The orthodontist Mike Meru has $1 million of student debt. Right away when I saw the Wall Street Journal piece profiling him, I knew he was paying too much on dental student loans. The public ripped Dr. Meru apart from the decisions that caused his conspicuously large debt load.

The problem is there are a lot of critics throwing rocks from glass houses. I’m reminded of the biblical phrase, “may the one without sin be the first to cast the stone.” Did Dr. Meru made some poor choices in how he racked up dental school debt? Sure. However, 40% of Americans don’t even have $400 to their name.

I’ve met dentists and other professionals in their 50s who have almost nothing saved for retirement. Physicians and veterinarians come to me and want to spend 3.5 times their income on housing. A huge percentage of my clients have massive car payments when they consult with me.

We should absolutely discuss the broken system that allowed Dr. Meru to take out so much debt. It is not entirely his fault. My guess is that he’s not especially financially literate, like many doctors. He probably listened to the BS peddled by many dental schools that “everything is going to work out great, you’ll pay this back in no time. Here’s another loan form to sign…”

This article will focus on the only thing I want any professional with a stressful amount of debt focusing on once the problem already exists. How can Dr. Meru face the harsh reality of dental school debt and pay as little as possible using the rules of the student loan game?

Why Debt Avalanche or Debt Snowball Would Be a Poor Choice Here

The public and most financial advisors over 40 believe that the solution to student debt is simple: pay it back. However, Dr. Meru pays about $1,590 a month. He owes about $1,060,000. Meru’s average interest rate is probably 7.5%.

He’s not eligible for PAYE because he borrowed before 2005, so his choices are between IBR (Income Based Repayment) and REPAYE (Revised Pay As You Earn). His wife has no loans and no income so there’s no reason why he would file taxes separately.

That means REPAYE would be a clear choice. He consolidated in 2015, so he has about 3 years of credit toward dental school debt forgiveness, which would happen in 22 years since he needs 25 total. That year is 2040.

The very best he could do right now if he could even refinance at all would be a 4.5% for a 10-year term. With the publicity generated from this article, I’ve heard that a lot of financial experts desiring to contact him. I wouldn’t be shocked if a refinancing company offered him a special deal in order to get him as a spokesperson.

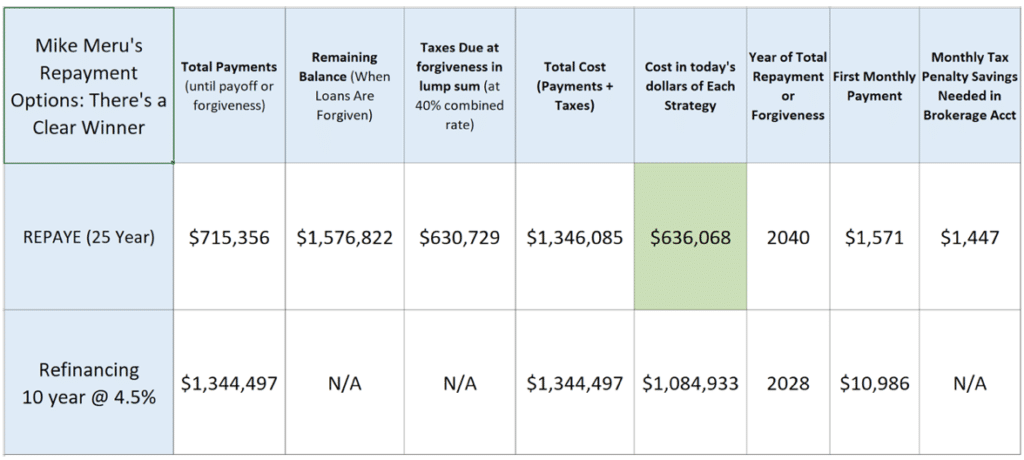

Let’s assume his decision is between REPAYE for 22 more years or paying everything back over 10 years. I will assume Dr. Meru receives 10% raises until his income passes $300,000 and then it levels off with inflation level increases. I’m assuming his wife continues to not receive an income, thus keeping his payments lower. Finally, I assume he could get a 5% investment return so we can see the cost of both strategies in today’s dollars. Here’s the result:

Notice that my estimate of what Dr. Meru will pay monthly in the second to last column on the right is almost identical to the $1,590 he pays monthly currently. I’m assuming that Dr. Meru’s income really soars, which would make loan forgiveness look even less attractive.

