Podiatrists graduate with monster student loan debt, but they also have a few great student loan forgiveness programs and repayment options — even if they work in private practice.

Doctors of Podiatric Medicine (D.P.M.s) focus on one of the most complex parts of the human body — our feet and ankles. Most people underestimate the impact feet and ankle health has on the rest of our bodies. That’s why podiatrists concentrate solely on this part of the body.

This training is a huge benefit for us as patients but also comes at a significant cost.

In this guide, we’ll show three different paths for D.P.M.s to pay as little out of pocket as possible while becoming student debt free: Public Service Loan Forgiveness (PSLF) and taxable loan forgiveness, when to forgo forgiveness and when to pay back the loans aggressively.

Podiatrist student loans among highest with graduate degree

Due to the complexity of the foot and ankle, D.P.M.s go through significant training. First, they must earn a four-year bachelor’s degree. They then go on to complete four years at a school of podiatric medicine and a three-year residency. Medical school tuition is not cheap.

Projections show Kent State University College of Podiatric Medicine will cost over $75,770 per year for four years for the class of 2024. The average D.P.M. from the Western University of Health Sciences graduates with $261,832 in debt. Samuel Merritt University will cost more than $183,000 without factoring in living expenses.

By the time the average podiatrist graduates, they’re left owing close to $300,000 in student loan debt. That’s a hefty load, especially considering they enter residency making $50,000 to $60,000 a year for three years before becoming an attending.

Although the Bureau of Labor Statistics reports the average podiatrist makes about $158,000 post-residency, loan repayment remains a challenge.

D.P.M.s are also much more limited in their loan forgiveness options compared to other medical professionals. This is because over 80% of them work in individual or group practices and may not qualify for Public Service Loan Forgiveness (PSLF). The good news is they still have some great options.

Get Started With Our New IDR Calculator

The 3 best options for podiatrists to save money paying back their student loans

We’ve done thousands of student loan borrower consults covering more than $1.9 billion in student loan debt. In our experience, we’ve found three overall approaches that save people the most money paying back their student loans.

PSLF

This is one of the most powerful programs out there for podiatrists if they’re eligible. It’s available for D.P.M.s who have Direct student loans, work full-time for a nonprofit or government employer (including universities) and are on an income-driven repayment (IDR) plan for 120 total months.

Most podiatrists work in private or group practice. So unless the practice is associated with a nonprofit hospital, PSLF isn’t an option.

For those D.P.M.s who do work for a nonprofit or government employer, they should keep their payments as low as possible, save on the side and stay on track for PSLF.

Taxable loan forgiveness using an IDR plan

Podiatrists who owe more than two times their income in student loans (e.g., D.P.M.s who owe $300,000 and earn $150,000 or less) and don’t meet the PSLF criteria could be best served by paying on an IDR plan for the required 20 to 25 years. In the end, the remaining loan balance is forgiven, but taxes will be owed on the forgiven amount.

The idea is to keep student loan repayment as low as possible, save up for the tax bomb and work toward other financial goals along the way.

Aggressive repayment

This strategy is about throwing everything including the kitchen sink into paying off the debt as quickly as possible (i.e., 10 years or less). This is best suited for podiatrists who have 1.5 times their income in student loans or less (e.g., owe $225,000 or less and make $150,000 or more) and who aren’t eligible for PSLF.

This might not be the best path for podiatrists when they’re starting out in residency. But it could become a powerful strategy once a D.P.M. gets established in their private or group practice.

PSLF eligibility for podiatrist student loans

A low percentage of podiatrists might qualify for PSLF, despite most of them working in private practices. Here are the three primary criteria for student loans to be eligible:

Direct Federal Student Loans

The Direct Loan Program was launched in 2010, so most federal loans issued after that should be Direct. However, it’s still important to check, especially for undergraduate loans.

The fastest way to see if your loans are Direct is to log in to the NSLDS website and see the breakdown of your federal loans.

Any Federal Family Education Loans (FFEL) are not Direct and are thus not eligible for PSLF. These may require consolidation. It’s free to consolidate your loans, so don’t pay anyone to do it for you.

