If you have federal student loans and feel the pressure of debt weighing on you, you might be looking into student loan forgiveness. You might qualify to get your federal student loan debt forgiven through Public Service Loan Forgiveness (PSLF) and income-driven repayment (IDR) plans.

Read on to learn about these programs, the student loan forgiveness forms you’ll need and how to apply for student loan forgiveness.

Major student loan forgiveness programs

Federal student loan borrowers can get 100% of their loan balances forgiven under PSLF or IDR. There are some major differences between the two programs, though.

Under PSLF, borrowers must commit to working in the public sector for 10 years and make 120 payments to qualify. The payments don’t have to be consecutive, and your employer must be a 501(c)(3) or a government agency to qualify.

The income-driven repayment plan is a bit different. There are four repayment plans under the IDR umbrella, where you pay 10% to 20% of your discretionary income for 20 to 25 years. You must submit a student loan forgiveness form if you pursue student loan forgiveness under one of these programs.

Additionally, as of August 2022, President Joe Biden announced debt relief of $10,000 to $20,000 for eligible loans and borrowers to help make student loan repayment less of a burden. On top of that, the payment pause is set to end August 30, 2023, unless the courts rule on lawsuits sooner than that.

Get Started With Our New IDR Calculator

How to apply for student loan forgiveness (and the forms you’ll need)

The first step to applying for student loan forgiveness is filling out the student loan forgiveness form. The process can vary based on the program, which is explained in detail below.

President Biden debt relief application

President Biden debt relief

| Do you need a student loan forgiveness form? | Yes |

| Form | The debt relief application was released on October 17, 2022. |

| When to submit the application | Submit it before the deadline on December 31, 2023. |

| Where to submit form | Submit the application with the Department of Education |

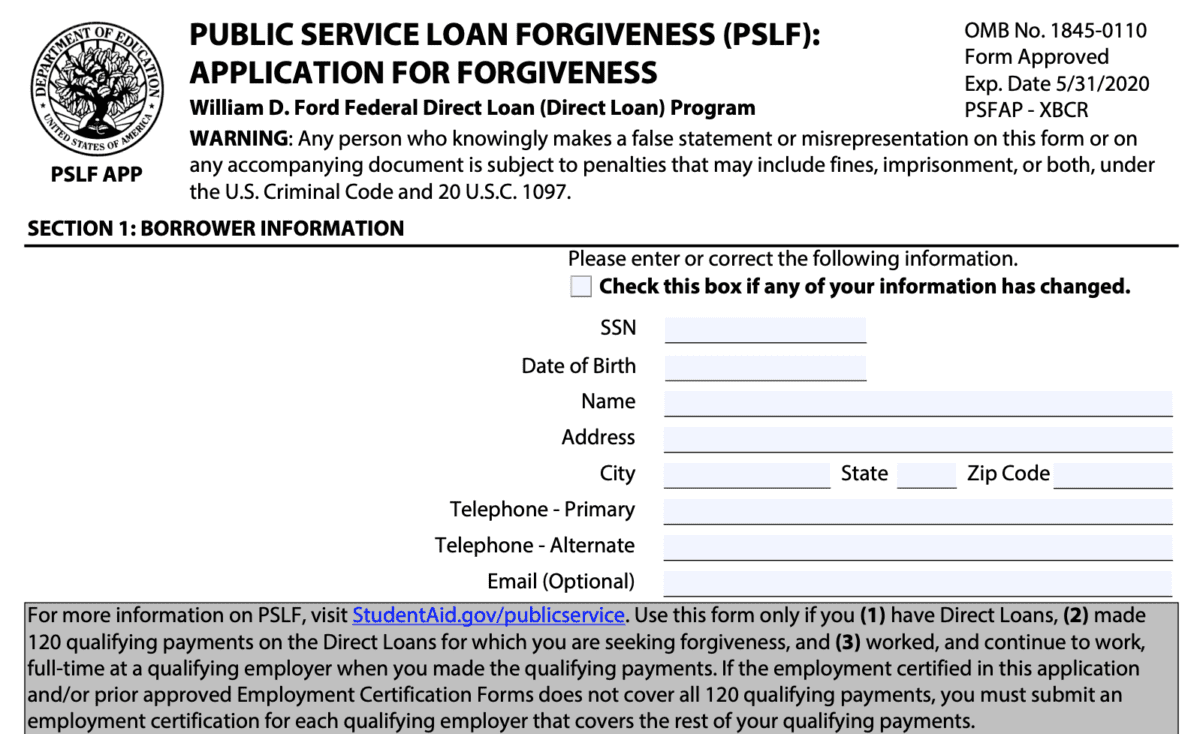

PSLF student loan forgiveness form

PSLF student loan forgiveness

| Do you need a student loan forgiveness form? | Yes |

| Form | Public Service Loan Forgiveness Application for Forgiveness |

| When to submit the application | After 10 years of service and 120 payments. |

| Where to submit form | MOHELA. See below for instructions. |

After making 120 payments (under a qualifying repayment plan) and working for 10 years on a full-time basis in public service, you can submit your PSLF student loan forgiveness form to get the process started.

The first step is to fill out the Public Service Loan Forgiveness Application for Forgiveness. The top portion of the form requires you to fill in your personal information.

The second portion of the form is agreeing to the terms and conditions of student loan forgiveness. For example, you have made 120 payments and worked for a qualifying employer. You also must agree to have your loans transferred to FedLoan Servicing, the official loan servicer for PSLF. However, as of September 2022 the PSLF servicer is changing to MOHELA.

