If you’re a resident physician or a fellow planning to qualify for Public Service Loan Forgiveness for your student loans, you’re going to be heavily affected by the new Tax Cuts and Jobs Act (TCJA) passed in late 2017. Colloquially known as the Trump tax cuts, this change to the tax code can actually allow you to save even more with the PSLF program.

If you’ve read my blog for a while, you know that one key strategy in increasing the value of student loan forgiveness is to find out how residents can lower AGI for the PSLF program. The government uses your AGI to determine your monthly payments on PAYE, REPAYE, or IBR, the three main PSLF eligible repayment programs. So is it worth it to lower AGI to minimize PAYE payments?

I want to show you some hacks you can use to save at least $10,000 on your student loans during your training years. Your future, attending physician self will thank you.

Cutting Your Taxable Income Increases the Value of Loan Forgiveness

Why and how would you reduce AGI? There’s not a resident meeting where they teach you that. Just to explain the math with an example, pretend Christina is a PGY-1 making $60,000. If she does nothing, she’ll report her $60,000 AGI. Her family size is 1.

To calculate her payment on REPAYE, we look up the federal poverty line for 2018 for a family size of 1, and we find $12,140. We multiply that number by 1.5 and get $18,210. Then we take $60,000 minus that result and get $41,790. This result is Christina’s discretionary income.

Example: $12,140 x 1.5 = $18,210 then $60,000 – $18,210 = $41,790

REPAYE requires you to pay 10% of your discretionary income, so she would need to pay $4,179 over the course of the year. That’s about $348 a month.

If Christina could reduce her taxable income that she claims by $5,000, that would reduce her student loan payments by $500 in the following year. FedLoan Servicing uses prior year tax returns to certify income, so there’s always a lag.

That effort to reduce her income would cut Christina’s student loan payment by about $42 a month.

The more tricks you know that can reduce your taxable income, the better because it reduces your student loan payments. If you plan to reach PSLF status, then those lower payments increase the value of the program for you, which saves you lots of money.

When my wife was a resident of NYC, she was so burdened with crazy call schedules and her budget didn’t give her a ton of money left over for other things. You won’t be able to do all the things I’ll suggest, but if you do some of them it’ll be fantastic for your finances.

Here’s the list of things I’ll cover for you. Above the line and below the line just means whether you can take the deduction before itemizing or not. Above the line is better than below the line.

Ways you can lower your AGI (above the line deductions):

- Pre-tax (not Roth) contributions to your 401k or 403b plan

- Health Savings Account Contributions

- Student loan interest deduction

- Capital Loss Deduction

Ways you can lower your taxable income that are now very difficult from the Tax Cuts and Jobs Act (below the line deductions):

- Charitable contributions

- Mortgage Interest

- State Income Taxes and Property Taxes Paid

You Can No longer Lower taxable income with this method after the Trump Tax Act

- Moving expenses for work

Above the line deductions reduce your AGI but below the line deductions reduce your taxable income. The above the line deductions are the ones that can impact your student loans and give you a lower payment.

Related: Lowering Your AGI and Student Loan Payments with Municipal Bonds: A Win-Win Solution

Pre-Tax 401k or 403b Contributions Vs Roth IRA

This is the most intense part, so I’ve done most of the number crunching for you. Most financial planners would tell you to contribute to a Roth IRA during residency. After all, you’re in the lowest tax bracket of your working career, right?

The answer is that it depends on your individual circumstance. If you’re married with a stay at home spouse with kids, then maybe the tricks I’m going to show you still don’t beat putting money into a Roth IRA.

However, for most of your residents and fellows out there, it’s a good decision to use the pre-tax option instead of the Roth IRA. After all, you want to build wealth and save on taxes while pursuing PSLF.

While you could certainly contribute $18,500 to the plan at work, take the tax deduction, then contribute to a Roth IRA $5,500 on your own, no resident really has that much disposable income to be honest.

That means for most residents it's an either or decision. When you’re deciding you need to know some things about tax brackets.