Select an IDR plan

Payments on an IDR plan are not based on the loan amount. Rather, they’re based on income, kind of like a tax. The main ones are Income-Based Repayment (IBR), Pay As You Earn (PAYE) and Revised Pay As You Earn (REPAYE).

Here’s more information on the different IDR options available.

Work full time for a nonprofit or government employer

This can also be accomplished if you have two or more part-time jobs with qualifying employers totaling at least 30 hours a week.

Read more about PSLF eligibility from the Federal Student Aid website.

How podiatrists can save even more money with PSLF

The ultimate goal when pursuing PSLF is to pay as little as possible and to maximize loan forgiveness.

- Select the repayment plan that requires the lowest monthly payment, even if this means your loan balance will grow. Typically, this is either PAYE or REPAYE, since the payments are 10 percent of your discretionary income. Occasionally, the best plan could be IBR. This would mainly be for D.P.M.s who are married and want to file their taxes separately but who aren’t eligible for PAYE.

- Lower your Adjusted Gross Income (AGI) by maxing out pre-tax retirement plans and health savings accounts (HSA). If you have a spouse whose income is factored in to calculate your payment, they should max out pretax retirement as well.

- Don’t make extra payments toward your loans. This is a huge mistake. Any extra payment will be money that goes into oblivion as any unpaid balance will be forgiven anyway.

Podiatrists would be better off saving aggressively on the side rather than making extra payments on their loans. This also acts as defense should there be any changes to the PSLF program or to their career path. They’ll have a chunk of money to throw at the loans if needs be.

After 120 qualifying monthly payments (which don’t have to be consecutive), a podiatrist can apply to have the remaining loan balance forgiven tax-free.

We suggest filing the employment certification form (ECF) at least once a year and then checking each loan to make sure you’ve received your credit toward PSLF. For D.P.M.s who are a few years in but haven’t sent in their ECF yet, do so immediately. This way you can get an accurate count of credit toward PSLF.

Check out our top tips for PSLF to learn about even more ways to optimize PSLF forgiveness.

Taxable podiatry school student loan forgiveness using income-driven repayment

Podiatrists who aren’t eligible for PSLF still have a loan forgiveness option for paying back their med school loans. This strategy works well for D.P.M.s who owe more than two times their income in student loans and is similar to PSLF.

Here are the steps to follow:

- Select an IDR plan that will keep your payments as low as possible.

- Do what you can to lower your AGI. You can do this by contributing to pretax retirement accounts and an HSA if you have one available.

- Don’t make any extra payments toward your loan.

There are two major differences between PSLF and taxable loan forgiveness:

- Payments span from 20 years (PAYE) to 25 years (REPAYE and IBR) instead of 10 years on PSLF.

- The amount of loans forgiven will be treated as income in the year it’s forgiven, so you’ll owe taxes. We call this the tax bomb.

First, let’s explore why keeping student loan payments as low as possible and maximizing the amount forgiven makes sense even if it’s taxable.

For example, let’s say Michael has $270,000 in student loans at a 6.5% interest rate. He just graduated from a school of podiatric medicine and is earning $55,000 in residency. He’ll start at $120,000 as an attending with 3% salary increases each year. He’s not going to go for PSLF.