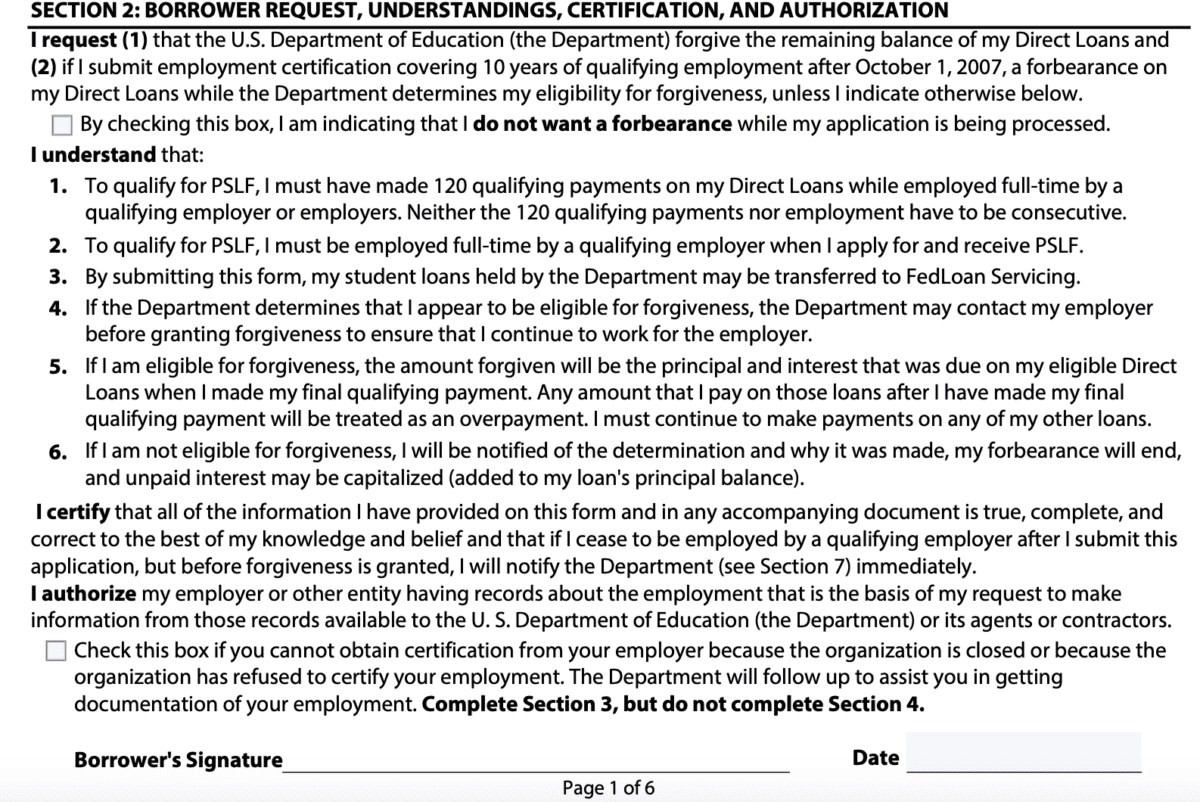

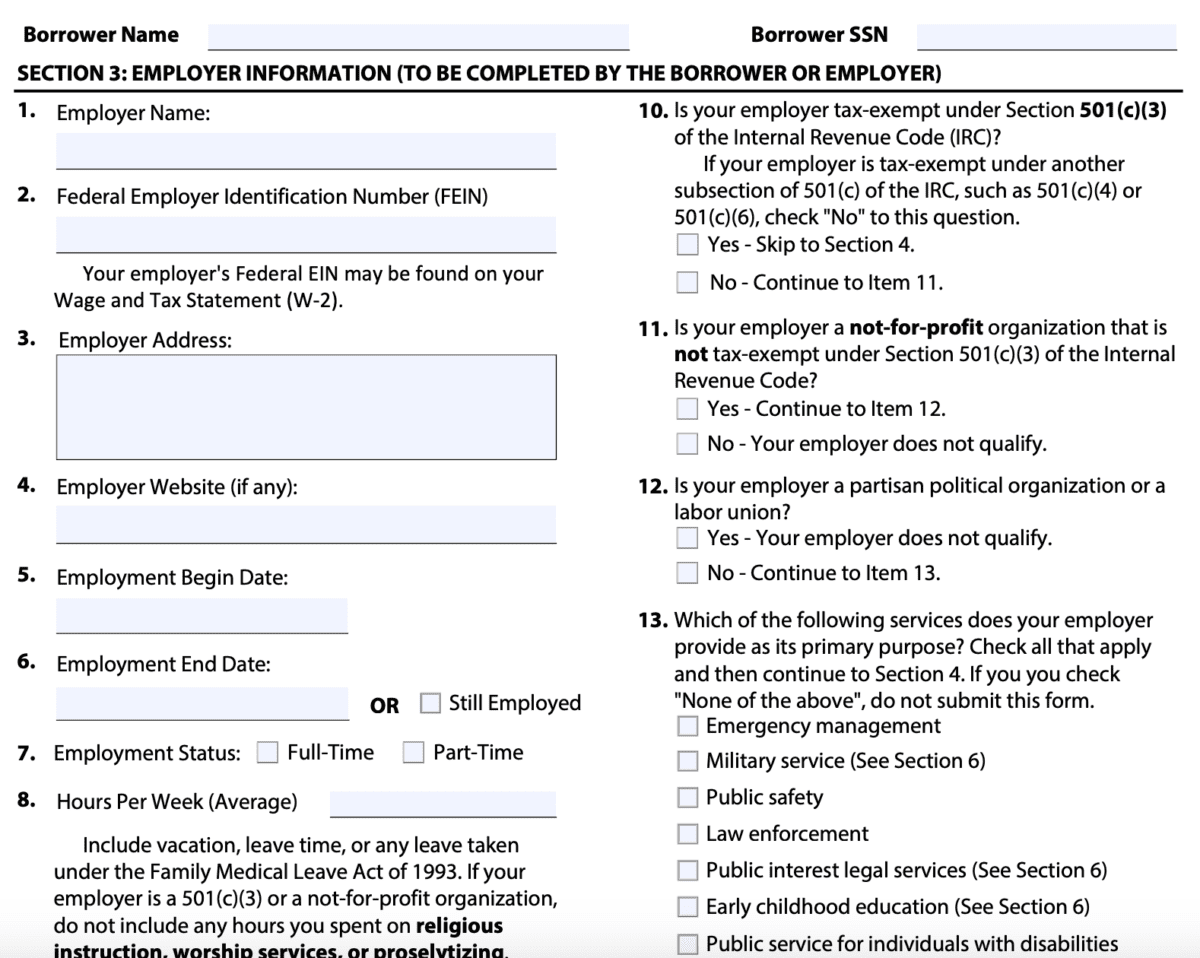

Once you fill out those two sections, the third section can be completed either by you or your employer.

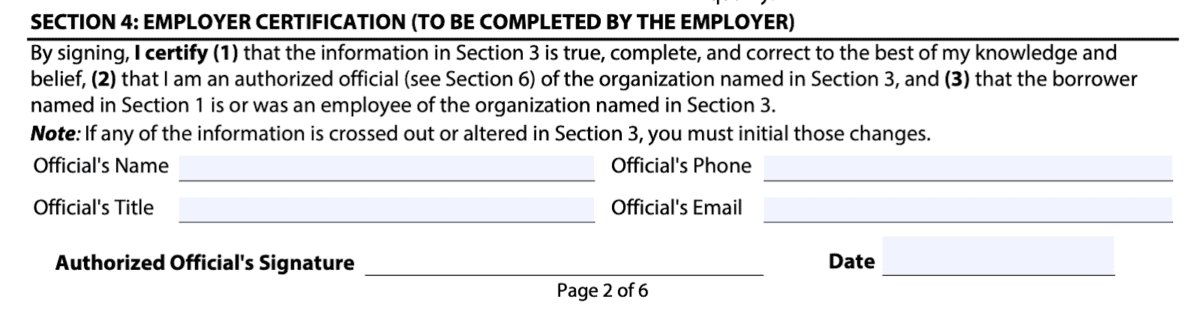

Section 4 of the PSLF student loan forgiveness form will need to be filled out by an official representative from your employer who can verify your employment.

Once the PSLF student loan forgiveness form is complete, you can submit your PSLF application to MOHELA. You can also call if you have questions about PSLF using this number: 855.265.4038.

This is the only student loan forgiveness form you’ll need to apply for student loan forgiveness. If you don’t qualify for the Public Service Loan Forgiveness (PSLF) program, you may qualify for Temporary Expanded Public Service Loan Forgiveness (TEPSLF).

You should also look at the IDR Waiver which may add qualifying payments that may not have previously been eligible.

Income-driven repayment student loan forgiveness

Income-driven repayment student loan forgiveness

| Do you need a student loan forgiveness form? | No, but you must fill out an IDR request form to get on the plan and stay on the plan. |

| Form | Income-Driven Repayment Plan Request form |

| When to submit the application | There is no formal student loan forgiveness application yet, but you must submit a form to get on an IDR plan and recertify your status every year. |

| Where to submit form | Return to the loan servicer. |

Under income-driven repayment, borrowers can get the remaining balance on their loans forgiven after 20 to 25 years. This program launched over a decade ago and has a longer repayment term. The form is called an “IDR plan request,” so there is no student loan forgiveness form related to IDR.

According to the Department of Education, “Your loan servicer will track your qualifying monthly payments and years of repayment and will notify you when you are getting close to the point when you would qualify for forgiveness of any remaining loan balance.”

The process hasn’t been standardized, but hopefully, as more and more borrowers take advantage of this program, the Education Department will unveil an official student loan forgiveness application specific to IDR.

Once you’re on an IDR plan, you must recertify your income every year to stay on track for student loan forgiveness. The form to apply for IDR and to recertify are the same. You’ll complete the Income-Driven Repayment Plan Request form and turn it into your loan servicer.

