

Also, keep in mind that if you consolidate your loans immediately after graduation, you could get a $0 payment on REPAYE with a huge interest subsidy the first year. Hence, even though refinancing isn’t a cakewalk with a 1099 locum employment situation, it can be done.

Other folks like PAs, NPs, and CRNAs can still refinance with locum tenens income history, but it sounds like companies would tend to prefer two years of tax returns.

Student loan forgiveness options for locum tenens

Even though locum jobs don’t qualify for PSLF, you can still get student loan forgiveness while working locum tenens positions. You simply need to have a high enough debt-to-income ratio to make the math make sense.

For example, 1099 contractors can start a solo 401k and contribute up to $58,000 pre-tax in 2021. Here’s how this could work.

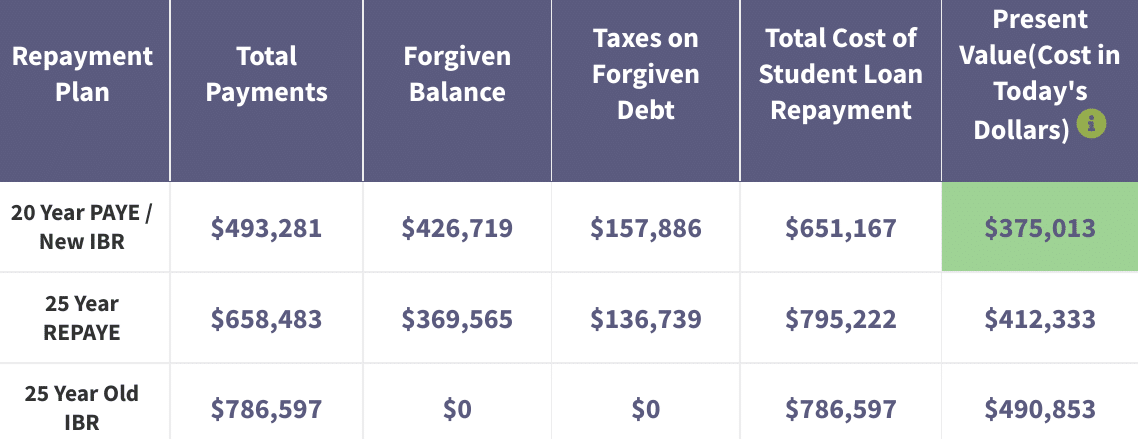

Timmy will do long-term locum tenens work and earns $250,000 per year as a 1099 contractor. He has $400,000 in federal student loans at an average interest rate of 6.5% Without making any solo 401k contributions, here's how he would pay with the various IDR plans:

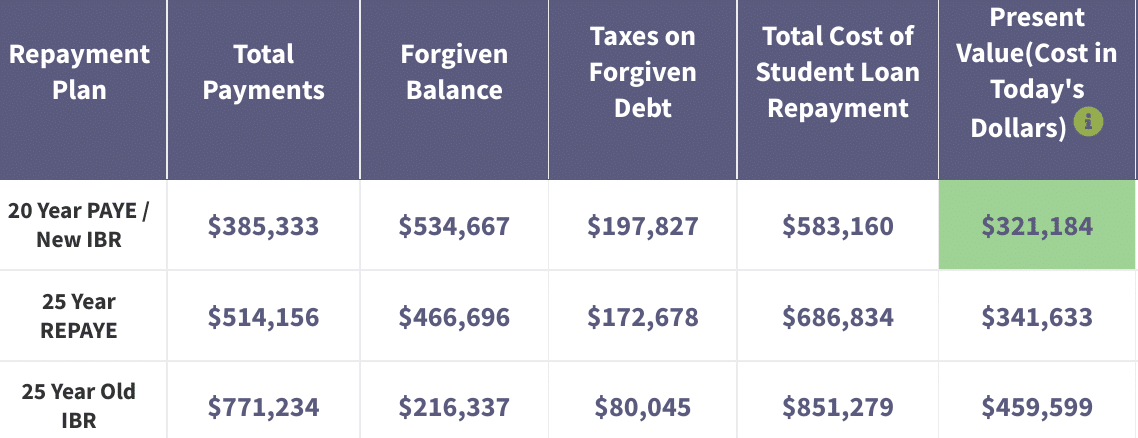

But Timmy decides to work with a CPA who sets up an S corporation with a “locum tenens salary” of $120,000 per year. He makes a contribution of $19,500 as an employee plus 25% of his wages. That lowers his AGI by $49,500.

Now, instead of making $250,000 for tax purposes, he actually makes $200,500. Keeping the same student debt numbers as before, here’s how the math could look:

Notice how the cost of paying the 20 years of payments on the Pay As You Earn plan (PAYE) plus the tax bomb gives a lower cost in today’s dollars of over $50,000. That’s a lower present value, which means you could come out even further ahead if you invested that money and earned a 5% rate of return.

Most locum tenens student loans prep should involve working with someone like us and a CPA. The goal would be to figure out if lowering your taxable income could give you projected forgiveness with today’s rules.

Employers might be willing to make contributions towards your loans as well in exchange for specific service length.

Locum tenens benefits: income, location, and job flexibility

As a locum tenens doctor, you'll typically have very low living expenses. In most cases, your travel expenses, housing, and even your malpractice premiums will be covered by your agency. You can also deduct anything your CPA says counts as a business expense.

In addition, you have more freedom and flexibility. And geography doesn't have to get in the way of you pursuing the jobs that offer the highest possible income. You can take extra shifts to boost your pay even further. Or if you’d rather work less, you can do that too (and rely on income-driven repayment plan forgiveness to make it financially viable).

Maybe you’re not interested in working for big healthcare facilities. So you use locum tenens to visit a bunch of remote locations you wouldn’t see otherwise. In fact, locum tenens agencies have been known to offer bonuses to medical professionals who work for an extended period of time in short supply areas.

Get a plan that reflects why you’re doing locum tenens work

Most healthcare professionals are going to move on to a permanent role at some point. Until then, make sure the way you manage your student loans reflects what you’re thinking.

For quick debt payoff, you might think about the Revised Pay As You Earn (REPAYE) plan or refinancing. If you’re unsure but might want to do PSLF, keep your options open and your debt with the federal government.

Do you think you want to do temporary roles long-term as a lifestyle play? If so, you might want to think about going for taxable forgiveness.

Regardless of what path you take, have fun and don’t stress about your loans. We can help you navigate what to do if you want professional guidance since nobody else is thinking about locum tenens and loan strategies the way we are.

What are your thoughts about locum tenens work? Do you recommend it or is there something you wish you had done differently?

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Can a SEP IRA offer the same tax benefits as a SOLO 401K? Why would you do one over the other in terms of lowering AGI?

What if you work both as an employee and do locums as a side gig? Can you get tax deductions if you have a 403B, traditional IRA, (maxing out both) AND a SEP IRA or SOLO 401K?

Thanks!

Hi Bria, here is what our consultant Dan has to say: A Solo401k does offer some of the same tax benefits as a SEP IRA. In addition to those same tax benefits (lower AGI, tax-deferred growth), a Solo401k offers more potential benefits in terms of higher contribution potential (this depends on your income) which can lower AGI even more and a Roth Solo401k option as well, something a SEP IRA does not offer.

The major item that separates these two types of investment accounts is that the Solo401k allows a self-employed individual to make an Employee payroll Contribution ($19,500) plus the same Employer profit-sharing contribution that the individual would make to their SEP IRA…all in the same Solo401k account.

In both cases, I would make sure to consult with a tax professional to ensure that you are accounting for any payroll taxes or other taxes involved.