The Saving on a Valuable Education (SAVE) plan is arguably the most exciting repayment plan available to federal student loan borrowers. Launched in 2023 and effectively replacing the Revised Pay As You Earn (REPAYE) plan, the new SAVE plan offers considerable benefits. From an interest benefit to a change in the poverty line calculation for discretionary income, you might be able to lower payments thanks to these changes.

The SAVE plan is rising in popularity, with 5.5 million borrowers signed up for it as of November 2023. More than half of those borrowers are eligible for $0 monthly payments. Despite the advantages of this plan, one of the many misconceptions about it is that it’s the best IDR option for all borrowers. Keep reading to discover other common myths around this new income-driven repayment option.

Myth: You don't pay interest on the SAVE plan.

The interest subsidy is one of the most talked about benefits of the SAVE plan. The student loan repayment plan offers the most borrower-friendly treatment of unpaid interest, which helps with the burden of debt.

However, a common SAVE plan myth is that under this repayment option, you don’t have to pay any interest. This isn’t true.

Borrowers still have to pay interest, with monthly payments going toward accrued interest and the principal balances. But if your total monthly payment doesn’t pay off the accrued interest, the government will pay the unpaid interest for that month.

The key word is “unpaid”. You’re still on the hook for paying interest that your payment can cover. But if you have low monthly payments that don’t cover the entire monthly interest accrued, then the unpaid interest won’t be added to your balance. This keeps your loan amount from growing exponentially.

Since this is an income-driven repayment plan (IDR), payments are calculated based on income. Borrowers are set to pay 5% to 10% of income, depending on the type of loans and degree level.

To qualify for this benefit, your income likely needs to be low relative to your student loan debt. If you have a higher income, your payments will be higher and might cover all the interest that accrued during the month.

Get Started With Our New IDR Calculator

Myth: The SAVE plan is the best repayment option for everyone.

There’s no doubt that the SAVE plan ushers in some major changes that benefit student loan borrowers. This is the new “it” repayment plan, propelled by great publicity from The White House. However, here’s a student loan repayment fact — it’s not the de facto best option for everyone.

One reason is that there’s no cap on the size of monthly payments under the SAVE plan. Other options like PAYE and IBR ensure that your payments won’t exceed what you’d pay on the Standard Repayment plan. That’s not the case with SAVE.

High-income earners might not see the benefit here. Under SAVE, you might pay more than what you would under the Standard Repayment Plan. It might not make your payments more affordable and risks not having a remaining balance to forgiveness, if you’re pursuing that path.

Additionally, it might not be the best option for borrowers with graduate loans working toward student loan forgiveness. Through SAVE, the repayment term is 25 years for borrowers with graduate loans. Alternatively, PAYE offers forgiveness after just 20 years, regardless of what type of loans you have. That’s a major downside for graduate borrowers with the SAVE plan, as the extra years of payments can add up and set back your debt-free date.

Before enrolling in the SAVE plan, don’t just look at the monthly payment amount. Look at your total costs over the life of the loan, including all of the interest, using our IDR calculator.

Student loan borrowers with any graduate loans might be better off on PAYE, with fewer years of repayment.

Myth: The SAVE plan is permanent.

Many student loan borrowers stand to benefit from the new SAVE plan. But just as the new repayment option was launched, it could potentially be taken away as well. Let’s look at how it came about in the first place.

Originally, President Biden had high hopes of offering student loan forgiveness of $10,000 to $20,000 to borrowers. Ultimately, that plan was struck down by the Supreme Court and didn’t move forward.

Shortly thereafter, the Biden administration released information about the groundbreaking SAVE plan and how it benefits borrowers. Although it’s not the debt relief he was hoping for, it’s being marketed as the “most affordable student loan repayment ever.”

The Biden administration launched this specific repayment option, but it won’t be in office forever. Changes in the political landscape could mean changes to repayment plans, including SAVE. In other words, it’s a myth to think that the SAVE plan is permanent, as we don’t know what the future holds.

Myth: You don’t have to report all of your income for the SAVE plan.

Like other IDR plans, the SAVE plan’s payments are based on discretionary income and family size. One of the most significant changes with SAVE is the calculation of discretionary income.

The poverty guideline income exemption went up to 225% from 150%, which could have a dramatic impact on monthly payments.

This new calculation of discretionary income might result in confusion around reporting income. For example, some people might believe they don’t have to report all of their income, but that’s false.

