If you’re interested in becoming an oral surgeon, let me share a word of caution. We've consulted on more than five dozen different occupations with huge student debt. Oral and maxillofacial surgery (OMFS) is the second most expensive path.

OMFS student loans have a significant impact when you finally earn “real money” at the end of a 12- to 14-year educational journey.

When managing this debt the right way, OMFS student loan repayment strategies could mean the difference between reaching financial abundance in your mid-40s and feeling insecure (despite earning multiples of the average household income in America).

The average debt of our dental student clients is $611,286 in student loans if they're in the oral surgeon field. Most of these oral surgeons went through an MD program. The overall average student debt for becoming an oral surgeon is likely lower than our average. But this statistic still throws cold water on the salary a new oral surgeon could expect.

How to become an oral surgeon

Oral surgeons complete about as much education after graduating high school as they complete from kindergarten to 12th grade.

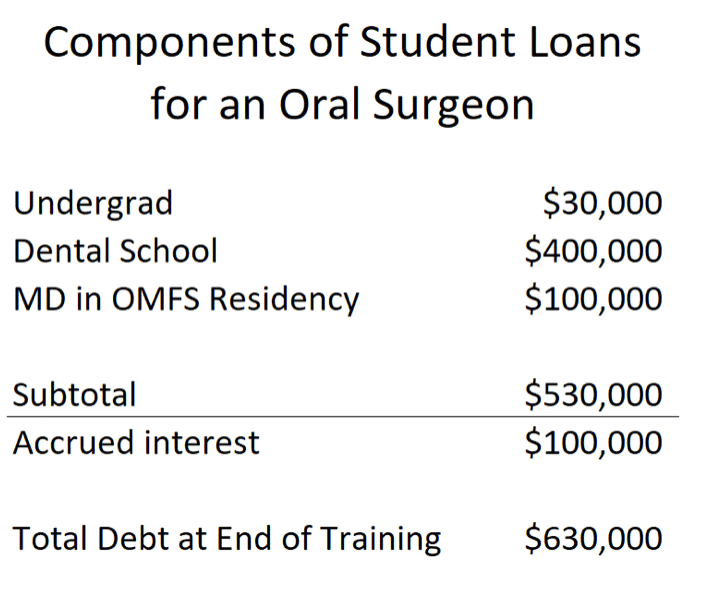

- First, you obtain a four-year bachelor’s degree while completing necessary prerequisites for dental school. You might expect a typical $30,000 level of student debt for this degree.

- Second, you must gain entry to a dental school in the U.S. accredited by the American Dental Association (ADA). This usually takes four years and costs anywhere between $250,000 to $550,000 of student debt

- Third, you need to complete a residency in oral and maxillofacial surgery. These residency programs take between four and six years. You can also earn your MD by taking additional classes through an affiliated med school. This could add an additional five or low six-figure sum to your student debt.

Boston University has a nice chart showing a typical six-year residency with the MD path. This can prepare you well for work within a hospital system. For those who seek to earn money as quickly as possible and pay down their debt, the four-year residency could be better purely evaluated under return on investment.

Practice Loan Quote Form

Why do oral surgeons have so much student debt?

While most students leave college with a low five-figure sum, dental school is where future oral surgeons accrue the biggest chunk of their massive student debt. If you go to a state dental school, you might be able to come out with only $250,000 of dental school loans.

However, if you attend a private dental school in a big city, you could easily leave with $400,000 to $500,000 of debt or more.

Oral surgeons need to gain admittance to an oral surgery residency program after dental school. This training lasts an additional four to six years after dental school. During the years you’re not in medical school in an oral surgery residency, you’ll earn a salary typical for a resident doctor ($50,000 to $60,000 range).

You have the option to obtain your MD at some institutions. Usually, you will take med school classes for approximately two of your six years in the earlier part of your training if you choose the MD path as an OMFS.

If you decide you want to have an MD in addition to your DMD or DDS as an oral surgeon, you will need to borrow additional funds to cover tuition. Most oral surgery residents place their loans into deferment, allowing interest to grow at a rapid rate. Residency is where I see a lot of the financial carnage happen with OMFS student loan repayment strategies.

Residency deferment causes tens of thousands of interest to accrue on top of the already massive loan principal.

How oral surgery residents can cut their student loan interest

One of my top tips for oral surgery residents is that they demand to have their loans placed into repayment on the Revised Pay As You Earn (REPAYE) program.

