Before a professor stands at the front of a class, they’ll spend years in the seat. Learning how to pay off your student loans for multiple degrees is one test that’s not on your transcript, but probably should be. Student loan refinancing for professors and student loan forgiveness programs are the two units you need to know to start your study.

Wide range of average professor's student loan debt

In the 2018-2019 school year, there were 184,000 PhD graduates and 816,000 master’s degree graduates. Not all graduates will stay in higher education, but many grads are required to get an advanced degree in order to become a professor.

According to the Bureau of Labor Statistics (BLS), typically professors need a PhD, although in some cases, a master's degree is enough. This leaves a wide window for the amount of student debt professors can carry.

Where the doctoral degree is earned has just as much to do with the professor's student loan balance as the field of study. For example, Clinical Counseling and Applied Psychology is a doctoral degree at many universities. The average debt for West Virginia University's doctoral grad was $38,207, whereas Union Institute and University grads average $204,688.

It’s totally possible for professors to walk out with a PhD and six figures of debt.

Not all doctors with six-figure debt have six-figure salaries

Those with doctoral and professional degrees are ranked as having the highest wages in the U.S., according to the BLS. The running joke among professors with PhD’s, however, is that they’re “not that kind of doctor.”

The average salary for a professor is $78,470. This can vary just like the debt balance does depending on what you teach and where you teach. A law professor's average salary is $111,140, but a psychology professor's average salary is $76,710.

One thing is certain, you’ll need a plan to pay off the debt once you start teaching.

Student loan refinancing for professors

Student loan refinancing is an option for professors, but not one that is recommended if you and your loans qualify for loan forgiveness.

When you refinance your student loans you’ll be giving up borrower protections like:

- Income-based repayments

- Deferment or forbearance in the case of financial hardships

- Eligibility for forgiveness programs

Your lender pays off your old federal student loans and gives you one new private student loan. Once your loans move from federal to private, you can’t go back.

In a job like academia, having the flexibility with your student loan payments is truly important. Beyond this, the numbers will work in your favor to go for Public Service Loan Forgiveness (PSLF) over refinancing.

Student loan forgiveness programs for professors

Professors are eligible for two major student loan forgiveness programs:

- Faculty Loan Repayment Program (FLRP)

- Public Service Loan Forgiveness (PSLF)

Professors are also eligible for Perkins Loan Forgiveness. However, Perkins Loans are no longer distributed, so this only applies if you have older Perkins Loans.

Faculty Loan Repayment Program

The FLRP program is administered by the Health Resources and Services Administration (HRSA). This program is for professionals who want to teach at accredited health professional schools. FLRP is only for federal student loans. Private student loans and Parent PLUS loans aren’t eligible.

To be eligible for FLRP you must:

- Be a U.S. citizen

- Be from an economically or environmentally disadvantaged background and provide proof

- Have a qualifying degree in an eligible health profession such as nursing, clinical psychology, dentistry or public health

- Have employment either full-time or part-time at an eligible health professions school

- Have all student loans in good standing

You can have up to $40,000 of student loans forgiven for two years of service. Although this option is a fast way for professors to knock out some student loan debt, it doesn’t work for those outside the health field.

Public Service Loan Forgiveness Program

The PSLF program is open to any professor who works at a qualifying university or college. Your university or college qualifies if:

- It’s a government organization like a state or public college.

- It’s a not-for-profit that is listed as a 501(c)(3).

You can check to see if your university or college qualifies by using the PSLF help tool. If you work at a for-profit college, then you won’t qualify for PSLF. This is a good example of when you might want to consider refinancing your student loans.

Professors need to work full time in order to qualify for PSLF. This means at least 30 hours a week. If you teach at multiple colleges as an adjunct professor, your time needs to add up to 30 hours a week.

To get total tax-free forgiveness, you need to make 120 qualifying payments and stay on top of paperwork:

- First, sign up for a qualifying repayment plan. You have four options all under Income-Driven Repayment.

- Next, you’ll make sure that your school qualifies and apply for PSLF.

- Lastly, you’ll file an employment certification form every year you’re teaching.

If you’re a professor, you know the paperwork never ends. But the paperwork for student loan forgiveness will be worth every second of your time. Because it’s tax-free forgiveness, you can divert your cash flow toward investing instead. If you plan to be a professor long-term, then PSLF makes the most financial sense overall, but let’s examine two scenarios.