If he remains employed at a corporate practice in one of the most saturated areas of dentistry in the country (Utah), I don’t believe his income would hit $300,000. I’m being optimistic in my model though.

I have no doubt that personal finance personalities will want to meet Dr. Meru and teach him their system of cutting back and paying off dental school debt. One popular strategy advocated by Dave Ramsey is the debt snowball method. You pay the smallest loan off first then work your way up until you paid off the large loan.

His philosophy works great for folks with credit card debt that is rarely more than two times their income. It fails miserably in this case with government student loans and their unique rules.

Another repayment approach is debt avalanche. Dr. Meru would pay his highest 8.5% interest rate loans first then work his way down the interest ladder until he’s paying off the lowest interest rate loans. This also would be highly inefficient as he could refinance the debt and cut the interest rate almost in half.

Get Started With Our New IDR Calculator

How REPAYE Can Be Used for Massive Student Loan Balances

On REPAYE, Dr. Meru would pay $715,356 in my model over 22 more years. He would have a $1.576 million remaining balance. The WSJ assumed it would hit $2 million, probably if his income stayed roughly the same.

After 22 years, he owes $630,729 in taxes assuming a 40% tax rate. His total payments plus tax bomb would be $1.346 million. Contrast that to $1.344 million with a 10-year refinancing path. Would you rather pay the exact same amount of money over 22 years or 10 years? Because of inflation, you would always choose 22 years.

Hence, the cost we should care about is the cost in today’s dollars and compare the two plans. This is called present value. If we do this, we can see that Dr. Meru’s REPAYE cost would be about $636,068 in 2018 dollars. This assumes he could invest in his retirement accounts or a dental practice and earn a reasonable 5% rate of return. Importantly, if he earned more the cost in today’s dollars would be even lower.

How I Know That Mike Meru Is Paying Too Much on His $1 Million

Dr. Meru saves almost nothing for retirement if the $225,000 income the Journal reported is his pre-tax earnings instead of his AGI. What’s the difference and why does it matter to you? Pre-tax earnings are what you receive from your employer, whereas Adjusted Gross Income (AGI) is the amount of taxable income declared on your tax return on your 1040.

AGI can be reduced to lower than your pre-tax income in several ways. The main one available to employees is retirement deductions.

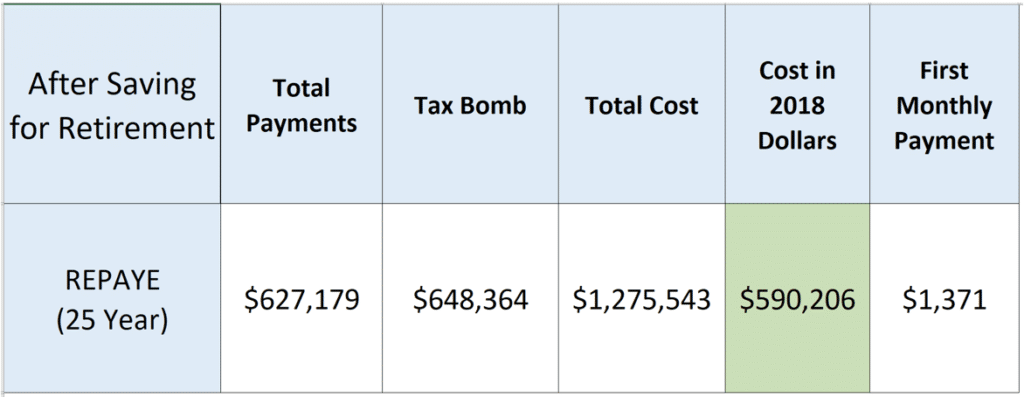

At a minimum, Dr. Meru should be contributing $18,500 to his 401k plan. Since his wife does not work, she would be eligible for a Spousal IRA contribution of $5,500. Both would be deductible. Hence, Meru could subtract $24,000 a year from his taxable income, which lowers his student loan payment by $2,400 a year, or $200 a month. Here’s the new cost of his loans on REPAYE.

Why Specialists and Dentists with Huge Balances Need to Be Practice Owners or 1099 Contractors

The good news for Dr. Meru is that $24,000 in tax-shielded savings is nothing. He could do way more, but he needs to throw off the corporate dental group shackles that are holding him back. He is probably a W-2 employee, which means that the employer controls things like his benefits package and income.