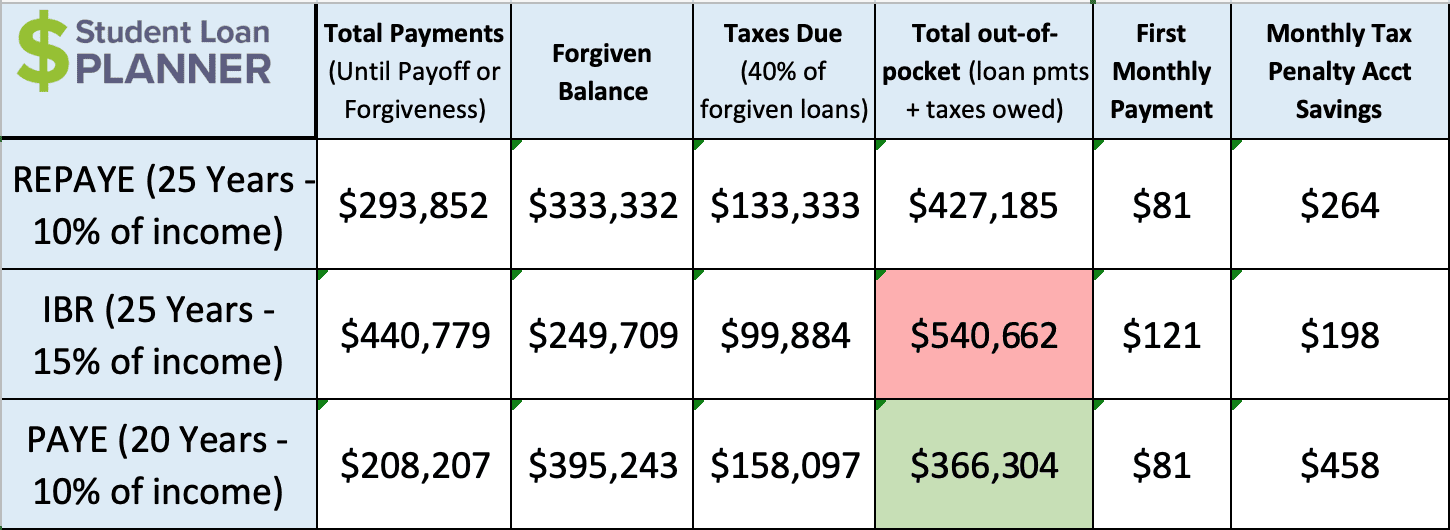

Michael is choosing between PAYE (payments are 10% of his discretionary income for 20 years, REPAYE (payments are 10% of her discretionary income for 25 years) and IBR (payments are 15% of discretionary income for 25 years).

At the end of the 20 to 25 years, remember that any loans remaining will be forgiven and treated as income on that year’s tax return.

Let’s project the forgiven balance will be taxed at 40% (this is the tax bomb).

PAYE is the clear winner.

PAYE vs REPAYE

Michael is projected to save $85,000 in payments on PAYE versus REPAYE, since repayment is five years shorter on PAYE. He’ll be debt free sooner, and it'll cost him less money. That’s a double win.

His loan balance will be much higher on PAYE, though. He’ll owe a projected $158,000 in taxes (a.k.a. the tax bomb). This may seem like a big number, but he has 20 years to save up. This would work out to saving $458 per month in an account that could potentially earn 5% interest annualized over the next 20 years.

PAYE vs IBR

The numbers for IBR support the idea of keeping payments low and saving aggressively on the side instead of paying off as much as we can. With IBR, Michael would pay 15 percent of his income instead of 10 and be in repayment for five more years. Because of that, IBR payments would be $232,000 more than PAYE. Sure, the estimated taxes owed would be lower but not nearly enough to compensate for those monster payments. All in all, IBR is projected to cost $174,000 more than PAYE between the projected payments and estimated tax bomb.

So to summarize, a podiatrist could benefit from keeping payments low, maximizing taxable loan forgiveness and saving aggressively on the side in this scenario.

When a podiatrist should refinance student loans

Taxable loan forgiveness typically works well for podiatrists who owe more than twice their income in student loans. But refinancing and aggressively paying back the loans comes into play when D.P.M.s owe 1.5 times their income or less.