By doing this, you could get an interest subsidy worth $10,000 to $30,000 per year while in training depending on how much you owe. This is possible because the REPAYE program pays 50% of all interest left unpaid by your required monthly payment, which is based on your income.

Assume you owe $40,000 in interest on your $600,000 student loan debt. Pretend your monthly payment on REPAYE is $4,000 per year as a PGY-1. The interest subsidy on REPAYE would therefore be ($40,000-$4,000)/2= $36,000/2 = $18,000.

In this case, deferment would cost an oral surgery resident $18,000 every year for four to six years. That’s a massive cost for not understanding the complex student loan repayment strategy options for dental residents.

What is an oral surgeon salary?

Many doctors I’ve spoken with have said that oral surgeon salary is all over the place depending on what kind of practice environment and geographic location you’re talking about.

The Bureau of Labor Statistics (BLS) states that the average oral surgeon salary nationwide is $234,990.

This seems a bit low to me. Many of the OMFS doctors I’ve worked with started around $250,000. Practice owners often make in the mid $300,000 to $400,000 range. One doctor claimed to have a friend in Maine earning over $800,000 per year as an oral surgeon.

Assuming that $400,000 is more in line with actual oral surgeon earnings, how would a doctor handle their $600,000 student debt from becoming an OMFS?

How do you pay back student loans as an oral surgeon?

Let’s assume Connie decides to do a six-year oral surgery residency program. She accumulates $600,000 during her first couple years of the OMFS curriculum while she’s getting her MD.

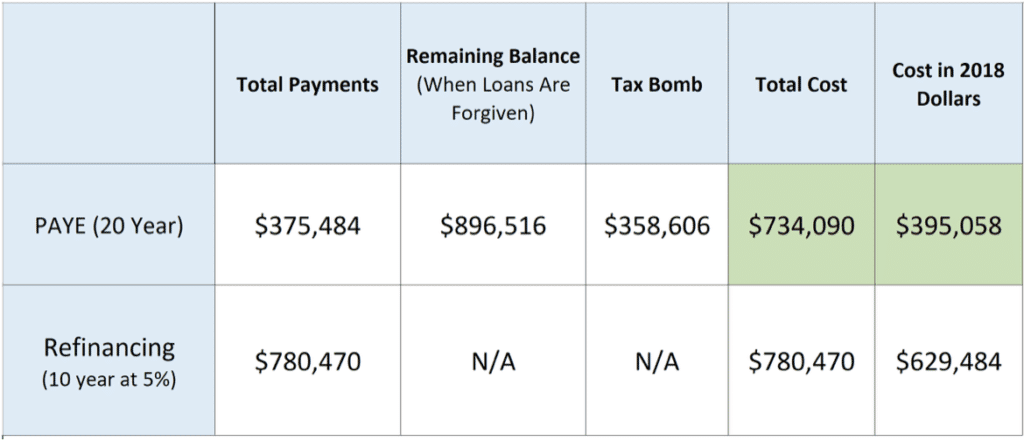

She decides to consolidate at the end of her MD program and gets her loans set up on the Pay As You Earn plan. On this plan, you can pay for 20 years and have your loans wiped away at the end after paying tax on the forgiven balance.

When she graduates after six long years of training, she should have at least four years credit towards the 20 that she needs.

We'll assume she starts earning $400,000, but that she writes off $75,000 per year from depreciation, retirement contributions, and business interest expenses. That means her adjusted gross income (AGI) is around $325,000. We’ll adjust that upward for 3% inflation.

These results are incredible because they reveal a huge misconception about paying off student loans in full after becoming an oral surgeon. Even at a high income, the PAYE program allows Connie to pay less than half what she’d have to pay with refinancing.

Connie would need to pay taxes of $358,606 in 16 years after she earns her MD (assuming she starts repayment right then instead of waiting until residency ends).

If you use present value to answer the question of what the OMFS degree costs in today’s dollars, you’d see that the difference in cost of the two approaches is roughly $234,000 in 2018 US dollars (the column farthest to the right).

Oral surgeons deserve the best student loan success help

If your grades and profile get you into an oral surgery residency program, you’re already very smart. That said, the student loan rules are boring and complicated enough to make mistakes extremely common.

Don’t assume loan forgiveness programs aren’t for you, even if you earn a huge salary of over $300,000 per year. If you want to refinance your student debt, try to prioritize four-year programs over six-year programs. Also, resist earning your MD unless you’re doing it out of passion rather than the increased financial reward you expect.