The company Dr. Meru works for has five different offices. He’s working his tail off for someone else’s empire. There’s nothing wrong with that, but his priority should be taking care of his own family, not building wealth for someone else.

If Mike Meru switched to a 1099 Contractor status, he could save way more for retirement. That would make him responsible for more taxes, but since he’s already over the limit for Social Security taxes, it might just be around $10,000 he would need to pay on his own extra from this setup. The employer already pays this tax, so they should be willing to give it to him instead as extra salary and it wouldn’t cost them a dime.

So let’s say he makes $235,000 on a 1099 with the employer giving him the Social Security tax they paid back to him in salary. He would now be eligible to write off every single expense he has related to his one-man business. He could take deductions for CE courses, conference travel, equipment he purchases, professional and accounting fees, and more. Perhaps he would be able to get his income down $15,000 in this way (although I think it would be way more). Now his taxable income is at $220,000.

In terms of healthcare, Dr. Meru could ask for the health premium the employer pays as a direct contribution to his own effort to buy health insurance. That part would be less than ideal, but the ability to save for retirement is where being a 1099 contractor is awesome.

Instead of a $24,000 max he can shield from taxes, Meru could save $18,500 for himself but he could also add his wife to his one-man corporation. She could put $18,500 as well away for retirement.

How S Corporations with Single Employees Can Reduce Student Loan Payments with Smart Retirement Strategies

Since Meru is the employer of this S corporation, he could make an employer match to an individual 401k plan for himself and his wife. This is limited to 25% of wages paid, up to a combined max of $55,000 a year each.

Meru would need to sell his Tesla and drive a beater car to do this, but he could remain in his house with the $400,000 mortgage.

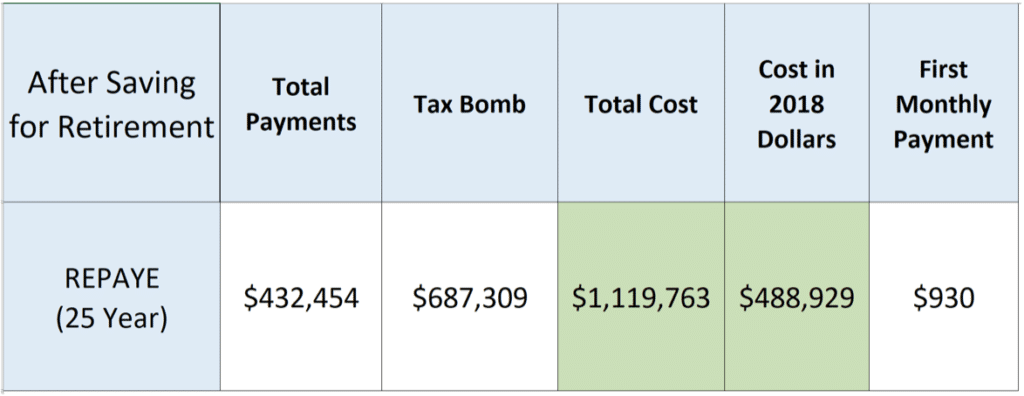

Hence, let’s say his S corporation pays Meru $120,000 (he takes the rest as a profit distribution to avoid self-employment tax), and his wife receives $20,000 in salary (enough to do the 401k contributions but not too much).

Thus, they could make an employer contribution to their plan of $35,000. Their combined contribution would be $35,000 of employer contribution plus $37,000 of employee contribution. In consultation with a CPA, they might choose to take more salary to increase the contribution limit all the way to the maximum of $110,000 together in 2018. Right now though, let’s just assume that they put away $72,000 A YEAR for retirement. Here’s the impact on their REPAYE.

We cut the payments by almost $200,000 over 22 years and reduced the cost in today’s dollars to $488,000 from $636,000. That’s significant present value savings. Additionally, Dr. Meru and Mrs. Meru would have a retirement account worth between $2 million and $5 million in 22 years if they did this.

How Tax Deductions from Dental Practice Ownership Reduce Student Loan Payments

I have dental practice owners as clients making over $500,000 a year who are paying as little as $500 a month on their student loans. We have a faulty system in place that encourages this that should be changed. That said, if the rules exist you should take advantage of loopholes to the fullest extent of the law, otherwise, you’re paying too much.