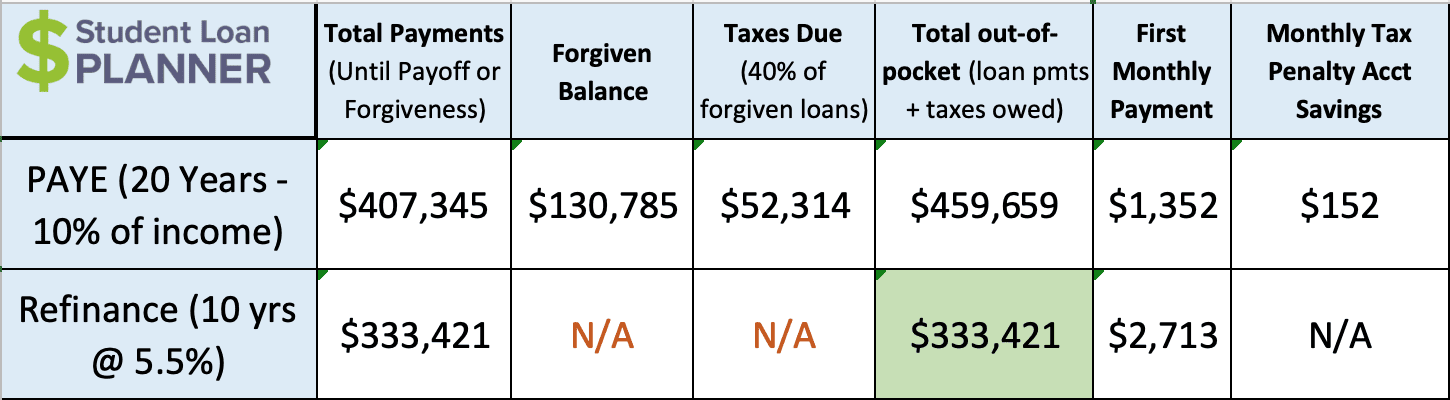

Let’s say Janet is an established podiatrist in private practice. She’s making $180,000 and should have a steady 3% income growth going forward. Right now, she owes $250,000 in student loans at 6.8% interest. She got pre-approved to refinance her loans at 5.5% over a 10-year term.

Because Janet’s debt is 1.39 times her income, refinancing and paying off her loans in full over 10 years is projected to save her $126,000 versus being on PAYE for 20 years. Plus, she’ll be debt free in half the time.

Janet can afford the $2,700 per month payment and wants to put $4,000 to be debt free in six years. Being more aggressive in paying back her loans will save her an extra $40,000 compared to drawing it out over the full 10-year term.

Podiatrists who want to take an aggressive approach to pay back their loans should refinance to a lower interest rate and pay back the loans in 10 years or less. This will reduce the amount of interest paid by a podiatrist, which means more stays in their pocket.

How to use a DPM mortgage to more efficiently pay back student loans

Thanks to your education as a podiatrist, you can qualify for a DPM Mortgage with some banks. This is a special category of the “doctor mortgage.”

Using a DPM Mortgage allows you to put as little as 0% down on your house. The money you saved for your down payment can go into your student loans instead. Since mortgage interest is tax-deductible if you itemize, and the student loan interest is not, you can save significant amounts in taxes by paying down the less tax efficient debt first.

It helps that a DPM Mortgage also has no private mortgage insurance or PMI.

This is not a game-changer like some of the strategies above, but a DPM Mortgage + refinancing student loans strategy could save you a few thousand in taxes per year until you're debt free.

If you're interested in a DPM Mortgage, use the form below to get a quote or see the full list of doctor mortgage for all 50 states.

What mortgage product do you need?

Your Occupation

Home Price Range

Preferred Down Payment

Stage You're At in the Home Buying Process

When Do You Want a Mortgage Approval?

How Many Banks Would You Like Quotes From?

Any Bankruptcies or Short Sales?

Full Name

Phone Number

State Where You Plan to Purchase

Metro Area Where You Plan to Purchase

Citizenship Status

Communication Preference

Would You Like to Add Any Additional Details?

How to save the most money paying back podiatrist student loans

I’ve laid out the three main strategies podiatrists can use to pay back their loans: PSLF, income-driven repayment with taxable loan forgiveness and aggressive repayment.

But your situation is unique.

There’s a ton of money at stake when we’re talking about paying back six-figure student loan debt. So it makes sense for an expert to review your specific situation while taking family size, career path, household income and financial goals into consideration.

By the end of a consult with us, you’ll understand the path that will save you the most money paying back your loans. You’ll also gain the clarity you need to feel in control.

I’d love to help you finally feel confident about how you’re handling your student loans and save as much money as possible.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments

Comments are closed.

Hi, currently heavy load of student loans from podiatry school. Started my own practice, I am five years in with AGI increasing. Currently doing IDR but would be curious about other options. Thank you.

Rick depends on your debt to income ratio. If you still owe more than 2x your taxable income, the PAYE or REPAYE options are likely better. If you have ways to reduce your AGI legally from being a business owner, this might make your situation even tougher to justify refinancing. But if you’re making bank then at some point you could refinance: https://www.studentloanplanner.com/refinance-student-loans/