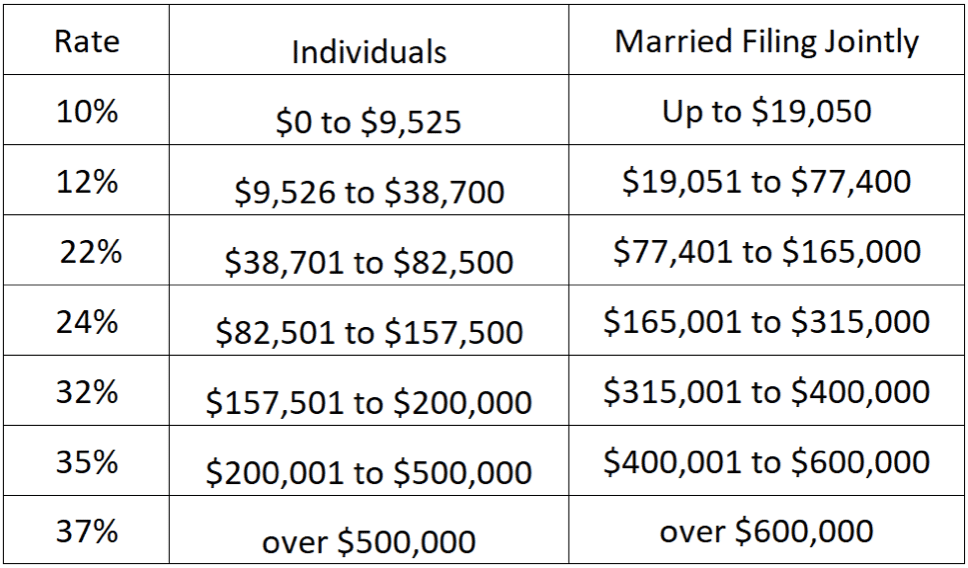

Most residents and many fellows are single during training. If that’s you, then the 22% tax bracket starts at $38,701 of taxable income. To figure out what your taxable income is, you take your AGI and reduce it by either your itemized deductions or the standard deduction, which is $12,000.

That means for every dollar you earn above roughly $50,000, you would be taxed at a marginal tax rate of 22%. That’s different from your average tax rate, which is the taxes you pay divided by your income. Your marginal rate is always higher than your average rate.

That means if you’re going to save less than $10,000 as a resident, you could save on the 22% tax bracket level. You would also get to deduct state income taxes in almost every case. If you live in a higher tax area of the country (like New York and California), you could save almost 30% in taxes based on your contributions.

On top of that, the money you put in the pre-tax account at work reduces your AGI, which reduces your student loan payment. That means if you put $10,000 in your 401k, you could save $1,000 on your student loans. If you’re taxed at a marginal tax rate of most residents, that means saving about $1,200 in pre-tax income.

Hence, for most residents saving less than $10,000 in retirement who are single, your marginal tax rate savings from contributed to the pre-tax retirement account instead of the Roth is about 35% to 45% depending on what state you live in.

The vast majority of physicians are not in that tax bracket in retirement. If you happen to be that rich when you’re no longer working, then you’ve won the lottery of life and can chill about cutting your taxes.

The most optimized way to do this is putting $18,500 into your pre-tax retirement account to save $1,850 a year on your student loans. If you’re married, this complicates things a lot. Two residents married to one another have a similar analysis. You can use the way of thinking above to apply it to your situation if you and your spouse have a big income difference.

Health Savings Account Contributions Cut Your Loan Payments

This is one of my favorite hacks, even if you’re trying to grow a family or have high medical expenses. You can contribute $3,450 as an individual or $6,900 as a family. You can also deduct this on your taxes. If you save the max in your Health Savings Account (HSA) as an individual, then you’d save $345 on your student loans thanks to Public Service Loan Forgiveness each year you’re in training.

When you use an HSA, you have a high deductible. The funds in an HSA grow tax-deferred and if spent on medical expenses can be withdrawn tax-free. It’s a triple tax-exempt account, maybe quadruple tax exempt if you account for the reduction of your student loan payments. When you go to the doctor, you can use your debit card the HSA administrator gives you or pay out of pocket. Many planners suggest leaving the HSA account alone to let it grow.

Look at your out of pocket maximum on your health insurance. If it happens to be a reasonable amount that you could cover, you’re going to be getting a better deal with a high deductible health insurance plan in almost every case.

The “better” plans just charge you for the cost of healthcare you get over the year in the form of higher monthly premiums.

Student Loan Interest Deduction While in Residency

You need to have a Modified Adjusted Gross Income of less than $65,000 to qualify to take the student loan interest deduction. The good news is that almost all residents and fellows would get it if they make sure to put a decent amount of money in their retirement accounts.

You receive a Form 1098-E from your lender with the amount of interest on it. When you’re doing your taxes, you should claim your student loan interest, and you can deduct up to $2,500.

Remember that every trick you find to lower taxable income is worth 40% of the reduction. Hence the student loan interest deduction could get almost every single resident or fellow about $1,000 back. Filling out the free file might be costing you a week’s pay if you don’t claim this deduction.

The student loan interest deduction barely survived Trump’s tax law aka the TCJA, but you can still take it so you should.

Capital Losses Can Reduce Your Income Too

Did you know that if you have a loss on your investments that it can reduce your taxable income by up to $3,000? What’s more is that you can carry forward additional losses to future years.

If you happen to have a robo advisor like Betterment or Wealthfront that automate tax loss harvesting, this could be a big deal for you.