If Dr. Meru did become a practice owner, the retirement deductions I showed above would change a bit, but they would be more than offset by deductions from his business.

Meru could buy an orthodontic practice and should. His work for a corporate group even if they try to make him a minority partner in the dental practice will never result in him getting the ROI on his education that his family deserves.

He could purchase an orthodontic practice for perhaps $1 million to $1.5 million in the general Utah area, or he could make a careful business plan and try to start his own. He would do a demographic study, be willing to drive up to 30 min to an hour to work to be in a good area and be ready to work his tail off.

He would listen to dental business podcasts, talk to dental CPAs familiar with dental specialist businesses, and he wouldn’t be afraid of hiring consultants to help him expand his business.

Practice Loan Quote Form

You Can Still Get Practice Loans Even with Monster Dental School Debt

Dr. Meru could absolutely still get a practice loan. I have clients with similar amounts of debt who plan to be practice owners. The limitation is the monthly payment, not the total debt amount, especially if you shop around with different banks.

As a practice owner, Dr. Meru could make far more money, but here’s how he would shelter it from taxes and student loan payments. Recall that student loan payments on REPAYE are 10% of your taxable discretionary income. By lowering your taxable income, you lower your payments and get more forgiven.

Building Depreciation

As an owner of a building the IRS allows you to write off the useful life of a building owned by a business. This could be a five-figure reduction in income yearly

Equipment Depreciation

Would Dr. Meru buy any expensive equipment for his practice? While specialist overhead is less than that of a generalist if he did purchase any big-ticket items, Meru could also depreciate these.

Staff and Salary Expense

These expenses are all deductible and he could make an employer contribution to retirement too.

Interest

He would be able to deduct the interest on his practice loan.

There are many more deductions that a CPA would know better than I would. What I’m showing you is that Meru (and you) could be growing the value of a business and shielding money from taxes, legally.

The highly indebted practice owners who are really intrepid buy multiple practices. In doing this, they take so many paper losses and deductions that they reduce their income to very low numbers compared to the gains happening within their business. Warren Buffett operates a similar strategy to pay tens of millions in taxes on many billions of yearly income. He hides it all in his business.

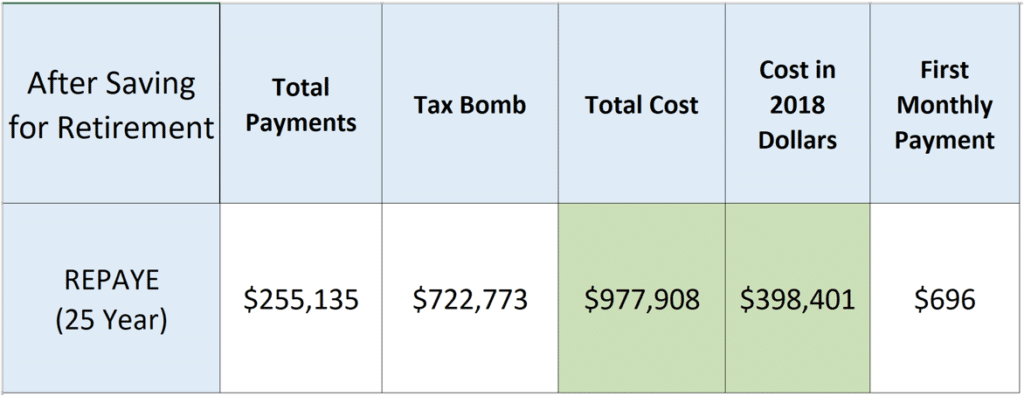

Let’s assume Meru could limit his taxable income to $120,000 adjusted for inflation based on aggressive write-offs of depreciation, business expenses, and aggressive retirement savings. Keep in mind, his net worth could be increasing by multiples of that each year.

Using these strategies, we cut Dr. Meru’s payments by more than 50%, from $715,000 to $255,000. His tax bomb at $722,000 is large, but he could save for it by putting about $1,650 a month into a brokerage account in index funds.

You Can Easily Cost Yourself $100,000 with a Silly Loan Repayment Strategy

The difference between the highest cost path of refinancing in today’s dollars (refinancing) vs the one I’m advocating (REPAYE forgiveness) is $1,084,000 vs $398,000.

That means if Meru listens to the famous personal finance crowd and the angry public who want him to pay it all back, he would cost himself over $600,000!!