Case studies: student loan refinancing for professors vs. PSLF

Let’s say you still want to consider refinancing your student loans because you’d rather be rid of them or you don’t owe a lot. If this is the case, the debt number is going to be your determining factor.

Let’s use the psychology professors as an example.

Scenario 1: High debt and an average salary

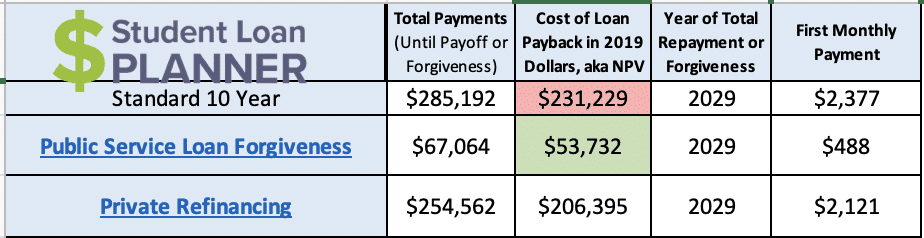

In example No. 1, a psychology professor graduated from Union Institute and University with $204,688 of student loan debt and an average interest rate of 7%. Now they’re single and teaching, making $76,710 a year.

Because they owe more than 1.5 times their income, loan forgiveness for this professor is the best option. The amount of money that comes out of the professor's pocket is far less than the standard repayment option and student loan refinancing.

Scenario 2: Low debt and an average salary

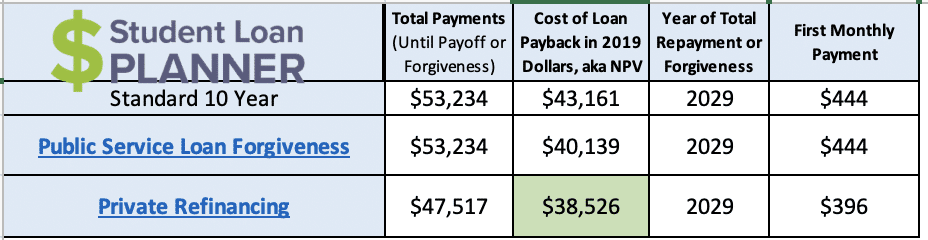

In example two, this psychology professor went to West Virginia University's doctoral program and graduated with $38,207 of debt. The average interest rate was 7%, and they make the same amount as the above professor, $76,710 per year.

In this case, the professor has two options:

- Because the professor owes a significantly smaller amount, refinancing for a rate of 4.5% or less on a 10-year term will keep more money in their pocket than PSLF.

- There is one more loan forgiveness option for this professor. They could qualify for FLRP as a psychologist with an advanced degree. All of their loans would be forgiven in two years if they work at a qualifying school.

Refinancing is generally the best step for most professors in this situation unless you teach in the health professions. Remember, refinance only if you’re comfortable giving up borrower protections and forgiveness.

When student loan refinancing for professors is definitely a good idea

There are two common scenarios in which refinancing for professors could be a good idea:

- You have private student loans.

- Your place of employment doesn’t qualify for PSLF.

If either one of these is true, then look into refinancing. You can lower your interest rate and keep more money in your pocket. Be sure to shop around and compare rates.

The last reason you might refinance is if you owe less than 1.5 times your income and don’t mind giving up borrower protections, like example No. 2 above. You should compare to FLRP and run the numbers to be sure.

Always compare loan forgiveness for professors with refinancing

The bottom line: Refinancing for professors who qualify for PSLF isn’t recommended. You want to leverage that tax-free forgiveness and invest your cash flow elsewhere.

However, professors who have private student loans, don’t qualify for PSLF, or carry a small student loan balance should consider refinancing. Only refinance your student loans after running your specific numbers and comparing it to PSLF.

The Student Loan Planner® calculator was developed for exactly that. Run your numbers and see what option for tackling your student loan debt is best. If you want to talk to a professional about your student loan debt options, then reach out to the team at SLP.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.19 - 9.74% APR

Variable 5.99 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 10.98% APR

Variable 5.28 - 12.41% AR

|