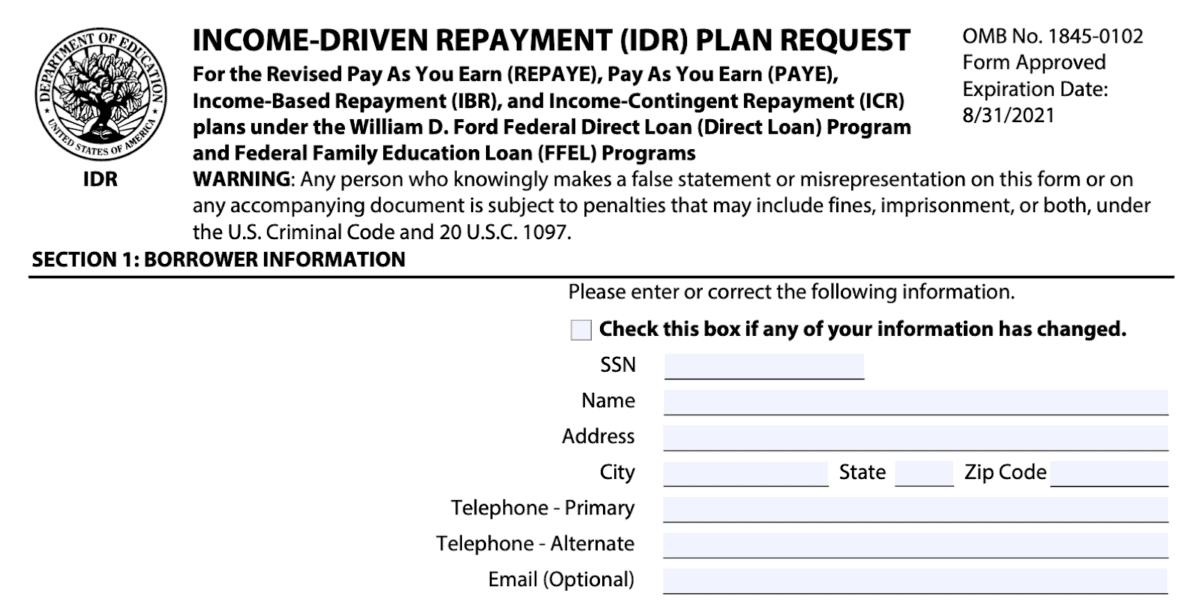

In the first section of the form, you’ll input your personal information:

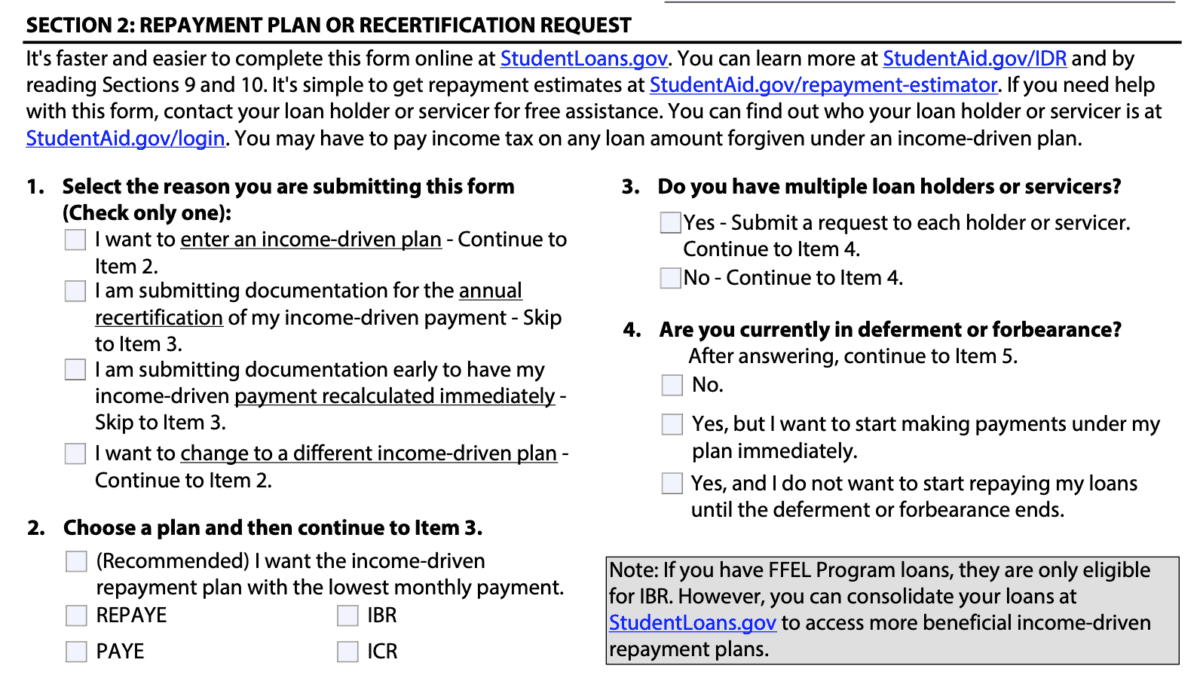

In section 2 of the form, you’ll be prompted to choose one of the four IDR plans or be asked to recertify your income:

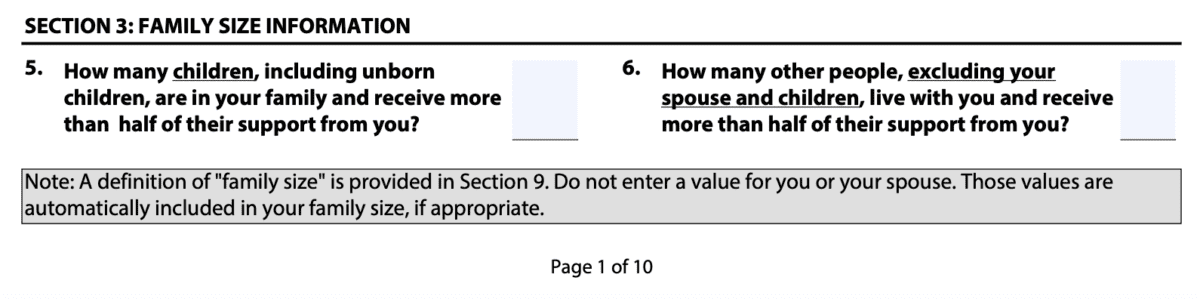

Section 3 asks you to input information about your family size:

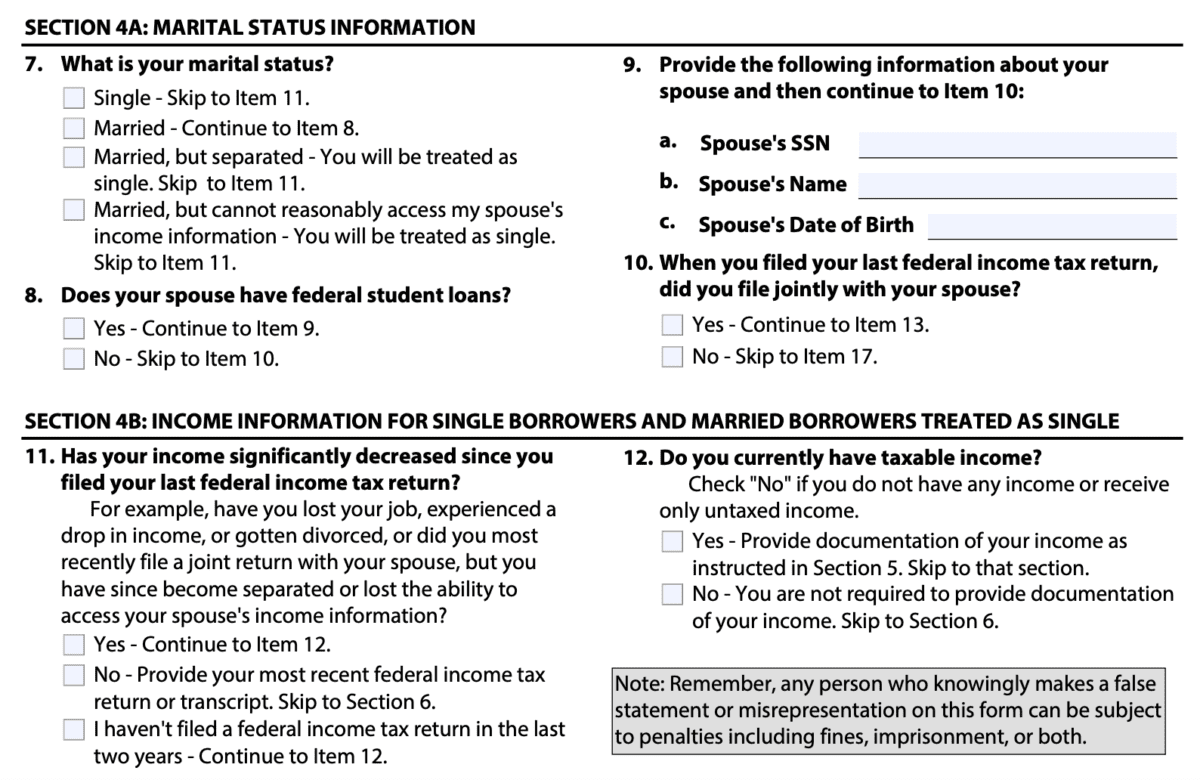

In sections 4A and 4B, you’ll be asked about your marital status, which can affect your IDR payments if you file jointly. If you are filing jointly, both of your incomes will be used to determine your eligibility and payment amount.

Sections 4C and 4D are separate sections for married borrowers filing jointly or separately. In section 5, you’ll be instructed on how to document your income, typically with a paycheck stub.

For section 6 of the form, you’ll be authorizing and certifying that the information you provided is correct, and then you sign your name. Once the form is complete, you can send it back to your loan servicer. You may also fill out the student loan forgiveness application online to save time.

It can seem laborious, but you’ll need to recertify your income each year for 20 to 25 years to get student loan forgiveness. Because your payments are based on your income, your monthly payments may go up when you report income changes.

After making payments for the entire repayment term, you can talk to your loan servicer about student loan forgiveness forms and options.

Other types of student loan forgiveness

Public Service Loan Forgiveness and income-driven repayment are the main ways federal student loan borrowers can get student loan forgiveness. But there are other types of student loan forgiveness based on profession or certain situations.

Below we’ve listed some other types of student loan forgiveness and the forms you’ll need to apply for them.