I see this all the time with my student loan consulting practice. I’ve advised hundreds to stop paying too much on dental school loans and figure out loopholes like this based on their own specific personal circumstances. If you’re interested in getting this kind of an analysis done for you, I’d love to potentially save you from a six-figure mistake too.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

First off the author’s use of scripture near the top of the article is misguided and tasteless. (“may the one without sin be the first to cast the stone.” ) No one is suggesting that we stone the man to death.

Second it seems that if Dr. Meru’s practice is not yielding him an adequate income, needs to cut his living expenses and find a second job so he can contribute more than the $1500/month minimum payment that is required…

Disagree with you on the use of scripture; I think it’s appropriate and it’s a metaphor similar to removing the plank in your eye before noticing the speck in someone else’s. I saw a ton of comments from mostly older readers in the Wall Street Journal that attacked Dr. Meru when I’m sure they have no intention of paying market rates for health insurance instead of Medicare and returning their Social Security.

I think there’s a legitimate argument that he should have a moral obligation to pay everything back. That said, if he can minimize his payments and better his family financially I think he has a greater obligation to them than to the taxpayer. If the rule is unfair or unwise then it should be changed.

I could have summarized Meru in two words: Irresponsivle financial moron. Oh wait, that’s three words. Well, the point stays.

Kind of odd he is giving talks on he issue. I doubt anyone logical would have any sympathy for the guy. I’d like to see him come up with the tax bomb in 20 years. I will get my popcorn ready.

It’s actually two words since “irresponsivle” is not a word. So you were wrong… but you were right!

And honestly, Travis, I am dismayed that you chose to pump this story (you mentioned that you worked to get this story to to get published in the WSJ). You chose inarguably a very unsympathetic figure whose financial troubles are completely his own doing. You are not doing the hard-working, honest dentists who are in the majority any favors by using this Meru guy as a poster boy for student loan troubles. Instead, you probably stirred up more hatred and antipathy than anything else. Either you didn’t think this through or your motivation is warped.

[…] not uncommon for a graduate of private schools to have a half-a-million dollars in debt, and a $1 Million in student loan debt is not unheard […]

Check this guy out on Instagram to see how he lives…@hukesnow. I went to school with him and have zero pity. Don’t even think he works more than once a week.

I’m sure he could’ve made some different decisions, but even if he’d been the model of frugality he still wouldve owed about 600k. That still would’ve put him in the exact same forgiveness boat if he wanted to live anywhere in the state of Utah. And if he makes 250k like the WSJ profile suggested he probably works a full schedule. It’s just a super saturated area.

[…] Dr Mike Meru has become somewhat of a legend- with people from Dave Ramsey to Jaspreet Singh to The Student Loan Planner talking about […]

I find your reasoning disgusting. Mr Maru should sell the Tesla, drive a beater. Sell the 400,000$ home, rent an apartment. Live frugal and use his 225,000$ salary to pay 100,000$ a year on his student debt. That is the moral and ethical thing to do.

You could argue the moral and ethical thing for seniors to do is opt out of Medicare and Social Security because the taxes they paid in are so much less than the benefits expected to be paid out. Yet no one does that. The rules should be changed for everyone if debts like Dr. Meru’s are too high so that it can’t happen in the first place.

VERY WELL SAID. Thanks for this article, Travis. Truly enlightening. It’s about time hard-working professionals become fully aware of what multi-million dollar corps and big businesses have been doing for the longest time to skirt the system (legally) — minimizing their taxes while maximizing their growth. It is only fair. And YES I totally cannot stand the hypocrisy of these comments either.

I am confused by how a dental practice owner can make 500k but pay $500 a month. I thought these were “Income Based Repayment” plans? I am in the veterinary field and am becoming deeply disturbed by my colleagues seeking out this forgiveness instead of hustling to try to pay their student debt off. I believe the true path to wealth is by saving/investing and getting rid of unnecessary student debt as fast as possible.

That’s A path to wealth but it isn’t the only one. Savings rate matters the most. And they don’t pay 500 a month long term. They pay 10% of AGI less a FPL deduction, which can be a lot less than 10% of income. I agree it’s concerning what schools are doing but it will only change w a cap on Grad PLUS borrowing.

you could always stay in school and take water color art classes FOREVER,and be qualified to be excused from paying off any loans, since you would legally qualify as a full-time student!!!