If you made a stupid investment, and I’ve made plenty, you can cut your losses assuming you don’t think the stock will recover. Then that loss can be applied directly to your income and save you about $1,200 using our assumed 40% rate thanks to PSLF.

You do not want to go out and create some losses for fun. Losing 100% to save 40% still leaves you very broke. But if you happened to have some bad luck with bitcoin it helps to have a bit of a cushion from Uncle Sam.

Related: What to Know About Tax-Loss Harvesting’s Impact on Student Loans

Below the Line Deductions that You Probably Won’t Take but Should Know About

We’re moving into the below the line deductions. These deductions can only be taken if you’re NOT taking the standard deduction, which is $12,000 for an individual and $24,000 for a couple.

Most people will not be itemizing anymore. The standard deduction used to be about $6,000 for an individual, and it was relatively easy for anyone with a house living in a high tax state to save extra on taxes.

The items I’m going to mention below have to be combined together. You’re looking at charitable contributions, mortgage interest, state and local taxes, property taxes and seeing if you can find a number higher than the standard deduction to take.

Otherwise, you just take the higher standard deduction. This is one of the main points of the Tax Cuts and Jobs Act was to simplify the tax code and get more people to itemize.

These deductions only allow you to pay a lower tax bill. This does not allow you to have lower student loan payments.

Charitable Contributions Are Way Tougher to Deduct

Most people who tithe for their church might give $5,000 to $6,000 as a resident. Others donate less, or they’ll give to charities they support.

Unfortunately, your Goodwill runs are not getting you much to claim. If you aren’t unusually generous, then most likely you won’t be able to deduct any of the money you give on your taxes.

If for some reason you do itemize, keep track of receipts and letters showing what you paid. Email these days should suffice for most charities for record keeping purposes.

Unless Buying an Extremely Expensive House, Think About the Mortgage Interest Deduction

When you buy a house, the mortgage interest is front loaded. That means if you’re eligible, it might make sense to itemize to take advantage of this trick to lower your taxable income.

Most mortgages might have about $500 to $1,000 a month of interest on them. I’m assuming you’re buying a house in a resident’s price range, which is $100,000 to $180,000 unless you want to take big risks with your personal finances.

That’s not enough of a deduction to beat the standard deduction alone. You’ll need to piecemeal other deductions together like the one I’m mentioning next.

State, Local, and Property Taxes Could Get You Over the Hump

One big punch in the face in the new tax law is a limitation of the deduction of state, local, and property taxes. You can only deduct a combined total of $10,000 now. Anyone with a house in New Jersey is already screwed.

Assume your property taxes are around $1,000 to $4,000 like most residents. As a resident, your state and local income tax will probably be between $2,000 to $4,000, so you do not need to worry about the cap.

The takeaway message is that if you happen to be a homeowner, live in a high tax state, and tithe or give a lot to charity, you might be able to itemize on your taxes and get thousands of dollars in lower taxable income.

That would save you 10% on your student loan payments of any amount you can lower your income by past the standard deduction by itemizing.

Gone: The Moving Deduction for Taking a New Job

It used to be that you could deduct certain moving expenses if you took a job in a different area. This happens to residents all the time, as you can match in a totally different part of the country.

The new tax law eliminated this deduction from what I can tell. Employers also will not be able to pay for relocation expenses. It’s a good thing my wife’s hospital employer shipped everything to where we live in St. Louis in 2016, otherwise, I probably would’ve wanted to rent a U-Haul and go the DIY option instead of shell out thousands for movers.

Learn the Tax Code or Pay Someone To Know it For You

Now that you know how residents can lower AGI for the PSLF program, it's important that you don't forget about taxes.

When it comes to taxes, your CPA will know more and if you don’t like the idea of figuring this out yourself, just pay someone a couple to a few hundred to take care of it for you. I just demonstrated with the student loan interest deduction alone how you could cost yourself more than double the cost of having someone do your taxes for you.

When it comes to how your taxes and income affect your student loans specifically, 99% of CPAs will have no idea. The 1% who do understand the benefit when it comes to PSLF reducing your income.

We’ve done over 1,000 student loan plans and are experts in this space (hopefully you can tell by now). I know that residency and fellowship can be a cash-strapped time, but if you get set up with the perfect student loan strategy now, you can literally save tens of thousands of dollars by not waiting until you’re an attending.

If you need help figuring this stuff out, we’re here to take it off your plate with our personalized student loan repayment plans. You’ve got plenty of work to do and free time in training is incredibly precious.

Got any questions about the above? Maybe you’ve got some additional ideas residents could use to save on PSLF? Comment below.

Not sure what to do with your student loans?

Take our 11-question quiz to get a personalized recommendation for 2025 on whether you should pursue PSLF, SAVE or another IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.