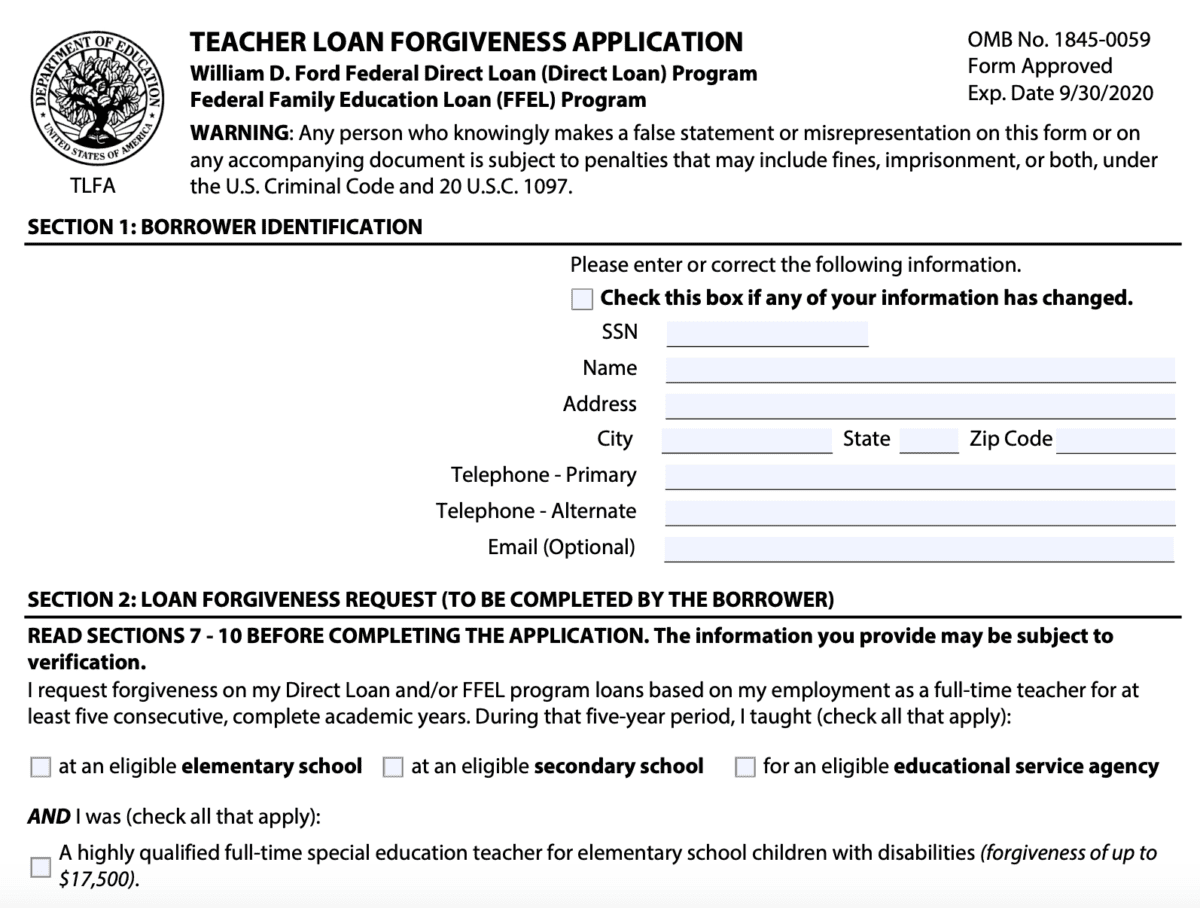

Teacher loan forgiveness

Teacher student loan forgiveness

| Do you need a student loan forgiveness form? | Yes |

| Form | Teacher Loan Forgiveness Application |

| When to submit the application | After five years of teaching. |

| Where to submit form | Return to the loan servicer. |

If you’re a teacher and meet certain requirements, you may be eligible for partial student loan forgiveness under the Teacher Loan Forgiveness program. Under this program, teachers considered “highly qualified” and work at an eligible elementary or secondary school five years in a row may be eligible for student loan forgiveness.

Teachers could be eligible for either $5,000 or $17,500, based on their subject area. After five years of service, you can submit the Teacher Loan Forgiveness Application to your loan servicer. You’ll need an official at your school to complete part of the application and verify your employment.

Preview of the Teacher Loan Forgiveness application

NHSC loan repayment forgiveness

NHSC loan repayment forgiveness

| Do you need a student loan forgiveness form? | Yes |

| Form | NHSC loan repayment forgiveness application |

| When to submit the application | During application cycle — check the website. |

| Where to submit form | Online |

The National Health Service Corps (NHSC) has repayment assistance for certain healthcare providers who serve for two years at a qualified site. Working in certain occupations in primary care, dental care, and behavioral and mental health could make you eligible for this loan repayment program.

You can find the applications and forms online, and you may be asked to provide supporting documentation.

Perkins loan cancellation

Perkins loan cancellation

| Do you need a student loan forgiveness form? | Yes |

| Form | Must get from the school. |

| When to submit the application | School or loan servicer will offer instructions. |

| Where to submit form | School or loan servicer will offer instructions. |

If you have Perkins Loans, you may qualify for Perkins Loans cancellation, depending on your profession. If you are a teacher who works at an eligible school in a qualifying position, you could get 100% of your Perkins loans forgiven. The amount of forgiveness is incremental:

- 15% is canceled in your first two years of service

- 20% is canceled in your third and fourth year of service

- 30% is canceled for the fifth year of service

Workers in another profession may be eligible for partial or full student loan forgiveness. For example, some eligible professions include firefighter, nurse and public defender.

You can find more information about Perkins loan cancellation on the Federal Student Aid website to see if your employment or Volunteer Service qualifies and get the necessary forms from your school or loan servicer.

Closed school discharge

Closed school discharge

| Do you need a student loan forgiveness form? | Yes |

| Form | Contact your loan servicer. |

| When to submit the application | Within three years of the school being closed. |

| Where to submit form | Return to the loan servicer. |

If your school closed after you took out federal student loans, you might be eligible for closed school discharge. Contact your loan servicer for information on how to apply and what forms are required. Continue making payments to remain in good standing until your loan discharge is confirmed.