Many oral surgeons could qualify for some of the lowest interest rates in the country on a refinance. That said, when implementing OMFS student loan repayment strategies, make sure you’re putting your oral surgeon earning power at the top of your priority list.

If you have massive student debt from your oral surgery program, we'd love to make a customized plan for you. We’re probably the only team in the country that regularly consults on oral surgery student debt above the $600,000 range. We take pride in providing smart student loan repayment strategies.

Avoid refinancing too soon and sign up for the REPAYE plan if you want subsidies while in training. Consider PAYE if you’re sure you want forgiveness, and focus on building your earning power through the right job opportunity. Build your assets and play catchup with the above-average income you’ll earn as an oral surgeon. Finally, avoid forbearance and deferment like you’d want to avoid a facial infection (excuse the joke).

What has your experience been as an oral surgeon paying back your student debt? How fast were you able to do it? Are you worried about forgiveness on such a high income? How are you currently managing your OMFS student loans?

Comment below to let us know!

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

I am in a 6 year OMS program with 630k debt. In my last six months of training. The loans have been in forbearance (deferred For the two years of Med school) throughout my training. Have I missed the boat on taking advantage of REPAY? Would it even be worth it to attempt a 20yr forgiveness plan at this point? I wish I had read this blog at the beginning of my training:(

It’s ok Avi there’s still a lot of money to save. Are you done with med school now and are you done borrowing? If so you should try to consolidate them and enter repayment immediately. Depending on where you want to practice, forgiveness could still be very much in play here. I’d suggest getting a plan w that debt amount: https://www.studentloanplanner.com/hire-student-loan-help/

Thank you for such an informative article Travis. I am about to graduate and start residency. I know that I want forgiveness. Should I choose REPAYE while in residency, then switch to PAYE after completing residency? Or would it be best to enroll in PAYE even while in residency?

Choose PAYE if you’re sure you’re going loan forgiveness route and REPAYE if you’re sure you’re paying it all back in full. Youll need to request an in school deferment waiver which they’re not going to be guaranteed to give you. We do consults for situations like this Kevin if you have it in the budget would recommend it at some point

How does PSLF factor in to repayment? I will have around 500k debt going into residency for 5 yrs. planning to use 5 yea for PSLF and then find work for 5 yrs after that.

PSLF is a smart strategy, especially if you’re going into residency for a few years – you’ll have a head start by the time you finish residency. To find out how it could work for you, I recommend a consult with one of our student loan experts because every situation is different.

My program does 6 months of intern year (paid by the hospital) before going back into medical school where I will need to take out additional loans. I want to do the REPAYE plan while in residency and refinance once I am out, but am wondering if I should start REPAYE for my first 6 months or wait until after medical school?

Hey there! I first want to share with you our free student loan calculator so you can verify your savings: https://www.studentloanplanner.com/free-student-loan-calculator/. Second, here is a blog on REPAYE and what you should know: https://www.studentloanplanner.com/repaye-save-1000/. Lastly, it is hard to provide guidance without having a full scope of your situation. So for that, a customized student loan plan may be best. Watch here why that is important. If you have further questions, reach us at help@studentloanplanner.com. Thanks!

My program is an MD integrated program, but we start with 6 month of intern year (paid by hospital) before going to med school. I am planning on going with REPAY during residency and refinancing after I am done, but I’m not sure if I should start REPAY during those first 6 months or wait until after medical school. Thanks so much for your help!

Hey Taylor, congrats on starting your MD integrated program! Without knowing your full situation, it may be best to get a pre-debt consult from the team. I do want to leave you with some blogs for you to read though!

Here are some of the best repayment strategies without PSLF: https://www.studentloanplanner.com/repayment-strategies-without-pslf/

How to pay off medical school debt: https://www.studentloanplanner.com/how-to-pay-off-medical-school-debt/

If you plan to refinance, learn about our Student Loan Refinancing Ladder strategy: https://www.studentloanplanner.com/student-loan-refinancing-ladder/

Lastly, there was a recent caller who called in during Episode 128 (https://youtu.be/514jASnqtag) at 4:14 asking about the REPAYE program. It may be similar to your situation but again, it may be best to book a consult with us. Learn about our services here: https://www.studentloanplanner.com/hire-student-loan-help/.