Borrowers must include all income when applying for the SAVE plan and also for recertification. This includes W-2 wages and self-employment income. If you’re a practice owner, this means including your profit distributions as part of your income as well.

Myth: The SAVE plan saves everyone money.

The SAVE plan has been touted as an affordable repayment plan for student loan borrowers, with many qualifying for $0 payments. It can easily seem like the SAVE plan saves everyone money, but that’s a myth.

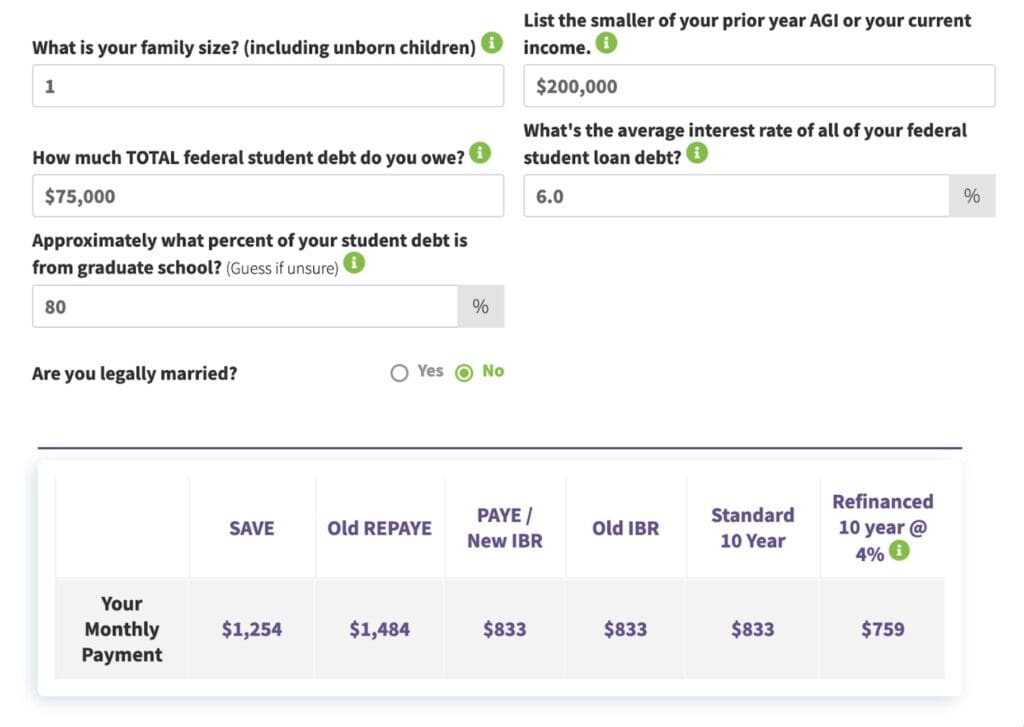

The fact is that the SAVE plan won’t save everyone money, especially those with higher incomes. Using our IDR calculator, you’ll find that SAVE doesn’t guarantee the lowest payment possible.

In the scenario above, we’ve calculated the monthly payment across all repayment plans for a single borrower who has an annual income of $200,000. This individual owes $75,000 in student loans at 6%. Eighty percent of this education debt is from graduate loans.

The calculator revealed a monthly payment under SAVE of $1,254. This amount far exceeds the estimated $833 monthly payment under PAYE/New IBR. That’s a $421 difference.

Notice that the lower amount is also the same as the 10-year Standard Repayment Plan. In this case, the Standard Repayment Plan is likely the best option to achieve debt freedom as soon as possible.

Remember, PAYE and IBR have payment amount caps, so they will never be higher than the Standard Repayment Plan. As you can see in the example, SAVE doesn’t adhere to this rule.

Although the SAVE plan is a great option for many borrowers, low- to middle-income borrowers stand to benefit the most, or borrowers with larger families.

For high-income earners who are single, the SAVE plan might not necessarily save you money. It’s always best to run the calculations to see for yourself so you know what you’re getting into.

SAVE Plan: Sticking to the facts

It’s important to know the SAVE plan student loan facts before signing up for this new repayment option. Despite all the buzz and some clear benefits, there are myths like the ones above making this new option more confusing.

To see if SAVE is right for you, determine your monthly payments, interest costs and total costs over the life of the loan. If you’re unsure how forgiveness, marriage, or a higher or lower income affects your strategy, there’s help.

Book a Student Loan Planner consultation to get tailored advice based on the details of your loans and your life.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).