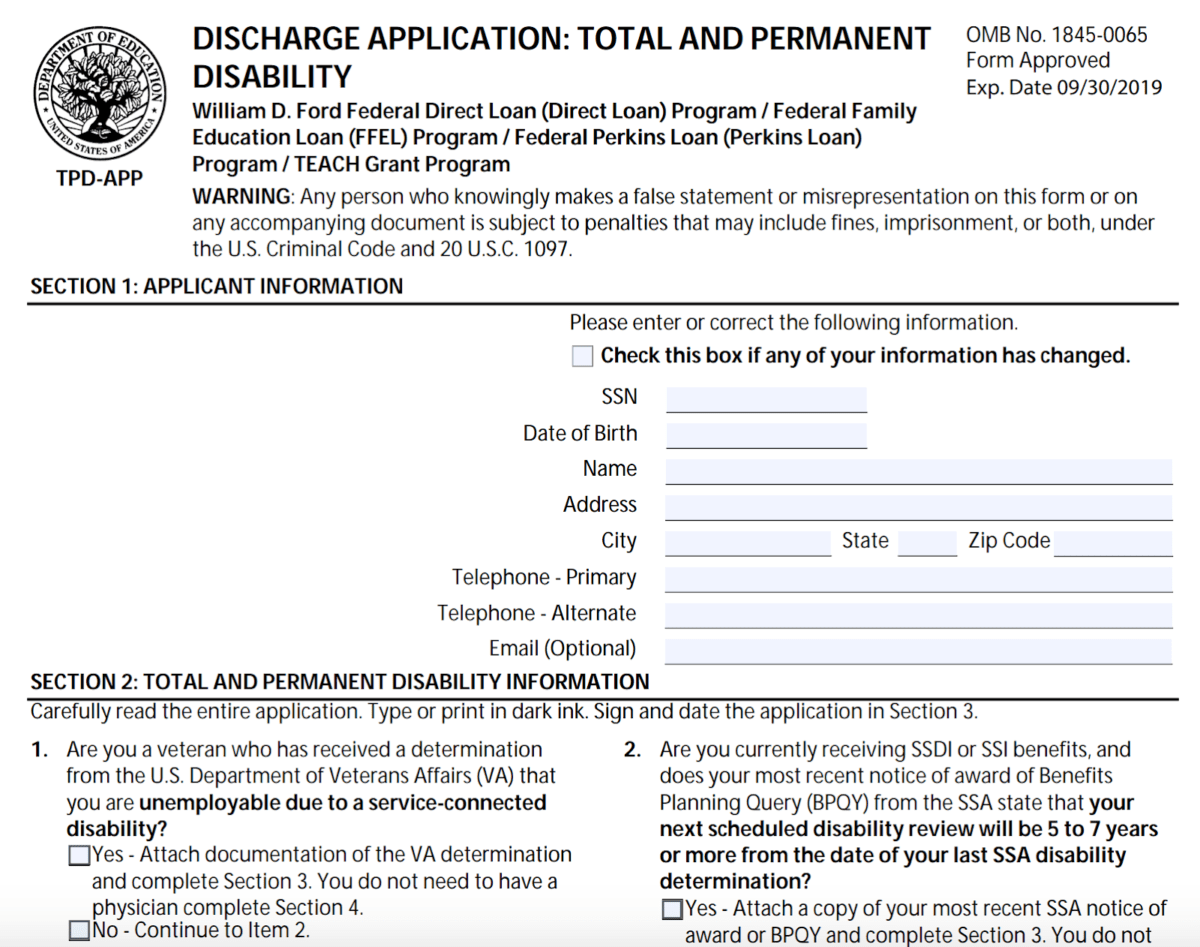

Total and permanent disability discharge

Total and permanent disability discharge

| Do you need a student loan forgiveness form? | Yes |

| Form | Total Permanent Disability Discharge Application |

| When to submit the application | After filling out the application and getting supporting documentation. |

| Where to submit form | Online |

Disabled borrowers may be unable to work and pay back student loans. If that’s the case for you, you might qualify for total and permanent disability discharge if you have federal student loans.

You can fill out the application online, and you will need supporting documentation from a physician, the Social Security Administration or the U.S. Department of Veterans Affairs. Any loans discharged under this program until December 31, 2025, won’t be considered taxable income, so you won’t have to pay taxes on the forgiven amount.

Preview of Discharge Application for Total and Permanent Disability

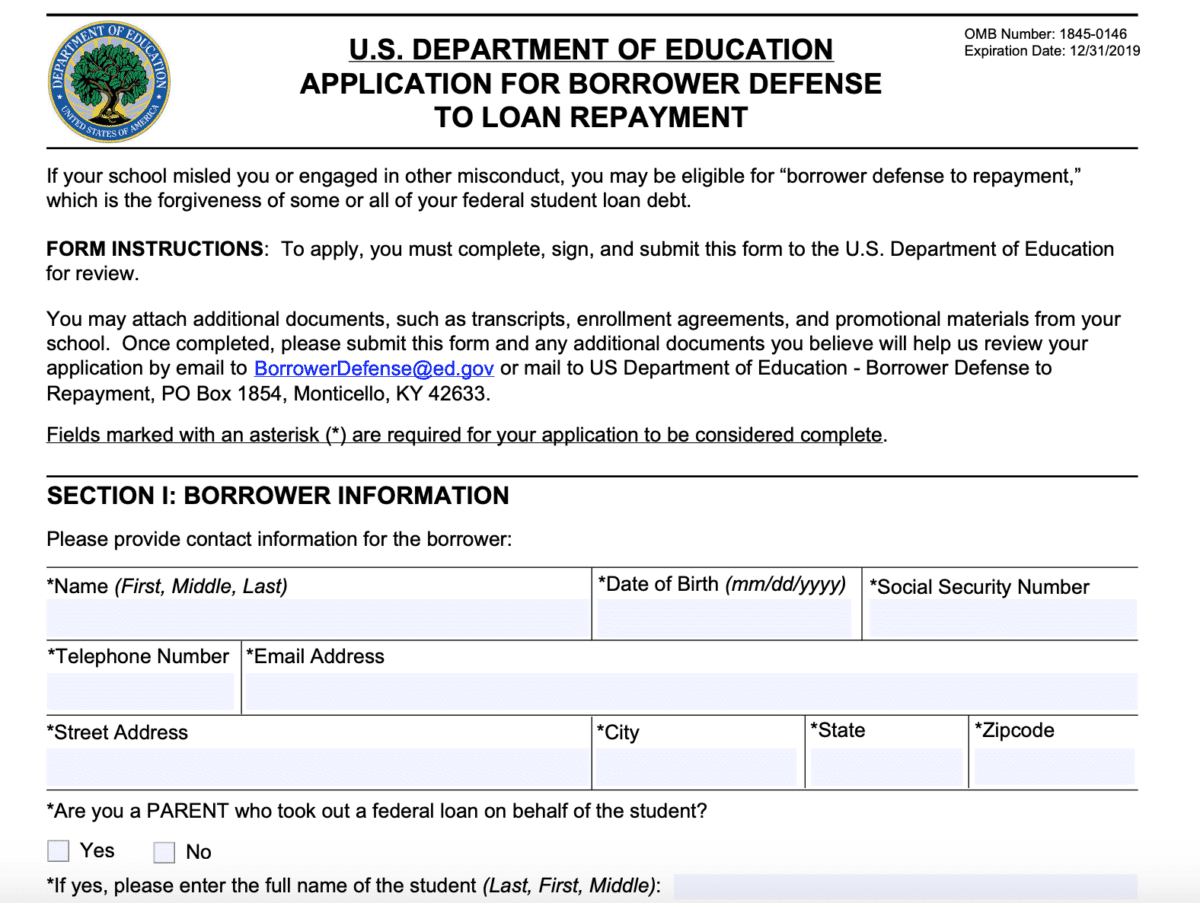

Borrower defense to repayment loan forgiveness

Borrower defense to repayment

| Do you need a student loan forgiveness form? | Yes |

| Form | U.S. Department of Education Application for Borrower Defense to Loan Repayment |

| When to submit the application | ASAP |

| Where to submit form | Online |

If you went to a school that misled you or engaged in fraud or misconduct, you could be eligible for student loan forgiveness through the Borrower Defense to Loan Repayment law.

You can fill out the application online, and if you have any supporting documentation, that can also help.

Preview of Borrower Defense application

Alternative to student loan forgiveness

If you’re struggling to make your student loan payments or work in a low-paying field, opting for PSLF or student loan forgiveness under IDR can be a lifesaver.

There’s another option, however, if none of the above circumstances fit your situation. It’s not quite student loan forgiveness, but it could save you thousands of dollars.

Student loan refinancing can be an alternative to student loan forgiveness for some borrowers, and it can slash your interest rate if you have good credit and qualify.

You might be able to score a better interest rate and change your repayment term. While this can be a huge benefit, the major drawback of refinancing is that you lose out on federal protections like student loan forgiveness and income-driven repayment options.

So, before you refinance, you must be pretty sure you won’t need those federal options. Refinancing can be a good option for borrowers with good credit, stable employment and a low debt-to-income ratio.

Get started reducing your student loan burden

Using the forms above, you can get on the path to pursuing student loan forgiveness. Keep good records, and make sure you have everything in writing. It’s your job to follow up with loan servicers and ensure you’re on track to reduce or eliminate your student loan debt.

Be your own advocate so you can get those loans off your back! If you’re unsure whether you should pursue student loan forgiveness or loan refinancing, we can help. Get in touch for a student loan debt consult, and we’ll steer you in the right direction.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments

Comments are closed.

I have a couple questions on “Total and permanent disability discharge” discussed above. First, can a Direct Parent PLUS loan be discharged under this “disability discharge” ? Second, if one parent has disability and the other parent is not disabled and working, do they qualify for a “discharge” ? Specifically, the mother is totally disabled, can not work and has received Social Security Disability for over 10 years. The father is working and earns over $40,000 per year. Question — do these parents qualify for a “Total and permanent disability discharge” ? Thank you for your help.

It’s all based on who’s name is on the loans. If youre disabled and your name is on the loans theyre forgiven. Spouse status is irrelevant if their name is not on the loans.

Travis,

Thanks for your reply. Follow up question– can the name of the disabled spouse be added to the loans ? or, can the loans be transferred to the disabled spouse ? Appreciate your help.

Hi – can my own charity qualify for PSLF forgiveness even if I work full time in another field/role?

Thank you!

This article might answer your question: https://www.studentloanplanner.com/starting-non-profit-pslf/

My daughter Melissa graduated with a bachelor degree in illustration from Columbus College of Art & Design in 2015. I co-signed for her loan in 2011 so that she could attend this college. The loan was 108k (160k minus 48k grant she received in high school). She died in Sep.2015 and in inherited the balance of $75k and today (Feb.2021) have balance down to 42k. The loan is thru UAS Connect (877) 530-9782, studentchoiceconnect.com.

I’ll be 62 this July (2021) and asking for a loan forgiveness, otherwise I will be forced to use my only retirement (401k).

I’m sorry to hear about your daughter. It sounds like she might have had a private studnet loan that you cosigned for. Private student loans don’t qualify for forgiveness. However, you may be able to refinance to a lower rate and/or longer repayment term to lower your monthly payment obligation. I’d suggest applying through our cash back refinancing links.